The #1 Takeaway from Big Tech Stocks Earnings

Companies / Earnings Aug 10, 2024 - 05:44 PM GMTBy: Stephen_McBride

It’s a jam-packed Jolt on artificial intelligence (AI) today… plus, a well-deserved dunk on The New York Times.

Let’s get after it…

- America spent $600 billion (in today’s dollars) building its highway system.

Big tech companies will spend more money constructing AI data centers in the next four years.

It’s the biggest infrastructure buildout ever, and it’s not even close.

Heavy-hitters Microsoft (MSFT), Google (GOOG), Amazon (AMZN), and Facebook (META) all reported earnings over the past two weeks.

The #1 takeaway: They continue to plough historic sums of money into AI.

Google’s first “data center” was a tiny steel cage stuffed with 30 PCs. Now, tech companies are spending hundreds of billions of dollars (each year) building high-tech meccas to power ChatGPT and its competitors.

Microsoft and Google both announced a near doubling of the amount of money they’re spending on chips, servers, switches, and cooling equipment.

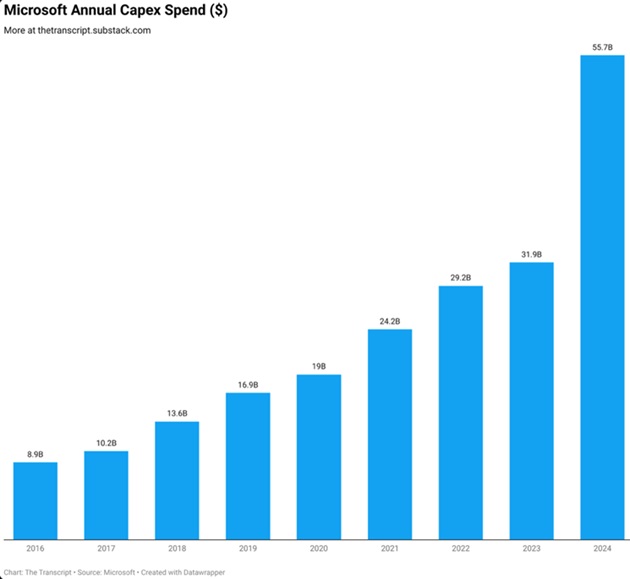

Look at Microsoft’s AI-related spending surging:

Source: Microsoft

Facebook plans to plough $40 billion into its AI data centers this year. And there’s no end in sight.

On its earnings call, Facebook CEO Mark Zuckerberg said the amount of chips needed to train its next AI model will be 10X what it used to train its last one. And Facebook already bought 600,000 Nvidia (NVDA) AI chips!

Would you rather own the companies spending all this money… or those receiving it?

There are few no-brainer choices in investing. Investing in the companies capturing the hundreds of billions of dollars of guaranteed AI chip spending is one of them.

- Who wins the AI arms race?

When asked about the billions of dollars it’s investing in AI, Google’s CEO said, “The risk of underinvesting is dramatically greater than the risk of overinvesting."

Zuckerberg echoed these comments.

Read: We’re locked in an AI arms race. Don't expect it to end anytime soon.

Amazon… Microsoft… Facebook… and Google are convinced AI will be as transformational as the internet. I agree.

And they’re hellbent on spending as much money as it takes to win the race. Ploughing billions of dollars into AI is worth it when the prize for winning is worth trillions.

Many investors are worried the AI bubble will soon go ka-boom. I disagree.

Four of the largest, most profitable companies in history—worth a combined $8 trillion—have plenty of money to afford this.

Smaller players like OpenAI that need chips to run their AI models might be a different story.

My contacts tell me there’s a sense of panic among the OpenAIs, Anthropics, and Perplexitys of the world. They’re worried they won’t be able to secure chips, won’t be able to afford them, or both.

Takeaway: We’re still in the early innings of the AI spending boom.

Heed the I.P.A. pattern. Own companies drinking from the firehose of AI infrastructure spending.

- AI’s thirst for energy is off the charts.

Transformers—which deliver electricity from generators to users—are in such short supply that if you order one today, you’ll be lucky to get it in 2028!

AI is partly to blame.

The new ChatGPT uses roughly 100,000,000X more “compute” compared to cutting-edge models a decade ago.

Microsoft alone operates more than 300 data centers around the world. And it’s on pace to build between 50 and 100 more each year for the foreseeable future. Some of these data centers will use as much energy as a small city.

The International Energy Agency estimates AI could use as much power as Japan in two years!

Electricity isn’t what you think of when you hear “fast-growing megatrend.” But powering AI will be one of the most important investing trends of the next decade.

Soon, you’ll read about the AI energy shortage in every newspaper in America. People will freak out about ChatGPT stealing their electricity.

Last month, Tesla (TSLA) refused a shipment of AI chips because it had no electricity to power them.

AI servers run 5X hotter than traditional data centers. The new state-of-the-art is “liquid” cooling, as opposed to giant fans blowing cold air.

- Today’s dose of optimism…

Forty years ago, Venezuela was twice as rich as neighboring Chile.

Then Chile gave Milton Friedman’s “free market” ideas a go, while Venezuela tried communism.

The results are in, and we have a clear winner:

To get more ideas like this sent straight to your inbox every Monday, Wednesday, and Friday, make sure to sign up for The RiskHedge Report, a free investment letter focused on profiting from disruption.

By Stephen McBride

Chief Analyst, RiskHedge

© 2024 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.