Thursday, March 04, 2021

Get Ready for Inflation Mega-trend to Surge 2021 / Economics / Inflation

By: Nadeem_Walayat

So the US looks set to approve stimulus spending of $1,9 trillion for the US economy during 2021, with economists singing it's praises of how basically you get a free lunch, one of huge deficit spending at zero interest rate and no inflation. Understand $1.9 trillion is 10% of the US Economy! This for an economy that has already recovered from the covid depression and was destined to grow by about 3% in 2021. So what happens when one throws 10% of GDP at an economy that is growing by 3% per annum. No you don't get GDP growth of 13% per annum, yes it will boost US GDP for 2021 but not by 10%, perhaps by another 3%, so where does the other 7% or $1.5 trillion go? Into HIGHER PRICES, INFLATION! Some of which may be reflected in the official inflation indices.

Read full article... Read full article...

Thursday, March 04, 2021

Stocks, Gold – Rebound or Dead Cat Bounce? / Stock-Markets / Financial Markets 2021

By: Submissions

None of Friday‘s intraday attempts to recapture 3,850 stuck, and the last hour‘s selling pressure is an ill omen. Especially since it was accompanied by high yield corporate bondsh weakening. It‘s as if the markets only now noticed the surging long-end Treasury yields, declining steeply on Thursday as the 10y Treasury yield made it through 1.50% before retreating. And on Friday, stocks didn‘t trust the intraday reversal higher in 20+ year Treasuries either.

Instead, the options traders took the put/call ratio to levels unseen since early Nov. The VIX however doesn‘t reflect the nervousness, having remained near Thursday‘s closing values. Its long lower knot looks encouraging, and the coming few days would decide the shape of this correction which I have not called shallow since Wed‘s suspicious tech upswing. Here we are, the tech has pulled the 500-strong index down, and remains perched in a precarious position. Could have rebounded, didn‘t – instead showing that its risk-on (high beta) segments such as semiconductors, are ready to do well regardless.

That‘s the same about any high beta sector or stock such as financials – these tend to do well in rising rates environments. Regardless of any coming stabilization / retreat in long-term Treasury yields, it‘s my view that we‘re going to have to get used to rising spreads such as 2y over 10y as the long end still steepens. The markets and especially commodities aren‘t buying Fed‘s nonchalant attitude towards inflation. Stocks have felt the tremors, and will keep rising regardless, as it has been historically much higher rates that have caused serious issues (think 4% in 10y Treasuries).

Read full article... Read full article...

Thursday, March 04, 2021

The Top Technologies That Are Transforming the Casino Industry / Personal_Finance / Gambling

By: Submissions

...

Thursday, March 04, 2021

How to Get RICH Crypto Mining Bitcoin, Ethereum With NiceHash / Currencies / Crypto Mining

By: N_Walayat

How get rich crypto mining with your desktop computer or laptop. Here's my step by step guide for first time beginners crypto mining with Nicehash, lets see how easy it is to get started and start making money crypto mining, how many bitcoins can I make with my old 4790k GTX 970 desktop as I await for my 5950x, RTX 3080 to get delivered.

Step1 Download the Nicehash mining software....

Read full article... Read full article...

Wednesday, March 03, 2021

Coronavirus Pandemic Vaccines Indicator Current State / Politics / Coronavirus 2021

By: Nadeem_Walayat

The UK and US continue to recover well from the pandemic with the EU experiencing a slower rate of recovery from the pandemic though from a much lower January peak. Meanwhile the likes of Brazil are doing their own thing and are heading towards new pandemic highs, where it should be noted that the quality of testing is far lower than in the UK, US and Europe so the number of cases are likely many times official figures which thus pose a risk of more variants appearing and spreading over the coming weeks and months.

Read full article... Read full article...

Wednesday, March 03, 2021

AI Tech Stocks Investing 2021 Buy Ratings, Levels and Valuations Explained / Companies / Tech Stocks

By: Nadeem_Walayat

My last look at AI stocks buying levels late November 2020 had some of the must own AI stocks trading at high valuations for instance Apple was trading on an EC of 76 against a target of 50, Nvidia on 173 against about 100! Whilst IBM was dirt cheap on -3, so I could not resist buying more where I am sure several years from now many investors will be kicking themselves for not having had the foresight to pick up IBM when it was trading so cheaply. Next I picked up some more Google as numero uno and Facebook given it's continuing VR market success despite the dying lame stream media lobbying governments to get the tech giants to share ad revenues with them. And I also sought to pick up some Amazon on trading below $3000.

Read full article... Read full article...

Wednesday, March 03, 2021

Stock Market Bull Trend in Jeopardy / Stock-Markets / Stock Market 2021

By: Troy_Bombardia

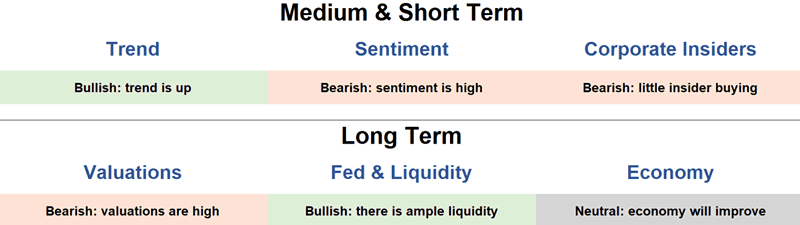

What a week it has been! Various markets saw noticeable declines on news of rising yields. The strong upward trend for stocks is finally taking a long-overdue breather and so is extreme sentiment.

Let’s look at some bullish and bearish factors to give us a better idea of what the markets are doing.

Read full article... Read full article...

Wednesday, March 03, 2021

New Global Reserve Currency? / Currencies / Fiat Currency

By: Raymond_Matison

Politicians and investors regularly claim that “this time it’s different”. But history shows us repeatedly that rarely things are truly or fundamentally different. The power of the Roman Empire two thousand years ago was established by military means. Over time, its government undermined that empire by continuing military campaigns and lavish spending. This ultimately required that their money, the silver Denarius coin, be diluted with other metals which brought its purchasing value down. This in turn reduced people’s trust in the empire’s money and eventually brought the empire into decline. Since then, this history has been repeated many times – only the name of the country and its currency have changed. It is a lesson which neither kings nor politicians have been willing or able to learn – to this day. And this time it is not different.

Starting in the 15th century, Portugal, geographically bounded by the Atlantic Ocean rapidly developed shipbuilding and maritime exploration. Discovering new lands (Brazil) and routes for the spice trade (India) and other commodities (Africa), and by expanding military incursions into Asia, their empire flourished as one of the world’s major economic, military, and political powers. When its king died in battle in Morocco, King Phillip of Spain seized the Portuguese crown, and Portugal was subject to military adventures from the Netherlands, France, and England – who were hostile competitors to Spain. Unable to protect its lands and vast global network of trading posts, its empire started a long and gradual decline.

Read full article... Read full article...

Wednesday, March 03, 2021

Gold To Monetary Base Ratio Says No Hyperinflation / Economics / HyperInflation

By: Kelsey_Williams

A fundamental tenet regarding money and inflation is that ongoing money creation by governments and central banks (Federal Reserve) cheapens the value of all money (US dollars) in circulation and leads to a loss of purchasing power. The loss in purchasing power shows up in the form of higher prices for all goods and services.

As long as the amount of money that is created is somewhat moderate and regular, then the effects are presumed to be moderate, as well. Hence, we experience increases in the cost of living on an ongoing basis, but in incremental amounts of maybe two or three percent each year.

Read full article... Read full article...

Wednesday, March 03, 2021

US Fed Grilled about Its Unsound Currency, Digital Currency Schemes / Currencies / BlockChain

By: MoneyMetals

As financial markets gyrated this week, Federal Reserve chairman Jerome Powell touted the U.S. dollar as a form of “sound money.” More on that incredible take in a moment.

But first, let’s review this week’s market action.

Inflation fears helped drive another spike in long-term bond yields, and by Thursday that began to spook Wall Street. The Treasury market is now off to one of its roughest starts to a year on record. As a result, calls are mounting for the Fed to up its bond purchases.

A steepening yield curve is helping to depress precious metals prices. Rising real interest rates tend to be negative for the gold market.

Read full article... Read full article...

Wednesday, March 03, 2021

The Case Against Inflation / Economics / Inflation

By: John_Mauldin

For inflation to be a near-term threat, five things would have to happen this year:

- Vaccines and other measures bring the pandemic under control this summer in the US and other developed countries.

- Consumers use relief dollars, savings, and/or borrowing to quickly increase their spending on discretionary goods and services.

- This spending is large enough to exceed post-pandemic production capacity and spark price increases.

- The Federal Reserve lets the economy “run hot” and maintains its low interest rates and asset purchases.

- Congress and the Biden administration leave the fiscal spigots open by not raising taxes or cutting spending.

All these are possible. Are they likely?

Read full article... Read full article...

Wednesday, March 03, 2021

How to Start Crypto Mining Bitcoins, Ethereum with Your Desktop PC, Laptop with NiceHash / Currencies / Crypto Mining

By: HGR

How get rich crypto mining with your desktop computer or laptop. Here's my step by step guide for first time beginners crypto mining with Nicehash, lets see how easy it is to get started and start making money crypto mining, how many bitcoins can I make with my old 4790k GTX 970 desktop as I await for my 5950x, RTX 3080 to get delivered.

Step1 Download the Nicehash mining software....

Read full article... Read full article...

Tuesday, March 02, 2021

AI Tech Stocks Investing Portfolio Buying Levels and Valuations 2021 Explained / Companies / Investing 2021

By: Nadeem_Walayat

My last look at AI stocks buying levels late November 2020 had some of the must own AI stocks trading at high valuations for instance Apple was trading on an EC of 76 against a target of 50, Nvidia on 173 against about 100! Whilst IBM was dirt cheap on -3, so I could not resist buying more where I am sure several years from now many investors will be kicking themselves for not having had the foresight to pick up IBM when it was trading so cheaply. Next I picked up some more Google as numero uno and Facebook given it's continuing VR market success despite the dying lame stream media lobbying governments to get the tech giants to share ad revenues with them. And I also sought to pick up some Amazon on trading below $3000.

As well as looking to pick up some more AMD given its moderating valuation in response to unlimited demand for it's CPU's. With Nvidia still a little pricey to prompt fresh buying despite the success of it's RTX 3000 series of GPU's that literally allows Nvidia to PRINT MONEY! Sell as many GPU processors as it can produce (most Nvidia GPU's are made by third parties using their GPU processors).

Read full article... Read full article...

Tuesday, March 02, 2021

There’s A “Chip” Shortage: And TSMC Holds All The Cards / Companies / Tech Stocks

By: Stephen_McBride

“You drove 1,000 miles just for this game?” Christmas 1988 was a stressful time for many American parents. Nintendo’s Super Mario Bros. 2 was the must-have toy that year. But copies of the hit videogame were as scarce as hen’s teeth.

ABC News ran a 20/20 special on the shortage called “Nuts for Nintendo.” They chatted to one dad who drove 1,000 miles from Indiana to NYC in the hopes of grabbing a copy.

“I’ve tried 7 stores a day for 3 weeks and still can’t find it,” he told reporters. They called it a “chip famine.”

Why was it so hard to get your hands on a video game? Longtime RiskHedge readers know computer chips, also called semiconductors, are the “brains” of electronics. There would be no iPhone, Amazon Webstore, or online messaging apps without them.

Read full article... Read full article...

Tuesday, March 02, 2021

Why now might be a good time to buy gold and gold juniors / Commodities / Gold and Silver 2021

By: Richard_Mills

Gold has been taking a beating in recent weeks, the sell-off prompted by rising bond yields which are taking the shine off the yellow metal. Higher interest rates diminish the argument for owning gold, which offers no yield.

On Wednesday, Feb. 24, spot gold dropped to $1,784.60 an ounce, just shy of $1,783.10 reached on Feb. 21, its lowest since July, 2020. The gold price climbed $342, or 22% last year, on pandemic fears, a low dollar and moribund bond yields, which for most of the year ran under 1%.

Gold has been pressured by higher yields on US Treasuries, most significantly the benchmark 10-year note, which is closing in on 1.4% (currently 1.37%), an increase of 44 basis points since the start of the year. The last time the 10-year was this high, was in February 2020, just before the start of the pandemic.

Kitco reported on Wednesday that a booming US housing market, fueled by low mortgage rates, is driving bond yields higher, after the Commerce Department showed new home sales rising 4.3%. The seasonally adjusted 923,000 units sold in January trounced consensus forecasts calling for 853,000 units to sell.

Read full article... Read full article...

Tuesday, March 02, 2021

Silver Is Close To Something Big / Commodities / Gold and Silver 2021

By: Hubert_Moolman

There is a sense that we are close to a significant move in silver. The current season since August 2020 till now, is shaping up in a similar manner to the season of August 2019 to February/March 2020.

Silver as well as the stock market peaked in February 2020, and crashed significantly into March.

Below, is a chart of silver (top) and the Dow (bottom):

Read full article... Read full article...

Tuesday, March 02, 2021

Bitcoin: Let's Put 2 Heart-Pounding Price Drops into Perspective / Currencies / Bitcoin

By: EWI

Here's what our "preferred" Elliott wave count said on Feb. 5, 2021

When financial historians discuss past manias, many of them point to the South Sea Company of the early 1700s as a classic example.

The enthusiasm to buy a piece of the action was so great that even Sir Isaac Newton became in investor.

He, along with many others, eventually lost big time when the South Sea Company Bubble burst.

Read full article... Read full article...

Tuesday, March 02, 2021

Gold Stocks Spring Rally 2021 / Commodities / Gold and Silver Stocks 2021

By: Zeal_LLC

Following a necessary correction, the gold miners’ stocks have spent much of recent months bottoming. This healthy basing process is rebalancing sentiment, preparing the way for this sector’s next bull-market upleg. That is looking to coincide with gold stocks’ spring rally, one of their strongest times of the year seasonally. That stiff tailwind blowing behind bullish technicals and fundamentals should make for big gains.

Seasonality is the tendency for prices to exhibit recurring patterns at certain times during the calendar year. While seasonality doesn’t drive price action, it quantifies annually-repeating behavior driven by sentiment, technicals, and fundamentals. We humans are creatures of habit and herd, which naturally colors our trading decisions. The calendar year’s passage affects the timing and intensity of buying and selling.

Gold stocks exhibit strong seasonality because their price action mirrors that of their dominant primary driver, gold. Gold’s seasonality generally isn’t driven by supply fluctuations like grown commodities see, as its mined supply remains relatively steady year-round. Instead gold’s major seasonality is demand-driven, with global investment demand varying considerably depending on the time in the calendar year.

Read full article... Read full article...

Tuesday, March 02, 2021

US Housing Market Trend Forecast 2021 / Housing-Market / US Housing

By: Nadeem_Walayat

Given the US governments continuing catastrophic response to the coronavirus virus resulting in severe economic contraction then one would assume that the crowing from the rooftops perma bear deflationistas would finally be proven right with their decade long perma bear messages of a US housing market crash finally being fulfilled. So is that what happened? Were the perma bears finally proven right by chance, a black swan event courtesy of a leak from a wuhan bio lab?

We'll in economic terms the US as is the case for all western nations has come under severe economic pressures following the panic lockdown responses to an out of control pandemic with further economic pain expected during Q1 2021 in a race against time to deliver vaccines into american arms.

The recovery in US employment has started to flat line as the US heads into new lockdown's as the pandemic Wave 4 starts to materialise, thus expect US unemployment to increase though to nowhere near the extent of the first wave.

Read full article... Read full article...

Tuesday, March 02, 2021

Covid-19 Vaccinations US House Prices Trend Indicator 2021 / Housing-Market / US Housing

By: Nadeem_Walayat

In my opinion one of the primary indicators for economic recovery for the US and the rest of the world is the percentage of the the adult population that has been vaccinated, and especially the segment of the population at highest risk of hospitalisation and death from covid-19 i.e. the over 50's. In which respect US vaccinations currently stand at 6.2 million with approx 1 million americans being vaccinated per day (1st dose) or about 0.3% of the population. Which frankly is just not good enough. So unless things step up a gear perhaps after Biden takes office then under the current pace the US is not going to have vaccinated 50% of the population until late May and that is just with the first dose!

Read full article... Read full article...