Energy Firms See Positive Long Term Trends

Commodities / Energy Resources Aug 13, 2009 - 05:57 PM GMTBy: Joseph_Dancy

While companies in the energy sector have not been on our quantitative screens for some time we remain over-weighted in the sector due to extremely attractive long term trends. Reserves in the ground in politically secure areas should substantially increase in value over the next few years. Developments last month include the following:

While companies in the energy sector have not been on our quantitative screens for some time we remain over-weighted in the sector due to extremely attractive long term trends. Reserves in the ground in politically secure areas should substantially increase in value over the next few years. Developments last month include the following:

- Pemex - Note that in June Mexican oil output fell below 2.6 million barrels per day for the first time since 1990. The decline of the massive Cantarell field has been stunning, surprising analysts as well as state oil monopoly Pemex – the operator of the field. Cantarell was the second most productive crude oil field less than a decade ago. Mexican output has fallen for 35 consecutive months, and Mexican exports of crude were down 12.7 percent from year earlier levels.

Pemex is likely to miss its’ 2009 output goal even after lowering its production forecast. It needs to raise output by at least 1.6 percent in the final six months of 2009 to reach a goal of 2.65 million barrels a day. Cantarell field production dropped more than twice as fast as government predictions, and additional monies will have to be allocated to slow or reverse production declines.

- Groppe - While some analysts are claiming crude oil will fall to $20 a barrel due to excess inventories, note that experts like Henry Groppe, 83, do not agree. He has been tracking the world of oil and gas production, consumption and pricing for more than half a century. The accuracy of global production and demand data is notorious unreliable he claims, in part due to the secrecy of governments and industry participants.

Mr. Groppe and his associates have spent years laboriously developing their own data to paint a reliable picture of oil flows. Relying heavily on oil import figures (which are more accurate than exports, because governments collect taxes on them), among other sources, they know who is shipping what to where and in what quantities.

Groppe’s findings: Actual imports have been as much as 1.25 million to two million barrels a day less than what has been claimed to have been exported in official statistics. Ignoring volatile weekly inventory numbers and dismissing claims of oil-filled tankers sitting idle in the Caribbean as largely fanciful, he has concluded that much of what has transpired in the past two and-a-half years “can be traced to specific changes to the supply-demand balance.”

Groppe postulates that much of the recent strength in the crude oil market is due to reduced exports from Saudi Arabia. He concludes “I would expect oil to approach $100 later this year and correct back to $50 or $60 the middle part of next year. And then do it again.”

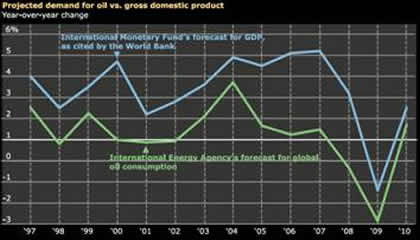

International Energy Agency - The International Energy Agency raised its forecasts for global oil demand this year and next, citing stronger energy appetite in Asian economies, particularly China. The new prediction of 85.3 million barrels a day for 2010 is a 1.6 per cent increase over this year. In its closely-watched monthly survey, the IEA also increased its 2009 forecast by 190,000 barrels a day to 83.9 million barrels a day. This demand level is still 2.7 per cent lower than 2008.

International Energy Agency - The International Energy Agency raised its forecasts for global oil demand this year and next, citing stronger energy appetite in Asian economies, particularly China. The new prediction of 85.3 million barrels a day for 2010 is a 1.6 per cent increase over this year. In its closely-watched monthly survey, the IEA also increased its 2009 forecast by 190,000 barrels a day to 83.9 million barrels a day. This demand level is still 2.7 per cent lower than 2008.

A rebound in oil demand next year would mark the end of two straight years of falling global oil demand. Its prediction for non-OECD demand is higher for both years after a “reappraisal of Chinese demand prospects.” Chinese oil imports jumped 18 percent last month to the equivalent of 4.6 million barrels a day. Energy use and global economic activity correlate closely (see chart from Bloomberg).

In an interview last month IEA’s chief economist noted we are on “the verge of a catastrophic oil crunch at current rates of consumption.”

He notes if global demand were to remain steady we still have supply issues as decline rates in existing fields are much higher than expected – roughly 6.7% instead of the 3.7% decline rate the IEA assumed in 2007. The IEA assessment also found that production at most of the top producing fields has already peaked.

“Many governments now are more and more aware that at least the day of cheap and easy oil is over… [however] I’m not very optimistic about governments being aware of the difficulties we may face in the oil supply,” he said.

- Iran - The New York Times notes that the Obama administration is talking with allies and Congress about the possibility of imposing an extreme economic sanction against Iran if it fails to respond to the offer to negotiate on its nuclear program: cutting off the country’s imports of gasoline and other refined oil products.

The option of acting against exporters that supply Iran with 40 percent of its gasoline has been broached with European allies and Israel. But enforcing what would amount to a gasoline embargo has long been considered risky and extremely difficult; it would require the participation of Russia and China, among others that profit from trade with Iran. Iran has threatened to respond by cutting off oil exports and closing shipping traffic through the Strait of Hormuz, at a moment that the world economy is highly vulnerable.

Dollar v. Crude Oil - We ran a regression of the value of a U.S. dollar bullish exchange traded fund

Dollar v. Crude Oil - We ran a regression of the value of a U.S. dollar bullish exchange traded fund

(‘UUP’) versus the value of the ‘USO’ oil exchange traded fund that tracks crude oil prices. We found a strong negative correlation since the first of the year.

When the dollar was strong energy prices weakened, and vice versa. Since January 1st changes in the value of the dollar ‘explained’ roughly 75% of the changes in value of crude oil. The charts at right illustrate the long term inverse relationship, courtesy Hays Advisory.

Goldman & Commodity Spikes – In a report issued last month Goldman Sachs said it expects commodity prices to spike sharply higher next year, mimicking the moves in 2008 when oil almost hit $150 a barrel and other commodities touched a series of all time highs.

Goldman & Commodity Spikes – In a report issued last month Goldman Sachs said it expects commodity prices to spike sharply higher next year, mimicking the moves in 2008 when oil almost hit $150 a barrel and other commodities touched a series of all time highs.

The U.S. bank said potential supply shortages created by years of underinvestment have been exacerbated by the global financial crisis and

tight credit conditions.

"As the commodity markets rebound with the broader global economy we expect a redux of 2008 when severe supply constraints forced the rationing of demand through sharply higher prices to keep the market balanced. . . As the developed world increasingly begins to consume like Westerners the

demands placed on the finite resources of the planet increases. This trend of human populations growing faster than the earth's ability to produce not only impacts food production but that of commodity usage."

- Hurricane Forecast - Officials from the National Oceanic and Atmospheric Administration are reducing the number of named storms they expect in the 2009 Atlantic hurricane season. The original outlook, issued in May, called for nine to 14 named storms, including four to seven hurricanes.

NOAA’s revised forecast issued last month said that there is a 70 percent chance of seven to 11 named storms, with three to six of them becoming hurricanes. There have been no named tropical storms or hurricanes this season in the Atlantic – the latest this has occurred in at least 17 years. Hurricane season, which started on June 1, has now entered its historical peak, August through October.

Hurricane activity is significant to the extent roughly one-third of the nation’s refining capacity is located on the Gulf Coast, and roughly one-fifth of our oil and gas production is located offshore or in shoreline areas along the Gulf. Chances of a supply interruption due to storm activity are greatly diminished this year, but have not been eliminated.

- Earnings conference calls – Publicly traded firms - We find it useful to review comments by management in their quarterly conference calls, especially comments dealing with capital spending, industry activity, or sector outlook. Some of the comments cut from recent transcripts we found interesting include the following:

Q2 2009 Chesapeake Energy Corporation Earnings Conference Call

. . . Q: I see. In a more general sense, with regard to service cost deflation, do you see some of the -- having industry give some of that back, when prices recover and to what degree do you think there's inertia there on that deflation?

AUBREY MCCLENDON: We're probably bottoming and have bottomed and we'll probably give some of it back but we don't expect the rig counts to pop-up too meaningfully going forward. I'd be surprised to see it above 1,000 or 1,100 over the next 12 months or so. So, I think you're in a time when service companies are realizing the same things a lot of E&P companies have realized, which is, everything is different as a result of these shale plays. And we're not going back to a service industry supporting 1,700 or 1,800 rigs in the US. So, there's going to have to be rationalization of capacity, I think, in the industry. In the meantime, I think most of that capacity will stay around and will keep prices reasonably low for us. Marc, do you want to add anything to that?

MARC ROWLAND: Yes I would just focus on the capacity. We've got an environment where you had nearly 2,000 rigs running, less than 50% of those now -- I know in our service businesses that we've invested in, rigs are mostly down. Frac service equipment has been stacked. People have been laid off. So, there's a tremendous amount of recently built-up new capacity that has idled and I think it will take quite a while even after prices start to return on the gas front, before much of that trickles into the service side of things.

Q: Thanks for that, Marc. And just one last question more general to the commodity. I wanted to get your thoughts on the accuracy of the 914 data and is that telling a story consistent with your view of what's happening with natural gas?

AUBREY MCCLENDON: We'll let Jeff take that. Go ahead, Jeff.

JEFF MOBLEY: There are some flaws in the 914 data. And a change in their methodology that they announced earlier in the year does make you a little bit curious about the data. But at the end of the day, we think it is probably the most current and most reliable data that you can find in the market in an aggregate basis. As you might have seen in our prior presentations, we've done quite a bit of work to try to model out U.S. gas production. And so far, the numbers that we've seen reported for the EIA are right on top of the model that we've outlined. So I have a reasonably high degree of confidence in those numbers. I would point out, though, that with the rig count having dropped for natural gas to well below 700 and kind of leveled out in the 675 or so rig count range, that really sets the stage for natural gas prices to decline materially into the back half of this year and the first half of next year. We've seen a slow steady climb in gas production from 2005 through March of 2009. And it's leveled off to a very slow sequential decline through the summer but that should pick up dramatically. And we can see production declines on a year-over-year basis of perhaps as much as 2.5 bcf to 3 bcf per day by the end of the year, approaching 5 bcf a day down year-over-year by late spring early summer next year. . .

Q: Thanks. And then, on line pressures are you seeing any impact now from pressure back-ups? And do you have any expectations regionally for where you would expect to see these happening first?

AUBREY MCCLENDON: Haven't really seen it yet but we will, over the next couple of months. And it is hard to predict regionally, because so much of it's going to depend also on where declines are kicking in and 914 data is beginning to show, we track it here, of course, our conventional production, or our non-big four shale production peaked actually in the second quarter of 2008 and has been in decline now for five quarters. So, we know that that's happening across the industry and will accelerate in the second half of the year. And so, that will have some relevance as well. And then the pipeline system is so big and integrated that it's really hard to imagine -- or to exactly be clear on where it's going to happen. But just from what I read, on analytical commentary, it does appear the Rockies and Canada are probably going to have the biggest problems in terms of getting to full storage faster than other areas, which of course, will create some pretty significant production problems there as well as price problems. . .

Q: Okay. Can I ask one industry question? Aubrey, if you look out a year from now, next August, would you care to venture where you think the U.S. gas rig count would be?

AUBREY MCCLENDON: Yes, I think somewhere in the 1,000 to 1,100 and I think that's kind of what's likely to be equilibrium going forward.

STEVE DIXON: On the gas prices?

AUBREY MCCLENDON: Well, total rigs, of which, 90% or 85% will be gas. So, we're at this week, on the gas rig count -- yes, 675, so I would expect we'll say, let's call it around 900, then with another 200 working on oil projects. And I think you'll see gas prices in the $6, $7, $8 range and there's a lot to like about 2010. I think it's all setting up right now and there's going to be a lot of kind of wailing and gnashing of teeth here in the next 60 days, as we get slow on storage but after that, you've got an improving economy. You've got oil at $12 per mcf gas equivalency. You've got decline curves starting to kick in pretty aggressively. You've got every E&P company that I watch pretty scared about gas prices and you've got a net speculative short position that will have to turn around at some point. So, I think it's all shaping up to be a pretty favorable summer of 2010 and you're not likely to get weather as unhelpful as it has been this summer, with New York having the second coldest summer since 1888, I think and Chicago having the fourth coldest summer since 1935 or something like that. So, our hope is that that foreshadows a little colder winter and we would suspect next summer would be a little warmer. So, we like 2010 and we're looking forward to getting there. . . .

Q2 2009 Devon Energy Corporation Earnings Conference Call

. . . As we discussed in May we have reduced CapEx significantly in 2009 in response to the macro environment. Our 2009 exploration and production budget of 3.5 million to $4.1 billion is less than half of 2008 levels. We are now in the very, very early stages of developing our 2010 exploration and production budget which will ultimately reflect our outlook for commodity prices and cost in the future. Long-term we believe that the combination of prices and cost will adjust sufficient to the reward increased investment in the business. But we also know that the low cost producer always has a distinct advantage and this is especially true during periods of strained industry economics. Accordingly, we are always focused on identifying opportunities to improve our efficiency and our effectiveness. . .

Looking ahead as Larry mentioned, in response to low gas prices we are taking steps to reduce our expected output in the second half of the year. In aggregate, we expect to reduce production buy between 15 billion and 21 billion cubic feet or 2.5 million to 3.5 million BOEs over the remainder of 2009. First, we are reducing incremental compression in the Barnett and Arcoma Woodford. This accounts for more than half of the reduction and most of the remaining reduction will result from deferred completions across North America and by shutting in some marginal wells in the Rockies. . . .

Due to the lack of visibility for natural gas prices for the second half of 2009 and for 2010 we recently began taking steps to protect the minimum level of cash flow during these uncertain times. For the second half of 2009 we've entered into additional gas hedges for the last four months of the year. For September we now have protected a total of 425 million cubic feet per day at a weighted average price of $6.65 per MCF. For the fourth quarter we protected our price of $5.86 on 865 million cubic feet per day. We are currently weighing the flexibility of our 2010 capital budget, our projected debt levels and our pricing outlook to formulate our plan for 2010 hedging. . . .

Q2 2009 Crosstex Energy, L.P. Earnings Conference Call

. . . During the second quarter, we saw liquids prices begin to improve. And as the economy improves, we expect natural gas liquids prices will benefit, as will natural gas prices. We also continued to see some strong drilling activity in the Haynesville Shale. From a macro perspective, although gas prices remain depressed, last week was the first week that we did not see a decrease in the overall US rig count, which appears to be stabilizing. We're also starting to see some improvement in capital markets. Credit spreads and yields on equity for the pipeline in midstream sector have improved, and we are encouraged that these general improvements will provide additional options to us as we execute our plan. . .

Now, we have seen producers further reduce their 2009 discretionary drilling. And in turn, they've continued to revise their drilling programs and well completion plans for the remainder of the year. In mid-July, the natural gas rig count in the US dropped to 665 rigs, its lowest level since May 3rd, 2002. And as of early August, the rig count in the Barnett Shale was approximately 78 active rigs, less than half of the total rig count from a year ago. But despite the decline in drilling activity, we have negotiated several new supply deals and restructured other deals and contracts. We anticipate that the deceleration will likely impact our overall 2009 operational results, and this has been factored into our new 2009 guidance. . .

Q: Okay. And I'm just curious. You mentioned the number of rigs, I think, in the North Texas at 78. In terms of discussions with producers, are you getting any sense for when they're expected to bring more rigs back online?

BOB PURGASON: John, I think everybody's waiting to see what happens after this storage season and winter begins. So I really don't expect much clarity there till the beginning of 2010.

BARRY DAVIS: John, one of the things I would add -- we have just recently given all of the changes of late -- the changes in the drilling rig, producers' perspectives, etc. -- we've updated our view of the Barnett Shale through engineering reports and studies done by outside parties. And one of the things that we are very encouraged by is that the Barnett has done nothing but continue to get better. We believe that the resources there -- I think everybody in the industry does -- we believe the drilling will be there. It's simply a matter of when the capital markets return and the gas price returns.

So I think that's something that we have emphasized all along is just the quality assets, the strategic position. In fact, when you look at where the gas is being produced today and where it will be produced in the future, we could not be positioned any better in the Barnett Shale. Access to future production -- and so it's just a question of timing, not a question of quality, and we remain optimistic because of that.

Q: Do you know what gas price that has to be achieved before you expect additional deployment?

BILL DAVIS: I don't know if it's just a function of gas price, John. I think it's, as much as anything else, a function of capital availability and other capital commitments that producers have. I don't know that there's a bright line you can create with a gas price above and below $5, for example. . . .

Q2 2009 Compton Petroleum Earnings Conference Call

. . . Though the expected longer-term trend is for increased commodity prices through 2010, continued depressed natural gas prices have impacted our financial results. The outlook for North American demand for natural gas is expected to improve once the economic recovery takes hold. In the short term supply is decreasing due to reduced development activity and natural declines. In addition, some natural gas has been [shut in] to low commodity prices. In this environment we remain focused on restructuring our balance sheet, and we will continue with our defensive strategy until a clear signal in the recovery of commodity prices are evident. . . .

Q2 2009 Quanta Services Earnings Conference Call

. . . During the quarter gas revenues associated with a gas gathering services declined due to depressed natural gas prices and a continued decline in drilling activity in the tight shale gas fields. Also, gas distribution work remained consistent, but at lower levels, as customers continued to upgrade existing infrastructure to comply with corporate requirements. The American Clean Energy & Securities Act of 2009, if enacted, will legislate enhanced American energy independence and reduced national carbon footprint. While coal is currently the nation's major fuel for electric power, natural gas is the fastest growing fuel. According to the Department of Energy, more than 90% of the fossil fuel power plants to be built in the next 20 years will likely be fueled by natural gas. Also, natural gas is likely to be the primary fuel to offset the intermintency of renewable generation. Because of these dynamics, we believe the demand for natural gas may increase significantly over the coming years and if this occurs, the nation's existing natural gas transportation pipeline infrastructure is likely to be insufficient to meet future demands. We're optimistic about the outlook of the natural gas industry and are continuing to evaluate opportunities in this area. . .

Q2 2009 Unit Corp Earnings Conference Call

. . . In our contract drilling operations, activity remains very depressed. The low natural gas prices continue to impact the level of industry rig activity. We averaged operating 32 rigs during the second quarter. In June, we were down to averaging only 27 rigs, and subsequent to then, the rigs have increase back up to 33. So maybe -- and I do stress maybe -- we have seen the bottom of the rig count. We're not expecting to see a rapid increase in industry rig utilization during the second half of '09. However, as the decline in US natural gas production grows, rig utilization will need to increase.

Our average day rates during the second quarter were $17,305, down $1300 per day from the first quarter, and operating margins were down $1100 per day. We are expecting continued pressure on day rates over the remainder of 2009.

In our midstream segment, financial results for the second quarter exceeded the results of the first quarter of '09. Realized prices for natural gas liquids improved substantially during the quarter compared to the beginning of the year. Gathered volumes remained fairly steady during the second quarter, while process volumes continued to increase. Although gathered volumes has been fairly steady through the second quarter, we are starting to see a reduction in new well connects due to the slowdown in drilling activity around several of our gathering systems.

Our emphasis on cost reduction and operational optimization is succeeding as field operating costs are down quarter to quarter and liquid recoveries at our processing facilities are improving.

We are beginning to see potential acquisitions in the midstream segment. We expect to see an increasing number of potential pipeline acquisition possibilities in the Mid-Continent Region during the second half of 2009. In Appalachia, several pipeline projects related to the Marcellus shale drilling activity are in various stages of analysis and negotiation. Producers we're negotiating with are preparing to start -- to restart their Marcellus shale exploration efforts in late 2009 and into early 2010. . . .

In summary, our strategy to delay discretionary drilling activity during the first half of 2009 has positioned us to be able to increase our drilling and completion activity for the remainder of 2009 at substantially lower well costs. Both the Haynesville and the Marcellus shale plays are in the early stages of development for us, but we look forward to obtaining results from the upcoming horizontal wells that will be completed during the second half of this year. Coupled with these emerging plays, we will continue to develop and expand our opportunities in our core areas . . . .

EnCana Conference Call

“We continue to increase our [Haynesville] drilling program and the latest well results continue to be very positive. We plan to drill about 15 net wells this year which will enable us to further increase our understanding of the play . . . we estimate that they have a potential to produce between 15 million and 20 million cubic feet per day against line pressure for 30 days. We continue to believe that the Haynesville will be one of the most important gas plays in the future of our company.”

By Joseph Dancy,

Adjunct Professor: Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2009 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.