What Led to the Current Brexit Crisis?

Politics / BrExit Jun 27, 2019 - 06:17 PM GMTBy: Travis_Bard

It’s more than a thousand days since the UK voted to leave the European Union, but the future relationship between the country and its continental neighbor is still unclear. The historic House of Commons, hailed as the Mother of Parliaments and based in the Palace of Westminster, has reached an impasse and can now only ask for an extension to the exit process in order to buy itself more time for a way out of the current predicament.

The public is as bitterly divided as the politicians – with more than six million people signing a petition to call for Brexit to be stopped and a mass march in London demanding another referendum to revisit the exit issue.

So, how did we get here? Why is Britain so divided over Brexit? We examine the key factors:

Austerity

Like the rest of the world, the Great Recession took its toll on the UK. Huge bank bailouts caused the debt and deficit to balloon and led to a coalition government which entered into a period of ‘austerity’ involving cuts to public services. While many people in the country felt the pinch of economic tightening – and an unprecedented period of wage stagnation - there was a perception that the bankers who caused the problem and general ‘elite’ were relatively unharmed. Economic hardship and political resentment found their ultimate expression in the ballot box with Brexit.

Cameron’s referendum gamble

After unexpectedly winning a majority in the 2015 General Election – in spite of the tough period of austerity – David Cameron took the chance to try to settle the ‘Europe question’, which had dogged his Conservative Party for years. The hardline United Kingdom Independence Party (UKIP) was threatening to eat into his party’s core support so a referendum was offered to address the matter head on. Despite getting fairly meagre concessions from the EU to reform the UK’s current position, Cameron breezed into an election battle he expected to win and allowed the change proposition – Leave – to get away without needing to be properly spelled out and defined. People don’t know what Brexit will properly entail now and that’s in part because it wasn’t properly sketched out at the start.

The campaign

The campaign itself turned into a bitter battle between opposing camps and lay the foundations for divisions that have not healed since. Vote Leave broke electoral law and politicians make grand and bold statements that have since been shown to have been exaggerated at best. The nature of the campaign left enough of a sour taste to suggest that the matter isn’t over or that it was won in a fair way – while also exposing spin on both sides that made compromise between opposing camps tough afterwards.

The ‘red lines’ that defined Brexit

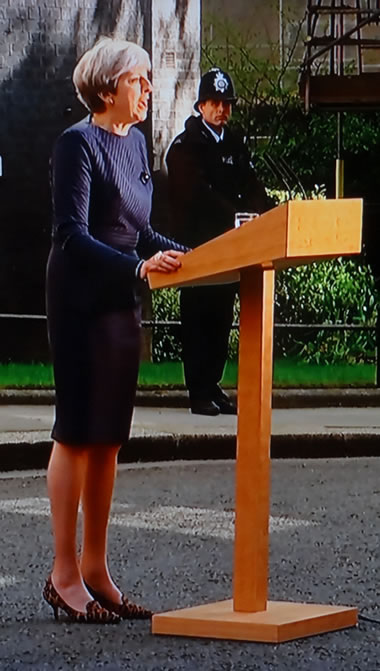

A 52-48 victory for Leave was a shock – but was also a narrow victory that needed careful stewardship. David Cameron departed and the resulting leadership contest saw most contenders fall by the wayside leaving Theresa May to take charge. Despite nominally being a Remainer, the former Home Secretary aimed to prove she was committed to the cause and set out her negotiating red lines that narrowed the field of options and established the need to leave the Customs Union and Single Market, things that some Leavers had previously supported. She also vowed that ‘no deal was better than a bad deal’ – which empowered hardliners to pursue this as a back-up plan. After Lancaster House, GBPUSD traded in a 3.6% weekly range (low-to-high), and the FTSE 100 dropped 2.90% in a week.

The snap election

The snap election

Seeing a battle ahead, the new Prime Minister opted to call a snap election in April 2017 in a bid to strengthen her hand in the negotiations and provide a bigger majority to help her force through her Brexit plan. Yet this backfired spectacularly and, rather than increase her majority, May actually lost control of the Commons and found herself having to do a deal with the Northern Irish Democratic Unionist Party to carry on in government. As this timeline demonstrates, GBPUSD traded in a 3.12% weekly range (low-to-high) and the FTSE 100 fell 3.64% in a week. Politically, May has faced an uphill struggle to overcome the Parliamentary arithmetic since.

May’s leadership style

The election exposed May’s weaknesses as a campaigner and media performer – earning her the nickname the ‘Maybot’. Her awkward style has done little to endear her to her opponents and has hindered the process of consensus building.

Polarisation of politics

Little has been done to put a lid on the heated debate provoked by the referendum. Politics is increasingly polarised – with ‘Remainers’ and ‘Leavers’ standing by their referendum identities in a way that has eroded party loyalty and made the situation in Westminster more complicated than ever before. The slogans and arguments persist and there has been little appetite for genuine compromise.

The shadow of the past

Finally, a spectre hangs over the whole debate in the form of a big question – ‘what is the UK’s place in the world?’. In a post-war, post-Empire world, the UK is increasingly looking like a nation in the grip of an identity crisis. Arguments about sovereignty and the national character were dragged up by the referendum and are yet to be satisfactorily answered. No form of Brexit – and certainly not Brexit alone – can address these alone.

A nation yet to come to terms with its past, a polarised politics, the character of the Prime Minister, the result of a snap election, the Brexit red lines, the nature of the referendum campaign, David Cameron’s referendum gamble and the post-crash era of austerity all lead us to the current impasse and explain why Brexit has been allowed to develop into a full-blown crisis.

By Travis Bard

This is a paid advertorial.

© 2019 Copyright Travis Bard - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.