Analysis Topic: Economic Trends Analysis

The analysis published under this topic are as follows.Tuesday, June 05, 2007

Economist Illustrates Why the Fed Should First Do No Harm / Economics / Money Supply

By: Paul_L_Kasriel

In the June 4th edition of The Wall Street Journal, Greg Ip has written a piece explaining why the National Income and Product Account data, the data from which GDP estimates are derived, can be confusing and erroneous for various reasons (see "Options Hinder Efforts to Gauge Economic Growth,").Read full article... Read full article...

Sunday, June 03, 2007

The International Consequences of the Federal Reserve / Economics / Money Supply

By: Gerard_Jackson

I have written numerous times on the consequences of the Fed's loose monetary policy and how it can aggravate the current account deficit. Until recently figures confirmed my worst fears that the current account was racing along unabated. But what else should one expect given the monetary boom that the Fed unleashed. Now the actual CAD figures don't matter -- what matters is the trend and the reason for it. The reason has already been established and is now monetary history.Read full article... Read full article...

Saturday, June 02, 2007

Real Consumer Spending is the Key to US Recession and Stock Market Sell Off / Economics / US Economy

By: John_Mauldin

Thoughts from the Frontline - In this issue:

Some Discretion in Discretionary Spending, Please

Real Consumer Spending is the Key

The Great Puzzle

Edinburgh, Barcelona, Planes and Trains

Are we on a slippery slope of a recession, or was last quarter's weak GDP a turning point? This week's travel shortened e-letter looks at recent data and re-visits some thoughts on consumer spending from friend Joe Ellis' superb book called Ahead of the Curve. This week I wrote from a rainy Edinburgh, Scotland, although this afternoon was pleasant enough, allowing me to walk around some. But on to important matters.

Read full article... Read full article...

Saturday, June 02, 2007

US in Recession and Housing Market Nosediving, What you don't Hear from the Media... / Economics / US Economy

By: Andy_Sutton

... will hurt you

This is not going to come as a big shock to anyone, but it is now rather clear that the media is aiding and abetting the Federal Reserve (and others) in its do-nothing stance with regards to interest rates. Taking a look back throughout history, media complicity is a common occurrence and usually happens when government at some level needs 'cover' to execute a particular policy.

Read full article... Read full article...

Friday, June 01, 2007

Will the Real Private Nonfarm Payrolls Please Stand Up? / Economics / US Economy

By: Paul_L_Kasriel

Each month the BLS heroically makes an adjustment to private nonfarm payrolls for the estimated hiring by new businesses not yet included in the BLS survey and the firing by closed-down businesses not captured in the BLS survey. This is called the "birth/death" adjustment. The birth/death adjustment does not take into account cyclical influences on business start-ups and failures.Read full article... Read full article...

Friday, June 01, 2007

US Politicians Playing with Matches as they Threaten a Mutually Destructive Trade War with China / Economics / Global Financial System

By: Ty_Andros

This week US Treasury Secretary, Hank Paulson, held a summit meeting with Chinese Vice-premier Wu Yi in Washington DC . It was mostly overlooked in the press and media as the fight over funding the war in Iraq consumed the headlines. The impact of this summit sets the table for the future of the United States in a far more meaningful manner as it outlines the coming miscalculations of the Mandarins in Washington DC . And like an exploding cigar, these issues have the potential to blow up in our faces, the unintended consequences of which can create investment opportunities that can be anticipated.

In the last several months the protectionist bombast (soon to be bomb blast) has been spewing forth from the most ignorant of our federal public servants who inhabit the Di strict of Columbia . These elected representatives from both sides of the aisle have decided to try to pin the tail on the Chinese for the failure of US public policy to set the table for wealth creation, and an expanding US economy, in the emerging global economy.

Read full article... Read full article...

Friday, June 01, 2007

When Will All This Bad News on the US Economy Sink In? / Economics / US Economy

By: Peter_Schiff

As a steady stream of bad U.S. economic news accumulates, one wonders when the stock market will finally take notice. After years of highly effective spin coming from Washington and Wall Street, stock investors must re-learn how to recognize bad news, and to stop making lemonade out of every economic lemon that comes their way.Read full article... Read full article...

Thursday, May 31, 2007

Inflation Or Deflation - Which One Is Worse? Which One Lies Ahead? / Economics / Deflation

By: Submissions

Surely inflation is our greater enemy, isn't it? Rising prices are bad for the economy. Falling prices are a good thing, aren't they?

Inflation and deflation are due more to mindset than anything else. Let me explain.

Read full article... Read full article...

Thursday, May 31, 2007

Confiscation of Wealth Through Inflation / Economics / Inflation

By: Mike_Hewitt

“ By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens .” (John Maynard Keynes, chief architect of our present-day fiat money system)

The Mission Statement of the Federal Reserve as stated on their website is to “… to provide the nation with a safer, more flexible, and more stable monetary and financial system.”

Read full article... Read full article...

Thursday, May 31, 2007

Washington is Robbing You Blind as National Debt Limit is Upped towards $10 trillion / Economics / US Debt

By: Money_and_Markets

Larry Edelson writes: Not many people noticed, but on May 17 the folks in Washington upped the country's national debt limit to $9.815 trillion . That's a whopping $1.635 trillion increase in less than three years.

The U.S. was broke when the debt ceiling hit $7 trillion … it was broke when the limit was raised to $8.18 trillion … and things just keep getting worse.

Read full article... Read full article...

Thursday, May 31, 2007

The Great American Household Savings Myth / Economics / US Economy

By: Paul_L_Kasriel

In the cover article of the May 28 edition of Barron's (see The Great American Savings Myth ) Gene Epstein, Barron's economics editor, argues that household saving is being underestimated. Epstein's argument centers principally on two issues – the growth in household net worth and the absence of spending on intangibles, such as research and development, from our official Gross Domestic Product (GDP)/saving statistics.

Read full article... Read full article...

Wednesday, May 30, 2007

US China Trade Imbalances - In the Shallow End of a Deep Pool / Economics / US Dollar

By: Paul_Petillo

Recent talks with Chinese ended last week with the feeling that we have gained little ground. And with good reason. Only the US sees the growing trade deficits and the dollar-Yuan peg as a problem of growing importance.

T he Chinese general/philosopher Sun Tzu once wrote “. . . If you know the enemy and know yourself, your victory will not stand in doubt, if you know Heaven and know Earth, you may make your victory complete”. He seemed to be offering rather pointed advice several thousand years removed on how negotiations with the US should proceed.

Read full article... Read full article...

Wednesday, May 30, 2007

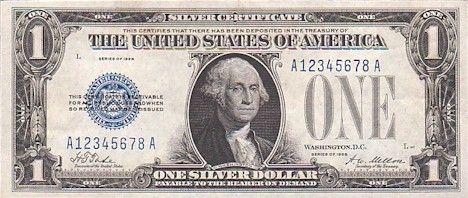

The Changing Face of the US Dollar from Tangible Asset to a Fiat Currency / Economics / Money Supply

By: Mike_Hewitt

The US dollar changed from a currency backed up by a tangible asset to a fiat currency. That being a paper note backed up by governmental promises. By looking at the history of American paper money one can clearly see the distinction.

Compare the images of the following historic dollar bills to those in your wallet today. Certain previously displayed phrases have been simply eliminated.

Wednesday, May 30, 2007

US Economy, Immigration and the Fallacy of Cheap Labour / Economics / Immigration

By: Gerard_Jackson

The question of illegal immigration has finally come to the boil in the US. In doing so it has exposed as nonsense the arguments of those who say that legalising the current status of illegals will promote growth. This attitude is boneheaded to say the least. Yet this is precisely where the Wall Street Journal. A while ago it published an article by Mary Anastasia O'Grady arguing that the real problem is not immigration per se butRead full article... Read full article...

Tuesday, May 29, 2007

Nolte Notes - Inflationary Growth / Economics / Inflation

By: Paul_J_Nolte

Let's be perfectly honest – economists are a geeky bunch. In what may be their own super Friday, economic reports galore will assist them in determining the overall direction of the economy. Mind you, many of these reports are monthly, they get revised regularly and an economy as large as ours rarely is going to turn on a couple of reports. However, the financial markets are likely to get all worked up about inflation (which we will see with the employment report), consumer spending (in the income/spending report) and job creation (in the employment report).Read full article... Read full article...

Tuesday, May 29, 2007

The Four Cylinders of Economic Growth - Part 1 / Economics / US Economy

By: Clif_Droke

Making economic predictions has always been a popular pastime, and never so more than today. We all fancy ourselves armchair economists, and why not, with the stakes higher than ever. Our very livelihoods are to a large extent tied up in the future direction of the economy. With so much at stake now and in the year ahead, the topic of economic growth has never been more relevant.

Yet behind all the economic rhetoric is a question that is seldom asked, namely, what exactly makes our economy tick? Why is it that some countries (notably the U.S.) seem to always have an essentially vibrant economy while others are constantly stuck in neutral...or worse! In short, what are the keys to economic growth? I think you'll agree that they can be distilled into essentially four key principles, which we'll examine here.

Read full article... Read full article...

Monday, May 28, 2007

My Two Cents - "The Complacent Consumer" / Economics / Debt & Loans

By: Andy_Sutton

For a long time now as I've watched consumers collectively dig themselves into debt-oblivion, I have wracked my brain trying to figure out why they are doing it. Recently, what I will call consumerism seems to be escalating as we have watched demand for gasoline defy the laws of economics. Instead of focusing on the product, I think it is appropriate to spend some time reflecting on the mentality behind recent behavior. No doubt, consumerism has already been responsible for a number of coming financial debacles, most notably the housing collapse, the negative savings rate in this country, record levels of debt, and rising bankruptcies. This week I am teaming up with a popular My Two Cents contributor CJH from Maryland to take a look at American consumerism....Read full article... Read full article...

Monday, May 28, 2007

Monetary Theory Of E.C. Riegel / Economics / Money Supply

By: Christopher_Quigley

IntroductionIn a life spanning over 70 years one of the greatest students of money and its meaning was the American E.C. Riegel. Many regarded him as a genius for his understanding of the nature and functioning of money as a human and social institution. This essay is an introduction to his main ideas on this subject as increasingly people are beginning to realise the need for a more stable monetary unit. In essence in his book "Flight From Inflation" he identified money as the mathematics of value and argued that for a democracy to thrive he believed the "money power" must be free.

Read full article... Read full article...

Monday, May 28, 2007

United States Battles Won and Battles Lost / Economics / US Economy

By: Money_and_Markets

Martin Weiss writes: Today is the day I remember my uncle Al, who volunteered for the Battle of the Bulge in World War II, was blown off a transport truck, suffered a lifelong injury, and has since passed away.

Martin Weiss writes: Today is the day I remember my uncle Al, who volunteered for the Battle of the Bulge in World War II, was blown off a transport truck, suffered a lifelong injury, and has since passed away.

But it's also my day to remember my father, Irving Weiss, who fought battles of a less violent kind.

Dad's struggle wasn't against a tangible enemy. Nor did it endanger his life. But its impact on our economy was longer lasting: He fought to safeguard the U.S. dollar. And although he won several battles, ultimately, he lost the war.

Read full article... Read full article...

Monday, May 28, 2007

What is a “ Canadian Dollar”? / Economics / Canadian $

By: Mike_Hewitt

have a growing concern regarding paper money. That concern is what defines a “dollar”. A dictionary definition describes a dollar as being a basic monetary unit equivalent to 100 cents. Further investigation reveals that a cent is equal to 1/100th of a dollar. This tautology is clearly an unsatisfactory answer.Read full article... Read full article...