Monday, August 12, 2024

Stocks Rebounded: What’s Next? / Stock-Markets / Stock Markets 2024

By: Paul_Rejczak

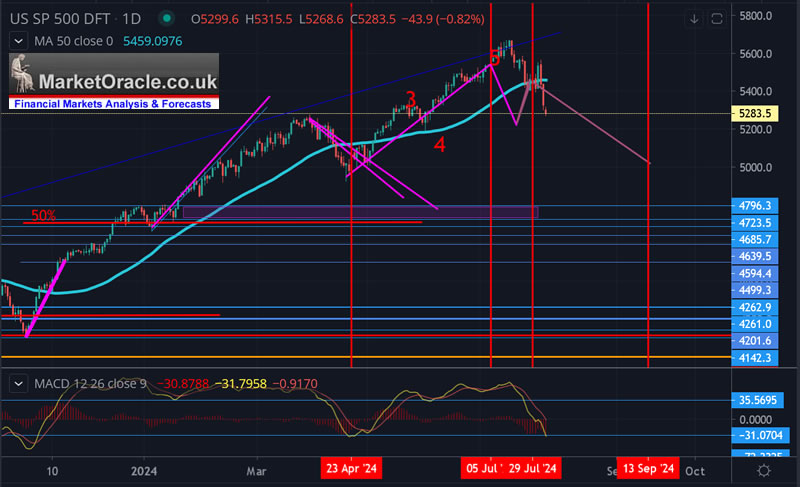

Tuesday's trading session was mixed; stock prices bounced, but they closed well below the daily highs. The S&P 500 reached a local high of 5,312.34 but closed more than 70 points below that level, gaining 'just' 1.04%. Overnight, calming words from the Bank of Japan were released, and this morning, the S&P 500 is likely to open 1.0% higher in another attempt to retrace more of its recent sell-off.

Before the current turmoil, investor sentiment had slightly improved last week, as indicated by the last Wednesday's AAII Investor Sentiment Survey, which showed that 44.9% of individual investors are bullish, while only 25.2% of them are bearish – down from 31.7% last week.

Saturday, August 10, 2024

AI Will Turn Everyone Into Gamblers! The Greatest Wealth Transfer In History is Coming.. Part 1/2 / Stock-Markets / Financial Markets 2024

By: Nadeem_Walayat

Dear Reader

Have you managed to capitalise on the stock market correction as many patrons have in key target AI tech stocks?

Saturday, August 10, 2024

Plunging Stocks, Gold Miners, and Lucrative Implications / Stock-Markets / Gold & Silver Stocks 2024

By: P_Radomski_CFA

The stock markets around the world are sliding, and so does bitcoin – just as I warned.

Miners invalidated their tiny breakout, closed below the July low on Friday, and they are poised to slide even more.

That’s just the beginning.

Let’s start with a quote from my Friday’s Gold Trading Alert:

Stocks might have had their “oops” moment this week. (…)

Saturday, August 10, 2024

The #1 Takeaway from Big Tech Stocks Earnings / Companies / Earnings

By: Stephen_McBride

It’s a jam-packed Jolt on artificial intelligence (AI) today… plus, a well-deserved dunk on The New York Times.

Let’s get after it…

- America spent $600 billion (in today’s dollars) building its highway system.

Big tech companies will spend more money constructing AI data centers in the next four years.

It’s the biggest infrastructure buildout ever, and it’s not even close.

Saturday, August 10, 2024

Stock Market Sentiment Speaks: Reasons For A CRASH / Stock-Markets / Stock Markets 2024

By: Avi_Gilburt

Recently, we have seen a 10% drop in the S&P500. And, there is no shortage of reasons that the financial media pundits have ascribed to that decline. While many point to the bad jobs data, we have to at least be honest in recognizing that the market began this decline well before those poor jobs numbers were announced. So, we can easily dismiss that superficial reason.

But, the most common reason for the market decline to which the pundits point was the unwinding of the yen carry trade. In fact, I counted at least 3 articles on Seeking Alpha alone with that reason in their title, with at least another 5 or 6 proffering that reason within the heart of their articles.

Read full article... Read full article...

Saturday, August 10, 2024

Optimal Gold Stocks Macro Evolving / Commodities / Gold & Silver Stocks 2024

By: Gary_Tanashian

The macro setup for gold stocks is evolving into something that will surprise many after decades of poor fundamentals

I don’t make a habit of pumping the most frustrating stock sector on the planet just for the sake of it. I have made a habit of discussing why, since 2003, the macro market backdrop has been adversarial to gold stocks much more often than not. By extension, internal indicators like the HUI/Gold Ratio have rightly been long-term bearish.

As you can see, the HUI/Gold ratio made a top in 2003 and has been down and flat ever since. Personally, I believe it made a double bottom earlier this year. I don’t believe that because I want to (even though I do want to). I believe it because of macro developments currently in play.

Read full article... Read full article...

Saturday, August 10, 2024

Financial Markets Attempting To Find Its Footing / Stock-Markets / Financial Markets 2024

By: The_Gold_Report

USD dollar index futures are higher (+0.24%) this morning, and bond yields are also higher.

Gold (+0.49%) and silver (+0.08%) are rallying a tad, while copper and oil are flat.

Stock futures are rallying, with risk barometer Bitcoin up 1.39%.

Read full article... Read full article...

Saturday, August 10, 2024

Big US Stocks Fundamentals / Stock-Markets / Stock Markets 2024

By: Zeal_LLC

The big US stocks dominating markets and investors’ portfolios just reported a truly-spectacular quarter. Their collective revenues neared record levels, driving their highest earnings ever witnessed. Yet despite all that, risks abound. The US stock markets have never been more concentrated, relying on fewer and fewer companies. Valuations remain deep into dangerous bubble territory, and market fragility signs are mounting.

The flagship US S&P 500 stock index has enjoyed a banner 2024, blasting up 18.8% year-to-date in mid-July! Traders’ fascination with mega-cap techs involved in artificial intelligence fueled fully 38 new record-high closes this year, over 1/4th of all trading days. The resulting greed and euphoria have left the SPX chronically- and extremely-overbought, mostly stretching far above its baseline 200-day moving average.

Read full article... Read full article...

Saturday, August 10, 2024

U.S. Trilogy: debt-based dollar and economy, stablecoin digital currency, BRICS new world. / Stock-Markets / Global Financial System

By: Raymond_Matison

Debt-based dollar and economy

Over a century ago the United States Congress approved a deceitfully promoted Federal Reserve Central Bank, which then established a new debt-based monetary system. Its concept of creating and introducing ever more currency into a country which had little debt, initially worked well to create economic stimulus at the time, and currency available to participate in WWI and WWII. That stimulus also bought forth the wild market speculation of the 1920s, the necessary precursor for tightening of credit and the Great Depression. Outlawing citizen ownership of real money (Constitutionally designated as gold and silver coins) in 1934, it required citizens to turn in their gold coins to banks, which were complicit with government to steal money from citizens as gold was then revalued by from $20.63 to $35.00 an ounce.

Read full article... Read full article...

Thursday, July 04, 2024

Stocks Correct into Bitcoin Happy Thanks Halving - Earnings Season Buying Opps / Stock-Markets / Financial Markets 2024

By: Nadeem_Walayat

Dear Reader

It's 4th July 2024 Britains Independance Day from Clown Sunak.

The polls will be opening at 7am today when the British electorate get to give their damning verdict on what will likely be one of the worst governments in British history led by a Clown, Rishi Sunak, a fool who was never fit to be an MP let alone a PM. Not for much longer as this fool will be out of No 10 within 24 hours, the writing is on the wall, Liebour is heading for a landslide election victory of well over 400 seats as the Tories die an electoral death.

Read full article... Read full article...

Thursday, July 04, 2024

24 Hours Until Clown Rishi Sunak is Booted Out of Number 10 - UK General Election 2024 / ElectionOracle / UK General Election

By: Nadeem_Walayat

The polls will soon open at 7am today when the British electorate get to give their damning verdict on what will likely be one of the worst governments in British history led by a Clown, Rishi Sunak, a fool who was never fit to be an MP let alone a PM. Not for much longer as this fool will be out of No 10 within 24 hours, the writing is on the wall, Liebour is heading for a landslide election victory of well over 400 seats as the Tories die an electoral death.

Read full article... Read full article...

Monday, July 01, 2024

Clown Rishi Delivers Tory Election Bloodbath, Labour 400+ Seat Landslide / ElectionOracle / UK General Election

By: Nadeem_Walayat

Mentally soft as a sponge Richi Sunak clearly cannot take the pain of being PM any more even though his job is mostly about reading cue cards handed to him by his handlers, nevertheless Richi has thrown in the towel and declared he does not want to do it for another 6 months, he's had his fun playing at being PM and so announced a General Election for the 4th of July, Richi's Independence Day! Can you imagine that this clown has been PM for 575 days! They used to call John Major a dull boring grey man in a grey suit, but this guy Richi has done a worse job than if Mr Bean had been PM! I do not recall anything that this fool has done over the past 575 days as PM! He was never fit to be an MP let alone PM, his primary focus has always been to get to a net worth of £1 billion! Which is fine and dandy but why the hell make the British people suffer for near 2 years in the process? The Tories deserve to DIE an electoral death, the party needs to undergo a major PURGE!

Read full article... Read full article...

Sunday, June 30, 2024

Bitcoin Happy Thanks Halving - Crypto's Exist Strategy / Currencies / Bitcoin

By: Nadeem_Walayat

Bitcoin on cue trended lower into halving setting a new swing low on Friday at $59.6k before bouncing post halving, currently trading at £65k. Overall picture remains for BTC in a trading range of $72k to $60k pending a breakout higher probably timed with when the dollar turns lower.

Read full article... Read full article...

Sunday, June 30, 2024

Is a China-Taiwan Conflict Likely? Watch the Region's Stock Market Indexes / Stock-Markets / Chinese Stock Market

By: EWI

By Mark Galasiewski | Elliott Wave International

The U.S. government in early May sanctioned 300 Chinese entities for supplying machine tools and parts to Russia for its war against Ukraine, while in mid-May Russian president Vladimir Putin made a two-day visit to China. In turn I found myself thinking about how tensions between China and the United States could lead to open conflict, specifically over Taiwan.

The likelihood of conflict depends in part on the region's social mood, as reflected in Asia's stock market indexes. When social mood is negative, countries are more likely to behave aggressively.

Read full article... Read full article...

Sunday, June 30, 2024

Gold Mining Stocks Record Quarter / Commodities / Gold & Silver 2024

By: Zeal_LLC

The gold miners will soon report what will almost certainly prove their best quarter ever. Mostly due to Q2’s record-shattering gold prices, gold miners’ earnings should soar off the charts. Those will be further boosted by slightly-lower mining costs many of these companies are predicting. With such incredibly-strong fundamentals, more professional fund managers should soon start investing in this high-potential sector.

Four times a year, publicly-traded companies report quarterly results. These earnings seasons are very important, illuminating how gold miners are actually faring fundamentally. That really cuts through the obscuring sentiment fogs often shrouding this sector. I enjoy learning about companies’ fundamentals, so for 32 quarters in a row I’ve analyzed the latest quarterlies from the top 25 gold stocks in both their leading ETFs.

Those are of course the GDX VanEck Gold Miners ETF dominated by super-major and major gold miners, and its little-brother GDXJ VanEck Junior Gold Miners ETF which is actually overwhelmingly weighted to mid-tier gold miners despite its name. Those categories are defined by annual production levels, with super-majors exceeding 2,000k ounces, majors above 1,000k, mid-tiers over 300k, and juniors under that.

Read full article... Read full article...

Sunday, June 30, 2024

Could Low PCE Inflation Take Gold to the Moon? / Commodities / Gold & Silver 2024

By: P_Radomski_CFA

The PCE Index statistics were released today, and you might wonder what impact they will have on the price of gold.

Let’s dig in.

One might think that PCE is a critical driver of gold prices (and thus, you might be concerned with what the number is going to be), and there is some truth to it, but looking at how those reports have indeed influenced gold price provides extra context to what might seem obvious.

Wednesday, June 26, 2024

UK General Election 2024 Result Forecast / Politics / UK General Election

By: Nadeem_Walayat

UK General Election - 4th July 2024

Mentally soft as a sponge Richi Sunak clearly cannot take the pain of being PM any more even though his job is mostly about reading cue cards handed to him by his handlers, nevertheless Richi has thrown in the towel and declared he does not want to do it for another 6 months, he's had his fun playing at being PM and so announced a General Election for the 4th of July, Richi's Independence Day! Can you imagine that this clown has been PM for 575 days! They used to call John Major a dull boring grey man in a grey suit, but this guy Richi has done a worse job than if Mr Bean had been PM! I do not recall anything that this fool has done over the past 575 days as PM! He was never fit to be an MP let alone PM, his primary focus has always been to get to a net worth of £1 billion! Which is fine and dandy but why the hell make the British people suffer for near 2 years in the process? The Tories deserve to DIE an electoral death, the party needs to undergo a major PURGE!

Read full article... Read full article...

Wednesday, June 26, 2024

AI Stocks Portfolio Accumulate and Distribute / Companies / Investing 2024

By: Nadeem_Walayat

Several more target stocks have entered their buying ranges - TSMC, ASML, Apple.ALB, CRUS, JBL, GPN to join the likes of AMD, ADSK, GFS and TSLA.

The key metrics to watch are the buying ranges and deviations from all time highs i.e. AMD is well within it's buying range and is trading at -36% deviation from it's all time high set just a few weeks ago! As well as now no longer trading above 100% of it's PE range unlike META.

Read full article... Read full article...

Wednesday, June 26, 2024

Gold Stocks Reloading / Commodities / Gold & Silver 2024

By: Zeal_LLC

The gold miners’ stocks have been grinding lower for a month now, sapping traders’ enthusiasm. But this is par for the gold-summer-doldrums course, what typically happens in June. This sentiment-rebalancing drift is quite bullish for this high-potential sector, reloading it for another strong surge higher. With their probable mid-summer bottoming nearing, traders have a mid-upleg opportunity to add undervalued gold stocks.

Reloading always reminds me of target shooting, which was a fun part of my life growing up. Back then liberals hadn’t demonized guns yet, they were part of the cultural fabric. At my high school, its parking lot was full of kids’ pickups with loaded firearms hanging in their back windows! Most teenagers hunted with their fathers, and some participated in a local trap-shooting league along with my town’s police officers.

Back then ammunition was cheap, making target shooting affordable. You could buy 1000 rounds of 5.56 at many sporting-goods stores for under $100! That made for a fun afternoon of shooting with friends. My favorite targets were eggs. They are small and challenging to hit at range, explode nicely, and don’t need to be cleaned up as they’re biodegradable. Reloading magazines before shooting was the worst part.

Read full article... Read full article...

Wednesday, June 26, 2024

Gold Price Completely Unsurprising Reversal and Next Steps / Commodities / Gold & Silver 2024

By: P_Radomski_CFA

Did today’s decline in gold surprise you? It shouldn’t – during Thursday’s rally, gold moved to two resistance lines.

And I sent out a special Alert indicating that this was actually a shorting opportunity. That’s my second position in gold in years, and we closed the previous one (it was a long position) profitably in April this year.