Gold To Monetary Base Ratio Says No Hyperinflation

Economics / HyperInflation Mar 03, 2021 - 04:47 PM GMTBy: Kelsey_Williams

A fundamental tenet regarding money and inflation is that ongoing money creation by governments and central banks (Federal Reserve) cheapens the value of all money (US dollars) in circulation and leads to a loss of purchasing power. The loss in purchasing power shows up in the form of higher prices for all goods and services.

As long as the amount of money that is created is somewhat moderate and regular, then the effects are presumed to be moderate, as well. Hence, we experience increases in the cost of living on an ongoing basis, but in incremental amounts of maybe two or three percent each year.

NEGATIVE EFFECTS OF MONEY CREATION

However, if the amount of money creation is liberal enough, and occurs over a very short period of time, the effects can be much more severe. In some extreme cases this can lead to hyperinflation; or runaway inflation, as it is sometimes called.

In those instances, the money can become nearly worthless, and the simple purchase of a loaf of bread (when the transaction can be made) might cost the buyer $10,000 or more.

A century ago, gold and the US dollar were interchangeable at a fixed price of $20.67 per ounce. The fixed price was supposed to be a restraint on government’s tendency to expand the money supply. Unfortunately, the government found lots of reasons to ignore the restraint which dollar convertibility required.

After the link between gold and the dollar was severed completely and restoration of private citizens right to own gold was restored, the price of gold continued higher. At a $1815 per ounce, the price of gold currently reflects a nearly ninety-nine percent decline in the purchasing power of the US dollar over the past one hundred years.

We have said, and we know, that money creation by the Fed cheapens the existing supply of dollars and leads to higher prices for goods and services. And that has happened progressively over time.

However, the extraordinary increase in the money supply by the Federal Reserve in such a short period of time last year has led some to expect the hyperinflation that we referred to earlier.

But, that does not seem to be happening. Nor, did it happen after 2008 when the Fed adopted very similar quantitative measures then. Let’s see why not.

RUNAWAY INFLATION IS UNLIKELY

There are two specific reasons why runaway inflation did not happen a decade ago, and why it won’t likely happen now, either.

First, the demand for money is overwhelming the desire to spend. People are choosing to pay bills, pay down debts and save money rather than borrow and spend more. The demand for cash counterbalances the supply of cheap credit available. (see Supply And Demand For Money – The End Of Inflation?)

As a result, the cheap credit has fueled price explosions in stocks, bonds, and real estate. Now, all financial assets are overpriced and subject to huge downside drafts. This could lead to further drops in economic activity and a full-scale depression.

Second, the effects of inflation created by the Fed are unpredictable. Also, the impact of that inflation has been declining for more than fifty years. (see Fed Inflation Is Losing Its Intended Effect)

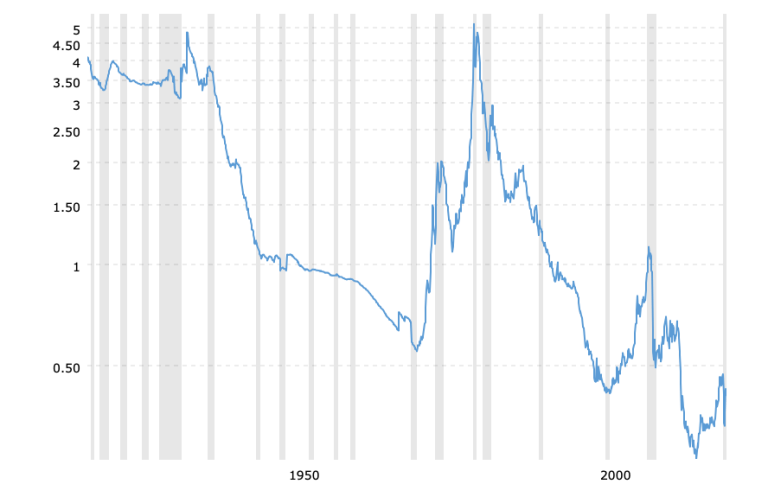

The chart below (source) shows the ratio of the gold price to the St. Louis Adjusted Monetary Base back to 1918…

GOLD TO MONETARY BASE RATIO – CHART

A false assumption by some gold bulls is that the size of the money creation is mathematically correlated to higher prices for gold. If the inflation effects of money creation are not evident, it is assumed that gold’s price will eventually go up in a way that corresponds proportionately to the amount of money that has been created. This is not true.

As we have said before, the higher price for gold is correlated directly to the loss in purchasing power of the US dollar; NOT to the amount of money created. Just as important, the quantitative loss in purchasing power is unpredictable; and gold’s price increases to reflect that actual loss after it has occurred – not before.

A significant amount of new money creation is required ongoing just to keep debt deflation at bay and stave off economic collapse. Wait! Isn’t that what just happened?

As long as the Fed creates enough new money to prevent debt deflation, any amount of new money created above that level presents the potential for minimal inflation effects, such as higher prices for goods and services. Those minimal effects are unpredictable. (see The Fed’s 2% Inflation Target Is Pointless)

As the Gold To Monetary Base Ratio shows, hyperinflation isn’t in the cards.

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2021 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.