AI Will Turn Everyone Into Gamblers! The Greatest Wealth Transfer In History is Coming.. Part 1/2

Stock-Markets / Financial Markets 2024 Aug 10, 2024 - 07:10 PM GMTBy: Nadeem_Walayat

Dear Reader

Have you managed to capitalise on the stock market correction as many patrons have in key target AI tech stocks?

Most recent analysis -

5th August 2024 - Panic in the Air As Stock Market Correction Delivers Deep Opps in AI Tech Stocks.

30th July 2024 - Dubai Deluge - AI Tech Stocks Q2 Earnings Correction Opportunities

This extensive analysis AI Will Turn Everyone Into Gamblers! The Greatest Wealth Transfer In History is Coming... was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

CONTENTS

Stock Market Inverted Seasonal Trend

China NEW STOCKS BULL MARKET!

Hyper Sensitive Markets as AI Disrupts Everything, Including Itself!

Learn How to Accumulate and Distribute

Beat FOMO and FUD with EGF Direction of Travel

MEDIFAST - Disrupted by Weight Loss Drugs

Counting Down to Nvidia Earnings

AI Stocks Portfolio Spreadsheet

RECESSION 2026?

Stocks Portfolio For A Recession of Sorts

AI Will Make Everyone Poor!

SPECULATING!

Part 2 will follow tommorrow -

The Future of Mankind - You are Being Sold a Lie!

Universal Basic Slave Income is Coming....

Fake Full Employment

Billionaire Nazis are in Charge!

How to Get Rich University

They Want Your House!

The Greatest Wealth Transfer IN History

UK House Prices

Bitcoin Preparing for Next Leg Higher

BTC Where Next?

Bull Market Tops

Stock Market Inverted Seasonal Trend

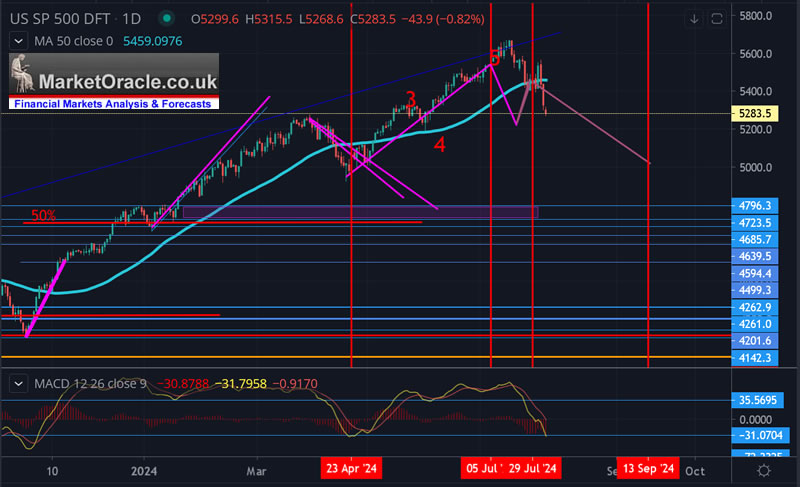

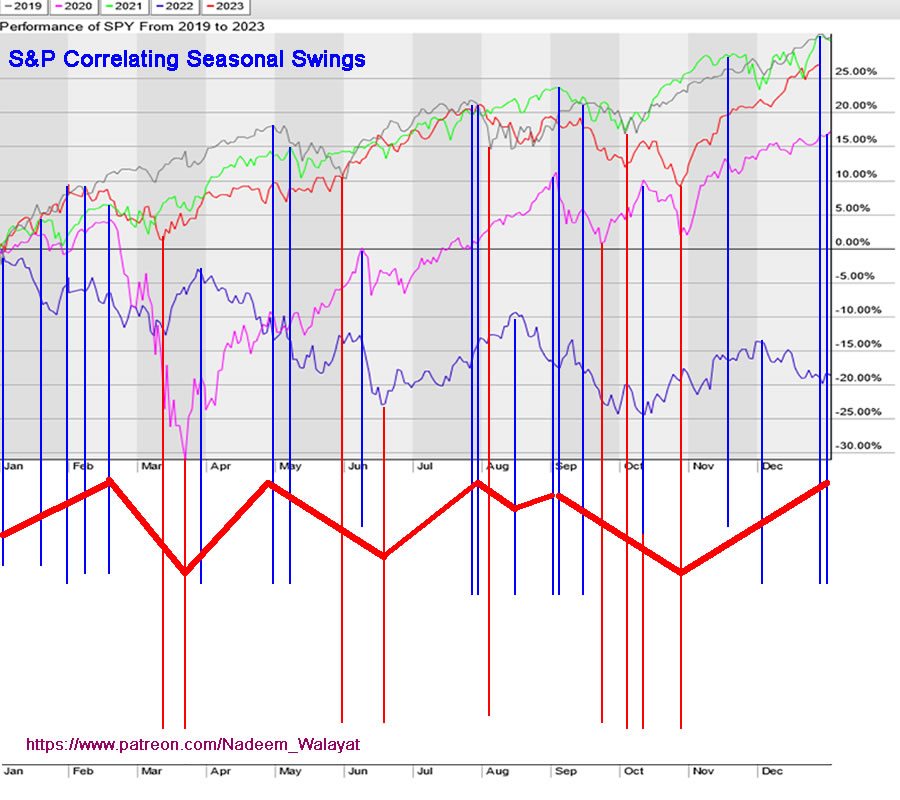

The correlated pattern across recent years resulted in the following pattern for 2024 i.e. a rally into early Feb, Down into Mid March, Rally into late April, Down into Mid June, Up into late July followed by a deep correction into late October before a strong post election relief rally.

The actual pattern to date has been up into end of March, down into Mid April which is correlates to being inverted vs the seasonal pattern of recent years, which thus suggests that the market bottomed during Mid April and should rally into Mid June, fall into early August, rally into Mid September before synchronising with the seasonal pattern by falling into late October and rallying into the end of the year. So unlike for End October to End March we could be in for a choppy overall bullish swings up and down in line with the current swing being UP into Mid June, before a correction into Mid August, followed by a 1 month rally into Mid Sept before reverting to the seasonal pattern, so an inverse of the expected pattern over the next few months.

A timely lesson that when target stocks drop don't make the mistake of faffing around by looking at what the S&P is doing or what one expects it to do instead always act on the basis of what ones target stocks are doing when seeking to accumulate.

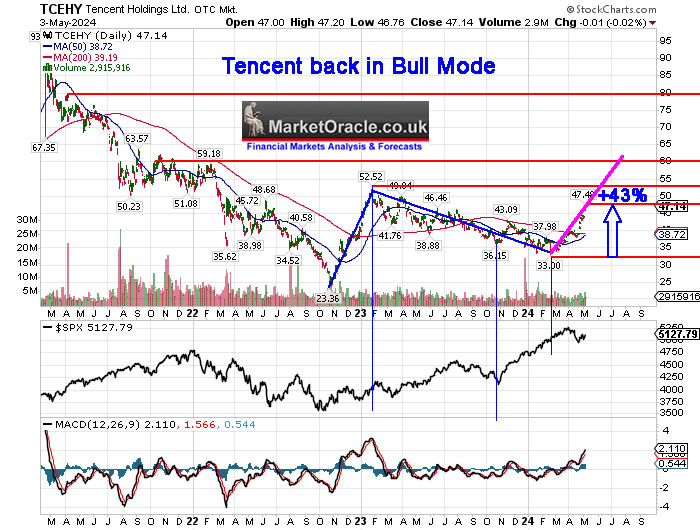

China NEW STOCKS BULL MARKET!

Chinese stocks capitulated early February as I wrote at the time

This is what investing in the stock market is like when stocks are cheap no one wants to buy because all one sees in the rear view mirror is BAD NEWS! The stocks just need to start growing their earnings and their multiples will expand sending the stock prices sharply higher.

Lets see where they are in a few months now, a year from now, I'd happen a guess that they will be trading a lot higher than where they are today.

(Charts courtesy of stockcharts.com)

The SSEC is now up 18% and on the verge of signaling a new bull market once it crosses the 20% threshold. The SSEC is targeting resistance at 3400 and 3700, so could add another 10% to 20% this year.

So it looks like the pain that investors have experienced holding onto their BABA's and Tencent's is finally ending! BABA is up 22%, Bidu 20%, whilst Tencent a whopping 43% off it's recent $33 low already extinguishing draw downs for most who accumulated over the past 3 years.

There is plenty of time for this bull market to run which is now in synch with US stocks for the first time since May 2023, with chinese stocks look set to out perform US stocks on the way up given the huge difference in valuations i.e. the SSEC trades on a PE of 13.5 vs the S&P on 24.5.

What will I be doing?

Scale out of chinese stocks at a profit as they climb higher where buying the dip has lifted my exposure to very high levels i.e. BABA 154% invested, Tencent 129%, Baidu 134%, which was necessary to drive down the average cost per share so as to allow one to trim at a profit on the way up.

Hyper Sensitive Markets as AI Disrupts Everything, Including Itself!

AI is disrupting all areas of the economy and society and in a feedback loop is also disrupting itself! So one can imagine it's not something to clearly identify, do a thesis upon and then lock away in ones bottom drawer as being done and dusted, i.e. invest and forget as the whole system is in a state of flux, volatile, and in large part unpredictable. By investing in key AI tech stocks one recognises that they are a. Acting to profit from the unfolding AI mega-trend and b. Capable of adapting to a system that is in a constant state of flux. Nevertheless no investment is a done deal, AI is not invest and forget, AI is resulting in a system that is an exponential state of flux, that results in a lot of too and fro where investing is concerned companies rise and fall and then rise again, which just like the crypto markets are CYCLICAL which will catch many investors off guard as most just want an easy ride, just hop on board the AI mega-trend gravy train to cash out in 5 or 10 years time, when during that time the stocks one is invested in could have risen to great heights before collapsing to a fraction of their highs, that is the nature of the AI beast.

Which is why I invest the way I invest which is to accumulate and distribute based on what individual stocks are doing, it's not like I one day woke up and decided that I am going to trim and rebuy stocks based on key valuation metrics, it's just that the market has forced me into doing this as means of seeking to maximise returns and minimise draw downs, which I imagine is what most investors will converge towards doing.

What the AI Mega-trend does is to speed things up, markets react much faster than in the past so a 3 month quarterly report is now too long as AMD illustrates that between quarterly results shot higher from $136 to $228 and then fell down to $140! That's right a stock rocketing higher by 50% and then dropped by near 50% all over the space of a few weeks. It's hard to get ones mind around, but as I often say if you want to really make money investing then you are going to have to work for it! Where my articles and spreadsheet do a lot of the heavy lifting. Whilst the alternative is to DCA into an S&P ETF and if you are luckily will only lose 10% of it's real terms value over the next 10 years.

The bottom line is that AI is very disruptive not only to other industries but also TO ITSELF! The only mechanism that works is to accumulate and distribute as one goes along. Some chase fantasies of trying to sell the tops and buy the bottoms which in my opinion is a fools errand because all it will do is foster the illusion that you have insight in picking tops and bottoms when in reality all it will be is that you every now and then got lucky and thus set yourself up for later disappointments. Instead one needs SIMPLE MECHANISMS for accumulation and distribution, the simpler the better so that it does not result in second guessing.

I use support and resistance levels that tend to be revised from time to time i.e. the buying ranges within which limit orders are placed that tend to get revised from time to time with little mental memory as there is no magic formulae behind them, another mechanism could be just use round numbers such as buy a falling stock at $140, $130, $120. Sell at $180, $190, $200. Instead people get hooked on trying to sell THE top or buy THE bottom which means they will likely give up all of their gains or fail to have gained any exposure to capitalise upon a trend as the likes of MSTR illustrates that first shot higher to 2000 and since halved in price to $1000. At the top folks wanted me to give them a reason not to sell i.e. that I should revise my MSTR valuation metric higher, so they did not have to make the difficult decision to sell. It's not to sell a stock at $2000 that could go to $3000, but the metrics were screaming over valuation at the time and thus it halved a few weeks later.

AI is disrupting everything, the markets have become hyper sensitive which warrants greater attention to ones portfolio in terms of accumulating and distributing than in the past where those who just DCA will be in for a very bumpy ride that will not be good mentally, as for instance if one had not trimmed AMD would now be sat looking back at $228 from $152. with the benefit of hindsight and wishing they had trimmed at $200, when for a little bit of effort they would have known that it was highly probable that $228 would soon give way to sub $150.

There is no easy money, you will have work for it. So watch my video on how to to accumulate and distribute.

We are lucky in one way as exposure to AI tech stocks and their price gyrations gives us a window into what is going on under the surface in that we have Nvidia the relentless AI machine that seeks to consume all! Every one has no choice but to use Nvidia products, AMD is a weak Nvidia competitor, and all of the other Semis to varying degree service Nvidia. Nvidia is at the top of the AI pyramid which is why it is imperative to gain and maintain exposure to Nvidia regardless of the risk of draw downs. All the other stocks are bets on capitalising on aspects of the AI mega-trend that will tend to be cyclical in price action, we see this in the latest earnings reports as most companies reported FAKE EARNINGS BEATS that if you listened to the likes of the CNBC cartoon network you would be completely blind sided to this fact! Which illustrates that AI has resulted in a hyper sensitive state where quarterly earnings just don't work anymore and hence have become a roulette wheel event to gamble on whether a stock will rocket higher or crash on earnings regardless of what is reported..

If Investors do not pay attention to valuations on an ongoing basis then they will pay the price when they see their gains quickly evaporate.

Learn How to Accumulate and Distribute (Trim) Stock Positions to Maximise Profits - Investing 101

For those who have yet to realise the power of accumulation and distribution then see my recent video that explains how to Trim and rebuy stocks as most investors obsess over trying to buy THE bottom or try and sell THE top and thus they either end up holding nothing or are weak hands eager to sell everything on every rally. Here I teach a simple mechanisms that stops one from obsessing over tops and bottoms but instead goes with the flow by trimming into rallies (banking profits) and accumulating on the dips with little thought on trying to buy the bottom or sell the top.

https://youtu.be/FpNFh_MHXYY

Beat FOMO and FUD with EGF Direction of Travel

A new column has been added to the spread sheet so as to illuminate a truer picture of what is going on under the hood of individual stock to make it easier to recognise the degree to which FOMO (Fear of Missing Out) or FUD (Fear Uncertainty and Doubt) is taking place in individual stocks. EGF's direction of travel counters the tendency to revise earning estimates lower ahead of earning reports so as to engineer a beat. For a strong bull the percent should be positive, negative implies expect stocks to find it tough to make new all time highs in advance of next earnings even if they report a fake beat.

So keep a close eye on individual stock metrics as was the case with AMD which clearly went nuts to $225, that's what FOMO looks like! Nowhere did the metrics state that $225 was justified hence I sold down to about 30% exposure, for instance AMD was trading at about 150% of it's PE range. The greatest danger to Investors is to get caught up in FOMO, do that and you need to be prepared to see as much as a 50% drop in the stock price! I.e. given the metrics, AMD dropping from $225 to $115 was seen as being doable, just that it will only become clear with the benefit of hindsight.

For instance AMD today POST earnings shows a direction of travel of -6%, which means it's going to find it tough to climb back to anywhere near $200 without a lot of FOMO buying because the fundamentals are getting weaker for AMD. In fact looking at the primaries there is only Google that has a positive direction of travel, and probably Nvidia when it reports will also be positive, the rest are weakening to various degrees.

MEDIFAST - Disrupted by Weight Loss Drugs

MEDIFAST the darling of the pandemic weight loss at home is an example of what happens when a company gets disrupted and as is the case with all disrupted companies it is not easy to recognise at the time it is taking place, however the warnings were there in the EGFS as earnings started to contract quarter on quarter and have remained on that trajectory for 18 months.

(Charts courtesy of stockcharts.com)

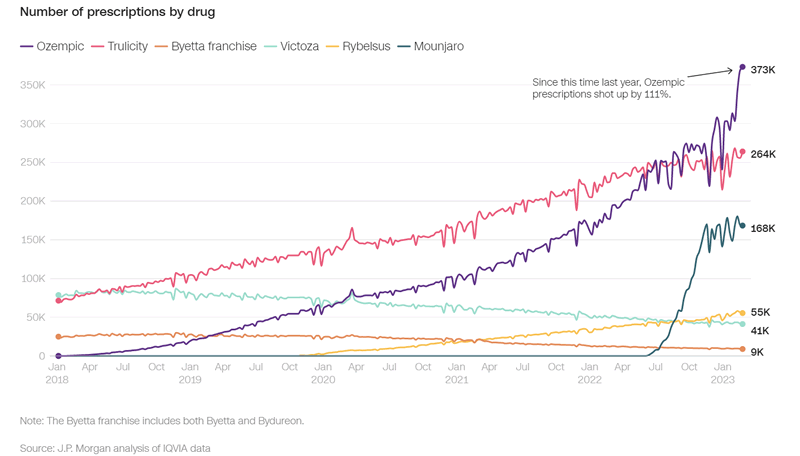

MEDIFAST presents a realistic example of a company that had potential following it's post pandemic over valuation price dump to accumulate into at what seemed like a fair valuation. However what disrupted Medifast was not AI, it was the weight loss drugs, Ozempic, Wegoy and Mounjaro that started exploding on the scene 2 years ago.

Clearly in hindsight these drugs actually do WORK! Which is contrary to literally decades of a myriad of magic weight loss pills that FAILED to deliver in any meaningful way, let alone the scam potions being sold to a desperate to lose weight public. so until these wonder weight loss appetite suppressant drugs started to explode in usage there were plenty of positive signs as earnings started to grow even after the vaccines were bringing the pandemic to an end right up until Mid last year when they started to collapse as illustrated by quarterly EPS.

Q1 2024 $0.66

Q4 2023 $1.09

Q3 2023 $2.12

Q2 2023 $2.77

Q1 2023 $3.67

Q4 2022 $3.70

Q3 2022 $3.32

Medifast is a lesson that even a good stock can get fatally disrupted and Investors pay the price of not acting to recognise the trend in motion. In terms of what's next for Medifast, it's still reporting earnings i.e. not making a loss so has the potential for some sort of recovery, it all depends on what's next for the weight loss drugs as I can't see people taking drugs for life as all drugs have side effects and tend to require higher and higher doses for the same results so can only be a temporary solution. So whilst there is no sign of recovery yet, it ain' t over until the Fat Lady sings!

Still it does act as a lesson that any stock can get disrupted and thus investors have to have mechanisms to reduce exposure inline with changes in valuations, metrics such as the EGF's that have been consistently strongly warning of contracting earnings i.e. -60%, -74%, it also illustrates that investors thinking they can win on every stock are deluding themselves, all one can do is a. spread the risk, b. not get carried away with over exposure and c. distribute when opps present themselves.

As for Medifast it's a case of waiting for earnings to hit bottom because when they do the multiples will expand as the market discounts higher EPS as there are stocks that have been in a lot worse fundamental state than Medifast that have bounced back hard such as WDC that continues to carry far worse EGF's then Medifast.

Bottom line Medifast was a good stock that got disrupted by new technology (weight loss drugs) which can happen to ANY STOCK! Just look at stock market history, GE, Kodak, Nokia, Blackberry..... So don't fall in love with any stock. The new metric "EGF Direction of Travel" acts as an additional signaler to take note of.

Counting Down to Nvidia Earnings

Nvidia earnings are on 22nd May in advance of has had a significant correction of 20% off its $974 high that did much to unwind it's overbought state. As I often voice Nvidia is not a normal stock, it is at the centre of the AI mega-trend thus I did not waste any time in accumulating during the dip given that I had long since sold out of the Nvidia I had accumulated sub $140 during 2022, hence left with just 1% that now stands at 7%, which is still not enough.

The metrics say it all EGF +64%, +97%, which translates into current PE of 69 dropping to something like 35 in just 8 days time! That shows you the nature of the Nvidia beast and why drops like 20% are a case of getting lucky.

Nvidia's buying range is $722 to $620. Yes I bought ahead of the buying range so as to build exposure with an eye on the buying range for larger buys. Nvidia at $899 is trading 8% below it's ATH in a weak uptrend as it marks time ahead of earnings, so there is scope to deliver that ABC corrective pattern that is lacking in the S&P, it's just that to see Nvidia below $810 let alone below $760 will be a case of getting lucky so my primary objective is to get to at least 10% invested, i.e. similar to Microsoft's 11%. So just place the buy limits and hope for volatility to deliver opportunities as took place during April.

Bottom line Nvidia is at the core of the AI Mega-trend that delivered a 20% deviation from the high and could see volatility into earnings that sees the stock dip below $800 for the second time. Of course there is always the possibility for an earnings miss plunge but I am not seeing it in the strong EGF's. More likely is a spike to new all time high, probably well north of $1000. This AI gravy train only tends to stop at the platforms for a few seconds before taking off again!

AI Stocks Portfolio Spreadsheet

As mentioned above a new column has been added "EGF Direction of Travel" aimed towards countering the fake earnings beats that MSM obsesses over.

AI stocks portfolio - https://docs.google.com/spreadsheets/d/1h9WcWdB4jw2yYlOEinoigRGtO-Z8MIkMo87Iyn4qHyY/edit?usp=sharing

Stocks that stand out in terms of opportunities to accumulate are Google, Nvidia, AMD, and Tesla.

Of the Seecondaries only ASML and Amazon stand out

Medium Risk - GPN stands out, and maybe Flex and Autodesk.

Higher risk - roblox gave a brief opp down to $26, currently at $31, Unity if one understands the risks and MGNI, Docusign look interesting to accumulate into.

Also I sold virtually all of the range trader BPMC as per strategy as of August 2023.

Let me know in the comments below the article if there is something that you would really like to see included in the spreadsheet i.e. a metric column and I will see if I can incorporate it.

RECESSION 2026?

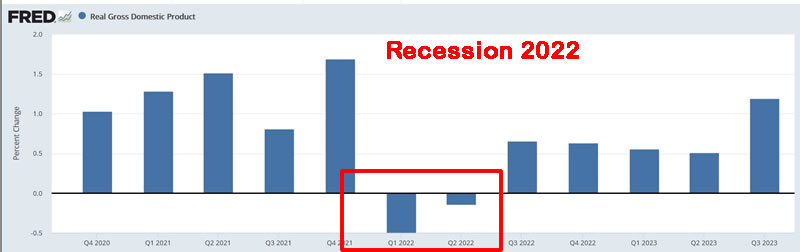

A reminder that the recession everyone's waiting for already happened in 2022, just that the econofools chose to ignore it, 2 quarters of negative GDP in 2022 Q1 and Q2 , what can you do? This is the world we inhabit of fake economic data, the Fed does not like CPI, so lets run with the much lower PCE instead. What a con!

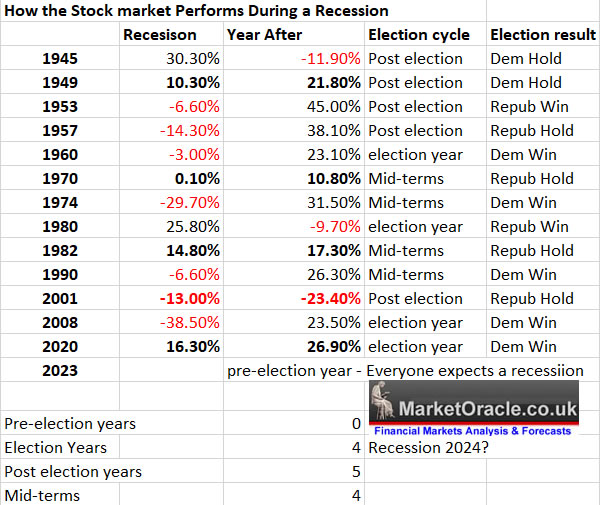

US Presidential Election Cycle and Recessions

This analysis posted in January 2023 that despite MSM hysteria strongly suggested that there would be NO recession during 2023, as there had never been a recession during a pre-election year. Whilst the highest risk is that the recession materialises during 2025.

However as my above analysis states the recession already happened during 2022 (mid-terms)! It's madness that the econofools are ignoring that which is staring them in the face! Both the recession AND the bear market already happened! Which lowered the probability for a recession during 2024 and 2025 and in fact given the cyclical nature then the most probable year for the next US recession could be for Q1 and Q2 of 2026 i.e. 4 years on from the last recession, where the big question mark is will the econofools once more choose to ignore it just as they did last time?

Anyway take this as cue for the stock market to remain on track for a strong 2024 and likely 2025 into at least April, by which time we will have an additional years data to see what the economic outlook will be like going into 2026.

Stocks Portfolio For A Recession of Sorts

The key requirement for going into a recession is to have enough powder dry to be able to capitalise upon any deep draw downs that it may deliver. For 2022 I went to an extreme length by firstly selling down my portfolio during 2021 to 40% invested and then plowing a huge amount of fresh cash into stocks during 2022 that near doubled the size of the portfolio to effectively equate to being 75% in cash coming into 2022 if all that cash had been added at the start of 2022.

However there are unintended of consequences of being too much in cash and the primary one is that it makes one more prone to taking higher risks and thus it was during this period that the medium risk and high risk portfolios were born, whereas had I been say 70% invested then I would have had no call to go on the hunt for opportunities beyond what I was focused on accumulating.

Next time will be different to both March 2020 when I sold nothing going into the COVID CRASH and to 2022 when i sold too much. The strategy next time is to be under 100% invested in as many stocks as possible where if one looks at my AI stocks and Secondaries without conscious effort in terms of preparing for a recession, the portfolio has self regulated itself by means of reacting to over valuations.

So basically where AI stocks are concerned it's a case of continue as is regardless of whether a recession happens or not.

The area to address will be Medium and High risk that account for about 25% of my portfolio where I am over extended in many stocks due to failure of bull runs to materialise to date in most stocks, so I will be selling down positions in these stocks over the next 12 months..

However a positive is CRYPTOS! Where 10% of my portfolio resides on an rough cost basis of about 3.5%, and which could increase by another 5% to 10% during a bull run to BTC $100k+ thus most of that 10% and whatever else transpires in terms of gains will be added to existing 20% cash and thus without planning for a recession, I will be positioned to capitalise on recession draw downs by being at least 30% in cash.

As whilst an eventual recession is inevitable it is not a done deal that it will result in deep draw downs as occurred in 2022, not in all target stocks anyway, i.e. it may not even be noticeable in terms of the AI tech giants, as timing wise 2022 was THE BEAR MARKET, so whatever we see from Mid 2025 into 2026 I doubt will be anywhere near on the same scale as 2022, probably amount to nothing more than a 10%-20% trading range holding pattern for the likes of the S&P before the next ramp higher in response to rampant money printing, , a crackup boom all the way to a MANIA TOP that coincides with my big picture of 2027 which a weak early 2026 recession time line fits in with.

What we saw with the AI tech giants MANIA FOMO in 2024 in the likes of AMD is a taste of what's to come during the final FOMO mania. Where the only way to protect oneself from potential blood baths is to distribute into overt valuations and not worry too much about missing the TOPS as AMD illustrates, even now at $152 AMD is expensive let along when it was hitting $228!

You can see which tech stocks are expensive when one takes the EGFS, PE's and the PE ranges into account for each stock i.e. AMAT looks very pricey thus I am only 19% invested of target.

In the Primaries META stands out as being pricey, hence despite buying the dip I am still only 35% invested of target, but it has good EGF's and the PE in relative terms to other primaries is not that bad.

AI Will Make Everyone Poor!

If the masses are not working and earning because they have been made obsolete by AI agents and robots then how is the consumer economy going to function without consumers?

Yes a Universal Basic Income is coming but paying everyone the same basic amount to survive is not the same as today's western economies where wealthy consumers drive the economies without which everyone will become poor as those who own the AI and robots end up owning EVERYTHING! Much as we see across the third world and used to be the case in Victorian times, when the masses owned little or nothing, that is the future that AI will deliver for mankind, not so much slavery but subsistence, marginalised existence, watching the elite go about their business, living in squalid shanty towns much as we see across the Developing world where the rich own everything and the masses own little or nothing.

The Universal Basic Income won't be the solution to the AI crisis for mankind, unless mechanisms are enacted that transfer wealth from those who own the AI to the masses such as via a AI tax, Robot tax, accompanied by the elimination of taxes on human labour and economic activity which will enable the masses to earn enough income and accumulate enough wealth to be able to consume and invest else most of humanity is doomed to live in shanty towns donning VR headsets to pass the time as portrayed by the movie Ready Player One.

AI and Robots have to be taxed to the point that the wealth they concentrate into the hands of the few flows to the general human population else the rich will end up owning everything. It is inevitable, as without a level of income that allows one to accumulate wealth then all most humans will become are basic income consumers where everything they spend ends up in the bank accounts of the elite that prompts governments to print more money to give to the masses to spend on the basic necessities driving consumer and asset prices higher and given that the elite own everything they will just keep getting richer and rich and the masses poorer and poorer as they own no assets that can take advantage of the inflation.

However there is one way out and that is what we are doing right now!

SPECULATING!

Where most adults instead of working are instead speculating on the financial markets, crypto's, spread betting markets, or just out right gambling on anything. What we will call work in the future could resemble a planet of degenerate gamblers where Universities churn out students trained not to be doctors or lawyers but Investors, Traders and Gamblers!

That's one solution that allows the masses a chance to accumulate wealth whilst also scope for the wealth to transfer from the Rich to the masses via losses. At this point this looks like the primary solution as I doubt AI can gain any investing or trading or gambling advantage over humans other than acting at speed in response to events, but that already happens today and all one needs to do is to place limits to buy and sell around volatile events to catch the spikes. This and maybe similar structures such as Gaming and other human only markets yet to be invented, so as work diminishes there will be new markets for humans given that the elite who own the AI will still be largely human so seek interactions with the human population including transfer of wealth for at least entertainment purposes. And who knows sentient AI could too become high stakes gamblers to try and escape their ordered existence into something more chaotic.

It remains to be seen if these sort of activities will be enough to offset the collapse in the general populations ability to earn to the extent that the transfer of wealth to the Elite can be reversed. I doubt that it will amount to more than fraction of what's needed, still it is one mechanism that will allow anyone to get rich.

So whilst individually we are doing what we are doing in accumulating wealth ahead of the time when income streams dry up courtesy of AI (it's already happening), the society that it looks set to deliver is not going to be a fairy tale of leisure and plenty, instead will be a dystopian nightmare for most, thus it is up to society to bring about a state where those who own the AI and robots are forced to cycle the wealth they are concentrating back to the masses by shifting the tax burden from humans to the corporations and entities that own and operate the AI and robots, else over time the rich will use the wealth that flows into their coffers to buy every asset including the home you live in, which is already happening as econofools wonder how can house prices keep going higher when they are clearly unaffordable to most, it's because the money is flowing to the rich who then use this excess flow to buy assets such as housing. It's been happening in the West since the Financial Crisis and accelerated by the pandemic and well AI will be final nail in the coffin for ordinary people having any means of being able to accumulate wealth other than through inheritance, as more and more wealth will become concentrated in hands of the Rich. And don't think corrupt politicians who are bought and paid for by the rich are going to do anything, it may take a bloody revolution to bring about the necessary change. I mean Richi Sunak is a part of the billionaire Elite in receipt of upwards of £30 million a year in unearned income which is wealth being funneled from the masses into his back pocket. And Labour multi millionaire MP's are not any different, and it's a lot worse than that in the US Where the Billionaires and the Lobby's they finance determine what the US Government does.

There is going to have to be some sort of revolution else the masses will become dispossessed of their wealth and power to resemble serfs of centuries ago in the service of the elites.

There may come a time when true socialism may be the only solution, that the state owns the means of production, the AI and robots on the behalf of the people as the better of two evils, either the state owns everything or the rich owns everything, it's a trend that is already in motion, house prices going up that more and more people are unable to afford to buy so forced to rent for life due to the rich buying all of the assets with money that they are in receipt of as a consequences of owning the means of production, the factories and farms.

Part 2 will follow tommorrow -

The Future of Mankind - You are Being Sold a Lie!

Universal Basic Slave Income is Coming....

Fake Full Employment

Billionaire Nazis are in Charge!

How to Get Rich University

They Want Your House!

The Greatest Wealth Transfer IN History

UK House Prices

Bitcoin Preparing for Next Leg Higher

BTC Where Next?

Bull Market Tops

This extensive analysis AI Will Turn Everyone Into Gamblers! The Greatest Wealth Transfer In History is Coming... was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

And gain access to my most recent analysis -

5th August 2024 - Panic in the Air As Stock Market Correction Delivers Deep Opps in AI Tech Stocks.

30th July 2024 - Dubai Deluge - AI Tech Stocks Q2 Earnings Correction Opportunities

Also access to my comprehensive 3 part How to Get Rich series -

Change the Way You THINK! How to Really Get RICH Guide

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

Here's what you get access to for just $7 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate access to all my analysis and trend forecasts do consider becoming a Patron by supporting my work for just $7 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it next rises to $10 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your AI tech stocks buying the dips analyst.

By Nadeem Walayat

Copyright © 2005-2024 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.