Economic Stimulus Can’t Save US from Deflation and Recession

Economics / Recession 2020 Mar 16, 2020 - 04:16 PM GMTBy: Richard_Mills

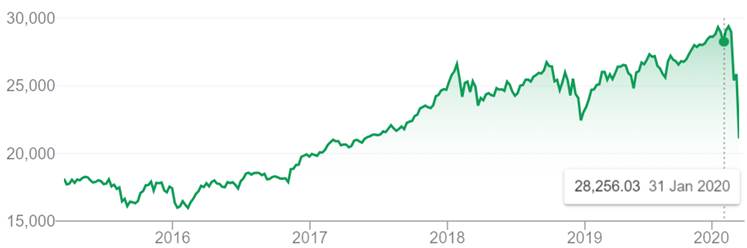

One of the worst weeks on Wall Street mercifully ended on Friday.

S&P 500

DJIA

Nasdaq

After multiple sessions of panic selling, the markets caught an up-draft after US President Trump declared a national emergency over the coronavirus, thus freeing up $50 billion in federal aid to help contain the rapid spread of the pandemic.

As stocks accelerated gains in the final hours of trading, posting the biggest one-day lift since the financial crisis, USA Today reported traders and analysts saying that Trump’s remarks removed some of the uncertainty hanging over financial markets.

“The change in tone shows that the Trump administration is taking this more seriously now,” said a senior portfolio manager at Atlanta-based GLOBALT Investments. “This still isn’t over by any stretch, but it’s a better sign.”

Too right. Even with Friday’s rally, the S&P was down 8.8% for the week and all the gains US stocks accrued in 2019 have been wiped out. All three indices are now in a bear market, defined as a drop of at least 20% from all-time highs.

The state of emergency will allow certain laws and regulations to be waived to ensure the virus can be contained and patients treated. On Friday morning, Treasury Secretary Steve Mnuchin said a deal on a virus response package with Congress is imminent. A bill just passed by the House of Representatives includes free virus testing for all Americans including the uninsured, and two weeks of paid sick leave granted for those who cannot attend work due to the virus.

Earlier in the week Trump announced suspension of flights from Europe to the United States, in an effort to stop the spread of covid-19 from countries like Italy, which is in a state of lock-down.

The virus has so far infected about 128,000 people globally, and killed 4,700. The death toll in the United States has climbed to 39, among 1,300 infections. In Canada, there are 178 cases and one person has died - an elderly man at a North Vancouver care home.

Despite the relatively low Canadian numbers, fear of the virus is causing major disruptions. In Ontario, which has the most infections, the number of cases rose from 60 to 79 on Friday, triggering new measures from civic authorities.

In Toronto, universities, daycares, libraries, community/ recreation/ fitness centers, arenas, pools, March Break camps and tourist attractions will all be closed until April 5, according to CBC. There will also be reductions in GO train and express bus service, starting next week.

Big box stores like Costco were chaotic scenes Friday, as panicked shoppers stockpiled supplies amid fears the virus will continue spreading and force quarantines.

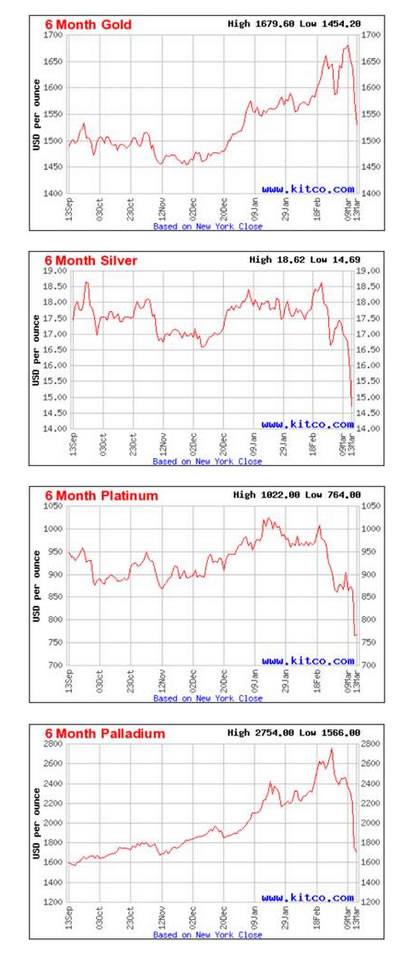

One of the most surprising economic outcomes of the week was the performance of precious metals, swiped by a strengthening dollar and profit-taking.

Normally safe havens in times of financial crisis, gold, silver, platinum and palladium all fell. Gold was down $146, or 8.7% for the week, silver lost 15.4% and platinum slumped 12.8%. Palladium was the worst hit, suffering a $678 loss or 28.6%.

Interventions

Beyond public health measures aimed at containing the virus, finance officials and central bankers around the world have been taking extraordinary steps to contain the economic fallout from covid-19.

On Friday, the New York Federal Reserve announced it would ramp up Treasury bond purchases, adding to the Fed’s stated intention on Thursday to intervene in short-term funding markets to the tune of $1.5 trillion, and purchase US Treasury securities, opening the door to another round of quantitative easing. Also on Friday, the Bank of Canada said it will make an emergency 50-basis-point cut to its overnight interest rate, bringing it down to 0.75%.

Earlier this week the UK Chancellor in his first budget announced a £12 billion emergency fiscal stimulus to counter the shock of the coronavirus outbreak, and the European Union unveiled emergency measures, including flexibility regarding rules on budgets and state aid, and a 37-billion-euro fund for coronavirus support.

Other interventions included the People’s Bank of China releasing $79 billion worth of liquidity, the Bank of Japan planning to buy $1.9 billion in overnight bonds, and Italy spending up to 16 billion euros on a stimulus package.

In the US, rumors are circulating of a return to financial crisis-era programs like TARP. Many Fed observers think there will be another big rate cut, likely in the range of 100 basis points, when the Federal Open Market Committee meets again on March 18.

Question is, will all this stimulus be enough to head off financial catastrophe?

Lower interest rates and massive asset purchases by central banks are the monetary tools of choice when it comes to restoring shocked financial systems. The idea being that making the cost of borrowing cheap for individuals and businesses will entice them to spend, spend, spend. And it’s no wonder this is the panacea for floundering markets. In the US, consumer spending makes up two-thirds of Gross Domestic Product; in Canada it’s also the largest portion of the economy. If it doesn’t work and prices start falling, we have deflation.

Back in 2008, several rounds of quantitative easing, or QE - essentially printing money to buy government bonds and mortgage-backed securities - worked to allay the worst effects of the financial crisis, for a couple of reasons. First was the fact that interest rates were much higher at the time, meaning the Fed’s staged reductions had a lot of room to make an impact. Not so in 2020, when three interest rate cuts in 2019 left the federal funds rate in a range of between 1.50% and 1.75% at the point of the coronavirus becoming an epidemic in January-February (the 50-basis-point reduction earlier this month puts the current rate at 1.25-1.5%).

The second reason is self-evident; in 2008-09, there was no coronavirus to restrict spending. This, in our view, is the biggest risk to the US economy, right now. How can the usual stimulus response of low interest rates and money-printing work, in an economy where citizens are too scared to go out and spend? Could the lack of spending lead to deflation? Even a recession?

Consumer spending slows

We decided to take a look at what’s been happening with consumer spending, before and at the onset of the coronavirus. What we find is a slowing of spending up to three business quarters ago, recently becoming exacerbated by covid-19.

The first evidence of a trend started in early 2019, when central banks were lowering interest rates to fight deflation - seen as the number one threat to global economic stability.

Writing for the Financial Post, renowned economist David Rosenberg noticed the reason for so much deflationary pressure is something he calls the “output gap”. By that he means the difference between actual global GDP, and the level of a world economy operating at full capacity. For while the recovery from the Great Recession was long-lived (11 years), its magnitude has been weak.

“After a decade of expansion, growth in aggregate demand has been so insufficient in eating into aggregate supply, that we are left with a global output gap (the gap between actual global GDP and the level that would be consistent with an economy operating at full capacity) that is equivalent to 0.5 per cent of GDP.

The recovery in the wake of the Great Recession is known for its duration, but its magnitude has been so pathetic that we still have excess supply across the world.”

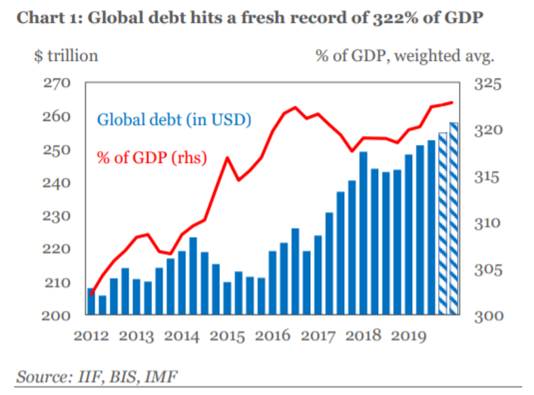

Now combine deflation pressure with rapidly expanding debt, in what Rosenberg calls “the most over-leveraged global economy of all time”. Noting that the hallmark of economic expansion has been a surge in global debt from US$116 trillion in 2007 to the current $244 trillion, Rosenberg argues all this excess debt has become a brake on aggregate demand.

Consider: over the last 13 years, debt has increased by $128 trillion, but GDP has only risen by $27 trillion:

So let’s get this straight: The increase in debt from cycle peak to cycle peak occurred with debt outstripping the income required to support that debt by a factor of five!

What is to be done? According to Rosenberg, the only policy prescription is debt default, something, obviously, that will never happen. However, it will take a resolution to the 290% world debt-to-GDP ratio for policy stimulus [to] be effective in creating the conditions for aggregate demand to play catch-up and surpass aggregate supply growth, thereby closing the deflationary output once and for all, he writes.

In a nutshell, we have been with a deflationary output gap now for over a decade, which is unprecedented in data back to 1985. And the ammunition for central banks is completely depleted for a late-cycle backdrop… Bond yields and inflation at some point will embark on a durable uptrend, but not before the output gap closes, and that does not look likely to happen for a very long time…

This is going to mean even lower inflation, in some cases a mild case of deflation ahead, and with that even lower bond yields…

A decline in consumer spending is the canary in the coal mine for deflation. We see it happening as early as September, 2019, when US retail sales fell for first time in seven months, as households slashed spending on building materials, online purchases, and especially cars, CNBC reported.

Three months later, sales at clothing stores declined the most since January 2009. The Reuters report also noted that January 2020 marked the second straight month of decreased industrial production - which jibes with our finding of a slowdown in manufacturing. The IHS Markit PMI in January fell to a three-month low, we wrote. Firms noted a slower improvement in operating conditions and slack domestic and foreign demand from clients.

What’s interesting here is the disconnect between evidence of a slowing economy and remarks from Fed Chair Jerome Powell, who stated at the time that the “economy is in a very good place, performing well.” Indeed before the coronavirus, the Fed was planning on holding rates steady, the rest of 2020. Didn’t they read about falling PMIs and consumer spending?

Consumer confidence is an indicator of consumer spending, and is therefore another sign post of coming deflation. We see confidence among US shoppers beginning to wane around December. That month, the Conference Board released a report stating that an index measuring consumer’s short-term outlook for income, business and labor conditions, fell from 100.3 to 97.4.

Carrying more meaning were remarks from Lynn Franco, the Conference Board’s director of economic indicators.

“While consumers’ assessment of current conditions improved, their expectations declined, driven primarily by a softening in their short-term outlook regarding jobs and financial prospects,” Franco said in a press release.

“While the economy hasn’t shown signs of further weakening, there is little to suggest that growth, and in particular consumer spending, will gain momentum in early 2020.”

This is the kind of thing that economists and investors should be paying attention to. Here is the Conference Board reporting that, in the midst of the longest-ever economic expansion in US history, the largest component of the US economy, American consumers, are about to put their credit cards away.

And there were other warnings, too. Business Insider reminds us of two reports in October, one from UBS that found consumers were struggling to cover expenses, and another from Bank of America Merrill Lynch stating that spending faced stronger headwinds than tailwinds.

The coronavirus has, understandably, deepened consumers’ fear of racking up any significant new purchases, like a new car, house, appliances or vacation. Earlier this week The Hill reported the Morning Consult consumer sentiment index is down 3.2% since the start of the year, with much of the decrease corresponding with the spread of the coronavirus in late February.

The last indicator of deflation is an increase in savings. When times are good, businesses are booming, cranking out products whose prices, over time, gradually rise. With an economy close to full employment, consumers don’t mind paying a little more for goods and services, since their jobs and incomes feel safe. This is a normal, healthy fiat inflationary environment.

Unfortunately that is not what we are currently seeing. Instead of going out and spending their hard-earned shekels, many Americans are plowing it into savings accounts, or investing it, or stuffing it under the mattress.

One would expect people to save more during the financial crisis years, and that is precisely what happened. According to the Wall Street Journal, the personal savings rate rose from 3.7% in 2007 to 6.5% in 2010, the year the recession ended.

The recovery that ensued should have seen the personal savings rate fall, as consumers gained more confidence in the economy. Instead, the savings rate kept climbing, to an average 8.2% in the first seven months of 2019 - higher than the average for any full year since 2012, WSJ notes.

Marketwatch tried to solve the mystery of the rising savings rate in a Feb. 22, 2020 article. A team of Goldman Sachs economists who studied the phenomenon found that tightened credit standards by financial institutions resulted in less borrowing.

Wall Street Journal makes another interesting observation - the savings rate jumped right after the December 2017 Trump tax cuts. “The timing is no coincidence,” WSJ quotes Paul Ashworth, chief North American economist at Capital Economics. “The tax cuts seem to have been saved.” Possible causes of higher US saving behaviour include aging baby boomers preparing for retirement, a more cautious buying public scared by the Great Recession, and the widening gap between the rich who save a lot and the poor who save very little.

FRED - Velocity of M2 Money Stock, last updated Feb 27th 2020

The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy.

Recession by July?

Whatever the reasons for consumers preferring saving over spending, it can’t be good for the economy. The possibility of a US recession has been mooted by a number of sources for months, evidenced by, for example, an inverted yield curve, investors holding a high percentage of cash instead of stocks, and unsustainable levels of debt.

The coronavirus could therefore be seen as the straw that broke the camel’s back. At least, that’s what America’s biggest bank thinks. According to JP Morgan, the US economy could shrink by 2% in the first quarter and 3% in the second. Over in the eurozone, where member economies have been struggling amid weak manufacturing output in industrial powerhouse Germany, the investment bank sees a contraction of 1.8% and 3.3% in the same periods.

A recession is defined as two consecutive quarters of GDP contraction.

As the coronavirus continues to spread across the United States, confidence among consumers is dropping like a stone. The consumer sentiment index fell from 100 to 95.9 during the first 11 days of March. As Marketwatch reported, that was right before an onslaught of bad news about the coronavirus epidemic pushed the U.S. into crisis mode.

Sentiment nearly matched a post 2008 recession high in February, but that’s likely to be the high water mark for quite some time. Large chunks of the economy — pro sports, higher education, cultural institutions and the like — are shutting down to try to limit the spread of the virus.

“The data suggest that additional declines in confidence are still likely to occur as the spread of the virus continues to accelerate,” said Jim Curtin, chief economist of the survey.

Big picture: The U.S. economy will soon slowly rapidly and probably begin to contract. Some forecasts call for gross domestic product, the official scorecard of the U.S. economy, to shrink as much as 4% in the second quarter that runs from April through June.

Hard-hit sectors

Among the industries likely to suffer most from coronavirus fallout are travel and hospitality. Not helping the airline or the cruise ship industry, is the perception that aircraft cabins and cruise ships are flying/ floating petri dishes full of bacteria and viruses.

The CDC has noted an “increased risk of infection of Covid-19 in a cruise ship environment.” Four major cruise ship companies - Carnival, Royal Caribbean, Norwegian and MSC Cruises - have agreed to suspend trips from the US for 30 days. Cruising is a $45-billion industry, and South Florida is home to two of the three busiest ports in the United States.

Soon after Trump announced the US has banned flights from Europe, “the big three” Delta, American Airlines and United Airlines all announced cutbacks. Delta for instance is slashing passenger-carrying capacity by 40% - more than the reductions made after the 9/11 terrorist attacks, CNBC said; 300 planes are expected to be grounded. The company is reportedly talking to the White House and Congress about a bailout.

“The speed of the demand fall-off is unlike anything we’ve seen – and we’ve seen a lot in our business,” said CEO Ed Bastian, in a memo to Delta’s 90,000 employees Friday.

British Airways and Lufthansa are also in trouble. According to The Guardian, BA’s chief executive, Alex Cruz, said in a message to 45,000 employees that the airline would be “parking aircraft in a way we never have before,” after falling demand for the carrier’s services was compounded by the US air travel ban from Europe. Germany’s Lufthansa could ground most of its fleet and ask for state aid.

The global auto industry, already hurt by poor sales in 2019, is getting it from both sides, as supply chains experience disruptions owing to covid-19, and the demand from buyers just isn’t there. In February car sales in China plummeted by 79%, their biggest ever monthly decline, to levels not seen since 2005. Sales in the world’s largest car market have declined for 20 straight months.

In Europe some assembly plants have shut down temporarily, or dropped shifts, and while plants in the US and Mexico have been less affected, the impact on operations will depend on whether they can access materials needed to keep supply chains running smoothly, the Globe and Mail said. Morgan Stanley expects US auto sales to drop by 9% this year, revising an earlier forecast of a 1-2% decline.

A big part of the reason for this past week’s stock market sell-off was the oil price war between Saudi Arabia and Russia. Caught in the middle are US shale oil producers - many of whom already had their backs to the wall due to high debt levels and financing difficulties. According to Commerzbank, drilling activity declined continuously until mid-January and has since stagnated at a low level.

In an article about the US shale collapse - something we at AOTH predicted long ago due to the Red Queen Syndrome of fast-depleting oil wells - Oilprice.com says at current prices, no shale well drilled today can make money.

CNN Business quoted an Obama-era energy advisor who now teaches at Columbia, saying “If this continues we will see widespread bankruptcies and layoffs in the oil industry.”

Gone is America’s energy independence.

Less related to the coronavirus but equally important to the big picture of how close the United States is to falling into recession, is the US agricultural sector. Burdened by near-record debt, rising bankruptcies, falling prices, Chinese countervailing duties, bad weather, climate change and tariffs American farmers are killing themselves at an alarming rate.

According to a recent feature story in USA Today, over 450 farmers from nine Midwestern states committed suicide between 2014 and 2018. The numbers are likely higher because not every state provides suicide data and some of the data has been redacted.

Behind each sad story are some stark figures: key commodity prices including soybeans, corn and wheat have fallen about 50% since 2012; farm debt is a third higher than in 2007; bad weather prevented farmers from planting nearly 20 million hectares in 2019; and US soybean exports to China dropped 75% from 2017-18, amid trade war tensions.

Conclusion

First considered “an Asia problem” that North Americans need not be overly concerned about, the coronavirus has morphed into a hugely complex issue that has many aspects to it. The most important is how quickly and how effectively the virus can be contained.

The market was clearly looking for a definitive action plan by the White House and it finally got it on Friday. The degree to which the plan is successfully implemented will have a considerable bearing on covid-19’s implications for the US economy and - by virtue of its close trade ties - the Canadian economy.

At AOTH we are obviously pleased to see a containment plan coming together not only from the White House but bi-partisan congressional legislation, however we also see things that are concerning. For example, of 9 million US veterans, only 70 tests for coronavirus have been done. This is shameful, especially considering there are only 350,000 World War Two veterans left - these elderly, immune system-compromised war heroes should be among the first to be contacted for testing.

China has proven itself incredibly efficient at quarantining vast numbers of people, shutting down entire cities and industries in a manner that just wouldn’t be possible in the West. South Korea is testing 10,000 people a day, minimizing deaths to less than 1% of infectious cases.

US medical professionals have been seen sharing and re-using protective masks. Patients showing symptoms of the virus are being sent home. Tests are being rationed. Many comparisons have been made between covid-19 and the regular seasonal flu. A common conclusion is that many more people die from the flu every year, so what’s the big deal? Well, the big deal is that this particular coronavirus is 10 times more deadly and far more contagious than the flu.

Containment efforts have failed in the US because of a lack of testing. Ohio Department of Health Director Amy Acton publicly stated:

“We know that 1% of the state’s population is carrying this virus today. That’s over 100,000 people.”

England is using the Herd Immunization Theory to fight the virus. Let it run its course through your population. Once 60% infection is reached a natural immunization will occur.

Mitigation efforts – social distancing, self quarantine, hand washing, masks, 3 meters of separation and no hand-shaking were throw out the window in a White House Rose Garden Presidential briefing. President Trump and business leaders were shaking hands, touching the podium and its microphone while being crammed into a very small area. Trump still hadn’t been tested in spite of coming into contact with an infected person the weekend before. Should not have everyone at his luxury resort, including staff, been tested, back tracked, and self quarantined? Reporters covering the brief sat jammed together passing a microphone back and forth.

It almost seems to us here at AOTH the very leaders in the US fight, the President, his chief medical advisers, the countries top CEOs and the media do not seem to be taking this seriously enough. Certainly their lackadaisical attitude, their disregard for their own stated policies and published rules, done clearly in view of the public, in defiance of their own stated goals for public response, suggests an attitude adjustment is necessary.

Consumer spending, which we have shown, is falling off a cliff. Quarantines, cancellations, business shutdowns, job losses and fear are growing. Consumers are stocking up on supplies best they can and holing up. Consumer spending isn’t coming back any time soon. Relief efforts and monetary stimulus efforts will fail this time around.

At AOTH we do not have a lot of confidence the US can avoid what might be a rather lengthy period of deflation/ recession.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.