Saturday, June 29, 2019

The Trump Stock Market Trap May Be Triggered / Stock-Markets / Stock Markets 2019

By: Barry_M_Ferguson

From the Christian Bible, John 8:32 - Jesus speaking: “If you abide in My word, you are My disciples indeed. And you shall know the truth, and the truth shall make you free.”

From the Christian Bible, John 8:32 - Jesus speaking: “If you abide in My word, you are My disciples indeed. And you shall know the truth, and the truth shall make you free.”

So, we have it on pretty good authority, Jesus Christ, that freedom is spawned from truth. If humans want to be free, they must therefore seek the truth.

The current day media, news - sports - financial, has gone full bore communist state mouth piece. They only report what they want us to believe. Deceivers push falsehoods to enhance their own power with the hope of enslaving the masses. The serpent doesn’t use an apple today. The serpent uses the microphone, politicians, entertainers, complete human ignorance, electronic media, and social media for deceit.

This is a truth we know. Low taxes plus low government regulation results in robust economies. Yet, no government on Earth facilitates this truth. In fact, they are the opposite and therefore in a spiritual sense, evil.

Read full article... Read full article...

Saturday, June 29, 2019

Gold Stocks Decisive Breakout! / Commodities / Gold and Silver Stocks 2019

By: Zeal_LLC

The gold miners’ stocks just blasted higher to a major decisive breakout this week! Driven by gold’s own huge bull-market breakout, the gold stocks surged well above vexing years-old upper resistance. The resulting new multi-year highs are a game changer, starting to shift long-apathetic sector sentiment back towards bullish. This will increasingly attract back traders, with their buying unleashing a virtuous circle of gains.

The gold miners’ stocks just blasted higher to a major decisive breakout this week! Driven by gold’s own huge bull-market breakout, the gold stocks surged well above vexing years-old upper resistance. The resulting new multi-year highs are a game changer, starting to shift long-apathetic sector sentiment back towards bullish. This will increasingly attract back traders, with their buying unleashing a virtuous circle of gains.

Traders usually track gold-stock fortunes with this sector’s most-popular exchange-traded fund, the GDX VanEck Vectors Gold Miners ETF. Launched in May 2006, this was the original gold-stock ETF. That big first-mover advantage has helped propel GDX to sector dominance. This week its net assets of $10.5b ran 44.6x larger than the next-biggest 1x-long major-gold-miners ETF! GDX is this sector’s leading benchmark.

And as recently as late May, neither speculators nor investors wanted anything to do with gold stocks. GDX slumped to $20.42 on May 29th, down 3.2% year-to-date. That was much worse than gold’s own slight 0.2% YTD decline then warranted. The gold stocks were really out of favor, largely ignored by apathetic traders. What a difference a month makes though, as their fortunes changed radically in June.

Read full article... Read full article...

Friday, June 28, 2019

Platinum Setting Up For A Big Price Anomaly / Commodities / Platinum

By: Chris_Vermeulen

Our clients and followers have been following our incredible research and market calls regarding Gold and Silver with intense focus. We issued a research post in October 2018 that suggested Gold would rocket higher from a base level below $1300 to an initial target near $1450 almost 9 months ago.

Our clients and followers have been following our incredible research and market calls regarding Gold and Silver with intense focus. We issued a research post in October 2018 that suggested Gold would rocket higher from a base level below $1300 to an initial target near $1450 almost 9 months ago.

As of this week, Gold has reached a high of $1442.90 only $7.10 away from our predicted target level. This has been an absolutely incredible move in Gold and we could not be more pleased with the outcome for our clients, followers, and anyone paying attention to our research posts.

Additionally, many of our clients have been asking us to share our predictive modeling research for Platinum, which has been basing near recent lows recently. We decided to share our research with everyone regarding the information our proprietary predictive modeling tools are suggesting.

Read full article... Read full article...

Friday, June 28, 2019

Silver Awaiting This Key Bull Market Signal / Commodities / Gold & Silver 2019

By: Hubert_Moolman

Although gold has successfully signaled its bull market, silver is yet to convincingly do so. It may be true that silver follows gold, but the two can diverge for quite some time. So, it is essential that silver gives us a clear bull market signal to confirm that the bull is real.

The following technique could provide a way to track silver until it provides that clear bull market signal.

Read full article... Read full article...

Friday, June 28, 2019

Yes, the Personal Finance Industry Is a Scam / Personal_Finance / Financial Education

By: Jared_Dillian

I’m bouncing off of Kashana Cauley’s mini-rant in GQ about Suze Orman and the personal finance “industry” in general. The key paragraph here:

I’m bouncing off of Kashana Cauley’s mini-rant in GQ about Suze Orman and the personal finance “industry” in general. The key paragraph here:

This past weekend, CNBC reminded us of Orman’s distaste for coffee: “If you waste money on coffee, it’s like ‘peeing one million down the drain.’” Man, personal finance experts do love shaming people for buying coffee. And avocado toast. If only we’d just stop paying for haircuts—as USA Today recently recommended—the dollars we’d save would also destroy our crushing student debt and sink the effects of years of wage stagnation, income inequality, and de-unionization with it, allowing us to buy those houses we’re too broke to buy right now five minutes before we kick the bucket. And we’d also end up with completely professional, hacked-off-ourselves hair.

Friday, June 28, 2019

Gold Stock Launch in the Books; What’s Next / Commodities / Gold and Silver Stocks 2019

By: Gary_Tanashian

You may know me as the…

…guy.

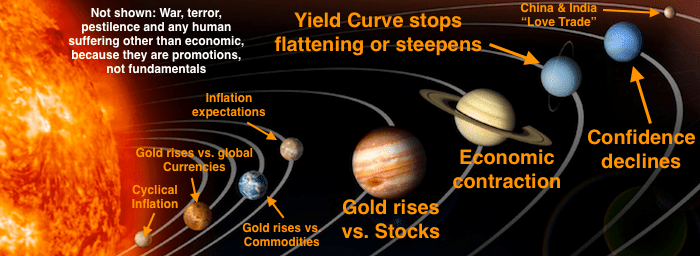

The guy using the planets of an imaginary gold sector Macrocosm with proper fundamentals that are decidedly not imaginary but rather, are necessary to call a real bull phase or even bull market. By managing a strict set of macro and sector fundamental inputs (to the sound of crickets and little else in the sector) NFTRH and its subscribers had a front row seat to the now obvious gold mining launch as first the fundamentals came in line, followed by the technicals.

Read full article... Read full article...

Friday, June 28, 2019

Can the Crude Oil Bulls Extend the Sputtering Rally? / Commodities / Crude Oil

By: Nadia_Simmons

The series of higher oil prices appears to be over as today, we might see the bulls’ power tested. Where can the bears aim realistically and what is most likely to happen next? These are certainly valid questions as the oil price has reached an important resistance and appears hesitating today. Will some geopolitical news come to the rescue? High time to dive in...

Read full article... Read full article...

Friday, June 28, 2019

Gold Declines As the Fed Dampens Rate Cut Expectations / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

What a week! On Tuesday, gold prices hit a six-year peak of almost $1,440. But they declined since then to almost $1,400. What is happening? We got the Fed speaking… Let’s dive in to the implications of what has been said.

What a week! On Tuesday, gold prices hit a six-year peak of almost $1,440. But they declined since then to almost $1,400. What is happening? We got the Fed speaking… Let’s dive in to the implications of what has been said.

Rally in Gold Ends

As we reported two days ago, the price of gold has jumped above $1,430 after the dovish FOMC meeting last week. However, the rally did not last long. Yesterday, the price of gold fell to a level slightly above $1,400, as the chart below shows. What happened?

Read full article... Read full article...

Friday, June 28, 2019

Gold Clearly Reverses at Consolidation’s Upper Border / Commodities / Gold & Silver 2019

By: P_Radomski_CFA

Quite a few journalists wrote about gold’s breakout in the previous days even though gold made an attempt to break above the key resistance – the mid-2013 high – only today (and it failed). At the same time, when the gold to silver ratio was breaking out in a clear way, many journalists ignored that and emphasized the importance of the resistance at hand. Either way, the focus was not on what was really going on, but on trying to make the reality fit the bullish case for gold. After all, “gold people” have to be bullish on gold all the time, right? Wrong – those, who want their clients to succeed need to stay focused on what is likely to happen based on objective, cold logic and facts, instead of chasing the emotions of the day. And what do the facts tell us?

Quite a few journalists wrote about gold’s breakout in the previous days even though gold made an attempt to break above the key resistance – the mid-2013 high – only today (and it failed). At the same time, when the gold to silver ratio was breaking out in a clear way, many journalists ignored that and emphasized the importance of the resistance at hand. Either way, the focus was not on what was really going on, but on trying to make the reality fit the bullish case for gold. After all, “gold people” have to be bullish on gold all the time, right? Wrong – those, who want their clients to succeed need to stay focused on what is likely to happen based on objective, cold logic and facts, instead of chasing the emotions of the day. And what do the facts tell us?

We have a twofold purpose in highlighting the pitfalls of permabullish emotionality. The first one is to show you how acting on emotions in investing backfires – gold rallied temporarily above $1,440 and in today’s pre-market trading, declined to almost $1,400. And it doesn’t seem that the decline is over. The second one is that we want to emphasize that there is almost nobody else in the gold analysis business that saw that the real resistance and the upper border of the long-term consolidation pattern in gold is at the mid-2013 highs. Many others cheered as gold moved above the previous – less important – highs, and they wrote about a major breakout in gold. These were breakouts, but not the key ones and nothing to call home about given that the highest of the relatively close highs remained unbroken. Please remember the above as gold moves to lower prices. Please also remember that we are writing right now that we will see gold below $1,200 well before we’ll see it above $1,500.

Read full article... Read full article...

Friday, June 28, 2019

Is the Market Sending a Crisis Era Signal on the Economy and Stock Market? / Stock-Markets / Stock Markets 2019

By: Troy_Bombardia

As the stock market continues to trend higher and Treasury yields continue to collapse, two groups of stocks are about to send crisis-era signals on the economy (according to Bloomberg). Today’s headlines:

As the stock market continues to trend higher and Treasury yields continue to collapse, two groups of stocks are about to send crisis-era signals on the economy (according to Bloomberg). Today’s headlines:

- Crisis era signals

- Stocks continue to rally and Treasury yields continue to fall

- Citigroup Economic Surprise Index still deep in negative territory

- Gold’s sentiment extreme and volume

- Bonds sentiment extreme

Friday, June 28, 2019

Is Bitcoin A Diversion from the Natural Monetary Order? / Politics / Bitcoin

By: Antonius_Aquinas

As modern man continues to wantonly deviate, flaunt, and reject the natural law and the Divinely-created order from which it derives, it is not surprising that illusions like Bitcoin and other crypto currencies have captured the imagination of many and have provided a vehicle for scammers to rip off their fellow man.

Crypto currencies are a more complex, yet still devious derivative of the immoral, economic destructive, and social debilitating system of central banking. In response, Bitcoin pumpers have craftily tried to portray digital currencies as a “decentralized” alternative to the present fiat, paper-money standard.

Read full article... Read full article...

Friday, June 28, 2019

Why Facebook May Pose a Greater Financial Danger Than Wall Street / Currencies / BlockChain

By: Ellen_Brown

Payments can happen cheaply and easily without banks or credit card companies, as has already been demonstrated—not in the United States but in China. Unlike in the U.S., where numerous firms feast on fees from handling and processing payments, in China most money flows through mobile phones nearly for free. In 2018 these cashless payments totaled a whopping $41.5 trillion; and 90% were through Alipay and WeChat Pay, a pair of digital ecosystems that blend social media, commerce and banking. According to a 2018 article in Bloomberg titled “Why China’s Payment Apps Give U.S. Bankers Nightmares”:

Payments can happen cheaply and easily without banks or credit card companies, as has already been demonstrated—not in the United States but in China. Unlike in the U.S., where numerous firms feast on fees from handling and processing payments, in China most money flows through mobile phones nearly for free. In 2018 these cashless payments totaled a whopping $41.5 trillion; and 90% were through Alipay and WeChat Pay, a pair of digital ecosystems that blend social media, commerce and banking. According to a 2018 article in Bloomberg titled “Why China’s Payment Apps Give U.S. Bankers Nightmares”:

Read full article... Read full article...The nightmare for the U.S. financial industry is that a technology company—whether from China or a homegrown juggernaut such as Amazon.com Inc. or Facebook Inc.—replicates the success of Alipay and WeChat in America. The stakes are enormous, potentially carving away billions of dollars in annual revenue from major banks and other firms.

Thursday, June 27, 2019

Silver Price Will Pause Before Going Higher / Commodities / Gold & Silver 2019

By: Chris_Vermeulen

Silver will likely find resistance near $15.60 and move slightly lower before another upside price leg takes place. Both gold and silver have begun incredible price rallies over the past 10+ days and we believe this is just the start of a much bigger price trend.

Silver will likely find resistance near $15.60 and move slightly lower before another upside price leg takes place. Both gold and silver have begun incredible price rallies over the past 10+ days and we believe this is just the start of a much bigger price trend.

We believe Silver, to be one of the absolute best potential trades and investment. It will likely pause just below $15.75, near the First Resistance level, rotate a bit lower (possibly towards $15.15), then attempt another rally towards the $16.50 level.

Read full article... Read full article...

Thursday, June 27, 2019

Precious Metals Expert Rick Rule Shares 'Gold Nuggets of Wisdom' / Commodities / Gold & Silver 2019

By: The_Gold_Report

Maurice Jackson of Proven and Probable and Rick Rule of Sprott USA engage in a wide-ranging discussion covering Pareto's law, the importance of courage and conviction in investment, copper, mentors and the upcoming Sprott Natural Resource Symposium

Maurice Jackson of Proven and Probable and Rick Rule of Sprott USA engage in a wide-ranging discussion covering Pareto's law, the importance of courage and conviction in investment, copper, mentors and the upcoming Sprott Natural Resource Symposium

Maurice Jackson: Joining us for conversation is legendary investor Rick Rule of Sprott USA. Mr. Rule, welcome to the show. In our interview last month, we addressed a number of topics regarding where and what Sprott USA is focusing their attention on in the natural resource space. And at the conclusion of the interview, Rick, you stated that we should discuss Pareto's law, which is known as the 80/20 law. But you put an interesting perspective on the law that I had not considered. Mr. Rule, expand the narrative on Pareto's law and please introduce us to the concept of the 4%.

Rick Rule: Sure. And actually I'll take a little further than that with your permission. Most people have heard of the 80/20 principle, which suggests that in any sort of major field of human endeavor, 20% of the people engaged in that activity generate 80% of the utility. In other words, 20% of the people do 80% of the work.

Read full article... Read full article...

Thursday, June 27, 2019

What Led to the Current Brexit Crisis? / Politics / BrExit

By: Travis_Bard

It’s more than a thousand days since the UK voted to leave the European Union, but the future relationship between the country and its continental neighbor is still unclear. The historic House of Commons, hailed as the Mother of Parliaments and based in the Palace of Westminster, has reached an impasse and can now only ask for an extension to the exit process in order to buy itself more time for a way out of the current predicament.

The public is as bitterly divided as the politicians – with more than six million people signing a petition to call for Brexit to be stopped and a mass march in London demanding another referendum to revisit the exit issue.

Read full article... Read full article...

Thursday, June 27, 2019

Scuffed Alloy Wheel Rims Repair Cheap Marker Pen Quick Quick Fix - Disco Sport / Personal_Finance / Money Saving

By: HGR

Here's a quick money saving repair for your alloy wheel rims using a cheap permanent marker pen that can be bought from any super market, the colour of the market of course will depend on the colour of your alloy wheels. In this video I used an ordinary cheap black permanent market pen on a Land Rover Discovery sports black alloys to do a quick job of hiding unsightly curb damage to alloys. So find out what you can expect in terms of looks in our latest video in our owning and driving a Land Rover Discovery Sports series.

Read full article... Read full article...

Thursday, June 27, 2019

Bonds and Stocks vs Gold / Commodities / Gold & Silver 2019

By: Richard_Mills

North American stock markets continued to rise on Friday, as more investors took the opportunity to jump into equities on the back of a clear signal from the US Federal Reserve that interest rates are likely heading down. The S&P 500 hit a new record on Thursday, finishing 249 points higher, or 0.9%, to 2,954.

North American stock markets continued to rise on Friday, as more investors took the opportunity to jump into equities on the back of a clear signal from the US Federal Reserve that interest rates are likely heading down. The S&P 500 hit a new record on Thursday, finishing 249 points higher, or 0.9%, to 2,954.

The Federal Open Market Committee (FOMC) concluded on Wednesday that it will leave the federal funds rate unchanged, in the 2.25% to 2.5% range. Importantly however, the Fed dropped its pledge to be “patient” on a widely anticipated rate cut, meaning it could be poised to act. Also, Fed Chair Jerome Powell stopped referring to below-target 1.8% inflation as “transient”. Persistent inflation under 2% is a strong prompt for the Fed to raise interest rates, since part of its mandate is to keep inflation at the 2% sweet spot.

Read full article... Read full article...

Thursday, June 27, 2019

MICROSOFT - MSFT Stock Investing to Profit From AI Machine Learning / Companies / Microsoft

By: Nadeem_Walayat

Where to invest to profit from the exponential machine intelligence mega-trend. I have ranked these stocks in in terms of risk vs reward and volatility. Do remember that when investing in the stock market that your capital is at risk. There are NO SURE BETS!

Where to invest to profit from the exponential machine intelligence mega-trend. I have ranked these stocks in in terms of risk vs reward and volatility. Do remember that when investing in the stock market that your capital is at risk. There are NO SURE BETS!

If you've not already done so then watch my following video from November 2016 which illustrates why everything will start to change exponentially by 2021.

Read full article... Read full article...

Thursday, June 27, 2019

Big Tech Break-Up Won’t Happen for This One Reason / Companies / Tech Stocks

By: Stephen_McBride

The US government recently announced it will launch an investigation into “big tech.”

The US government recently announced it will launch an investigation into “big tech.”

It is looking into whether Amazon (AMZN), Google (GOOG), and Facebook (FB) are too powerful and should be broken up.

These are the 3rd-, 4th-, and 6th-largest companies on earth. Combined, they are worth over $2 trillion. And they’ve grown 470%, 175%, and 95% over the past five years.

All three stocks tanked on the news. In recent weeks, Google has dropped 20%, Amazon 15%, and Facebook 18%.

Thursday, June 27, 2019

The Gold Asteroid That Could Make Everyone On Earth A Billionaire / Commodities / Gold & Silver 2019

By: OilPrice_Com

Whether it was the Big Bang, Midas or God himself, we don’t really need to unlock the mystery of the origins of gold when we’ve already identified an asteroid worth $700 quintillion in precious heavy metals.

Whether it was the Big Bang, Midas or God himself, we don’t really need to unlock the mystery of the origins of gold when we’ve already identified an asteroid worth $700 quintillion in precious heavy metals.

If anything launches this metals mining space race, it will be this asteroid--Psyche 16, taking up residence between Mars and Jupiter and carrying around enough heavy metals to net every single person on the planet close to a trillion dollars.

Read full article... Read full article...