Inflation, Birth / Death Ratio and Asking the Chinese to Buy Our Mortgages

Stock-Markets / US Economy Jul 14, 2007 - 09:47 AM GMTBy: John_Mauldin

In this issue:

The Birth/Death Ratio

Retail Sales Up? Let's Hear it for Inflation!

King Dollar and the Guillotine

Asking the Chinese to Buy Our Mortgages?

A Half a Trillion and Counting

Albacore, Maine, Denmark and Europe

Is the economy slowing down or is it getting ready to go on a new tear? Judging by the run-up in the Dow, the answer is a major turnaround for the economy in the last half of the year, from the close-to-recession numbers of the first quarter. So, what has happened to my forecast of a slowdown or minor recession?

This week we look at some hidden problems in the employment data, analyze retail sales and consumer spending, and speculate about the last half of the year. And we also look at how the dollar is doing, inflation, foreign reserves, and more. And you have got to hear the story about a US government official going to Beijing asking them to buy US mortgages. Seriously. You can't make this stuff up. There is a lot of interesting ground to cover, so let's jump in

First, let's look at the good news. Given the increase in inventories, the rise of all the manufacturing surveys, and a smaller trade deficit, most economists think that GDP for this second quarter will be in the 3% range. Given that first-quarter growth was an anemic 0.6%, this will give us an average for the first half of less than 2%, which is more or less the return of Muddle Through I predicted at the beginning of the year. Most of the growth was technical in nature, coming from a drop in the trade deficit and a significant rise in inventories. As we will note below, retail sales are not all that strong, which may help partially explain the rise in inventories.

The average Blue Chip economist is pegging the US economy to grow in a very robust 3% range for the last half of the year. Manufacturing surveys suggest that the economy is quite strong and are in the territory normally associated with 3% growth. Employment numbers came in surprisingly robust this week, and Wal-Mart had better sales than expected, even if they were weak. So, the market decided to party like its 1999.

So, what's not to like? When you look through to the underlying data, I think it suggest the economy will be much slower than 3% in the last half of the year.

The Birth/Death Ratio

To start with, let's dissect the employment numbers. The official headline number for June was 132,000 new jobs. Since we need about 150,000 new jobs just to stay even with population growth, that is hardly a robust number, but not too far off from what would be a good number. Except that there are some problems with the headline number.

The employment numbers come from a survey of established businesses. But obviously the Bureau of Labor Statistics (BLS) cannot call every business in the US, so they simply survey the larger businesses. But that means they miss the growth in the small-business sector of the economy, which is where the largest amount of new jobs are created.

The BLS surveys about 160,000 businesses in its sample model. There is an unavoidable lag between an establishment opening for business and its appearing on the sample frame and being available for sampling. Because new firm "births" generate a significant portion of employment growth each month, non-sampling methods must be used to estimate this growth. To make up for this, they add or subtract a certain number of jobs, called the birth/death (of new businesses) ratio.

They use the actual births and deaths of real businesses for the last five years to make their estimates of new jobs created from new business. This is quite a legitimate methodology, but it does have one problem. It is backward-looking data. BLS knows that and states the following on its web site:

"The most significant potential drawback to this or any model-based approach is that time series modeling assumes a predictable continuation of historical patterns and relationships and therefore is likely to have some difficulty producing reliable estimates at economic turning points or during periods when there are sudden changes in trend. BLS will continue researching alternative model-based techniques for the net birth/death component; it is likely to remain as the most problematic part of the estimation process."

Remember the jobless recovery of the first Bush term and the constant criticism about the poor economy? Why was the economy doing so well and yet job creation was so poor? It turns out that a great deal of the explanation is that the BLS underestimated the number of new jobs being created by small business. In the early years of the recovery, rather badly.

Likewise, the BLS data will overestimate jobs when the economy is slowing down. Is there some evidence that may be the case today? I think there is.

To the credit of the BLS, they are very transparent about their data. There are massive amounts of data available at www.bls.gov and the data on the birth/death ratio is at http://www.bls.gov/web/cesbd.htm . Now, let's examine the contribution of the birth/death ratio to the employment numbers.

Last month, the BLS estimated that there were 156,000 new jobs in the birth/death ratio category, which was 24,000 more jobs than they estimated were created for the month. OK, maybe no problem. Looking back over five years, the economy has created about that many new jobs during the month.

Except that they estimated 26,000 new small-business construction jobs. With home construction dropping, do we really think that the same number of new jobs was created in construction as in June of 2006 and 2005? Or that 153,000 new jobs in small-business construction have been created this year? Really?

In fact, since January, the BLS estimates for the birth/death ratio have added 747,000 new jobs of a total projected growth of 871,000 jobs, or 86% of the total of the jobs estimated supposedly created for the first half of the year.

Is there any other reason to believe that the birth/death ratio may be overstating employment as the economy slows? The always astute Paul Kasriel of Northern Trust thinks there is. He notes that in 2005 the contribution of the birth/death ratio (12-month average) to the overall employment numbers was well under 35%. Today it is over 56%. Given the recent numbers, that ratio is likely to rise.

"What has been happening to the relative contribution of birth/death estimates as the economy has slowed in the past year? The chart below shows that it has been rising. In the 12 months ended March 2006, the birth/death adjustment was contributing only 30.9% of the jobs to the change in nonfarm payrolls. The birth/death relative contribution has been trending higher since then. Notice that as the birth/death contribution to nonfarm payrolls has been trending higher, the percentage of small businesses saying that now is a good time to expand their operations has been trending lower. If existing small business managers do not think now is a good time to expand their operations, does it make sense that there are a lot of new small businesses starting up and hiring?

"Perhaps because the birth/death adjustment is not, itself, adjusted for the phase of the business cycle the economy is in, it is biasing upward the growth in nonfarm payrolls now. Perhaps the birth/death adjustment is the answer to the Fed's latest conundrum with regard to stronger-than-expected payroll growth given the sharp slowing in real GDP growth."

The number of unemployed rose by 114,000 in June, as both the labor force and population rose. That does not sound robust to me. That seems to call into doubt the recent numbers.

Retail Sales? Let's Hear it for Inflation!

Wal-Mart sales were up a higher than expected 2.4%. They noted that home goods and apparel sales were weak but that grocery sales surged. No kidding. With food inflation at almost 7%, grocery sales are clearly going to increase if we just eat the same food (although most of the country could stand to eat a lot less), and Wal-Mart is probably increasing market share because of its lower food costs. As Bill King notes, food inflation boosted June sales at other chains like Costco, where food sales are a large component of overall sales.

Retail sales in general dropped 0.9% last month, the worst drop in almost two years. Home Depot and Sears reported sharply lower earnings estimates on the back of a weak housing market. Same-store Home Depot sales may be down mid-single digits.

Disposable income has been falling for the last three months. Credit card debt continues to grow even as mortgage equity withdrawals are slowing rapidly. The consumer is clearly under pressure.

In fact, however you slice it, retails sales did not keep up with inflation on a year-over-year basis. And if you factor out increased gasoline and energy expenditures, they are downright punk.

And there is more price pressure in the pipeline. US import prices were up in May by 1.1%, followed in June by 1%. You can bet they will be up again in July, given the fall in the dollar and the rise of oil prices. And that kind of pace, given the massive amount of products we buy, is inflationary, however you look at it. If Senators Schumer, Graham, and their fellow economic illiterates in the Senate get their way, Americans will soon be paying another 20% more for our products from Asia. (As I write below, the Chinese are continuing to slowly allow their currency to rise.) Given the pressure on food and energy prices, more inflationary pricing pressure from consumer goods is not what the Fed needs to see if they want to cut prices.

I think consumer spending will be slower than forecast in the third quarter on the back of an ever-weakening housing market, rising energy costs, and slower growth in employment. Consumer spending is 68% of the US economy. If that growth slows at all, it will be hard for the 20% that represents manufacturing to make up the difference to bring us to 3% growth for the last half of the year.

It stands to reason that the buildup in inventories we saw last quarter will reverse over the next two quarters on slowing consumer spending. By the way, one of the reasons for the strength in manufacturing was the very strong buildup of car inventories. New labor contract talks this fall may be contentious, and auto manufacturers have built up inventories in anticipation of possible strikes. If there are none, then expect a slowdown in auto manufacturing later this year, especially on the heels of very slow auto sales this summer.

All in all, I still think we will see a slowdown later this year, if not a mild recession.

King Dollar and the Guillotine

I first used the above title in an e-letter written mid-March 2002, where I talked about the potential for the dollar to drop against the euro. It was at $.88. I had just turned bullish on gold a few weeks earlier and followed that up with a dollar-bearish view. The next year (2003) in May I suggested that the euro could go as high as $1.40.

The euro started at $1.14 in January of 1999 before shortly falling to $.82 and then started to rise. By the fourth quarter of 2004 it was at $1.20. It has gone back and forth on sentiment as the dollar gets oversold (just as it will do again), but the trend is clearly down over time.

Today the euro briefly rose over $1.38 and settled as I write at $1.378. It won't take much to push it to $1.40. In late August I will be traveling to Europe. By the time the banks take their fees, a euro will cost me well over $1.40.

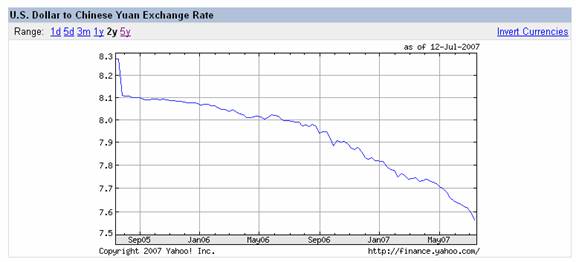

But another currency is slowly wending its way up. Take a look at the chart below. The Chinese yuan is up against the dollar from 8.28 to 7.57 to the dollar over the last two years. That is an increase of almost 9%. The movement in the last month has been particularly fast. I wrote over two years ago that the Chinese would slowly allow their currency to appreciate, and would move at their own pace, despite the screams from the US Senate to do it all at once.

In 2-3 years, the yuan will be down another 10-15% from where it is today, and the Chinese will be close to allowing the yuan to float. Should this be a cause for rejoicing in the US? Maybe for a few select companies, but consumers will not be as happy that (as noted above) prices are slated to rise.

For those interested in investing in currencies, but not wanting to do so in the commodity markets, you can call my friends at EverBank. You can open an FDIC-insured CD (certificate of deposit) in dozens of major and minor currencies, getting whatever the respective currency interest rate is. Their number is 800-926-4922. (The FDIC insures the account but not the currency risk. You can lose money if the dollar rises against your chosen currency.) And I wish all the best to good friend Chuck Butler at EverBank, who is recovering from cancer and hip replacement surgery.

Asking the Chinese to Buy Our Mortgages?

This all amusingly contrasts with the following news item today from Bloomberg, in the you can't make stuff like this up category. US Department of Housing and Urban Development Secretary Alphonso Jackson is in Beijing. He is meeting with various Chinese banking authorities, asking them to buy US mortgage-backed securities. Evidently he is doing this with a straight face. The same story goes on to talk about the collapse of the subprime market.

On the one hand we have US Congressional leaders demanding that China let the dollar drop another 20% or so against their currency, and then another government official asking them to buy more US debt, which will drop 20% when they do allow their currency to rise. And they call the Chinese inscrutable?

Has it come to this, that we have to have government officials going to China to ask (some would impolitely say beg) them to buy our debt? You do have to appreciate the irony. Then again, maybe they think it is their punishment for selling us bad pet food and toothpaste. You sell us unsafe products and you have to buy our mortgages.

A Half a Trillion and Counting

That being said, Chinese exports were $103 billion in June, the first time they have ever been above $100 billion. But that is not the truly impressive number. Greg Weldon ( www.weldononline.com , one of my truly must-read letters) highlights a very interesting trend.

(Chinese) "Official FX Reserves ... $1.333 trillion! Whew, seems like an astronomical figure ... until you consider the single month export total exceeding $100 billion for the first time ever, in June. What IS interesting is the quarterly 'flow-of-funds':

"Official FX Reserves ... up + $130.6 billion during the 2Q, similarly oversized and in line with the RECORD rise posted in the 1Q, at plus + $135.7 billion. In other words, $266.3 billion in reserve accumulation during the first six months of the year ... or ... MORE than ALL of last year, with 12-month, full year- 2006 reserve growth of + $247.3 billion

'Note the sequential quarterly reserve growth back to the end of '05:

4Q-05 ... up + $ 49.9 billion

1Q-06 ... up + $ 56.2 billion

2Q-06 ... up + $ 66.0 billion

3Q-06 ... up + $ 46.8 billion

4Q-06 ... up + $ 78.4 billion

1Q-07 ... up + $ 135.7 billion

2Q-07 ... up + $ 130.6 billion

"A moon shot on the back of skyrocketing monthly export figures. China is now accumulating dollars at a HALF-TRILLION PER YEAR PACE."

Think about that for a second. Banking authorities in China have to figure out how to invest $500 billion in new dollars this year! Maybe it makes sense to go ask them to invest in our mortgages after all.

Finally, Greg writes today of a statistic that causes me to raise my eyebrows. Total world foreign exchange reserves are $5.3 trillion. The dollar share is $3.4 trillion, or 64.2% of the total, which is at its lowest share level since 1996. Rising are the euro, pound sterling, and "others." Also falling in FX reserve share is the yen, which partially explains why that currency is also falling.

Russia, China, and India own almost $2 trillion of those dollars. Throw in Korea, Japan, and Taiwan and we rise to $3.1 trillion, or 93% of all dollar reserves in the hands of just six countries.

Notice one more thing. All of those countries are doing their best to keep their currencies from rising too rapidly against the dollar, even as all but the yen make new highs. That being the case, they are not likely to be selling too much any time soon. Rather, it is more likely they will diversify over time with new money coming in.

Also, think about the problems of a European manufacturer or business. Not only is there increased competition from all over Europe in the growing trade zone, but your currency is rising against all of Asia and the US. There are starting to be some very serious complaints about the weakness of the Japanese yen against the euro. Of course, that means the raw materials you buy are falling in price, but not your relative labor costs.

Albacore, Maine, London, Denmark and Europe

In late August, I will be speaking at a conference for Jyske Bank in Copenhagen and plan on spending a week or so after that in Europe on vacation. (Long-time reader Tom Fischer arranged for me to speak. Tom, I am sure that I meant for my speaking fees to be in euros.) I am thinking about visiting Sweden, Poland, and/or the Czech Republic, and maybe a few other countries in that region I have never been to. It is still up in the air.

I will be in London for one day and evening August the 22nd before going on to Denmark. My partners at Absolute Return Partners will be arranging for client and prospective client meetings that day and evening. If you are in the area, even though it is holiday time in Europe, I look forward to meeting you.

Tomorrow I fly to La Jolla with my youngest son Trey (age 13). We are going to meet up with Paul McCulley (of PIMCO fame) and take a charter tomorrow night out into the Pacific. In theory, they are catching 35-pound albacore tuna and the boats are catching their limits. I have notoriously bad luck at fishing, but my son is quite lucky. It will be interesting to see what happens when he gets a fish almost bigger than he is on a line.

Trey and I fly back on Tuesday and then leave Wednesday for Portland, Maine, where I speak on Thursday AM, and then Trey and I take a float plane to be with David Kotok (of Cumberland Advisors) and a host of friends for weekend fishing in the Grand Lake area at Leen's Lodge ( www.leenslodge.com ). It is a great place, and even better companionship.

Kotok hosts the event, which includes some of the better economic minds around, and on Saturday evening everyone puts their money where there mouth is by "betting" on where the various markets will be this time next summer. A Fed economist, who cannot bet, keeps track of the money. The bets are small, so there is more ego on the line than money. I can tell you, which will be no surprise, that I was very wrong on the stock market. I will let you know the outcome.

For what it's worth, last year, of some 25 people, the highest forecast for the Dow was 13,000. The average forecast for the euro was 132 and the ten year was at 6.2%, with oil at $65. I was a lot closer on my forecasts for those markets than I was on the Dow, where I was really wrong. Oh well.

It is time to hit the send button, as the younger boys just walked in from a day at the local water park and are ready to leave, and Dad is ready as well. Besides, Harry Potter opens tonight. I am up for some true marketing wizards.

Have a great week. I know I am.

Your actually hoping to catch a few fish for once analyst,

By John Mauldin

http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here: http://www.frontlinethoughts.com/subscribe.asp

Copyright 2007 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Note: The generic Accredited Investor E-letters are not an offering for any investment. It represents only the opinions of John Mauldin and Millennium Wave Investments. It is intended solely for accredited investors who have registered with Millennium Wave Investments and Altegris Investments at www.accreditedinvestor.ws or directly related websites and have been so registered for no less than 30 days. The Accredited Investor E-Letter is provided on a confidential basis, and subscribers to the Accredited Investor E-Letter are not to send this letter to anyone other than their professional investment counselors. Investors should discuss any investment with their personal investment counsel. John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an NASD registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Pro-Hedge Funds; EFG Capital International Corp.; and EFG Bank. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.