Analysis Topic: Stock & Financial Markets

The analysis published under this topic are as follows.Friday, July 20, 2007

MPTrader - Has Stock Market Correction Ended? / Stock-Markets / Tech Stocks

By: Mike_Paulenoff

With just over an hour remaining in today's session, I am wondering if a correction in the major equity market ETF's has ended, and if a new upleg is in its infancy. But I notice that financial powerhouse Goldman Sachs (NYSE: GS) remains down about 2.5% for the session, and more importantly, remains below its 200 DMA (208.31). I see that Google (NASDAQ: GOOG) is still down 5% for the session, having bounced off of its 50 DMA (510.81) this AM.Read full article... Read full article...

Friday, July 20, 2007

The S&P Stock Market Index Vibrating At Critical Mass / Stock-Markets / US Stock Markets

By: Joseph_Russo

Nearly a year ago, back in September of 2006, we shared a keen and timely awareness as The Dow Approached Critical Mass . Save for the miserable comparative retracement performance from the tech-sector off the 2002 lows, numerous equity indices have since broken decisively to the upside above their previous historic highs. The S&P is one of the last to arrive.

The mother of all benchmarks is on the hot-seat

As we pen this market update, the S&P has yet to close above 1553.11. Perhaps it will do so by today – perhaps not.

Read full article... Read full article...

Friday, July 20, 2007

Subprime Lenders Fallout - It's all hitting the fan! / Stock-Markets / Financial Crash

By: Money_and_Markets

Mike Larson writes: It's all hitting the fan — right here, right now! The two Bear Stearns (BSC) hedge funds that Martin told you about in late June have reportedly been all but vaporized. Wiped out!

According to a July 18 New York Times story,

"Bear Stearns told clients in its two battered hedge funds late yesterday that their investments, worth an estimated $1.5 billion at the end of 2006, are almost entirely gone. In phone calls to anxious investors, Bear Stearns brokers reported yesterday that May and June had been devastating months for the portfolios.

Read full article... Read full article...

Thursday, July 19, 2007

Investors – Will you be a Winner or Loser? / Stock-Markets / Financial Markets

By: Dudley_Baker

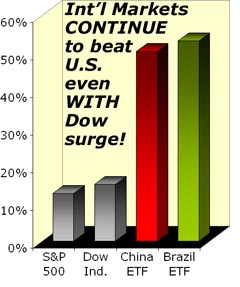

In the current markets seems all investors, virtually in the world, are being rewarded with gains in their portfolios.

The U.S. markets as measured by the Dow Jones Industrial Average (DOW) and the S&P 500 continue to make new highs as do most of the foreign stock markets, China, Brazil, Mexico, etc.

Read full article... Read full article...

Thursday, July 19, 2007

Investing - Steer clear of the US. Stock Market; Look to Asia! / Stock-Markets / Asian Economies

By: Money_and_Markets

I'm in Asia right now. And I can tell you first hand that things here are as vibrant as ever.

I'm in Asia right now. And I can tell you first hand that things here are as vibrant as ever.

There's been no change in the spectacular fundamentals underlying this region. With the exception of Thailand, almost all Asian countries are exploding with economic growth. For example, Singapore's second-quarter economic stats just blew away expectations, with GDP rising 8.5%.

All this growth has two important results:

Read full article... Read full article...

Wednesday, July 18, 2007

Why is the US Government Trying to Sell US Sub-prime Mortgages to China? / Stock-Markets / US Stock Markets

By: Marty_Chenard

A few months ago, the sub-prime problem seemed to be a mammoth problem to many investors.

But ... nothing bad happened, so investors thought that this was another over-hyped problem that really amounted to nothing. Besides, the Fed was being proactive as our big market-protectors, so there was nothing to worry about ... Mighty Mouse was here to save the day.

Read full article... Read full article...

Wednesday, July 18, 2007

MPTrader Mid-Day Minute - Financial Sector ETF Looking Bearish / Stock-Markets / Exchange Traded Funds

By: Mike_Paulenoff

Today's weakness in the Financial Select Sector SPDR (AMEX: XLF) has pressed the financial ETF below all of my relevant "trading" moving averages, which I consider to be a sign of impending decline. However, let's notice that the price structure must break both its 1-year support line as well as its prior pivot low, which reside at 35.53, in order to trigger downside acceleration towards a test of the next important, intermediate-term pivot low, at 34.18 (from 3/14).Read full article... Read full article...

Tuesday, July 17, 2007

The Financial Markets Big Picture - The Crack-up Boom Series Part VI / Stock-Markets / Financial Markets

By: Ty_Andros

In This Issue

1. The Crack-up Boom Series Part VI Introduction

2. Smoke Signals, aka The “BIG” Picture

3. Years Ending in 7 and What Comes After! Nice, Very Nice.

Foreword - For greater insight into our publication, have a look at the Overview of Tedbits . It helps current and potential subscribers understand our mission in serving you. It also gives a broad description of what's unfolding globally and what you can expect from Tedbits as a regular reader.

1. The Crack Up Boom series is exploring the unfolding “Indirect Exchange” (as detailed by Ludvig Von Mises), that dollar holders will be using to exit their holdings now and eventually is will be followed by all holders of fiat currency holdings no matter which country is perpetrating the “fraud” of confiscation of wealth through the printing and credit creation process that all such monetary schemes evolve into. The “Crack Up Boom” will drive an inflationary global expansion to inconceivable heights over the coming years. Asset prices will skyrocket as people do what they always do when threatened they will modify their behavior and do the things necessary for “SELF PRESERVATION” of their families, countries, economies and their wealth. Let's take a look at Von Mises description of the CRACK UP BOOM once again:

Read full article... Read full article...

Monday, July 16, 2007

Nolte Notes - Bulls On Parade / Stock-Markets / Financial Markets

By: Paul_J_Nolte

It is hard to argue with a bull market – stocks rose on the week breaking through the two-month range that has held the averages captive on better than average volume. The usual giddiness that ensues should carry the Dow through 14,000 (got your 14K hats ready?) before we get a bit of backing and filling “confirming” that the former high end of the trading range is now the market's new floor. Economically speaking, Goldilocks remains in the house (bears aren't home yet!), as the trade deficit widened a bit, but our export business continues to grow (the reason large cap stocks are doing well) and consumer confidence also improved – in the face of higher energy prices.Read full article... Read full article...

Monday, July 16, 2007

MPTrader Mid-Day Minute - Internet Holders Trust (HHH) Targets Upside Breakout / Stock-Markets / Tech Stocks

By: Mike_Paulenoff

Let's notice that so far today the Internet HLDRs ETF (AMEX: HHH) opened lower but has climbed into positive territory -- at new recovery rally highs, with the possibility of closing the session with a key upside reversal spike.Read full article... Read full article...

Monday, July 16, 2007

Cyclical Stock Market Highs – Secular Trends – And The Sinking Of The USS Titanic / Stock-Markets / Global Financial System

By: Captain_Hook

A great deal has already been written on this subject as it pertains to both stocks and commodities, with Michael Alexander's work a shining example in this regard. Of course if you were to compare how the markets are behaving in relation to how conventional analysis along these lines was foretelling what we should expect back at millennium's turn, one might be quite surprised today.Read full article... Read full article...

Sunday, July 15, 2007

Dow Jones Surges! But Brazil and China ETFs Rise Far More! / Stock-Markets / Emerging Markets

By: Money_and_Markets

Martin here with a quick update on the Dow and international markets.

Martin here with a quick update on the Dow and international markets.

On Thursday, even as the Dow surged 284, its biggest one-day gain since October 2003 …

My favorite international ETF — representing Brazil's bluechips — was up the equivalent of 573 points on the Dow!

Read full article... Read full article...

Sunday, July 15, 2007

Stock Market Cycle Turning Points Analysis 15th July 2007 / Stock-Markets / Cycles Analysis

By: Andre_Gratian

A 3-dimensional approach to technical analysis

Cycles - Breadth - Price projections

Current Position of the Market.

SPX: Long-Term Trend - The 12-year cycle is still in its up-phase but, as we approach its mid-point some of its dominant components are topping and could lead to a severe correction over the next few months.

SPX: Intermediate Trend - The intermediate trend made its low on 6/26 and has already produced a rally to an all time high. But internals are weak and it is not clear how sustained this move will be.

Read full article... Read full article...

Saturday, July 14, 2007

Stock Market Update: Profit is the Only Real Portfolio Protection / Stock-Markets / Elliott Wave Theory

By: Dominick

Even the most casual market observers will have noticed Thursday's record-breaking explosion in stocks and Friday's new all-time highs in the S&P 500, but how many of them bought the bottom? And I don't mean piling into the momentum and squeezed out a profit. How many expected the move into the low and bought the gap down on Wednesday? My guess is that, even among all the professional traders and retail investors, the number who really did is very low.Read full article... Read full article...

Saturday, July 14, 2007

Inflation, Birth / Death Ratio and Asking the Chinese to Buy Our Mortgages / Stock-Markets / US Economy

By: John_Mauldin

In this issue:

The Birth/Death Ratio

Retail Sales Up? Let's Hear it for Inflation!

King Dollar and the Guillotine

Asking the Chinese to Buy Our Mortgages?

A Half a Trillion and Counting

Albacore, Maine, Denmark and Europe

Is the economy slowing down or is it getting ready to go on a new tear? Judging by the run-up in the Dow, the answer is a major turnaround for the economy in the last half of the year, from the close-to-recession numbers of the first quarter. So, what has happened to my forecast of a slowdown or minor recession?

Read full article... Read full article...

Friday, July 13, 2007

Friday the 13th, Welcome to the Summer Rally / Stock-Markets / Financial Markets

By: Anthony_Cherniawski

Everything you wanted to know about Friday the 13th .

Is it like any other day or is there something about Friday the 13th ? Wall Street appeared to have its lucky day on the 12 th , so what gives today? If you were a Knight Templar in 1307, this day goes down in infamy.

A (not so) surprising decline in June retail sales.

Read full article... Read full article...

Friday, July 13, 2007

MPTrader Mid-Day Minute - S&P Holds Firm Despite Surging Crude Oil Prices / Stock-Markets / US Stock Markets

By: Mike_Paulenoff

Another $1 surge in oil prices thus far today, yet the S&P 500 Depository Receipts (AMEX: SPY) continue to hold up remarkably well -- considering also that they have climbed 3% in less than 48 hours.

Furthermore, let's notice that while the momentum oscillators are relatively overbought on an hourly basis, they nonetheless confirm the two session advance, which usually means that more upside is likely prior to the creation of divergences that point to the approach of a meaningful correction.

Read full article... Read full article...

Friday, July 13, 2007

Three Major Financial Market Trends You Must Watch / Stock-Markets / Financial Markets

By: Money_and_Markets

Mike Larson writes: There's so much going on out there in the markets, I almost don't know where to start. Stocks … bonds … currencies … they've been more volatile than I can remember in a long time.

But when I sort through the confusion, I see there are really three major trends driving the action. These three forces could very well hold the key to your investment performance over the next several months. So I want to share them with you right away …

Read full article... Read full article...

Thursday, July 12, 2007

MPTrader Mid-Day Minute - Big Cap Stocks Outperforming Small Caps / Stock-Markets / US Stock Markets

By: Mike_Paulenoff

One very interesting aspect of today's action is the outperformance of the BIG CAPS versus the small caps, which has widened my ratio spread long Dow Diamonds (AMEX: DIA)/short iShares Russell 2000 Index (AMEX: IWM) in a lopsided, powerful upday.... a signal perhaps that the leadership in this new upleg is being narrowed to the highly capitalized, substantial companies. It is with that in mind, that we take a look at the DJIA pattern.Read full article... Read full article...

Wednesday, July 11, 2007

MPTrader Mid-Day Minute - Nasdaq Looking Set to Start a New Upleg / Stock-Markets / US Stock Markets

By: Mike_Paulenoff

So far this morning's low at 48.29 in the Q's (NASDAQ: QQQQ) is looking very much like the conclusion of the pullback off of Monday's 48.99 high as well as the start of a new upleg. If all of the above proves accurate, then the current "up bar" on the 4-hour chart represents the initiation of a new advance that should hurdle 48.99 on the way to at least 49.50/60 and, more than likely, on the way to 50.Read full article... Read full article...