The Changing Face of the US Dollar from Tangible Asset to a Fiat Currency

Economics / Money Supply May 30, 2007 - 10:30 AM GMTBy: Mike_Hewitt

The US dollar changed from a currency backed up by a tangible asset to a fiat currency. That being a paper note backed up by governmental promises. By looking at the history of American paper money one can clearly see the distinction.

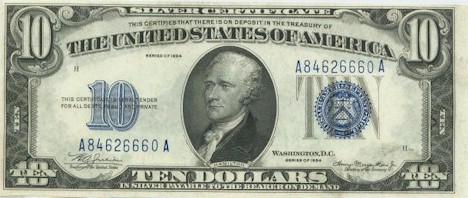

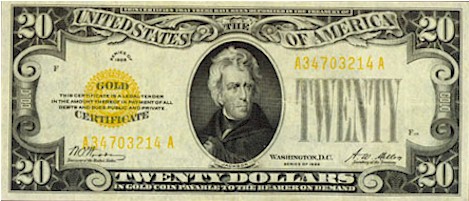

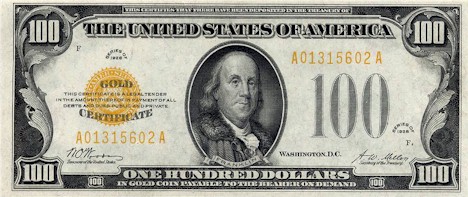

Compare the images of the following historic dollar bills to those in your wallet today. Certain previously displayed phrases have been simply eliminated.

These are Silver Certificates. On them it states, “THIS CERTIFIES THAT THERE IS ON DEPOSIT IN THE TREASURY OF THE UNITED STATES OF AMERICA [some number] DOLLARS IN SILVER PAYABLE TO THE BEARER ON DEMAND”. The amount of silver redeemable was approved in Section 9 of the 1792 Coinage Act which states that a dollar is equivalent to 371.25 grains of pure silver. One troy ounce is equal to 480 troy grains.

These Silver Certificates began to disappear from circulation during the 1940's and 1950's because they were immediately shredded once redeemed for silver due to a diminishing store of silver bullion in the treasury vaults. Silver Certificates were officially abolished by Congress on June 4, 1963 and all redemption in silver ceased on June 24, 1968.

In the late-1920's, higher denominations were gold certificates. The bearer could redeem his/her certificate for gold. Under the same Section 9 of the 1792 Coinage Act , a dollar was equivalent to 24.75 grains of pure gold.

There is some question as to the constitutional legality of Federal Reserve Notes we use today. According to Article 1, Section 10 of the U.S. Constitution , “No state shall … make anything but gold and silver coin a tender in payment of debts.”

What we today regard as US money are not dollar bills. There is no longer any paper currency or fixed concept of value known as a “dollar bill”. We carry and transact business with “Federal Reserve Notes”.

They merely represent the concept of dollar bill.

“If ever again our nation stumbles upon unfunded paper, it shall surely be like death to our body politic. This country will crash.” (George Washington)

By Mike Hewitt

http://www.dollardaze.org

Mike Hewitt is the editor of http://dollardaze.org a site about the current fiat monetary system and how to best position oneself using hard assets such as gold and silver along with shares of resource companies.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.