Category: Energy Resources

The analysis published under this category are as follows.Friday, September 11, 2009

Energy Sector Investing, Get—and Stay—Ahead of the Herd / Commodities / Energy Resources

By: The_Gold_Report

Back for another enlightening interview with The Energy Report, Marin Katusa, Chief Investment Strategist for Casey Research's Energy Division, shares some timely investing strategies for the ever-changing energy markets. Ultra-bullish on uranium, Marin foresees a great shakeout in the sector. "The key is being with just the right select players," he says. The seasoned strategist also covers oil, natural gas, coalbed methane (CBM) and geothermal, emphatically encouraging investors to get—and stay—ahead of the herd.

Back for another enlightening interview with The Energy Report, Marin Katusa, Chief Investment Strategist for Casey Research's Energy Division, shares some timely investing strategies for the ever-changing energy markets. Ultra-bullish on uranium, Marin foresees a great shakeout in the sector. "The key is being with just the right select players," he says. The seasoned strategist also covers oil, natural gas, coalbed methane (CBM) and geothermal, emphatically encouraging investors to get—and stay—ahead of the herd.

Friday, September 04, 2009

Looks for Natural Gas to Heat Up, Crude Oil to Climb Back Towards $100 / Commodities / Energy Resources

By: The_Gold_Report

Just back in his Wall Street digs from Spanish site visits to check out some "just absolutely mind-boggling" solar and wind projects, Blue Phoenix Chief Investment Strategist John Licata sat down for another exclusive interview with The Energy Report. Well regarded for his insights and forecasts across the commodity spectrum, John talks about some excellent investment opportunities in both natural gas and oil. And while acknowledging that he's probably in "a dark room alone on this one," he also sees reason to be bullish about the refining space.

Just back in his Wall Street digs from Spanish site visits to check out some "just absolutely mind-boggling" solar and wind projects, Blue Phoenix Chief Investment Strategist John Licata sat down for another exclusive interview with The Energy Report. Well regarded for his insights and forecasts across the commodity spectrum, John talks about some excellent investment opportunities in both natural gas and oil. And while acknowledging that he's probably in "a dark room alone on this one," he also sees reason to be bullish about the refining space.

Friday, September 04, 2009

Brazil Reactions to a Proposed Energy Law / Commodities / Energy Resources

By: STRATFOR

Brazilian President Luiz Inacio Lula da Silva submitted a proposal for a new oil law to the country's legislature. The proposal favors state-run energy company Petroleo Brasileiro SA (Petrobras) and shows that Brazil intends to protect its national interests when it comes to deepwater oil exploration and development.

Read full article... Read full article...

Monday, August 31, 2009

Why NRG Energy Inc is the Energy Sector's "Triple-Threat" Profit Play / Companies / Energy Resources

By: Money_Morning

Horacio Marquez writes: If NRG Energy Inc. (NYSE: NRG) were an athletic prospect, scouts would rate it as a triple threat. That's because the Princeton-based wholesale power generator is involved in all three of the key energy sources of the future: Solar, wind and nuclear.

Horacio Marquez writes: If NRG Energy Inc. (NYSE: NRG) were an athletic prospect, scouts would rate it as a triple threat. That's because the Princeton-based wholesale power generator is involved in all three of the key energy sources of the future: Solar, wind and nuclear.

Thursday, August 27, 2009

Investing for the New Long Term Energy Bull Market / Commodities / Energy Resources

By: The_Gold_Report

Encompass Fund managers Malcolm Gissen and Marshall Berol sat down with The Energy Report to share their views on energy investing and what they believe are the strongest subsectors in the mix. While bullish on coal and natural gas, both are strong advocates of uranium, citing a "definite supply-demand imbalance." Discover new opportunities for long-term appreciation in this exclusive interview.

Encompass Fund managers Malcolm Gissen and Marshall Berol sat down with The Energy Report to share their views on energy investing and what they believe are the strongest subsectors in the mix. While bullish on coal and natural gas, both are strong advocates of uranium, citing a "definite supply-demand imbalance." Discover new opportunities for long-term appreciation in this exclusive interview.

Thursday, August 20, 2009

The Most Important Aspect that most Economists and Analysts Fail to Recognize / Commodities / Energy Resources

By: Steve_St_Angelo

EROI…Energy Returned on Energy Invested

EROI…Energy Returned on Energy Invested

The biggest problem that most economists and analysts fail to comprehend when making forecasts and predictions on the US Dollar, Precious Metals, Financials or the whole Economy in general, is the ability to get to the Root of the Problem. Most of them are using information and methodologies that are either outdated, superficial or completely worthless. Those economists who are either Keynesians or Monetarists are living in a economic model that will have a life expectancy of less than a century. Indeed, a blip in the history of mankind and increasingly worthless going forward into the 21st century.

Read full article... Read full article...

Thursday, August 13, 2009

Energy Firms See Positive Long Term Trends / Commodities / Energy Resources

By: Joseph_Dancy

While companies in the energy sector have not been on our quantitative screens for some time we remain over-weighted in the sector due to extremely attractive long term trends. Reserves in the ground in politically secure areas should substantially increase in value over the next few years. Developments last month include the following:

While companies in the energy sector have not been on our quantitative screens for some time we remain over-weighted in the sector due to extremely attractive long term trends. Reserves in the ground in politically secure areas should substantially increase in value over the next few years. Developments last month include the following:

Friday, July 24, 2009

American Clean Energy Act Is Not Going Anywhere / Politics / Energy Resources

By: Ronald_R_Cooke

If you have read my book “Detensive Nation”, you know I am concerned about the damage we humans are doing to our environment. Our intensive consumption of energy, arable land, fresh water, and minerals is not sustainable. That means we humans will be forced to adopt a detensive Cultural EcoSystem. In order to ease the pain of this transition, we need a positive, proactive, and intellectually honest political system.

If you have read my book “Detensive Nation”, you know I am concerned about the damage we humans are doing to our environment. Our intensive consumption of energy, arable land, fresh water, and minerals is not sustainable. That means we humans will be forced to adopt a detensive Cultural EcoSystem. In order to ease the pain of this transition, we need a positive, proactive, and intellectually honest political system.Read full article... Read full article...

Wednesday, July 22, 2009

China Tightens Grip on Africa's Energy Resources with Stake in Offshore Field / Commodities / Energy Resources

By: Money_Morning

Jason Simpkins writes:CNOOC Ltd. (NYSE ADR: CEO) and Sinopec Corp. (NYSE ADR: SHI) have agreed to buy a 20% stake in an oil field off the shore of Angola for $1.3 billion, illustrating China's persistent attempts to acquire resources for its economic expansion at a time of weakness for many Western oil majors.

Jason Simpkins writes:CNOOC Ltd. (NYSE ADR: CEO) and Sinopec Corp. (NYSE ADR: SHI) have agreed to buy a 20% stake in an oil field off the shore of Angola for $1.3 billion, illustrating China's persistent attempts to acquire resources for its economic expansion at a time of weakness for many Western oil majors.

Friday, July 17, 2009

US Strategy of Total Energy Control over the European Union and Eurasia / Politics / Energy Resources

By: F_William_Engdahl

One of his first foreign visits as new President took Barack Obama to Ankara for a high-profile meeting with Prime Minister Recep Erdogan and other leading Turkish officials. Obama engaged in classical “horse trading” wheeling and dealing. “I give you support for Turkey’s EU membership; you open the diplomatic door to Armenia,” appears to have been the core of the deal. What other inducements the US President gave in the case of Turkish influence within NATO and such is secondary. Obama’s goal was to break a political deadlock in Turkey to construction of a major gas pipeline to Germany and other EU countries in direct opposition to Russian Gazprom’s South Stream pipeline.

One of his first foreign visits as new President took Barack Obama to Ankara for a high-profile meeting with Prime Minister Recep Erdogan and other leading Turkish officials. Obama engaged in classical “horse trading” wheeling and dealing. “I give you support for Turkey’s EU membership; you open the diplomatic door to Armenia,” appears to have been the core of the deal. What other inducements the US President gave in the case of Turkish influence within NATO and such is secondary. Obama’s goal was to break a political deadlock in Turkey to construction of a major gas pipeline to Germany and other EU countries in direct opposition to Russian Gazprom’s South Stream pipeline.

Thursday, May 14, 2009

Challenges and Implications for Energy Sector Investing / Commodities / Energy Resources

By: Joseph_Dancy

The U.S. Department of Defense published a report late last year that provides a global perspective on future trends and the implications for future joint force commanders, leaders, and professionals involved in national security issues. The report, entitled “The Joint Operating Environment: Challenges and Implications” focuses on long term global trends.

The U.S. Department of Defense published a report late last year that provides a global perspective on future trends and the implications for future joint force commanders, leaders, and professionals involved in national security issues. The report, entitled “The Joint Operating Environment: Challenges and Implications” focuses on long term global trends.

Monday, April 06, 2009

The Most Powerful Indicator for Trading the Energy Sector / Commodities / Energy Resources

By: Chris_Vermeulen

The energy sector has been moving sideways since October if, you look at the XLE energy ETF below. Although the energy sector dipped lower in March the bullish percent index is showing some signs of strength. A lot of stocks continued to drift lower in March due to the lack of buyers and not because of heavy selling. This pulled the sector lower until buyers stepped in and pushed things higher again.

The energy sector has been moving sideways since October if, you look at the XLE energy ETF below. Although the energy sector dipped lower in March the bullish percent index is showing some signs of strength. A lot of stocks continued to drift lower in March due to the lack of buyers and not because of heavy selling. This pulled the sector lower until buyers stepped in and pushed things higher again. Read full article... Read full article...

Friday, April 03, 2009

Instability & Depletion Add Uncertainty to Energy Sector / Commodities / Energy Resources

By: Joseph_Dancy

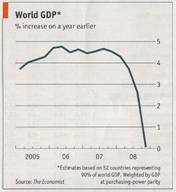

Energy use correlates closely with economic growth. Last month the World Bank forecast the global economy will likely shrink for the first time since World War II. International trade will decline by the most in 80 years according to the report, a stark trend in an economy that has been ‘globalized' over the last several decades.

Energy use correlates closely with economic growth. Last month the World Bank forecast the global economy will likely shrink for the first time since World War II. International trade will decline by the most in 80 years according to the report, a stark trend in an economy that has been ‘globalized' over the last several decades.

Both the IMF and World Bank forecast developing nations will bear the brunt of the economic contraction as they face huge shortfalls to pay for imports and to service debts. “This crisis is the first truly universal one in the history of humanity,” a former IMF Managing Director.

Read full article... Read full article...

Sunday, November 23, 2008

Energy Sector Investment Opportunities / Companies / Energy Resources

By: Investment_U

David Fessler writes: This week, we're continuing our investigation of Obama's “New Energy for America” plan. This comprehensive document details the President-elect's roadmap for energy independence. [You can read the plan in its entirety here .]

David Fessler writes: This week, we're continuing our investigation of Obama's “New Energy for America” plan. This comprehensive document details the President-elect's roadmap for energy independence. [You can read the plan in its entirety here .]

Under the Obama administration, I expect there to be many profitable energy investment opportunities under what will likely be a very “green-friendly” four- or possibly eight-year timeframe. Many of the opportunities will arise from his focus on energy independence and corresponding energy infrastructure.

Read full article... Read full article...

Saturday, November 15, 2008

Hydrogen Energy, IEA-2008 World Energy, Climate Change and Fossil Fuel Depletion / Commodities / Energy Resources

By: Submissions

Research by Manfred Zysk, M.E., Updated November 14, 2008

Research by Manfred Zysk, M.E., Updated November 14, 2008

1. HYDROGEN ENERGY REGENERATION - Hydrogen Energy and Hydrogen Regeneration processes are the only available global energy sources in adequate quantities and volume to replace diminishing oil and fossil fuel. Hydrogen obtained from the oceans, combined with hydrogen regeneration processes can provide adequate energy supply for most global energy needs for many centuries, and for a very promising future for the entire human race. Presently, wars are being fought over natural resources and over oil/fossil fuel.

Read full article... Read full article...

Friday, October 17, 2008

Winter Heating Costs: What Can Consumers Expect? / Commodities / Energy Resources

By: Mike_Shedlock

We looked at food prices earlier today in Where Are Food Prices Headed?

We looked at food prices earlier today in Where Are Food Prices Headed? With Winter right around the corner, there is likely to be some concern about heating bills. With that in mind, let's take a look at commodity prices to see what may be in store for the average consumer.

Read full article... Read full article...

Friday, September 05, 2008

Three Top Asian Energy Companies / Companies / Energy Resources

By: Money_and_Markets

Larry Edelson writes: I'm writing this while on a short holiday in Macau, Asia's booming Las Vegas. And let me tell you (again) — judging by what I'm seeing in Macau, there are very few signs of a slowdown in Asia!

Larry Edelson writes: I'm writing this while on a short holiday in Macau, Asia's booming Las Vegas. And let me tell you (again) — judging by what I'm seeing in Macau, there are very few signs of a slowdown in Asia!

More than 1.5 million international visitors arrived in Macau in the first six months of 2008 — UP 47% over the same period last year.

Read full article... Read full article...

Monday, August 18, 2008

Global Energy Sector Investing / Commodities / Energy Resources

By: Money_Morning

William Patalon III writes: Although consumers and businesses have gotten a bit of a reprieve at the gas pump as of late, the escalation in oil prices we've seen over the past year has led to some major changes in overall consumer behavior. Many car-owners have dumped their gas-guzzling pickup trucks and SUVs at the nearest used-car lot and used the proceeds to buy some gas-sipping rides. Companies with large distribution networks have redesigned their shipping schedules, crafting more efficient routes that accommodated larger truckloads.

William Patalon III writes: Although consumers and businesses have gotten a bit of a reprieve at the gas pump as of late, the escalation in oil prices we've seen over the past year has led to some major changes in overall consumer behavior. Many car-owners have dumped their gas-guzzling pickup trucks and SUVs at the nearest used-car lot and used the proceeds to buy some gas-sipping rides. Companies with large distribution networks have redesigned their shipping schedules, crafting more efficient routes that accommodated larger truckloads. Read full article... Read full article...

Thursday, July 24, 2008

Energy Resources Bull Market Remains Intact / Commodities / Energy Resources

By: Joseph_Dancy

Flooding last month interrupted rail traffic in the Midwest , disrupting ethanol production and shipments. Shipments of low-sulfur Power River Basin coal needed for many power plants has also been impacted. Coal inventories are already lean at many generating plants. Barge traffic has come to a standstill in many areas on the Mississippi River .

Flooding last month interrupted rail traffic in the Midwest , disrupting ethanol production and shipments. Shipments of low-sulfur Power River Basin coal needed for many power plants has also been impacted. Coal inventories are already lean at many generating plants. Barge traffic has come to a standstill in many areas on the Mississippi River .

The impact of the floods on the global agricultural and energy markets in our opinion will be much larger than expected. We think the extent of these impacts will become evident quite soon, and will be reflected in the markets.

Read full article... Read full article...

Tuesday, June 24, 2008

Energy Use Per Unit of GDP by Country / Commodities / Energy Resources

By: Richard_Shaw

Countries that require less energy per unit of GDP may fare better during a period of high energy prices.

Countries that require less energy per unit of GDP may fare better during a period of high energy prices.

This table shows the Kg of oil equivalent consumed per unit of GDP on a purchasing power parity basis for 32 countries, as reported by the United Nations.

Read full article... Read full article...