Gold Jumps Above $1,400 after Dovish Fed

Commodities / Gold & Silver 2019 Jun 26, 2019 - 11:32 AM GMTBy: Arkadiusz_Sieron

Last week was definitely hot. Both major central banks adopted a more dovish stance. Gold reacted positively, jumping above $1,400. What has changed, and what has not? How close are we to an actual rate cut, not only to the speculation of getting one for sure on the next Fed meeting? How will gold like it?

Last week was definitely hot. Both major central banks adopted a more dovish stance. Gold reacted positively, jumping above $1,400. What has changed, and what has not? How close are we to an actual rate cut, not only to the speculation of getting one for sure on the next Fed meeting? How will gold like it?

Doves Are Strong Within the Fed

The dovish shift was surprising. Maybe not the direction, but the scale for sure. After all, the GDP is steadily growing, while the unemployment rate is at record lows. While inflation is below the target, it is still above 1.5 percent. Why would the Fed lower the federal funds rate in such positive macroeconomic conditions?

But, as the fresh dot-plot shows, eight of the 17 members of the FOMC now show a willingness to cut interest rates this year, and seven of that dovish group would prefer to see rates being lowered twice in 2019. Eight other participants see no changes in the level of federal funds rate and only one person wants a 25-basis points hike.

It seems that the Fed either does the Wall Street’s bidding or it got swayed by Trump’s publicly expressed and repeated dissatisfaction with the tightening cycle. Or the U.S. central bank is really obsessed with having inflation exactly at 2 percent, as if it is a magic number. Anyway, the case for lower rates is building, as Powell said during his press conference.

However, it does not mean that the Fed will cut rates in July. They are just laying groundwork to act if needed. A lot will depends on the incoming economic data and the outcome of the Donald Trump-Xi Jinping meeting at G20 summit later this week. If the trade wars escalate while the economic reports substantially deteriorate, the Fed may indeed cut rates as soon as in July. However, it the trade wars deescalate while the economic picture remains solid, the cut should not happen, at least if the Fed still independently makes data-driven decisions. While the betting markets see the July rate cut as a foregone conclusion, it’s actually still far from being one – there’re many moving parts and the Fed has just laid the groundwork for a possible rate cut without committing to one.

Last week, a few economic reports came out. The leading index was flat in May. The Philadelphia Fed manufacturing index fell to just 0.3 in June from a four-month high of 16.6 in the prior month. And both IHS Markit flash manufacturing and services said its flash manufacturing PMI dropped to 50.1 in June from 50.5 in May, the worst reading since September 2009. All these news suggest somewhat slower growth in the months ahead, but they should not be enough to alter significantly the Fed’s outlook. The payroll figures or inflation readings would be more important.

Implications for Gold

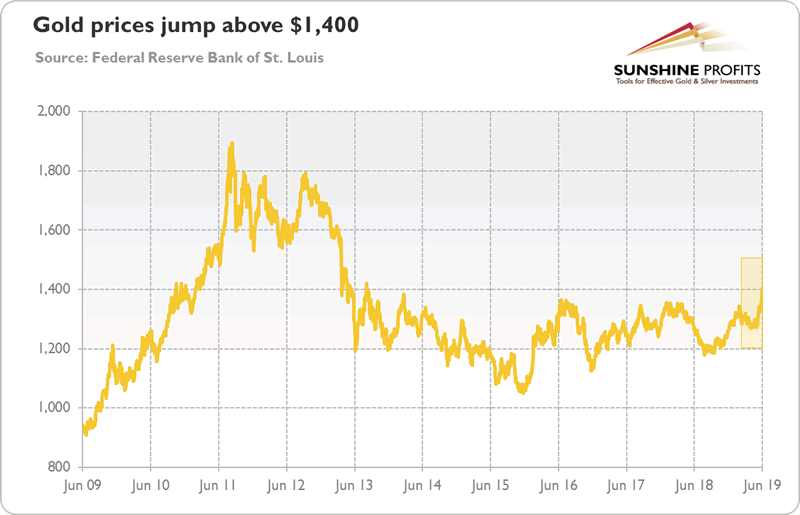

The dovish FOMC meeting was great for the gold prices. As one can see in the chart below, the price of the yellow metal soared above $1,400, to the highest level since 2013.

Chart 1: Gold prices (London P.M. Fix, in $) from June 2009 to June 2019.

It’s a huge development, as gold got out of a five-year trading range, despite the relative strength of the US dollar. For the past few years, the yellow metal could not unleash itself from the sideways trend and rally above $1,350. Now, it’s above $1,400, which creates hopes for further rally.

Although it is still way too early to announce the start of a new bull market, (especially the trading point of view highlights that quite a few metrics don’t correspond to what can be reasonably expected in the context of a newborn bull market), the fundamentals are slowly turning positive for gold. We have been repeating for a long time that the more dovish Fed will make 2019 better year for gold than 2018. While it’s still two quarters before the year is over, low bond yields won’t exert downward pressure on the gold price. If the markets were to start questioning the Fed’s credibility (aka confidence in the Fed takes a hit), that wouldn’t push gold price down only by itself either. The latest FOMC meeting clearly shows the limits faced by central bankers in unwinding the post-GFC stimulus and normalizing the monetary policy.

Moreover, the yield curve has recently inverted, which prompted many investors to assume that the recession is coming. So, they started to anticipate that the U.S. central bank will cut interest rates. An environment in which people worry about economic downturn, while the Fed considers reducing the borrowing costs, is conducive to higher gold prices. However, as the rate cut is not a done deal, the gold bulls may be in for a disappointment at the next Fed meeting.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.