Analysis Topic: Economic Trends Analysis

The analysis published under this topic are as follows.Thursday, March 19, 2020

Coronavirus Impact on Global Economic GDP Numbers / Economics / Global Economy

By: Chris_Vermeulen

Continuing our earlier multi-part research post related to our extensive number crunching and predictive modeling systems expectations going forward many years, (Part I) this second part will highlight some existing data points and start to discuss the concepts of what the Covid-19 virus event may do to the immediate global economy. Remember, in the first part of this article, we shared research related to the US Fed Funds Rate (FFR) and how the Covid-19 virus event may create an environment of economic malaise over the next 12 to 24+ months as well as potentially disrupt the population and deficits over a 5+ year span.

This type of event is very similar to war (think WWII) in the sense that consumer spending changes, population growth, and levels change, GDP changes and deficits change for all involved. Our researchers modeled the GDP levels from 2017 will now with the intent of attempting to identify probable outcomes of GDP output throughout the world over the next 5+ years. Throughout these types of events, a massive capital shift takes place where consumers within areas impacted by war shift their spending and purchasing habits to address the immediate real needs of their attempted survival. Speculation vanishes. People only spend on things they are confident they can afford to risk their money on. Anyone who is able to take advantage of the displaced or disparaged has a real opportunity to create some real gains if they don’t become the next displaced or disparaged individual.

Read full article... Read full article...

Monday, March 16, 2020

Economic Stimulus Can’t Save US from Deflation and Recession / Economics / Recession 2020

By: Richard_Mills

One of the worst weeks on Wall Street mercifully ended on Friday.

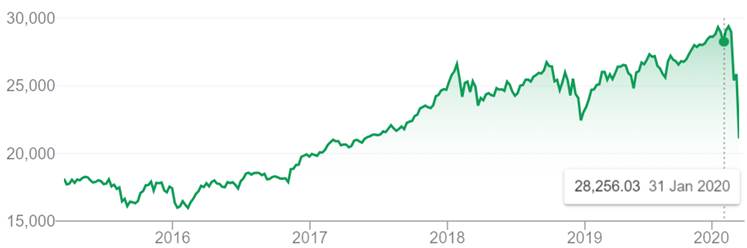

S&P 500

DJIA

Nasdaq

Read full article... Read full article...

Sunday, March 08, 2020

Iran Is Not Hyperinflating / Economics / HyperInflation

By: Steve_H_Hanke

Each and every day we read that Iran is hyperinflating or about to hyperinflate. The same is written about Zimbabwe and Venezuela, as well as a potpourri of other countries that are experiencing inflation flare-ups. While Iran came close to hyperinflating in the fall of 2012, it has never experienced an episode of hyperinflation. And while Zimbabwe experienced episodes of hyperinflation in 2007–08 and in 2017, it is not experiencing one now. At present, Venezuela is the only country experiencing hyperinflation.

It’s clear that journalists and those they interview tend to play fast and loose with the word “hyperinflation.” To clean up the hyperinflation landscape, we must define the word. So, just what is the definition of the oft-misused word “hyperinflation?” The convention adopted in the scientific literature is to classify an inflation as a hyperinflation if the monthly inflation rate exceeds 50 percent. This definition was adopted in 1956, after Phillip Cagan published his seminal analysis of hyperinflation, which appeared in a book edited by Milton Friedman, Studies in the Quantity Theory of Money.

Read full article... Read full article...

Saturday, February 29, 2020

The Greatest Economic Depression Just Began. This Is No Drill / Economics / Great Depression II

By: The_Gold_Report

Bob Moriarty of 321gold rings the alarm bells on the fallout from the coronavirus. Exactly a month ago I warned that the coronavirus outbreak was going to pop the "Everything Bubble." I did something fairly subtle. I buried my main message under a whole heap of cow manure. It doesn't make a rat's ass if I was right or wrong about calling for a market crash in October or the Fed dumping piles of new crisp $100 bills onto a bonfire in September.

This time I'm going to put my message right at the top so no one can miss it. I quote from the January 27th piece, "This has the potential for being the biggest mass casualty event in world history. At the very least it will take down the financial system as the world economy grinds to a halt with efforts to contain the virus."

Read full article... Read full article...

Sunday, February 09, 2020

The End of the Global Economy / Economics / Global Economy

By: Richard_Mills

The Trump administration has just granted its Commerce Department sweeping powers to slap tariffs on countries it decides are manipulating their currencies to the detriment of the United States and its exporting companies.

For some this will come as news; at AOTH, it is confirmation that our earlier warning, reported here, has come true.

In our article ‘US prepares for currency war’, we warned readers about these new powers when they were first proposed by the US government several months ago, amid its trade war with China.

The Commerce Department now says it will proceed with the plan, which gives Commerce a wide scope of power to decide whether or not a country is under-cutting US exporters by keeping its currency artificially low. Whereas Commerce normally follows the advice of the Treasury Department - which issues a twice-yearly report to Congress on suspected currency manipulators - on whether to impose trade sanctions, the new rules allow Commerce to slap duties on goods from accused countries and individual businesses, even in cases where the Treasury did not find them to be guilty of currency manipulation. Bloomberg neatly explains what broadening the Commerce Department’s mandate to impose anti-subsidy duties could mean:

Read full article... Read full article...

Saturday, February 08, 2020

The Historical Impact of Recessions on Gambling Activity / Economics / Gambling

By: Submissions

...

Friday, January 03, 2020

Where the World Is Going in 2020 / Economics / Global Economy

By: Patrick_Watson

We all want to know the future. Unfortunately, the future isn’t talking. It’s just coming, like it or not.We can, however, make educated forecasts. I think John Mauldin is broadly correct: the future is bright, but we’ll go through darkness first.

In fact, many of us are already in pretty dark situations, “left behind” in a supposedly thriving economy. We’re told there is no inflation even as the real cost of living rises ever higher.

Where is it leading us? To answer that, we have to think about how we got here.

Read full article... Read full article...

Saturday, December 28, 2019

Hacking The Economy To Determine An Election: Is It Happening? / Economics / Economic Theory

By: Dan_Amerman

On August 27th, 2019, in an editorial published in Bloomberg, William Dudley, the former president of the Federal Reserve Bank Of New York, did what had previously been considered unthinkable. The foundation premise of the Federal Reserve is that it is supposed to be completely nonpartisan, insulated from all political considerations. However, Dudley wrote that Donald Trump was a threat to the Federal Reserve and the nation, and urged Fed officials to make decisions that would take into account the need to keep Trump from being reelected.

The freezing up of the repurchase agreement (repo) market had nearly collapsed the U.S. financial system as one part of the financial crisis of 2008, however, the market had enjoyed 11 years of relative calm since then. Three weeks after Dudley's editorial, during the week of September 16th, 2019, the repo market returned to crisis mode and was likely saved only by emergency interventions on the part of the Federal Reserve. A contributing factor was some major mistakes that were made by career officials at the New York Fed - Dudley's former staff.

If the current related crises in the repurchase agreement market and with the funding of the national debt continue and get worse (which is far from certain at this time), crossing over into the wider markets, interest rates and the economy, it could become one of the defining political events of our lifetimes.

Read full article... Read full article...

Monday, December 23, 2019

The Fed Celebrates While Americans Drown in Financial Despair / Economics / Inflation

By: John_Mauldin

The Federal Reserve System is supposed to be independent. But it’s not. And as much as Donald Trump doesn’t like it, the Fed shouldn’t follow the president’s orders.

The Fed operates under a legal mandate from Congress. Its monetary policy role is “to promote maximum employment, stable prices and moderate long-term interest rates.”

So how is it doing?

Long-term rates are certainly moderate. Employment is historically high, though wages and job quality aren’t always great.

As for that “stable prices” part… it depends on what you are buying.

Thursday, December 19, 2019

US Fed Wooing Inflation / Economics / Inflation

By: Gary_Tanashian

The Continuum (the systematic downtrend in long-term Treasury yields) has for decades given the Fed the green light on inflation. Sometimes it runs hot (as per the red arrows) and sometimes it runs cold. One year ago people were confused about why a declining stock market was not influencing Fed chief Powell to reverse his relatively hawkish tone.

Read full article... Read full article...

Thursday, December 19, 2019

What to Expect in Our Next Recession/Depression? / Economics / Great Depression II

By: Raymond_Matison

Over the last several years numerous highly respected money managers and other economic writers have been warning investors about a coming recession or depression. However, few have been willing to describe as to what we may actually experience going through such an economic period.

Of course it seems a daunting task to foresee the future. To predict how technology may change our lives years from now is admittedly impossible, because such change seems to be taking place at an exponential rate, and we have little past experience as to how modern technology changes society, life style, or culture in a reliable way. Projecting how we might live ten years in the future from an economic perspective is not that challenging – particularly since this rate of change is relatively slow and such events have been experienced in numerous countries over hundreds of years. As a result, it is not impossible or even particularly difficult to foresee many of the important changes that we could expect to see from the onset of the next recession/depression.

Read full article... Read full article...

Wednesday, December 18, 2019

Inflation Threat Looms in 2020 as Fiscal and Monetary Stimulus Ramp Up / Economics / Inflation

By: MoneyMetals

The Federal Reserve left its benchmark interest rate unchanged as expected last week. However, Fed Chairman Jerome Powell made news with some of his most dovish remarks to date – stating flatly that he won’t hike rates again until inflation moves up significantly.

“In order to move rates up, I would want to see inflation that’s persistent and that’s significant,” Powell said at a news conference following the Fed’s announcement.

He would be anticipating “a significant move up in inflation that’s also persistent before raising rates to address inflation concerns.”

Tuesday, December 17, 2019

ONS UK Unemployment Statistics Paint a FAKE Picture of Falling Unemployment / Economics / Unemployment

By: Nadeem_Walayat

Today the ONS published it's latest labour market statistics which include headline grabbing news that unemployment has continued to fall to an historic low of just 1.28 million as the below graph illustrates, far below the trough before the financial crisis hit Britain. However there is a fly in the ointment of this rosy picture that the Governments economic propaganda arm (ONS is painting which is that official unemployment statistics have been manipulated lower by successive governments all the way to the point that on their own they are pretty much meaningless. For instance there are over 8.6 million people of working age who are ECONOMICALLY INACTIVE, that's another word for UNEMPLOYED!

Read full article... Read full article...

Tuesday, December 17, 2019

Economic Tribulation is Coming, and Here is Why / Economics / Great Depression II

By: Michael_Pento

The global fixed income market has reached such a manic state that junk bond yields now trade at a much lower rate than where investment-grade debt once stood. Investment-grade corporate debt yields were close to 6% prior to the Great Recession. However, Twitter just issued $700 million of eight-year bonds at a yield of just 3.875%. That is an insanely low rate even for investment-grade corporate debt. But, the credit rating on these bonds is BB+, which by the way, happens to be in the junk category.One has to wonder how fragile the fixed income world has become when investors are tripping over each other to lock up money for eight years in a junk-rated company that is offering a yield only 1.5 percentage points above the current rate of inflation. And, in a company involved in the technology space, which is a sector that evolves extremely rapidly with a high extinction rate. Oh, and by the way, Twitter missed on both revenue and earnings in its last quarterly report. Nevertheless, this issue was so oversubscribed that the dollar amount for the offering was boosted by $100 million just days before coming to market.

Read full article... Read full article...

Friday, December 06, 2019

What Fake UK Unemployment Statistics Predict for General Election Result 2019 / Economics / Unemployment

By: Nadeem_Walayat

It's the economy stupid! The party in government tends to lose elections to the opposition on the basis of where the economy stands at the time of the general election. So whilst Boris Johnson's "Get Brexit Done" headline grabbing mantra sounds like it could deliver the Tories enough votes to win. However, if the economy is on the slide then all slogans and promises will be ignored, much as was the case for Theresa May's 2017 all about getting Brexit done election campaign.

So the focus of this analysis is where the economy stands and it's direction of travel relative to where economy stood in the run up to the June 2017 General Election as one of the 9 key election forecasting lessons learned from the outcome of the 2017 general election.

Read full article... Read full article...

Wednesday, December 04, 2019

America’s “Full Employment” Hides a Dirty Secret / Economics / Employment

By: John_Mauldin

Should just being “employed” make people/workers happy?

On one level, any job is better than no job. But we also derive much of our identities and self-esteem from our work.

If you aren’t happy with it, you’re probably not happy generally.

Unhappy people can still vote and are often easy marks for shameless politicians to manipulate. Their spending patterns change, too.

So it ends up affecting everyone and everything.

Friday, November 29, 2019

We Are on the Brink of the Second Great Depression / Economics / Great Depression II

By: John_Mauldin

You really need to watch this video of a recent conversation between Ray Dalio and Paul Tudor Jones. Their part is about the first 40 minutes.

In this video, Ray highlights some problematic similarities between our times and the 1930s. Both feature:

- a large wealth gap

- the absence of effective monetary policy

- a change in the world order, in this case the rise of China and the potential for trade wars/technology wars/capital wars.

He threw in a few quick comments as their time was running out, alluding to the potential for the end of the world reserve system and the collapse of fiat monetary regimes.

Read full article... Read full article...

Tuesday, November 26, 2019

This Artificial Economic Boom Is Coming to an End / Economics / Global Economy

By: John_Mauldin

Nothing is forever, not even debt. Every borrower eventually either repays what they owe or defaults. Lenders may or may not have remedies. But one way or another, the debt goes away.

One of Western civilization’s largest problems is we’ve convinced ourselves debt can be permanent. We don’t use that specific word, of course, but it’s what we do and is why government debt keeps rising.

Monday, November 25, 2019

Preconditions for BRIC-style growth in Philippines / Economics / Asian Economies

By: Dan_Steinbock

In the postwar and post-Cold War era, the Philippines could have been an economic success story. Yet, the opportunity was missed between the mid-'60s and mid-2010s. In the Duterte era, the country is back on track, but BRIC-style growth is needed to overcome the legacy of past policy mistakes.

In the postwar and post-Cold War era, the Philippines could have been an economic success story. Yet, the opportunity was missed between the mid-'60s and mid-2010s. In the Duterte era, the country is back on track, but BRIC-style growth is needed to overcome the legacy of past policy mistakes.In the postwar era, the Philippines was one of the expected economic success stories in Southeast Asia. The country was positioned for rapid growth.

Or so it was thought.

Read full article... Read full article...

Tuesday, November 19, 2019

China's Grand Plan to Take Over the World / Economics / China US Conflict

By: John_Mauldin

When the US and ultimately the rest of the Western world began to engage China, resulting in China finally being allowed into the World Trade Organization in the early 2000s, no one really expected the outcomes we see today.

When the US and ultimately the rest of the Western world began to engage China, resulting in China finally being allowed into the World Trade Organization in the early 2000s, no one really expected the outcomes we see today.There is no simple disengagement path, given the scope of economic and legal entanglements. This isn’t a “trade” we can simply walk away from.

But it is also one that, if allowed to continue in its current form, could lead to a loss of personal freedom for Western civilization. It really is that much of an existential question.

Read full article... Read full article...