Winter Heating Costs: What Can Consumers Expect?

Commodities / Energy Resources Oct 17, 2008 - 04:21 PM GMTBy: Mike_Shedlock

We looked at food prices earlier today in Where Are Food Prices Headed?

We looked at food prices earlier today in Where Are Food Prices Headed?

With Winter right around the corner, there is likely to be some concern about heating bills. With that in mind, let's take a look at commodity prices to see what may be in store for the average consumer.

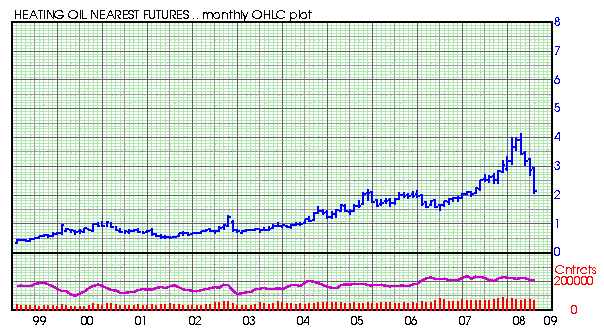

Front Month Heating Oil Monthly Chart

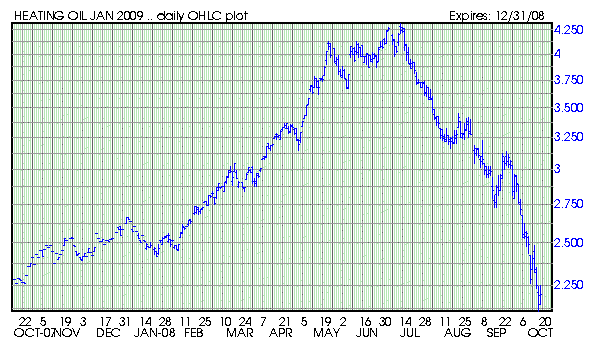

January Heating Oil Future

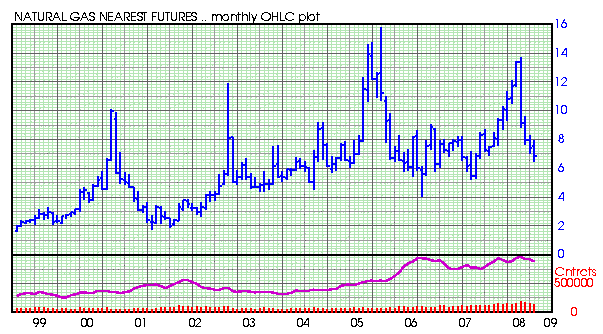

Front Month Natural Gas Monthly Chart

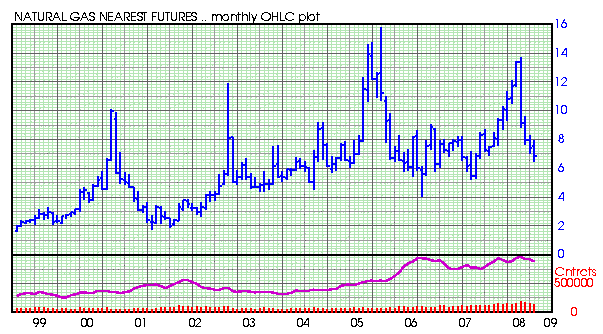

January Natural Gas

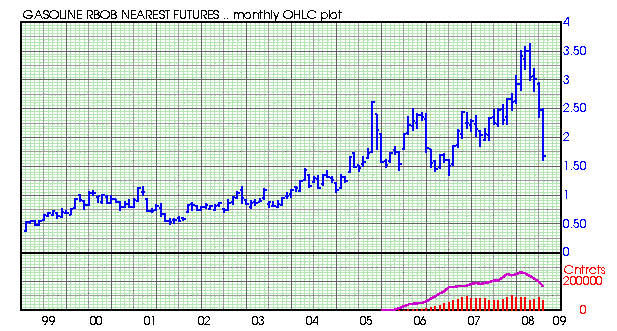

Front Month Gasoline Chart

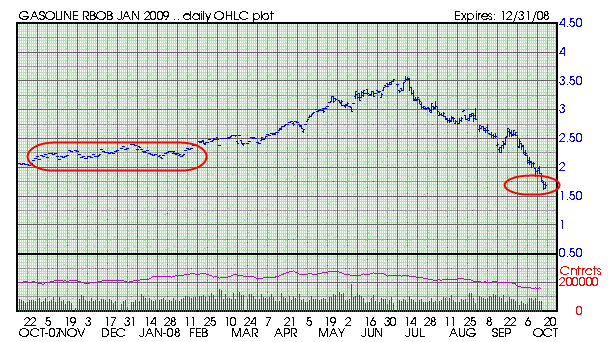

January Gasoline Chart

Charts courtesy of Barchart .

I picked January to plot as that is typically the coldest month. The monthly charts are continuous charts heading back to 1999 for comparative purposes.

What was shaping up to be a veritable disaster last summer now appears quite differently. From here on out, simple supply demand fundamentals (primarily weather conditions) will shape what is in store for heating oil and natural gas prices.

Note the dramatic change from mid-summer. Those mid-summer futures prices for January contracts simply were not based on fundamentals but rather speculation, in my opinion.

Depending on weather conditions and supply disruptions, and assuming you did not lock in prices out of fear earlier this year, heating oil and natural gas bills, as well as the cost to fill up your car may be lower than they were last year. That is good news for cash strapped consumers.

Gasoline Prices Plunge Most On Record

Cars.Com is reporting Gasoline Takes Biggest Weekly Dive Ever .

Turns out, 33 cents in one week is the biggest price drop in the history of anyone paying attention to the national average price of a gallon of gas. Currently, the national average price is $3.12, according to AAA. With the price of oil below $80 a barrel, this price could come down even more over the next few weeks, bringing $3 gas back into sight.

Even at $3.12, though, gas prices are probably the one part of the economy people don't need to sweat right now. However, car-buying trends still point to a decline in large SUV sales and an uptick in sales of efficient vehicles.

The Baltimore Sun is reporting Average price of gas in area drops below $3 per gallon .

What many Baltimore-area drivers have been experiencing this week is now official: The average price of gasoline is under $3.

AAA Mid-Atlantic today reported that the average price of regular gas in the Baltimore region dropped to $2.97 from $3.02 Thursday. The statewide average, propped up by higher prices in the Washington suburbs, remains barely above the 3-buck line at $3.01. If current trends continue, that average would slip below $3 this weekend.

The average price of gasoline in Baltimore reached a peak of $4.03 on June 19. But falling crude oil prices have brought a dramatic decline in the price at the pump over the last few months.

The region's prices remain above their levels of a year ago, when they stood at $2.66.

Year over year energy comparisons are now very favorable. If prices head lower or even simply stabilize, winter energy costs and gasoline prices will be lower than last year. Also note that year over year comparisons in the CPI look easy to beat in the months ahead. I expect to see the CPI sporting negative numbers (price deflation) in the months ahead.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.