Analysis Topic: Commodity Markets - Metals, Softs & Oils

The analysis published under this topic are as follows.Wednesday, January 17, 2007

Leveraging Gold Investments with Silver / Commodities / Analysis & Strategy

By: Robert_Watson

If you have been a regular reader of the various precious metal websites, you will know that gold is the metal that dominates the discussion. This should not surprise us. Despite that fact that less than 2,500 tonnes of gold are mined out of the ground each year as opposed to the 20,000 tonnes of silver, it is market cashflow that matters and a look at the recent statistics of the international London bullion market shows that in November 2006, $12.1 billion worth of gold was cleared through that city as opposed to $1.41 billion worth of silver. Clearly, when it comes to business transactions as well as Internet chat, it is gold that talks louder than silver.Read full article... Read full article...

Wednesday, January 17, 2007

Investing in Uranium Mining - China's Uranium Fever ! / Commodities / Investing

By: Money_and_Markets

A rush of Chinese miners is heading for Australia right now. We've seen this kind of thing before — in 1851. Back then, the Chinese miners were after gold. This time, they're after another metal ... uranium. Will they find it? If history is any guide, yes.

The Chinese are very good at mining. In fact, they were so good at finding gold that the Australians considered them supernaturally lucky. The animosity was palpable, evident in phrases like “a Chinaman's chance.”

Read full article... Read full article...

Wednesday, January 10, 2007

Three reasons to love and invest in uranium / Commodities / Investing

By: Money_and_Markets

Uranium had a great year in 2006 — prices doubled . But I think that its performance in 2007 could blow the doors off of last year's results! That's why I'm starting to line up my favorite uranium stocks for the coming year. More on that in a moment. First, I'd like to tell you why I'm so bullish on this white-hot metal.

Uranium: The Most Recession-Proof

Metal I've Ever Seen

Hey, I'm a pretty bullish guy by nature. But there are certainly troubling signs when it comes to the U.S. As guys like Mike Larson have been telling you, the housing bubble is imploding, Americans are in debt up to their eyeballs, and more.

Wednesday, January 10, 2007

What’s Behind the Crash in Crude Oil ? / Commodities / Analysis & Strategy

By: Gary_Dorsch

Is it enough to point the finger of blame for the latest crash in crude oil on the arrival of global warming? Unusually warm weather in Russia, Europe, and the United States, with temperatures reaching the upper 60’s in New York’s financial district, weakened global demand for heating oil by 23% below normal last week, and a 30% drop in heating oil demand is also expected in the days ahead.Quite often, markets seem designed to fool most people most of the time. Global economic growth and oil demand growth are usually linked, so given expectations for global GDP growth of 4.4% in 2007, it’s logical to expect global demand for crude oil to increase by at least 1.2 million barrels per day (bpd) this year. However, that would fall short of 1.8 million bpd of new oil supplies that OPEC expects to come on stream from Angola, Brazil, Canada, Kazakhstan, and Russia this year.

Read full article... Read full article...

Wednesday, January 10, 2007

Is the Commodities Bull Getting Buried Under the US Housing Rubble? / Commodities / Analysis & Strategy

By: Jas_Jain

Is the Commodities Bull Getting Buried Under the US Housing Rubble?

Please look at the following graph and see if you can spot correlation between the US Housing Bubble and the DJ-AIG commodity index (DJ-AIGCI, a balanced index of various complexes) bubble of recent years.

Monday, January 08, 2007

Russia cuts oil to Europe in response to Belarus syphoning off thousands barrels of oil / Commodities / Strategic News

By: Nadeem_Walayat

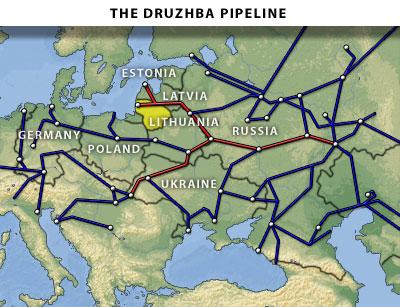

Belarus smarting from the doubling in the price of gas agreed just over a week ago, started to illegally syphon oil from the Druzhba pipeline,after the Russian pipeline operator Transneft refused to pay a retaliatory duty imposed by Belarus of $45 per metric ton of Russian oil shipped to Western Europe in pipelines that cross Belarus.

Saturday, January 06, 2007

Quantum finance and the scramble for gold / Commodities / Analysis & Strategy

By: Adrian_Ash

If you can't spot the patsy, then it must be you, says Adrian Ash. Get ready for the next raft of post-Crash regulations...Only in finance do the losers get to write history. The government then prints their memoirs in the statute books, while a new volume of folly and greed is begun.

Witness Barnard's Act of 1734. It sought "to prevent the infamous practice of stock-jobbing" that had peaked and exploded with the South Sea Bubble of 1720. Investors had long since fled Change Alley, however, and gone back to trading government bonds instead.

Read full article... Read full article...

Thursday, January 04, 2007

Crude Oil tumbles through support levels, is the bull market over ? / Commodities / Forecasts & Technical Analysis

By: Nadeem_Walayat

Crude oil plunges through key support levels built during the recent consolidation area of 56 to 63.

Crude Oil had been in an up trend since start of 2002, which had taken the price from just over $15 to just shy of $80 going into July 2006. Now following a failed attempt to resume the up trend, crude is threatening to end the bull market by yesterdays price action in the face of a much milder than expected US winter.

Read full article... Read full article...

Thursday, December 28, 2006

Gold Forecast - Four ways to profit as gold is set to shine in 2007 / Commodities / Forecasts & Technical Analysis

By: Money_and_Markets

It's been a wild year in the markets, and if recent events are any barometer, 2007 is going to be even crazier. Right off the bat, let me reaffirm my most important point: Gold is going to be the asset to own in 2007. The yellow metal posted an impressive return in 2006 — almost 22% for spot gold through yesterday. But I consider that move to be just the prelude to much higher levels. Indeed, gold's action so far is just an indicator of things to come ... rising inflation ... a falling dollar ... and insurmountable debts in Washington.

More on that in a moment. First, let me take you back in time ...

Read full article... Read full article...

Friday, December 22, 2006

Buying gold - The easy and safe way for personal investors to Buy, Sell and hold gold at market price / Commodities / Investing

By: Nadeem_Walayat

Russian and Chinese governments together with private investors are all buying gold bullion in strength, and the gold price has more than doubled in 5 years as a result. Owning physical gold is fast returning as the favoured way to secure wealth against the rising tide of global economic and financial weaknesses.

BullionVault.com is a revolutionary online market for private investors to buy gold, and later sell, directly within international high-security vaults. Customers trade gold with each other, or BullionVault.com, at the best price in a multi-currency real-time market. The service launched in May 2005 and is proving immensely popular. All bullion is held in the Brinks vault of choice in London, Zurich or New York. All accounts are openly audited daily.

BullionVault is currently being promoted with 1 gram of FREE gold bullion, stored in their Swiss vault, which is valued at $24 FREE

Read full article... Read full article...

Friday, December 15, 2006

Six critical market forecasts for 2007 ! / Commodities / Forecasts & Technical Analysis

By: Money_and_Markets

With the new year just about two weeks away, I think now is a good time to take stock of where we've been, where we are, and where the markets are going next year. Despite recent gyrations, especially in natural resources prices, the positions in my Real Wealth Report continue to pay off handsomely overall. And the best news is that I expect greater gains next year! Reason: All my models point to 2007 as the point in time when all the powerful forces I've been telling you about converge into some major explosions! So, without further ado, here are my six forecasts for next year ...Read full article... Read full article...

Sunday, December 03, 2006

Crude Oil rallies, but a widening Contango could lead to a collapse in oil prices during 2007 / Commodities / Analysis & Strategy

By: Nadeem_Walayat

As crude rallies to $63, we take a look at the effects of backwardation and Contango on the commodity markets such as crude oil. Knowing and allowing for these in future price trends can make the difference between profits and losses even if you get the market right on price direction.

Saturday, November 25, 2006

Are Arab Oil kingdoms and China Attracted to Golds Glitter? / Commodities / Analysis & Strategy

By: Gary_Dorsch

Wednesday, November 15, 2006

Crude Oil dips as it attempts to make a base above $56 before rallying / Commodities / Forecasts & Technical Analysis

By: Nadeem_Walayat

Crude oil prices fell as mild weather countered OPEC's announcement that it will cut production. Crude Oil continues to build a base between 58 and 62, above the support zone of $56, in prelude to an uptrend after the sell off into October that took crude oil to technically very over sold state.

Thursday, October 26, 2006

Silver Forecast - Bullish Pennant Pattern Developing / Commodities / Forecasts & Technical Analysis

By: Nadeem_Walayat

Silver recently followed the other commodities lower, such as gold and crude oil. But unlike gold, the price pattern is much more bullish, and resembles the Bullish Pennant, which is an strong and explosive bull pattern.

Read full article... Read full article...

Wednesday, October 18, 2006

Crude Oil is attempting to make a base above $56 / Commodities / Forecasts & Technical Analysis

By: Nadeem_Walayat

As expected Crude Oil is attempting to make a bottom after the recent sharp decline, but the quality of the bottom making process is poor, which suggests that an ensuing rally will also be poor.

Read full article... Read full article...

Tuesday, October 10, 2006

Crude Oil dips below $59, When will the uptrend resume ? / Commodities / Crude Oil

By: Nadeem_Walayat

Despite news that OPEC will cut production by 1 million barrels per day, crude fell below $59. The market also shrugged off news of the unrest in Nigeria which implies a significant shift in sentiment which in months gone past would have resulted in surge in prices. Which suggests the market is pricing in demand reduction and does not believe that OPEC will go ahead with the quota cuts.

Wednesday, September 27, 2006

The Commodities Bull Market - Where to Next ? / Commodities / CRB Index

By: Nadeem_Walayat

The speculators long of the metals and energy are reeling from the sell off these past few months, where greed has been gradually replaced by FEAR ! Many now wonder whether the bull market has come to an end.

Monday, September 18, 2006

What's behind the Meltdown in the Commodity markets? / Commodities / CRB Index

By: Sarah_Jones

By Gary Dorsch, Editor, Global Money Trends

“A Trend in Motion will stay in motion, until some major outside force knocks it off its course.” After climbing to a 25-year high of 365.45 on May 11 th , the Reuters Jefferies Commodities (CRB) Index began to show signs of fatigue in June and July, and then stumbled into a free-fall in August and September. With the CRB index slicing below its four-year upward sloping trend-line in early September, chart watchers would probably agree that a peak in the bullish cycle has been reached.

Monday, August 28, 2006

Is the 'Commodity Super Cycle' Fizzling Out? / Commodities / CRB Index

By: Gary_Dorsch

By Gary Dorsch, Editor of Global Money Trends newsletter

Since reaching a 25-year high of 365.45 on May 11 th , the Reuters Commodity Index, (CRB index), has been showing signs of fatigue, after a relentless four-year climb. The CRB index doubled from four years ago, led by commodity superstars, such as crude oil, copper, gold, platinum, silver, and sugar. However, since topping out three months ago, the CRB index has slumped about 9%, whipping up speculation that the 'Commodity Super Cycle' is fizzling out.

Defending its decision to pause its two-year rate hike campaign at 5.25% on August 8th , the Federal Reserve predicted that a softer US economy would take the steam out of commodity prices. 'Inflation pressures seem likely to moderate over time, reflecting contained inflation expectations and the cumulative effects of monetary policy actions and other factors restraining aggregate demand,' the Fed said. Putting his fragile reputation on the line, Fed chief Ben Bernanke hinted at a rate pause on July 19th , despite elevated commodity prices. “The recent rise in inflation is of concern, and possible increases in the prices of oil as well as other raw materials remain a risk to the inflation outlook. On the other hand, a slowing economy should reduce inflation pressures,” he told lawmakers on Capitol Hill.