Gold Price Completely Unsurprising Reversal and Next Steps

Commodities / Gold & Silver 2024 Jun 26, 2024 - 05:56 AM GMTBy: P_Radomski_CFA

Did today’s decline in gold surprise you? It shouldn’t – during Thursday’s rally, gold moved to two resistance lines.

And I sent out a special Alert indicating that this was actually a shorting opportunity. That’s my second position in gold in years, and we closed the previous one (it was a long position) profitably in April this year.

The Beginning of a Bigger Move

And let me tell you this – the move lower has only begun. I’m not going to show you short-term gold charts in this article, but I am going to show you several long-term charts confirming that what happened on a short-term basis was not accidental.

Let’s start off with gold’s monthly chart (based on monthly candlesticks), where you can see that gold formed two monthly reversals in April and May.

Since gold is likely to decline shortly, it’s also likely that we’re going to see a third monthly reversal in a row – what a powerful triple sell signal that will be!

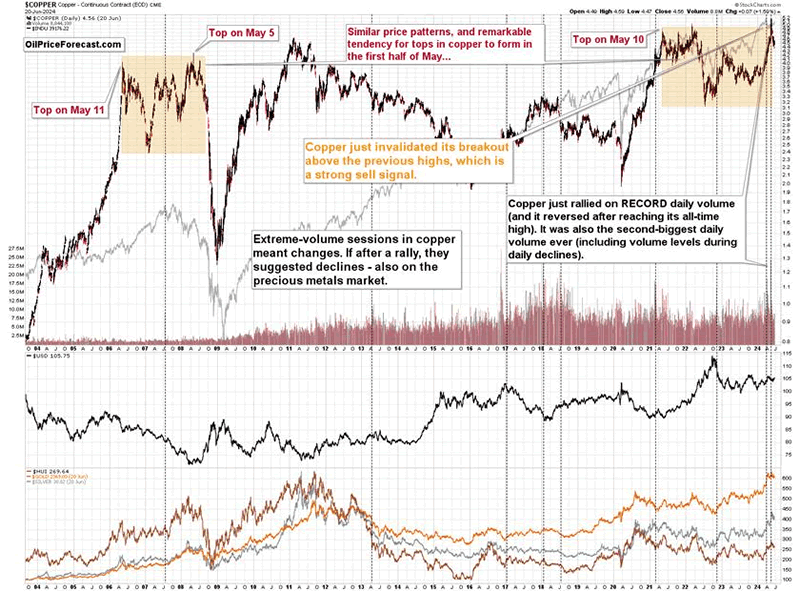

Copper has been indicating weakness for commodities for quite some time, and there’s nothing subtle about it.

Invalidation of the move to new highs is a powerful sell signal.

We saw one also in bitcoin.

Bitcoin’s halving failed to ignite a rally to new highs. The “new gold” is below even its 2021 top. Ok, it’s not as weak as mining stocks, but it’s not how a really strong market behaves.

It’s the same with Chinese stocks that just verified the breakdown below their rising support line.

This is bad. Like, really bad. This line proved to be strong support three times – in 2020 and in 2022. And now it was verified as resistance. Since commodities like copper are already declining, suggesting that technical indications from the Chinese market are not accidental, Chinese stocks can indeed slide.

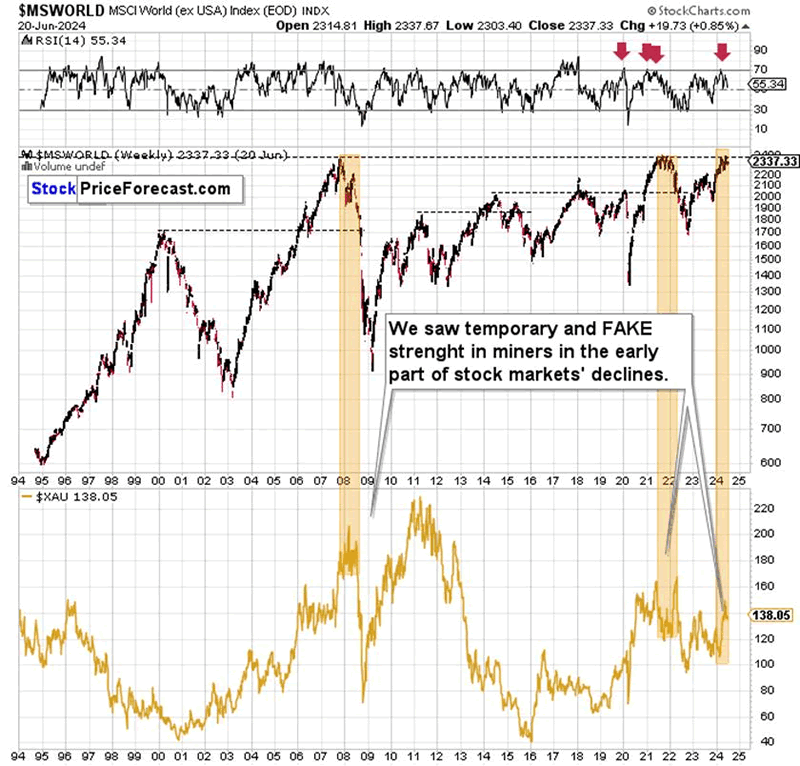

World stocks are most likely forming a broader top here, similar to the one that we saw in 2021, but since Chinese stocks already turned south, it seems only a matter of (little) time before this huge domino piece triggers the fall of the other pieces.

Technically, world stocks encountered extremely strong resistance – their all-time highs that already worked – this resistance stopped the rally in 2021.

Pessimistic Economic Indicators

On a side note, it’s quite pessimistic to see that despite all that stimulus money (and inflation measured not only by CPI that some view as artificially lowered, but by purchases reported by real people), stocks were not able to move to new highs. It’s not a recession on its own, but it does indicate that we might see one in the following months. Let’s keep in mind that technicals precede fundamentals, so a slide in world stocks here could indicate a global economic slowdown.

Also, both previous cases when world stocks topped at those levels were followed by huge declines in the mining stocks.

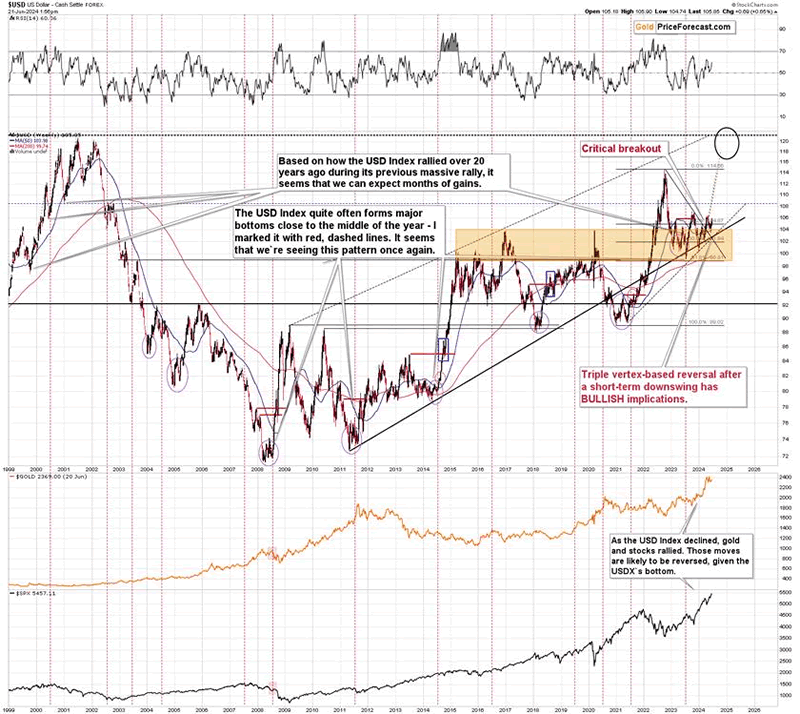

Let’s not forget that the USD Index is in a long-term uptrend and most likely still early in its powerful, medium-term upswing.

What used to be resistance (the 2016 and 2020 tops and the 100 level in general) are now support.

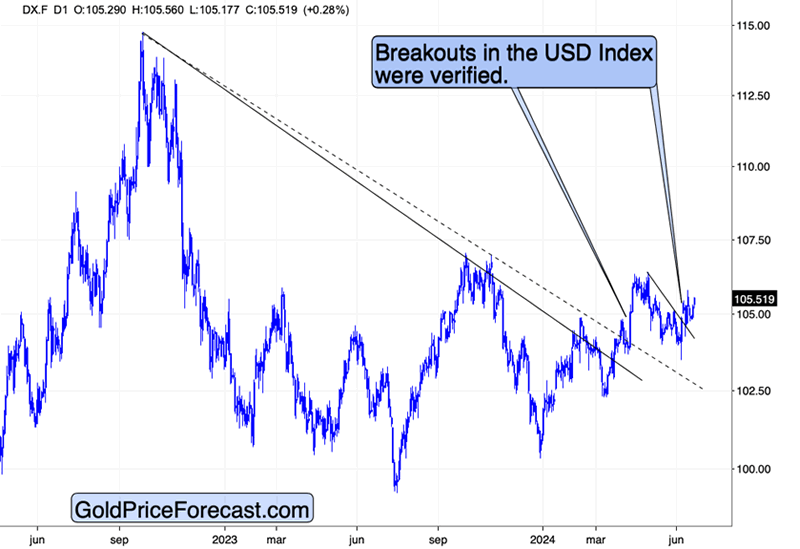

The short-term chart suggests that the outlook is also positive for the following weeks, not just months.

The USDX is after medium-term and short-term breakouts. Both were verified. The next move is very likely to be UP.

This is bearish for the precious metals sector. While there are times when USDX and gold move up together, those times pass, and the natural tendency for them to move in opposite directions takes precedence. Of course, I don’t mean the long term, where both markets move based on their own (connected, but still not identical) fundamentals and cycles.

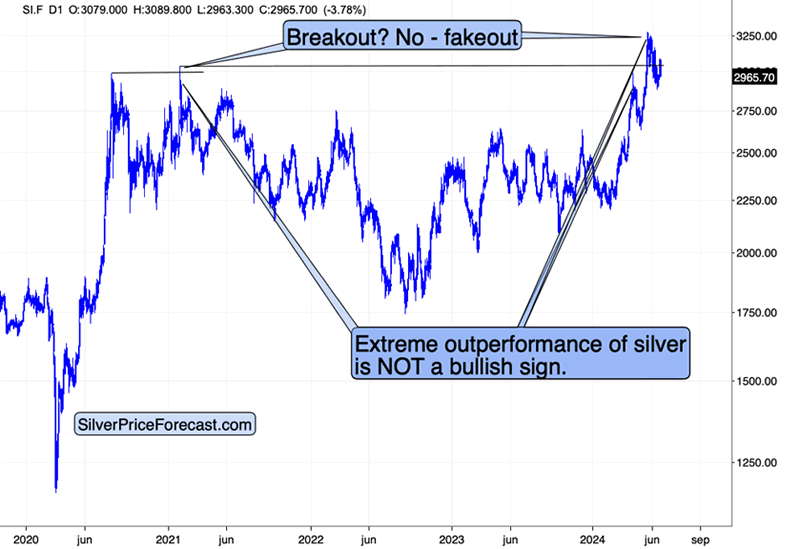

Let’s move to silver.

It surely didn’t take silver a lot of time to invalidate the move above $30. It was another fake rally – something that silver is known for, and something that I warned about.

As silver invalidated its moves above the 2020 and 2021 highs, we saw very strong sell signal. Today’s invalidation of the rally is just a cherry on this extremely bearish analytical cake.

I know, it’s hard to believe that silver might fall here (even though it has a long-term potential to go into triple digits), but that’s exactly what the technicals are suggesting right now. If one wants to buy gold or silver as insurance, then I have nothing against it (no, that’s not investment advice), but I’d suggest going with a trusted gold dealer or a reputable silver dealer. As far as the near-term and medium-term price moves are concerned, I don’t think that we’ll see higher prices.

I warned about silver NOT being able to break much higher when it topped in 2021, and I’m warning about the same thing now. The invalidation is not hypothesis – it already happened. What’s likely to follow next are significant declines.

You have been warned.

Thank you for reading today's free analysis. If you'd like to get my analysis in its premium version, I encourage you to subscribe to my Gold Trading Alerts that feature all key trading details for the current opportunity. And if you're not yet on our free gold mailing list, I encourage you to sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.