Analysis Topic: Stock & Financial Markets

The analysis published under this topic are as follows.Friday, January 25, 2008

The US Fed, Societe Generale Rogue Trader, William Poole, and Black Swans / Stock-Markets / Market Manipulation

By: David_Urban

On Tuesday morning, the Federal Reserve cut interest rates by 75 basis points in response to a worldwide selloff. The selloff started on mounting fears that the United States has fallen into a recession. The mass fear became so great that the Federal Reserve felt compelled to act before next week's meeting in an attempt to restore confidence in the markets. In the press release, one governor, William Poole from the Federal Reserve Bank of St. Louis voted against a move before next week's meeting. While his actions may leave some people scratching their heads, one needs to go to the website ( http://stlouisfed.org/default.cfm ), note the commentary on the left side of the page, and read the following speech ( http://stlouisfed.org/publications/re/2008/a/pages/inflation.html ).Read full article... Read full article...

Friday, January 25, 2008

Stocks Secular Bear Market / Stock-Markets / UK Stock Market

By: Zeal_LLC

Back in early October when the benchmark S&P 500 stock index was hitting all-time highs, “bear” was a heretical four-letter word. Merely letting it roll off your tongue or spill from your pen offered a fast track to pariah status. In the best of times, people tend to forget that the worst of times are even possible anymore.

Back in early October when the benchmark S&P 500 stock index was hitting all-time highs, “bear” was a heretical four-letter word. Merely letting it roll off your tongue or spill from your pen offered a fast track to pariah status. In the best of times, people tend to forget that the worst of times are even possible anymore.

But after the most brutal new-year selloff in market history, investors and speculators are far more receptive to the usually taboo topic of stock bears. Most on Wall Street consider a bear market a 20% decline from the latest interim high. This week we came pretty darned close to a 20% slide in S&P 500 (SPX) terms.

Read full article... Read full article...

Friday, January 25, 2008

Institutional Selling Goes Opposite to Stock Market Direction / Stock-Markets / US Stock Markets

By: Marty_Chenard

Every day, on our paid subscriber website, we show and rate 9 underlying fundamental conditions that are critical relative to rallies and corrections.

This morning, we will share one of them with you ... The rate and trend in Selling by Institutional Investors.

Read full article... Read full article...

Thursday, January 24, 2008

The US Debt and Yen Carry Trade Unwinding Time Bomb is About to Explode! / Stock-Markets / Financial Crash

By: Christopher_Laird

Synthetic Dollar Short - Richard Russell and other gold writers talked about a ‘synthetic dollar short' based on debt in 04/5. The thesis is that overly indebted entities will face a day when their loans are called in, and the demand for dollars will rise dramatically, as assets are liquidated to pay off positions/debt.

Synthetic Dollar Short - Richard Russell and other gold writers talked about a ‘synthetic dollar short' based on debt in 04/5. The thesis is that overly indebted entities will face a day when their loans are called in, and the demand for dollars will rise dramatically, as assets are liquidated to pay off positions/debt.

The often discussed Yen carry trade has a similar mechanism, where lots of Yen have been borrowed for the last 10 years and invested in various markets that yield more than the half percent Japanese interest rates. Big and small investors have taken advantage of this more or less free money, riding the interest rate bonus with little risk – up to now.

Read full article... Read full article...

Thursday, January 24, 2008

Investors Lose Relying On Worthless Rating Agencies - Moody's, Fitch and Standard & Poor's / Stock-Markets / Risk Analysis

By: Adrian_Ash

"The one sure way to prolong a depression is to resist it..." – Walter Lippmann, Sept. 1931

"The one sure way to prolong a depression is to resist it..." – Walter Lippmann, Sept. 1931

ISN'T MODERN LIFE MARVELLOUS? All risk has vanished, not least for high-risk behavior.

Hence Scott Anthony Gomez Jr., now suing the sheriff of Pueblo County in Colorado . Gomez was able to break out of his jail cell, push up a ceiling tile, and crawl to freedom through the ventilation shafts before slipping and falling 85 feet off the roof of his prison.

Read full article... Read full article...

Thursday, January 24, 2008

Global Impact of the US Debt Implosion / Stock-Markets / US Debt

By: John_Lee

We have written a series articles dating back to March 2007 tracking the US debt implosion, which are available here . The story started out in early 2007 with the blowout of Novastar and New Century, the multi-billion non-bank intermediary mortgage brokers. In summer of 2007 we witnessed the collapse of American Home Mortgage, America's largest subprime mortgage issuing bank. Then we saw a series of subprime write-offs amounting to hundreds of $ billions by banks, funds, and institutions around the world. Then the trouble moved up in the chain of the mortgage complex, with Fannie Mae and Freddie Mac announcing surprising losses.

We have written a series articles dating back to March 2007 tracking the US debt implosion, which are available here . The story started out in early 2007 with the blowout of Novastar and New Century, the multi-billion non-bank intermediary mortgage brokers. In summer of 2007 we witnessed the collapse of American Home Mortgage, America's largest subprime mortgage issuing bank. Then we saw a series of subprime write-offs amounting to hundreds of $ billions by banks, funds, and institutions around the world. Then the trouble moved up in the chain of the mortgage complex, with Fannie Mae and Freddie Mac announcing surprising losses.

Wednesday, January 23, 2008

Corporate Income Tax - Stock Market Investors Enemy Number Two / Stock-Markets / Investing

By: Steve_Selengut

The Investor's Eye view of politics is a simplistic, practical, dot-connecting approach to sorting things out so that win/win change can be considered. Real World politics is not concerned with such things, and that is one of the most serious problems facing investors today. As outlined in Investment Politics 2008, there are at least ten issues that require government action if we are to maintain our competitive position in the World Economy. Most of these are interrelated and need to be acted upon simultaneously... thus causing a major political dilemma.

The Investor's Eye view of politics is a simplistic, practical, dot-connecting approach to sorting things out so that win/win change can be considered. Real World politics is not concerned with such things, and that is one of the most serious problems facing investors today. As outlined in Investment Politics 2008, there are at least ten issues that require government action if we are to maintain our competitive position in the World Economy. Most of these are interrelated and need to be acted upon simultaneously... thus causing a major political dilemma.

Wednesday, January 23, 2008

Financial Market Forecasts - Elliott Wave International Free Week Access is LIVE! / Stock-Markets / Elliott Wave Theory

By: Nadeem_Walayat

Now Live ! - Access to Elliott Wave Internationals Premium Financial Markets, Commodities Forecasting Services

(No Strings Attached!)

From Wednesday, January 23 at noon (EST) to Wednesday, January 30 at noon (EST), The Market Oracle visitors can read the latest short, intermediate and long-term market analysis for FREE, from the world's largest market forecasting firm.

Wednesday, January 23, 2008

Greenspan's Grand Design To Serve the Money Trust - Financial Tsunami Part III / Stock-Markets / Market Manipulation

By: F_William_Engdahl

The Long-Term Greenspan Agenda

The Long-Term Greenspan Agenda

Seven years of Volcker monetary “shock therapy” had ignited a payments crisis across the Third World . Billions of dollars in recycled petrodollar debts loaned by major New York and London banks to finance oil imports after the oil price rises of the 1970's, suddenly became non-payable.

The stage was now set for the next phase in the Rockefeller financial deregulation agenda. It was to come in the form of a revolution in the very nature of what would be considered money—the Greenspan “New Finance” Revolution.

Read full article... Read full article...

Wednesday, January 23, 2008

Forecasts for U.S. Stock Markets, Bonds, Metals and more! / Stock-Markets / Financial Markets

By: Nadeem_Walayat

One Week of Elliott Wave Internationals Financial Forecasts worth $80 for FREE

One Week of Elliott Wave Internationals Financial Forecasts worth $80 for FREE

(No Strings Attached!)

From Wednesday, January 23 at noon (EST) to Wednesday, January 30 at noon (EST), The Market Oracle visitors can read the latest short, intermediate and long-term market analysis for FREE, from the world's largest market forecasting firm.

Wednesday, January 23, 2008

Stock Market and Interest Rates Forecast 2008 / Stock-Markets / Financial Markets

By: Ty_Andros

Introduction

Introduction

The first three weeks of the year started with a BANG and this is set to continue as the public servants wrestle with the consequences of their poor policies. And, instead of creating policies of wealth creation, the result to their decades-long policies of currency debasement and creeping socialism: “Temporary” stimulus plans, front and center with the various public servants trying to outbid each other as to the size of the package.

Wednesday, January 23, 2008

Expert Views on the Stock Market Credit Crisis and Global Economy / Stock-Markets / Global Financial System

By: John_Mauldin

This week we do something a little different in our Outside the Box. Every weekend I get a very information-filled blog called Investment Postcards from Cape Town ( http://www.investmentpostcards .com ) by Dr. Prieur du Plessis. In it he highlights what he thinks is the most important portion of the writings of 10 to 15 analysts from around the world on the state of the economy and investing, and summarizes the news and data. I find it very useful, as Prieur generally finds a lot of interesting pieces that I miss and go on to read in my effort to stay on top of the markets. You can subscribe on your own if you like by activating the subscription option on the blog.

This week we do something a little different in our Outside the Box. Every weekend I get a very information-filled blog called Investment Postcards from Cape Town ( http://www.investmentpostcards .com ) by Dr. Prieur du Plessis. In it he highlights what he thinks is the most important portion of the writings of 10 to 15 analysts from around the world on the state of the economy and investing, and summarizes the news and data. I find it very useful, as Prieur generally finds a lot of interesting pieces that I miss and go on to read in my effort to stay on top of the markets. You can subscribe on your own if you like by activating the subscription option on the blog.

Tuesday, January 22, 2008

Long Nasdaq 100 Trust Shares - The Fed Rate Cut Must Succeed! / Stock-Markets / Tech Stocks

By: Mike_Paulenoff

So why am I net long the market here, in the form of the Q's -- Nasdaq 100 Trust Shares (Nasdaq: QQQQ)?Read full article... Read full article...

Tuesday, January 22, 2008

Use Short Bear Funds to Hedge Crashing Stock Markets / Stock-Markets / Financial Crash

By: Donald_W_Dony

With the introduction of the bear fund, analysts and investors have another very valuable tool to review the markets that was not available before. The use of fundamental analysis can provide investors with an inside look at the financial health of a company, its management skills and spot potential difficulties for the organization in the near future. Technical analysis allows the investor to review large numbers of securities, in different time frames, for profit opportunities, but normally only from one perspective; the buy side. The bear fund offers that mirrored image of a security that when used properly, can greatly expands the investors vantage point and provide valuable data that is not available through simple fundamental reviews or only buy-side technical analysis.

With the introduction of the bear fund, analysts and investors have another very valuable tool to review the markets that was not available before. The use of fundamental analysis can provide investors with an inside look at the financial health of a company, its management skills and spot potential difficulties for the organization in the near future. Technical analysis allows the investor to review large numbers of securities, in different time frames, for profit opportunities, but normally only from one perspective; the buy side. The bear fund offers that mirrored image of a security that when used properly, can greatly expands the investors vantage point and provide valuable data that is not available through simple fundamental reviews or only buy-side technical analysis.

Tuesday, January 22, 2008

Retrospective: The Mysterious Case of Massive Liquidity / Stock-Markets / Money Supply

By: Mack_Frankfurter

“ Perhaps when a man has special knowledge and special powers like my own, it rather encourages him to seek a complex explanation when a simpler one is at hand. ” — Sherlock Holmes, The Adventure of the Abbey Grange (1904)

“ Perhaps when a man has special knowledge and special powers like my own, it rather encourages him to seek a complex explanation when a simpler one is at hand. ” — Sherlock Holmes, The Adventure of the Abbey Grange (1904)

It now seems so long ago, but it is only a year since global equity markets were entrenched in a relentless march upward, spurred by the “world growth story” and a wave of global liquidity. U.S. and European stock markets gained double-digit returns in 2006 while the emerging markets did even better. Alongside the upward trajectory came a remarkable decline in volatility with the VIX, known as the “fear gauge,” falling to 13-year lows in November and December that same year.

Read full article... Read full article...

Tuesday, January 22, 2008

Dow Jones Stock Market Diamond Pattern Formation / Stock-Markets / US Stock Markets

By: Captain_Hook

At first glance at the title above, because of the proliferation of Exchange Traded Funds (ETF's), with Dow Diamonds one of the most highly traded examples, one might think a discussion on the related subject matter is what we intend to talk about here today. Of course if you were an experienced market technician, and have been following the trade of late, you might have known right away this is not the case at all. You would have known what we are talking about is a technical formation in the trade that acts as a pivot at tops, usually in relation to larger degree trading ranges. And you also may have known that the Dow is almost finished tracing out another diamond at present, with the timing and circumstances when compared to the 1999 / 2000 sequence similar enough to take notice.

At first glance at the title above, because of the proliferation of Exchange Traded Funds (ETF's), with Dow Diamonds one of the most highly traded examples, one might think a discussion on the related subject matter is what we intend to talk about here today. Of course if you were an experienced market technician, and have been following the trade of late, you might have known right away this is not the case at all. You would have known what we are talking about is a technical formation in the trade that acts as a pivot at tops, usually in relation to larger degree trading ranges. And you also may have known that the Dow is almost finished tracing out another diamond at present, with the timing and circumstances when compared to the 1999 / 2000 sequence similar enough to take notice. Read full article... Read full article...

Monday, January 21, 2008

US Stock Markets - Near Term Bottom or Waterfall Crash? / Stock-Markets / US Stock Markets

By: Joseph_Russo

Hauntingly Familiar

Here we are once again, suddenly embroiled amid a frenzy of financial crisis, and looming bail-out interventions.

The jury is still out as to whether or not this crisis will turn out to be “the big one” that will take down the entire house of cards.

Read full article... Read full article...

Monday, January 21, 2008

Stocks Bull Market Ahead: Indicators Read Warp Speed Eight / Stock-Markets / Stock Market Valuations

By: Joseph_Dancy

With talk of a serious U.S. economic recession now being commonly heard on every corner, and with the massive write-offs now being taken in the financial sector soon to be followed by massive layoffs, it is a difficult time to be invested in the market. Volatility has been extreme, and we expect that will remain so for the first quarter of 2008. But our indicators point to the fact that later in the year we could see some very positive trends for investors.

With talk of a serious U.S. economic recession now being commonly heard on every corner, and with the massive write-offs now being taken in the financial sector soon to be followed by massive layoffs, it is a difficult time to be invested in the market. Volatility has been extreme, and we expect that will remain so for the first quarter of 2008. But our indicators point to the fact that later in the year we could see some very positive trends for investors.

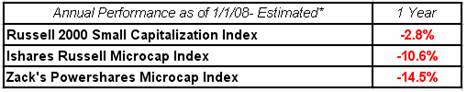

Keep in mind that last year was a very poor year for small capitalization stocks. In fact, in general the smaller the company the worse the stock performed.

Keep in mind that last year was a very poor year for small capitalization stocks. In fact, in general the smaller the company the worse the stock performed.

Monday, January 21, 2008

Stock Market Wake-up Call / Stock-Markets / US Stock Markets

By: Dominick

Two years ago I made a call that anyone who's read this newsletter long enough will remember or at least have heard about. In July 2006, with the market at multi-month lows, TTC got long the S&P futures for a move to 1360 that seemed incredible at the time – certainly no one else was seeing it, let alone trading it. But, by October the S&P futures had rapidly advanced 200 points and my target was hit.Read full article... Read full article...

Sunday, January 20, 2008

US Stock Markets Crash and Burn Whilst The Fed Fiddles / Stock-Markets / Financial Crash

By: Robert_McHugh_PhD

I hate to bash Fed Chairman Ben Bernanke, but I'm going to for a few pages. Here's the deal. The current economic threat is screaming for an aggressive inflation solution. Inflation comes from the Fed. Forget about the inflation the Fed has caused over the past 90 years, and the doubling of the money supply to goose markets for the past eight. A lot of that was dead wrong, a theft of our children's future, coming at an unnecessary time.

I hate to bash Fed Chairman Ben Bernanke, but I'm going to for a few pages. Here's the deal. The current economic threat is screaming for an aggressive inflation solution. Inflation comes from the Fed. Forget about the inflation the Fed has caused over the past 90 years, and the doubling of the money supply to goose markets for the past eight. A lot of that was dead wrong, a theft of our children's future, coming at an unnecessary time.Read full article... Read full article...