Coronavirus Pandemic Vaccines Indicator Current State

Politics / Coronavirus 2021 Mar 03, 2021 - 09:15 PM GMTBy: Nadeem_Walayat

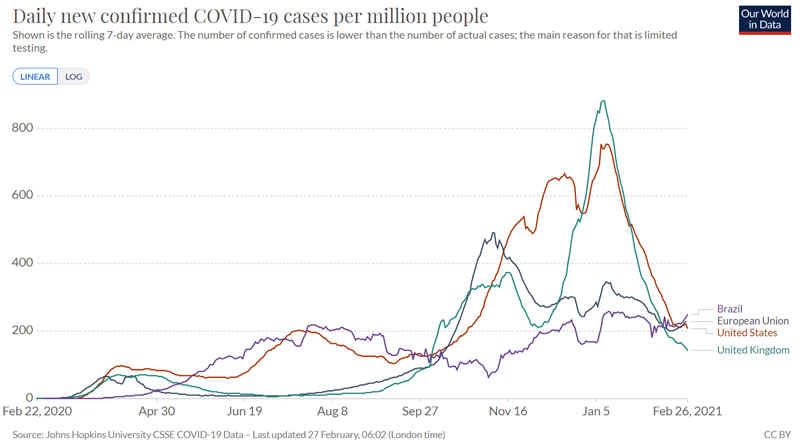

The UK and US continue to recover well from the pandemic with the EU experiencing a slower rate of recovery from the pandemic though from a much lower January peak. Meanwhile the likes of Brazil are doing their own thing and are heading towards new pandemic highs, where it should be noted that the quality of testing is far lower than in the UK, US and Europe so the number of cases are likely many times official figures which thus pose a risk of more variants appearing and spreading over the coming weeks and months.

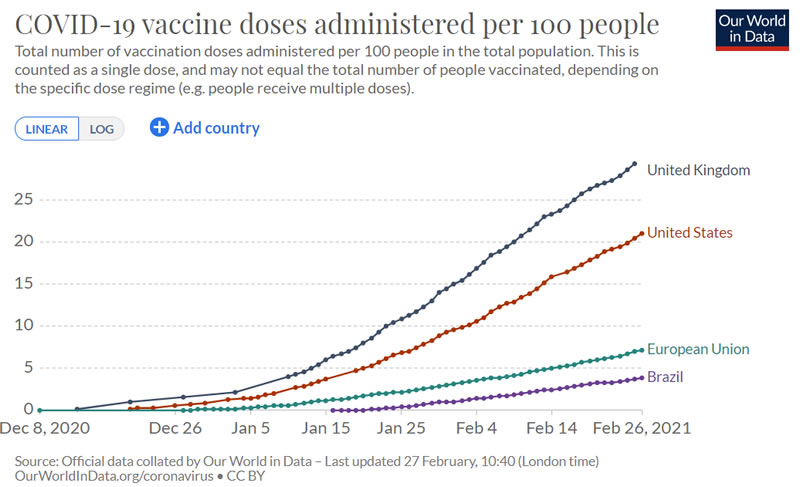

The vaccines indicator gives the reason why the UK has managed to go from one of the worst infection rates to one of the least in less than 2 months having now vaccinated 30% of the population. Whilst the United States has done well to play catchup under Biden's administration to total near 22% of the population. Meanwhile an inept dysfunctional blame everyone else EU is unable to get its vaccinations act together and stands at just 7%vaccinated. Whilst Brazils covid chaos is explained by the fact that only 4% have been vaccinated.

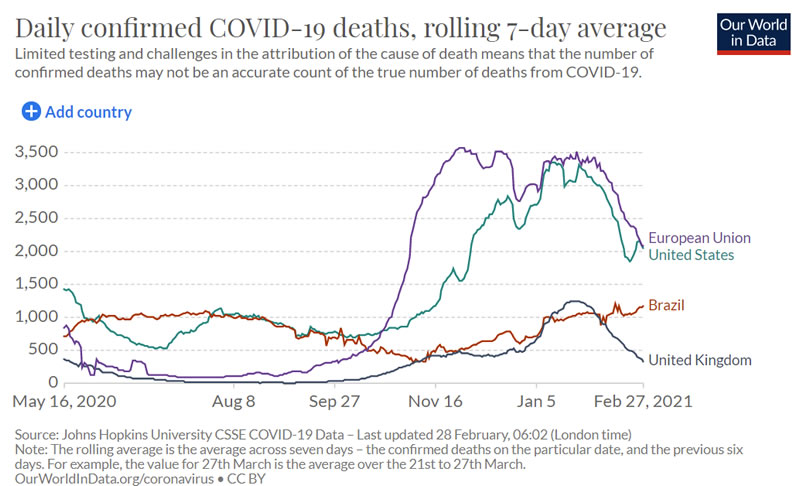

Successful vaccinations programmes are also being born out in the falling number of daily deaths and explains why Brazil remains on an upwards deaths trend trajectory and the lag in reduction of the number of daily deaths in the EU and US, which on this chart shows an up tick which likely is due to delayed reporting due to the snow storm that hit southern US states.

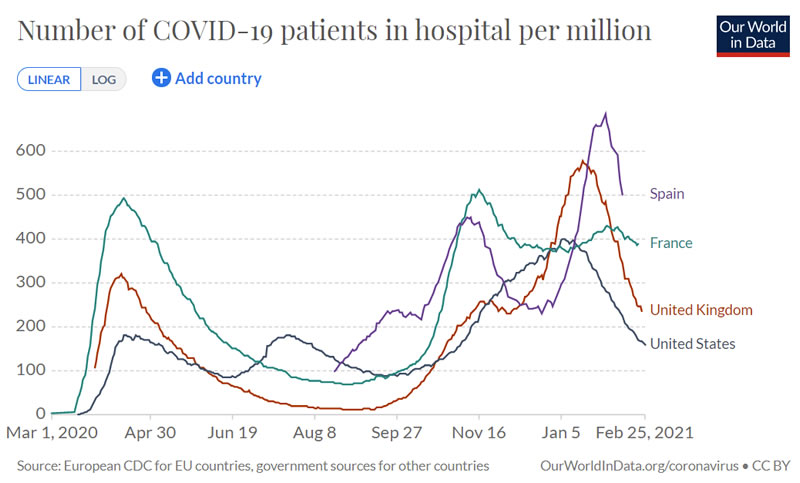

So regardless of the anti-vaxer noise in the blogosFear the vaccines are clearly working if not in preventing infections then in terms of hospitalisations and deaths as the following graph illustrates where the UK now has 1/3rd the covid patients in hospital (237/mill) than at the peak and the US half (163/mill). Whilst the likes of France are at 400 against a peak of 500/mill and Spain 500 against a peak of 670/mill.

Though there is a fly in the ointment where the US is concerned and that is the London variant which is expected to become dominant over the comin weeks, so depending on the speed of vaccinations the US could yet see a spike of sorts in hospitalisations and deaths.

Meanwhile France and Germany have finally given the go ahead for the Astrazenica vaccine to be used in the over 65's. This after a month of no other than the French President Macron himself bad mouthing the cheapest vaccine of the lot. Macron and all of the other EU critics should get on their hands and knees and apologise to the hard working scientists of Oxford / AstraZenica. Yet it is the French, German and european peoples who have paid the price in lives lost due to the incompetence of a corrupt and inept European Union's mishandling of the vaccinations programme.

And whilst those like me who are still waiting for the vaccine knock on the door, then I continue to take 4000iu of Vitamin D most days.

Post Pandemic Summer 2021 Social Unrest ?

I know the US has already experienced social unrest in the wake of the Black Lives Matter movement and in the run up to and aftermath of the US presidential election. But here in the UK things have been relatively calm and collective despite the stress to the system caused by the pandemic.

However, even with near 5 million UK workers on furlough, UK youth unemployment has soared, lifting the UK unemployment rate to 5% that once furlough ends could easily increase by another 50% to 7.5%.

Worse still is that black and asian unemployment rate is DOUBLE that of the official unemployment which is sowing the seeds for a post pandemic summer of discontent, demonstrations descending into rioting and looting in Britains major cities. Trends that are likely to be replicated across the western worlds major cities in a summer of jobless youth discontent.

Furthermore looking at the raw deal students have gotten so far i.e. forced to pay for £9,250 for SCAM University courses that are basically delivering learning worse than one can get off youtube then there is definitely a great deal of anger brewing in that segment of the youth population.

Hopefully governments will be able to read the writing on the wall and take preventative action, though looking at the actions of governments in the handling the pandemic then that seems highly unlikely, so a summer of youth discontent is more probable than not.

This article is an excerpt form latest extensive analysis that concludes in AI Stock buy ratings, levels and valuation analysis for investing in 2021 that has first been made available to Patrons who support my work.

AI Tech Stocks Buying Ratings, Levels and Valuations March 2021

- AI Tech Stocks Buying Levels and Valuations 2021 Explained

- Coronavirus Pandemic Vaccines Indicator Current State

- Post Pandemic Summer 2021 Social Unrest ?

- Get Ready for Inflation Mega-trend to Surge 2021

- The AI Megatrend Big Picture

- Human Brain vs High End Desktop PC in 2021

- AI Stocks Investing 2021 - Top 10 Stocks Analysis

- AI Stocks Portfolio Table 2021

- Stocks Bear Market / Crash Indicator (CI18)

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- High Risk Tech Stocks

- UK house prices trend forecast

- Bitcoin price trend forecast

- How to Get Rich

- US Dollar and British Pound analysis

As well as immediate access to my recent pieces of analysis -

Dow Stock Market Trend Forecast 2021

- UK Coronavirus Pandemic Current State

- US Coronavirus Pandemic Current State

- Stock Market Forecasts and Analysis Review of 2020

- The Stock Market Big Picture

- Post Covid Economic Boom

- GAMESTOP MANIA BUBBLE BURSTS

- FED Balance Sheet

- Dow Short-term Analysis

- Dow Long-term Trend Analysis

- ELLIOTT WAVES

- SEASONAL ANALYSIS / Presidential Cycle

- Stocks Bear Market / Crash Indicator (CI18)

- Dow Stock Market 2021 Outlook Forecast Conclusion

US Housing Market Trend Forecast 2021, AI Stocks and Coronavirus Pandemic Finale Catastrophe

- UK Coronavirus Catastrophe at Start of 2021

- US Coronavirus Catastrophe at Start of 2021

- US House Prices Trend Forecast Review

- The Inflation Mega-trend QE4EVER

- US House Prices Trend Forecast 2021

- General Artificial Intelligence Was BORN in 2020!

- How AI will come to rule the world

- Intel Fights Back!

- AI Stocks at Start of 2021

So again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.