Analysis Topic: Commodity Markets - Metals, Softs & Oils

The analysis published under this topic are as follows.Thursday, July 04, 2019

Crude Oil Price Pummeled, Where Is It Going Next? / Commodities / Crude Oil

By: Chris_Vermeulen

On Tuesday, July 2, 2019, the price of Crude Oil fell over -4.5% on continued expectations of global economic weakness and supply gluts. We found this interview rather interesting because it attempts to suggest a narrative that ignores Iranian issues while pushing the supply side fundamental for the current price decline (Source: CNBC).

On Tuesday, July 2, 2019, the price of Crude Oil fell over -4.5% on continued expectations of global economic weakness and supply gluts. We found this interview rather interesting because it attempts to suggest a narrative that ignores Iranian issues while pushing the supply side fundamental for the current price decline (Source: CNBC).

Back on May 21, 2019, we shared a post that is still very relevant today. The same price pattern is still in place and the same type of price action is working through the completion of an extended Pennant/Flag formation. We suggest all our follower read this May 21 post to catch up to current market levels.

Read full article... Read full article...

Thursday, July 04, 2019

Gold and Silver Precious Metals Breaking Out / Commodities / Gold & Silver 2019

By: Rambus_Chartology

I would like to start out this Report by looking at a long term monthly chart for the GDX. The multi year bear market actually began in September of 2011 at the head portion of the 3 1/2 year H&S top. The H&S top actually began to form in September of 2009 and ended in February of 2013 when the price action broke below the neckline. From that point the GDX declined for the next three years in its bear market so from a technical perspective the GDX ended its bear market in January of 2016 which marked its all time low.

I would like to start out this Report by looking at a long term monthly chart for the GDX. The multi year bear market actually began in September of 2011 at the head portion of the 3 1/2 year H&S top. The H&S top actually began to form in September of 2009 and ended in February of 2013 when the price action broke below the neckline. From that point the GDX declined for the next three years in its bear market so from a technical perspective the GDX ended its bear market in January of 2016 which marked its all time low.

The rally out of the 2016 low lasted seven months and ended in September of the same year. After a strong impulse move like that one looks for the price action to consolidate its gains before moving higher. There was no way to know at the time what trading range would develop and how long it will take to complete. Now in hindsight we can see the GDX built out the 2016 bullish falling wedge, that we’ve been following for well over a year, which took two years to complete from the August 2016 high to the September 2018 low. It wasn’t until the breakout above the top rail of the 2016 bullish falling wedge and the completion of the backtest two months ago in May that we had significant confirmation that the bear market that began in September of 2011 was officially over.

Read full article... Read full article...

Thursday, July 04, 2019

Gold Price Epochal Breakout Will Not Be Negated by a Correction / Commodities / Gold & Silver 2019

By: The_Gold_Report

Technical analyst Clive Maund charts the reasons why the recent gold breakout is genuine. It has been a truly glorious month for gold, and the purpose of this update is to point out firstly that the gold breakout of the past week was genuine and secondly that any short-term reaction back as far as $1,380 or even $1,370 will not negate the breakout—instead it should be seized upon as an opportunity to build positions across the sector, especially in trampled down undervalued silver stocks. Silver broke higher last week on its strongest upside volume since its frothy top in 2011 and on its second highest upside volume ever.

Technical analyst Clive Maund charts the reasons why the recent gold breakout is genuine. It has been a truly glorious month for gold, and the purpose of this update is to point out firstly that the gold breakout of the past week was genuine and secondly that any short-term reaction back as far as $1,380 or even $1,370 will not negate the breakout—instead it should be seized upon as an opportunity to build positions across the sector, especially in trampled down undervalued silver stocks. Silver broke higher last week on its strongest upside volume since its frothy top in 2011 and on its second highest upside volume ever.

On the six-month gold chart we can see the impressive breakout run-up of recent days, which has taken gold to a flag target that it has reached in an extremely overbought state. This means it is entitled to take a rest here, and that is what it is doing.

Read full article... Read full article...

Thursday, July 04, 2019

Silver Priced Poised for a Breakout / Commodities / Gold & Silver 2019

By: Clive_Maund

Technical analyst Clive Maund discusses why he believes silver is amazingly cheap and a sure sign that a major precious metals sector bull market is starting.

Technical analyst Clive Maund discusses why he believes silver is amazingly cheap and a sure sign that a major precious metals sector bull market is starting.

We have already been over the reasons why a major precious metals (PM) sector bull market is starting, and remarked on how undervalued silver is compared to gold, and how this is typical at the start of a major sector bull market. But it is worth "thumping the table" over this, because silver and silver investments may well be the best place of all to put your money at this time.

Many silver investors are manic-depressive and fanatical, which is a reality that we can turn to our advantage, for if we can figure when they are just starting to emerge from the depths of despair, it is the time to move into the sector in a big way.

They are just starting to emerge from the depths of despair right now as it happens, which is shown graphically by the silver-to-gold ratio, the basis of which is that when investors in the sector are at their most risk-averse, they tend to favor gold over silver. This is hardly surprising, as gold conjures up images of solidity and security to a much greater extent than silver, which is also known as "poor man's gold."

Read full article... Read full article...

Thursday, July 04, 2019

Crude Oil’s Reversal Sparks Our New Trading Decision / Commodities / Crude Oil

By: Nadia_Simmons

Yesterday’s oil session was indeed heavy on action. The initial upswing gave way to a reversal lower, leaving black gold to close almost unchanged. Well, it finished a bit lower than it opened the day actually. Does this signify something important? That important that it would make us act? You bet – let’s dive in to the juicy details.

Let’s take a closer look at the chart below (chart courtesy of www.stooq.com ).

Read full article... Read full article...

Thursday, July 04, 2019

Gold Plunges Below $1,400 On the News of Trade War Truce / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

Donald and Xi have confirmed their true and everlasting friendship now. Trade wars are over, it’s all rainbows and unicorns - and investors do not need safe havens anymore. Right? The celebratory mood feels great but let’s find out what the trade truce really means for the gold market.

Donald and Xi have confirmed their true and everlasting friendship now. Trade wars are over, it’s all rainbows and unicorns - and investors do not need safe havens anymore. Right? The celebratory mood feels great but let’s find out what the trade truce really means for the gold market.

Ufff, They Announce Trade Truce

The G20 meeting in Osaka, Japan, is behind us. Did I write “G20”? It should be “G2”, as the world’s focus was on the meeting between Donald Trump and Xi Jinping.

Read full article... Read full article...

Tuesday, July 02, 2019

Silver Price Is on the Launching Pad, Waiting for Ignition / Commodities / Gold & Silver 2019

By: MoneyMetals

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Coming up we have an interview with Greg Weldon that you absolutely are not going to want to miss. Hear what Greg has to say now about gold after accurately predicting the recent breakdown point to the dollar on this very podcast a little over a month ago. We’ll also get his thoughts on lagging silver, hear his breakdown the generational high we’re seeing in the gold to silver ratio right now and why he is on the verge of making a major trading decision in the white metal ahead of a big move he sees coming. All that and more coming up in our interview with Greg Weldon, right after this week’s market update.

Precious metals markets are set to close out the week, the month, and the quarter with underlying strength building for some big moves ahead.

The standout performer this month has been gold, breaking above $1,400 an ounce. Meanwhile, the raging palladium bull market is still powering ahead – with prices on the verge of posting new all-time highs. Even the lagging metals, silver and platinum, are showing signs of lifting off major bottoms.

Read full article... Read full article...

Tuesday, July 02, 2019

This Could Depress The Price Of Gold / Commodities / Gold & Silver 2019

By: Avi_Gilburt

I have to be honest and tell you that I am literally chuckling while I write some of my articles. My last gold article was one where I was certainly chuckling while writing it. Yet, I cannot tell you how many other “analysts” across the internet took me to task for something about which they thought I was being serious. I guess a sense of humor is not something that every reader possesses.

I have to be honest and tell you that I am literally chuckling while I write some of my articles. My last gold article was one where I was certainly chuckling while writing it. Yet, I cannot tell you how many other “analysts” across the internet took me to task for something about which they thought I was being serious. I guess a sense of humor is not something that every reader possesses.

You see, so many of these gold writers have their heads buried so deeply in the sand (or elsewhere) that they cannot even understand when someone is poking fun at their conspiracy or manipulation theories. And, to think that they view my theory of aliens causing a rise in gold as any different than some of the conspiracy theories they present is nothing less than laughable. But, everyone has their theories, just as they say that everyone has an armpit. And, many stink.

Read full article... Read full article...

Monday, July 01, 2019

Gold Huge Upside if Breakout Holds / Commodities / Gold and Silver Stocks 2019

By: Jordan_Roy_Byrne

As I pen this article, Gold is set to close the month and the quarter above $1400/oz and holding the majority of its recent gains. That does not necessitate continued strength but it is a good sign.

As I pen this article, Gold is set to close the month and the quarter above $1400/oz and holding the majority of its recent gains. That does not necessitate continued strength but it is a good sign.

The technicals and fundamentals are finally in place for Gold.

It is outperforming all major currencies and the Federal Reserve is weeks away from beginning a new cycle of rate cuts. The US Dollar has broken its uptrend.

The near-term outlook is very strong but if the Federal Reserve cuts three or four times and Gold strongly outperforms the stock market then this move can go to $1900/oz.

Read full article... Read full article...

Monday, July 01, 2019

China’s Rare Earths, Locked And Loaded / Commodities / Rare Earths

By: Steve_H_Hanke

President Trump has picked a fight with China on trade. This has run the gamut of badgering to the imposition of tariffs on Chinese exports to the United States. And, if that is not enough, the President threatens to lay on more tariffs if China fails to comply with a host of U.S. demands. China will not stand idly by and be beaten with a stick, but will they pull the trigger?

President Trump has picked a fight with China on trade. This has run the gamut of badgering to the imposition of tariffs on Chinese exports to the United States. And, if that is not enough, the President threatens to lay on more tariffs if China fails to comply with a host of U.S. demands. China will not stand idly by and be beaten with a stick, but will they pull the trigger?

One weapon that China has in its arsenal is rare earths. As the Global Times, a state-owned Chinese newspaper, put it: rare earths are “an ace in China’s hand.” Rare earths cover 17 important elements on the periodic table. And, they are elements in which China occupies a dominant position. Furthermore, the Chinese leadership is well aware of the strategic importance of rare earths. As far back as 1992, Deng Xiaoping stressed that “the Middle East has oil; China has rare earths.”

And that is not all. China knows that rare earths can be used to counterpunch. Last month, China’s Natural Development and Reform Commission, a body that oversees Chinese policy shifts, pointedly brought up rare earths in a question-and-answer bulletin on the threat of a rare earths export ban. The notice read: “Will rare earths become China’s counter-weapon against the US’s unwarranted suppression? What I can tell you is that if anyone wants to use products made from rare earth to curb the development of China, then the people of the revolutionary soviet base and the whole Chinese people will not be happy.”

Read full article... Read full article...

Monday, July 01, 2019

The Oil Crisis Saudi Arabia Can't Solve / Commodities / Crude Oil

By: OilPrice_Com

Saudi Arabia’s CEO Amin Nasr’s message to the press that oil flows to the market are guaranteed, should be taken with a pinch of salt.

Saudi Arabia’s CEO Amin Nasr’s message to the press that oil flows to the market are guaranteed, should be taken with a pinch of salt.

Looking at the current volatility in the Persian/Arabian Gulf and the possibility of a temporary closure of the Strait of Hormuz, the Aramco CEO’s message might be a bit overoptimistic. In reality, Aramco will not be able to keep the necessary crude oil and products volumes flowing to Asian and European markets in the case of a full Strait of Hormuz blockade. Even that Aramco owns and operates a crude oil pipeline with a capacity of 5 million bpd, carrying crude 1,200 kilometers between the Arabian Gulf and Red Sea, much more is needed to keep the oil market stable.

Read full article... Read full article...

Sunday, June 30, 2019

Once Upon a Time There Was a Goldilocks Economy. Will This Story End Well for Gold? / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

Once upon a time there was a Goldilocks (economy)… Would like to know the end of this story? So let’s read our today’s article – and find out whether it will have a happy end for gold!

Once upon a time there was a Goldilocks (economy)… Would like to know the end of this story? So let’s read our today’s article – and find out whether it will have a happy end for gold!

There was once a little girl whose hair was so bright and yellow that it glittered in the sun like spun-gold. For this reason she was called Goldilocks. One day she came to a house of Three Bears. They have gone out, but the girl saw the porridge through the window, so she went in.

She first tasted the porridge of the Great, Huge Bear, and that was too hot for her. And then she tasted the porridge of the Middle Bear, and that was too cold for her. And then she went to the porridge of the Little, Small Bear, and tasted that; and that was neither too hot nor too cold, but just right, and she liked it so well that she ate it all up.

Saturday, June 29, 2019

Gold Stocks Decisive Breakout! / Commodities / Gold and Silver Stocks 2019

By: Zeal_LLC

The gold miners’ stocks just blasted higher to a major decisive breakout this week! Driven by gold’s own huge bull-market breakout, the gold stocks surged well above vexing years-old upper resistance. The resulting new multi-year highs are a game changer, starting to shift long-apathetic sector sentiment back towards bullish. This will increasingly attract back traders, with their buying unleashing a virtuous circle of gains.

The gold miners’ stocks just blasted higher to a major decisive breakout this week! Driven by gold’s own huge bull-market breakout, the gold stocks surged well above vexing years-old upper resistance. The resulting new multi-year highs are a game changer, starting to shift long-apathetic sector sentiment back towards bullish. This will increasingly attract back traders, with their buying unleashing a virtuous circle of gains.

Traders usually track gold-stock fortunes with this sector’s most-popular exchange-traded fund, the GDX VanEck Vectors Gold Miners ETF. Launched in May 2006, this was the original gold-stock ETF. That big first-mover advantage has helped propel GDX to sector dominance. This week its net assets of $10.5b ran 44.6x larger than the next-biggest 1x-long major-gold-miners ETF! GDX is this sector’s leading benchmark.

And as recently as late May, neither speculators nor investors wanted anything to do with gold stocks. GDX slumped to $20.42 on May 29th, down 3.2% year-to-date. That was much worse than gold’s own slight 0.2% YTD decline then warranted. The gold stocks were really out of favor, largely ignored by apathetic traders. What a difference a month makes though, as their fortunes changed radically in June.

Read full article... Read full article...

Friday, June 28, 2019

Platinum Setting Up For A Big Price Anomaly / Commodities / Platinum

By: Chris_Vermeulen

Our clients and followers have been following our incredible research and market calls regarding Gold and Silver with intense focus. We issued a research post in October 2018 that suggested Gold would rocket higher from a base level below $1300 to an initial target near $1450 almost 9 months ago.

Our clients and followers have been following our incredible research and market calls regarding Gold and Silver with intense focus. We issued a research post in October 2018 that suggested Gold would rocket higher from a base level below $1300 to an initial target near $1450 almost 9 months ago.

As of this week, Gold has reached a high of $1442.90 only $7.10 away from our predicted target level. This has been an absolutely incredible move in Gold and we could not be more pleased with the outcome for our clients, followers, and anyone paying attention to our research posts.

Additionally, many of our clients have been asking us to share our predictive modeling research for Platinum, which has been basing near recent lows recently. We decided to share our research with everyone regarding the information our proprietary predictive modeling tools are suggesting.

Read full article... Read full article...

Friday, June 28, 2019

Silver Awaiting This Key Bull Market Signal / Commodities / Gold & Silver 2019

By: Hubert_Moolman

Although gold has successfully signaled its bull market, silver is yet to convincingly do so. It may be true that silver follows gold, but the two can diverge for quite some time. So, it is essential that silver gives us a clear bull market signal to confirm that the bull is real.

The following technique could provide a way to track silver until it provides that clear bull market signal.

Read full article... Read full article...

Friday, June 28, 2019

Gold Stock Launch in the Books; What’s Next / Commodities / Gold and Silver Stocks 2019

By: Gary_Tanashian

You may know me as the…

…guy.

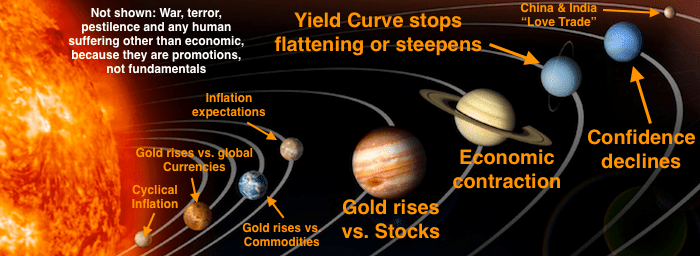

The guy using the planets of an imaginary gold sector Macrocosm with proper fundamentals that are decidedly not imaginary but rather, are necessary to call a real bull phase or even bull market. By managing a strict set of macro and sector fundamental inputs (to the sound of crickets and little else in the sector) NFTRH and its subscribers had a front row seat to the now obvious gold mining launch as first the fundamentals came in line, followed by the technicals.

Read full article... Read full article...

Friday, June 28, 2019

Can the Crude Oil Bulls Extend the Sputtering Rally? / Commodities / Crude Oil

By: Nadia_Simmons

The series of higher oil prices appears to be over as today, we might see the bulls’ power tested. Where can the bears aim realistically and what is most likely to happen next? These are certainly valid questions as the oil price has reached an important resistance and appears hesitating today. Will some geopolitical news come to the rescue? High time to dive in...

Read full article... Read full article...

Friday, June 28, 2019

Gold Declines As the Fed Dampens Rate Cut Expectations / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

What a week! On Tuesday, gold prices hit a six-year peak of almost $1,440. But they declined since then to almost $1,400. What is happening? We got the Fed speaking… Let’s dive in to the implications of what has been said.

What a week! On Tuesday, gold prices hit a six-year peak of almost $1,440. But they declined since then to almost $1,400. What is happening? We got the Fed speaking… Let’s dive in to the implications of what has been said.

Rally in Gold Ends

As we reported two days ago, the price of gold has jumped above $1,430 after the dovish FOMC meeting last week. However, the rally did not last long. Yesterday, the price of gold fell to a level slightly above $1,400, as the chart below shows. What happened?

Read full article... Read full article...

Friday, June 28, 2019

Gold Clearly Reverses at Consolidation’s Upper Border / Commodities / Gold & Silver 2019

By: P_Radomski_CFA

Quite a few journalists wrote about gold’s breakout in the previous days even though gold made an attempt to break above the key resistance – the mid-2013 high – only today (and it failed). At the same time, when the gold to silver ratio was breaking out in a clear way, many journalists ignored that and emphasized the importance of the resistance at hand. Either way, the focus was not on what was really going on, but on trying to make the reality fit the bullish case for gold. After all, “gold people” have to be bullish on gold all the time, right? Wrong – those, who want their clients to succeed need to stay focused on what is likely to happen based on objective, cold logic and facts, instead of chasing the emotions of the day. And what do the facts tell us?

Quite a few journalists wrote about gold’s breakout in the previous days even though gold made an attempt to break above the key resistance – the mid-2013 high – only today (and it failed). At the same time, when the gold to silver ratio was breaking out in a clear way, many journalists ignored that and emphasized the importance of the resistance at hand. Either way, the focus was not on what was really going on, but on trying to make the reality fit the bullish case for gold. After all, “gold people” have to be bullish on gold all the time, right? Wrong – those, who want their clients to succeed need to stay focused on what is likely to happen based on objective, cold logic and facts, instead of chasing the emotions of the day. And what do the facts tell us?

We have a twofold purpose in highlighting the pitfalls of permabullish emotionality. The first one is to show you how acting on emotions in investing backfires – gold rallied temporarily above $1,440 and in today’s pre-market trading, declined to almost $1,400. And it doesn’t seem that the decline is over. The second one is that we want to emphasize that there is almost nobody else in the gold analysis business that saw that the real resistance and the upper border of the long-term consolidation pattern in gold is at the mid-2013 highs. Many others cheered as gold moved above the previous – less important – highs, and they wrote about a major breakout in gold. These were breakouts, but not the key ones and nothing to call home about given that the highest of the relatively close highs remained unbroken. Please remember the above as gold moves to lower prices. Please also remember that we are writing right now that we will see gold below $1,200 well before we’ll see it above $1,500.

Read full article... Read full article...

Thursday, June 27, 2019

Silver Price Will Pause Before Going Higher / Commodities / Gold & Silver 2019

By: Chris_Vermeulen

Silver will likely find resistance near $15.60 and move slightly lower before another upside price leg takes place. Both gold and silver have begun incredible price rallies over the past 10+ days and we believe this is just the start of a much bigger price trend.

Silver will likely find resistance near $15.60 and move slightly lower before another upside price leg takes place. Both gold and silver have begun incredible price rallies over the past 10+ days and we believe this is just the start of a much bigger price trend.

We believe Silver, to be one of the absolute best potential trades and investment. It will likely pause just below $15.75, near the First Resistance level, rotate a bit lower (possibly towards $15.15), then attempt another rally towards the $16.50 level.

Read full article... Read full article...