Category: Recession 2020

The analysis published under this category are as follows.Monday, March 16, 2020

Economic Stimulus Can’t Save US from Deflation and Recession / Economics / Recession 2020

By: Richard_Mills

One of the worst weeks on Wall Street mercifully ended on Friday.

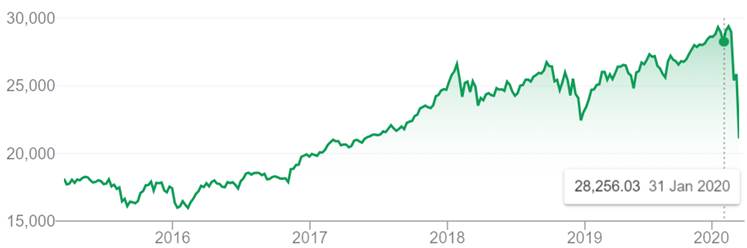

S&P 500

DJIA

Nasdaq

Read full article... Read full article...

Monday, September 16, 2019

These Indicators Point to an Early 2020 Economic Downturn / Economics / Recession 2020

By: Harry_Dent

The yield curve first flirted with inversion earlier this year. That occurred clearly recently when the 2-year Treasury bond yield crossed below the 10-year, and it has done that further more recently.

The yield curve first flirted with inversion earlier this year. That occurred clearly recently when the 2-year Treasury bond yield crossed below the 10-year, and it has done that further more recently.But that indicator can lead by nine months to 22 months. And Treasury bond yields have been so manipulated in the last decade of QE that who knows how meaningful that is anyway…

But certainly, this indicator is more of a warning of falling growth, as the real trend is that long-term bond yields are plummeting as the bond market sees slowing U.S. and global growth. That has been a big part of the recent correction in stocks.

Read full article... Read full article...

Saturday, September 14, 2019

Recession 2020 Forecast : The New Risks & New Profits Of A Grand Experiment / Economics / Recession 2020

By: Dan_Amerman

There is a very good chance that there will be a recession within the next 1-2 years, and this could even occur within the next few months.

There is a very good chance that there will be a recession within the next 1-2 years, and this could even occur within the next few months.

As explored in this analysis, if there is a recession, the means by which that recession will be contained and exited will necessarily be an unprecedented experiment. This means that there is an unusually high risk that it will not be a normal recession - which could knock the foundations out from underneath many conventional retirement investment strategies that blithely make the assumption that we can somehow know in advance that a "normal" mild and short recession is the downside scenario.

Once we accept the reality of the "grand experiment" - that means that we are likely to see investment prices changing in ways that are also quite unusual. Indeed, we are likely to see amplified profits to go along with the new risks. Crucially, what we also know right now (based upon the Federal Reserve's public plans) is that some of these profits will not be in the usual places or from the usual sources.

Many people believe that we have returned to normal times from an economic and investment perspective - and therefore, if there is a recession, it will be "normal" (by the standards of the last half of the 20th century), with "normal" investment results.

Read full article... Read full article...

Monday, August 19, 2019

The Geopolitical Consequences of a Coming Recession / Politics / Recession 2020

By: Antonius_Aquinas

With the recent ominous inversion of the 2-10 year yield curve and its near infallible predictive recessionary power, the consequences for the economy are plain to see, however, what has not been spoken of by pundits will be the effect of a recession on US foreign policy. If a recession comes about prior to November 2020, or if economic indicators such as GDP plummet even further, the chances of a Trump re-election is extremely problematic even if the Democrats nominate a socialist nut case such as Bernie Sanders or Pocahontas.

Read full article... Read full article...

Sunday, July 14, 2019

Fed’s Recessionary Indicators and Gold / Economics / Recession 2020

By: Arkadiusz_Sieron

How likely is a recession in the United States? Predicting a recession is difficult, but one can make some nice money with a good forecast. Consequently, we invite you to read our today’s article, which discusses the most important recessionary models developed by the Fed, and find out what do they imply for the gold market.

How likely is a recession in the United States? Predicting a recession is difficult, but one can make some nice money with a good forecast. Consequently, we invite you to read our today’s article, which discusses the most important recessionary models developed by the Fed, and find out what do they imply for the gold market.

How likely is a recession in the United States? Predicting a recession is difficult, but one can make some nice money with a good forecast. So let’s focus on the most important recessionary models developed by the Fed.

The first model is the smoothed recession probabilities for the United States developed by Marcelle Chauvet and Jeremy Piger based on the research published in the International Economic Review and Journal of Business and Economic Statistics. The odds are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales.

Read full article... Read full article...

Tuesday, June 04, 2019

Recession Is a Psychological Thing: It Will Happen When We Say It Happens / Economics / Recession 2020

By: Jared_Dillian

We haven’t had a recession in a while in the United States.

We haven’t had a recession in a while in the United States.

The last one was pretty bad, so it stands to reason we might want to avoid a repeat of that experience.

President Trump is working very hard to ensure that we do not have a recession (at least until the 2020 election). The Fed no longer seems to believe that inflation is the greater risk. We are basically running the economy at full speed all the time.

It is hard to have a recession when monetary and fiscal policy have buried the needle.

Tuesday, June 04, 2019

Could the Trade War Help Ignite the Coming Recession? / Economics / Recession 2020

By: Robert_Ross

Dear Reader,

Another of the many moving parts in the economy right now is the escalating trade war between America and China.

The costs are starting to be felt. In fact, the latest tariffs should cost the average American household $831 this year, according to the Federal Reserve Bank of New York.

Read full article... Read full article...

Friday, April 26, 2019

The US Economy Is Reaching a Dead End / Economics / Recession 2020

By: John_Mauldin

Sooner or later, the US will enter a recession. My best guess is it will happen sometime in 2020. I may be off (early) by a year or two, but it’s coming.

Sooner or later, the US will enter a recession. My best guess is it will happen sometime in 2020. I may be off (early) by a year or two, but it’s coming.We know two things will happen.

- Tax revenues will fall as people’s income drops.

- Federal spending will rise as safety-net entitlement claims go up.

The result will be higher deficits.

Read full article... Read full article...

Tuesday, April 23, 2019

Forecasting 2020s : Two Recessions, Higher Taxes, and Japan-Like Flat Markets / Economics / Recession 2020

By: John_Mauldin

I’m slowly losing confidence in the economy.

I’m slowly losing confidence in the economy.

I still think the economy is okay for now. But I also see recession odds rising considerably in 2020. Maybe it will get pushed back another year or two, but at some point, this growth phase will end.

It will be either recession or an extended flat period (even flatter than the last decade, which says a lot). On top of that, we are headed toward a global credit crisis I’ve dubbed The Great Reset.

Let me give you the CliffsNotes version of how I think the next decade will play out.