Category: Gold & Silver 2019

The analysis published under this category are as follows.Saturday, January 26, 2019

Gold Price Is Rallying in All Other Fiat Currencies / Commodities / Gold & Silver 2019

By: MoneyMetals

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Coming up Greg Weldon of Weldon Financial joins us for a 2019 outlook. I’ll ask him if the thinks the recent stock market rally has legs – and also for his forecast for gold this year. And Greg has some very interesting news regarding the yellow metal which – to his surprise – hardly anyone knows about. Don’t miss another fantastic interview with Greg Weldon, coming up after this week’s market update.

Gold and silver markets traded modestly lower through Thursday’s close as the U.S. Senate failed to pass bills to re-open the government. All the metals are up today however.

President Trump’s compromise deal garnered a majority but drew just one Democrat vote and came up a few shy of the 60 needed. So the shutdown persists – along with growing partisan rancor and pettiness.

Read full article... Read full article...

Friday, January 25, 2019

Gold Stocks Upleg Pauses / Commodities / Gold & Silver 2019

By: Zeal_LLC

The gold miners’ stocks have slumped in January, tilting sentiment back to bearish. This sector’s strong December upward momentum was checked by gold’s own upleg stalling out. Gold investment demand growth slowed on the blistering stock-market rally. But uplegs always flow and ebb, and this young gold-stock upleg merely paused. The gold miners’ gains will likely resume soon, rekindling bullish psychology.

The gold miners’ stocks have slumped in January, tilting sentiment back to bearish. This sector’s strong December upward momentum was checked by gold’s own upleg stalling out. Gold investment demand growth slowed on the blistering stock-market rally. But uplegs always flow and ebb, and this young gold-stock upleg merely paused. The gold miners’ gains will likely resume soon, rekindling bullish psychology.

Most investors and analysts track the gold-mining sector with its leading ETF, the GDX VanEck Vectors Gold Miners ETF. GDX was this sector’s pioneering ETF birthed in May 2006, creating a huge first-mover advantage that is insurmountable. This week GDX’s net assets of $9.9b were an incredible 56.7x larger than the next-biggest 1x-long major-gold-miners ETF! GDX dominates this space with little competition.

Back in early September, the gold stocks plunged to a major 2.6-year secular low per GDX. This sector suffered a brutal forced capitulation on cascading stop-loss selling, devastating sentiment. The triggering catalyst was gold getting pounded to its own major lows in mid-August on record futures short selling. At worst GDX fell to $17.57 on close, which was down an ugly 24.4% year-to-date. Most traders fled in disgust.

But major new uplegs are born in peak despair, and that was it. The gold stocks started recovering out of those fundamentally-absurd levels, gradually carving a solid upleg. By early January GDX had rallied 22.3% higher in 3.7 months, fueling more-optimistic sector sentiment. Plenty of speculators and investors including me were comparing 2019’s setup for gold stocks to the first half of 2016, a wildly-lucrative stretch.

Read full article... Read full article...

Thursday, January 24, 2019

If the Recent Sell-Off Spurred You to Buy Gold, You Have to Read This / Commodities / Gold & Silver 2019

By: John_Mauldin

BY ROBERT ROSS :

Gold has done well during the latest sell-off in the markets.

But it’s not surprising. Gold has always been seen as a safe haven. When the markets tumble, investors flock into this asset.

In the global financial crisis, the S&P 500 plunged 55.6% between October 2007 and March 2009:

Saturday, January 19, 2019

David Morgan: Expect Stagflation and Silver Outperformance in 2019 / Commodities / Gold & Silver 2019

By: MoneyMetals

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Coming up our good friend David Morgan of The Morgan Report joins me for a conversation on a range of topics, including his 2019 outlook for a number of different asset classes, most notably gold and silver. Don’t miss a fantastic preview of 2019 with the Silver Guru, David Morgan, coming up after this week’s market update.

Gold and silver markets are trading relatively quiet this week as the U.S. stock market continues to show surprising strength. It’s surprising at least to investors who expected markets to reflect growing political threats to the economy. As the partial government shutdown enters an unprecedented 28th day, economists are warning of a significant hit to first quarter GDP.

It’s not that furloughed government workers contribute much to economic productivity. It’s that since they are now starting to miss paychecks, they will have less to spend into the economy. GDP measures the nominal size of the economy, not how productive or efficient or free or fair it is.

Read full article... Read full article...

Friday, January 18, 2019

Macroeconomic Outlook for 2019 and Gold / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

Will 2019 be better than 2018 for the yellow metal? We invite you to read our today’s article, painting the macroeconomic outlook for 2018 and learn whether fundamental factors will become less or more friendly toward gold.

Will 2019 be better than 2018 for the yellow metal? We invite you to read our today’s article, painting the macroeconomic outlook for 2018 and learn whether fundamental factors will become less or more friendly toward gold.

What will 2019 be like? We do not know the precise answer, but we notice a few important economic trends that will shape the new year.

1. Interest rates will continue to rise.

2. However, the Fed’s monetary tightening will slow down.

3. Just when the ECB will start normalizing its own monetary policy.

4. And when the stimulus of the US fiscal policy will start to dissipate.

Thursday, January 17, 2019

No for Brexit Deal, Yes for May. And What for Gold? / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

71 days. That’s all that separates us from the Brexit deadline. And the UK has still no clear path forward exiting the EU. Does gold have one?

71 days. That’s all that separates us from the Brexit deadline. And the UK has still no clear path forward exiting the EU. Does gold have one?

Today's analysis features possible scenarios for the UK and for gold along with their likelihood. In the current political situation, it's a must-read.

Parliament Rejects May’s Brexit Deal

On Tuesday, the UK Parliament voted on Theresa May’s Brexit deal for leaving the EU. As expected, the MPs rejected her proposition. What was really surprising was the scale of defeat. The parliament voted 432-202 against May’s divorce deal, marking the worst defeat in modern British history.

Read full article... Read full article...

Wednesday, January 16, 2019

Gold Holds Steady Over £1,000 – Increased Likelihood Of A Disorderly Brexit / Commodities / Gold & Silver 2019

By: GoldCore

– Gold supported near $1,300/oz ahead of important British Brexit no-confidence vote

– Gold is consolidating in range between $1,280 and $1,300/oz (over £1,000/oz and €1,100/oz) – A break of resistance at $1,300 will likely see gold rise rapidly in all currencies

– Physical demand for gold coins and bars has picked up in the UK and Ireland, aided by Brexit uncertainty

Wednesday, January 16, 2019

Gold Price – US$700 Or US$7000? / Commodities / Gold & Silver 2019

By: Kelsey_Williams

Does either of the above preclude the other? In other words, if we expect gold to reach $7000.00 per ounce, and we are correct, does that mean that we can’t reasonably expect gold to go as low as $700.00 per ounce? Conversely, if we are predicting or expecting gold to decline from its current level and even breach $1000.00 per ounce on the downside, can $7000.00 per ounce, or anything even remotely close to that number, be a reasonable possibility?

Does either of the above preclude the other? In other words, if we expect gold to reach $7000.00 per ounce, and we are correct, does that mean that we can’t reasonably expect gold to go as low as $700.00 per ounce? Conversely, if we are predicting or expecting gold to decline from its current level and even breach $1000.00 per ounce on the downside, can $7000.00 per ounce, or anything even remotely close to that number, be a reasonable possibility?

I do not think either one precludes the other. In fact, I think it is entirely possible that we can see bothfigures. And not necessarily spread over an inordinately long period of time, either.

Here is a possible scenario that would allow that to happen.

As the U.S dollar strengthens, the U.S. dollar price of gold declines. This is clearly evident in the price action of gold since its high point of approximately $1900.00 per ounce in 2011. There is no way to know for certain how long relative dollar strength will last. And it is reasonable that if ongoing dollar strength takes gold below $1000, it might come to rest somewhere between $860 – 890.00 per ounce. In January 1980, gold peaked at $850.00. Revisiting that number is plausible, and well within the realm of realistic speculation. And, yes, there are technical indicators that point to a gold price of as low as $700.00 per ounce.

Read full article... Read full article...

Monday, January 14, 2019

New Shortfall in Production Capacity for Fabricated Silver and Gold / Commodities / Gold & Silver 2019

By: MoneyMetals

The two largest private producers of bullion bars and rounds in the U.S. have gone defunct over the past two years. Premiums for silver bars and rounds are already on the rise as markets adjust to the lack of supply.At present, demand for these products is manageable. A surge in buying activity, however, could lead to serious difficulty finding low-premium products.

Monday, January 14, 2019

Gold A Rally or a Bull Market? / Commodities / Gold & Silver 2019

By: Jordan_Roy_Byrne

Although the financial media conflates the two, there is a difference between a rally and a bull market.

Although the financial media conflates the two, there is a difference between a rally and a bull market.

A rally implies a rebound after or a reprieve from weakness. A bull market is higher highs and higher lows for a period of at least a few years.

Gold’s strength in the 2000s was not a rally, as many have deemed it, but a bull market. Gold’s rebound in 2016 was a rally.

Nevermind the Gold pundits who insist Gold is in an invisible or stealth bull market or even a correction. A market that pops for seven months then doesn’t make a new high for almost two and a half years is not a bull market.

Read full article... Read full article...

Sunday, January 13, 2019

Top Ten Trends Lead to Gold Price / Commodities / Gold & Silver 2019

By: Jim_Willie_CB

The year 2018 was a memorable year of great transitions. They involved changes in the political arena. They saw enormous changes in the debt picture, for both the USGovt and the major Western corporations. They saw a struggle to terminate the QE bond monetization, laced with hype-inflation. They offered staggering damage to California, whose effects are easily 100 times greater than the World Trade Center fallout. They offered resistance to the US-led bully tactics, in slapping sanctions even on the US allies, a forecast by the Jackass two years ago. The globalist cabal agenda has been dealt a powerful damaging blow, perhaps lethal, during a year of great exposure for their criminality. The transitions offered a complete shift away from the perception of USMilitary full spectrum dominance. But the most important changes have come in the finance & economic sectors.

The year 2018 was a memorable year of great transitions. They involved changes in the political arena. They saw enormous changes in the debt picture, for both the USGovt and the major Western corporations. They saw a struggle to terminate the QE bond monetization, laced with hype-inflation. They offered staggering damage to California, whose effects are easily 100 times greater than the World Trade Center fallout. They offered resistance to the US-led bully tactics, in slapping sanctions even on the US allies, a forecast by the Jackass two years ago. The globalist cabal agenda has been dealt a powerful damaging blow, perhaps lethal, during a year of great exposure for their criminality. The transitions offered a complete shift away from the perception of USMilitary full spectrum dominance. But the most important changes have come in the finance & economic sectors.

The Gold Standard has seen a paved road for its implementation, arrival, and acceptance. The road can be identified for its several major constructed arteries. The pathways are built by the Eastern nations, which will continue to champion the financial reform, and thus wrest global control from New York and London. History is being made. It will still take time, but the momentum is gathering in a notable and convincing manner. The common theme of all the leading factors is the movement away from the USDollar, a theme so popular and widespread that it has been given a name, de-Dollarization. In the next year, even the compromised corrupted Wall Street bank community will openly discuss that Gold must be the solution to the unresolved crisis.

Read full article... Read full article...

Sunday, January 13, 2019

Silver: A Long Term Perspective / Commodities / Gold & Silver 2019

By: Rambus_Chartology

Tonight I would like to show you a couple of long term charts for Silver that puts where silver is currently trading into perspective. We can look at the hourly charts or even the daily charts for the short term patterns, but if you really want know where a stock is relative to its history we need to look at the long term view. The more history a stock has the more relative the current price action is.

Tonight I would like to show you a couple of long term charts for Silver that puts where silver is currently trading into perspective. We can look at the hourly charts or even the daily charts for the short term patterns, but if you really want know where a stock is relative to its history we need to look at the long term view. The more history a stock has the more relative the current price action is.

Lets start with a 16 year monthly chart for silver which seems like a long time but in the big picture it only shows us a small part of its history. The dominate chart pattern is the 2011 bear market downtrend channel which is almost perfectly parallel. I purposely left the top rail of the 2011 downtrend channel and the top rail of the 2016 triangle thin so you can see the critical area silver is now trading at, red circle. So far this month silver has traded as high as 15.95 which puts it right against the top rail of the 2011 bear market downtrend channel and the top rail of the 2016 triangle.

Read full article... Read full article...

Saturday, January 12, 2019

Big Silver Move Foreshadowed as Industrial Panic Looms / Commodities / Gold & Silver 2019

By: MoneyMetals

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Coming up we’ll hear one of the more important interviews we’ve ever done on the broken nature of the precious metals’ futures exchanges, and what might be the driving force that ultimately destroys the confidence in these markets, paving the way to true price discovery. Mining analyst and precious metals expert David Jensen joins me to talk about how palladium might just be the straw that breaks the back of the paper market. Don’t miss this must-hear interview, coming up after this week’s market update.

As the government shutdown persists, and a declaration of national emergency by President Donald Trump looms, financial markets are unfazed. The Dow Jones Industrials have swung approximately 500 points higher so far this week.

However, the U.S. Dollar Index did hit a 3-month low on Wednesday. That helped boost oil prices in a big way. Crude climbed 10% to $53 a barrel.

The price action in precious metal markets is more subdued. Gold shows a modest gain of 0.4% this week to bring spot prices to $1,291 per ounce. The yellow metal flirted with the $1,300 level last Friday. More backing and filling may be needed before the market is ready to push through that resistance.

Read full article... Read full article...

Friday, January 11, 2019

Is It Time To Prepare For The Precious Metals To Get Whacked? / Commodities / Gold & Silver 2019

By: Avi_Gilburt

This article was originally published on Sun Jan 6 for members of ElliottWaveTrader: Over the last several weeks, I have seen those that were absolutely certain back in September and October that gold was going to drop below $1,000 now turn into major bulls in the metals complex. The silver rally especially has gotten the attention of many metal’s traders, and has everyone now all bulled up for a major break out in the complex.

It really is amazing to watch how price extremes dictate the manner in which investor’s views are driven about a market. Yet, as Roy Prassad, one of our more astute members at Elliottwavetrader.net, noted: “the goal of Elliott Wave is to analyze sentiment, not participate in it.”

Read full article... Read full article...

Thursday, January 10, 2019

Will Powell’s Put Support Gold? / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

Fed signals more patience with its monetary tightening, despite strong economy. Why? And what does it mean for the gold market?

Fed signals more patience with its monetary tightening, despite strong economy. Why? And what does it mean for the gold market?

Minutes from December FOMC Meeting and Gold

As everybody knows, in December the FOMC voted unanimously to raise interest rates for the fourth time in 2018. We have analyzed the implications of that hike for gold in two editions of the Gold News Monitor (here and here).

However, yesterday, the Fed published the minutes of its latest monetary policy meeting. The document shows that despite the apparent unanimity, the tensions were growing, as a “few” officials were actually arguing for the central bank to pause:

Read full article... Read full article...

Thursday, January 10, 2019

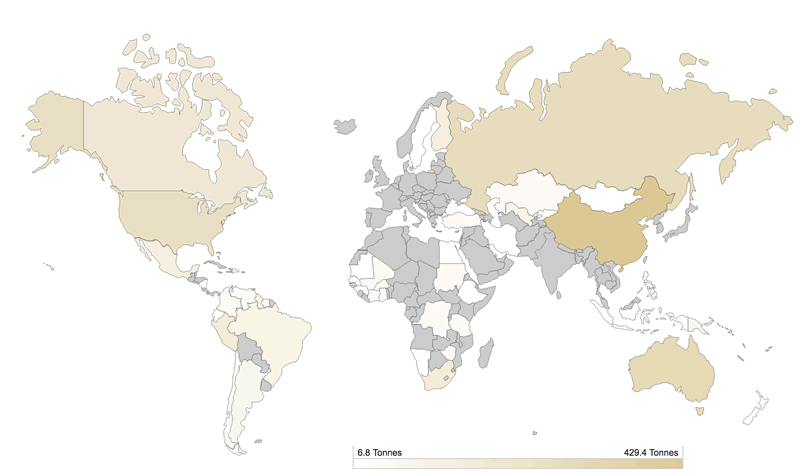

Gold Mine Production by Country / Commodities / Gold & Silver 2019

By: Michael_J_Kosares

Gold mine production by country Divergent paths among the major global producers tell an important tale

Read full article... Read full article...

Sources: MetalsFocus and the World Gold Council with permission.

Thursday, January 10, 2019

Silver Price Trend Forecast Target for 2019 / Commodities / Gold & Silver 2019

By: Nadeem_Walayat

My long standing approach to Silver is one of buying when cheap to invest and forget, for it only tends to come alive towards the end of precious metals bull runs as illustrated the last time I took a look at Silver on the 8th of May 2018 -

My long standing approach to Silver is one of buying when cheap to invest and forget, for it only tends to come alive towards the end of precious metals bull runs as illustrated the last time I took a look at Silver on the 8th of May 2018 -

Silver Forecast 2018 and Beyond, Investing for the $35+ Price Spike!

In terms of a Silver market position then as is currently the case the silver market can usually be expected to be a dead market with the tendency to flat line not just for many months but even years as it tends to play second fiddle to Gold in terms of tradable swings, usually only really coming alive towards the latter stages of precious metal bull markets.

Read full article... Read full article...

Tuesday, January 08, 2019

Did Strong December Payrolls Push Gold Prices Up? / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

December payrolls were strong – but gold prices rose. What happened?

December payrolls were strong – but gold prices rose. What happened?

Job Creation Surprises Positively

U.S. nonfarm payrolls accelerated in December, beating expectations. The economy added 312,000 jobs last month, following a rise of 176,000 in November (after an upward revision) and significantly above 182,000 forecasted by the economists. The number was the biggest increase since February 2018. On an annual basis, the pace of job creation increased slightly last month to 1.8 percent.

What is important is that the gains were widespread, but the most impressive expansion occurred in education and health services (+82,000), leisure and hospitality (+55,000) and professional and business services (+43,000).

Read full article... Read full article...

Monday, January 07, 2019

Will the Momentum in Precious Metals Continue? / Commodities / Gold & Silver 2019

By: Jordan_Roy_Byrne

The precious metals complex has enjoyed a nice run in recent months.

The precious metals complex has enjoyed a nice run in recent months.

GDX has gained 25% since the September lows while GDXJ has gained 22% since its November low. Gold has rallied over $100/oz since its October low and Silver has surged in recent weeks.

The Gold community is getting excited again. They think the equity market is doomed and Gold has started a real bull run. That may be true but in the interim there are questions on the sustainability of recent strength.

Below we plot GDX with its advance decline (A/D) line and its RSI indicator. We already know that the A/D line has been carrying a few negative divergences.

Read full article... Read full article...

Monday, January 07, 2019

Gold Golden Long-Term Opportunity / Commodities / Gold & Silver 2019

By: Dan_Steinbock

As global jitters are escalating with economic uncertainty and market volatility, gold looks more attractive. But there’s a big difference between its short- and longer-term prospects.

As global jitters are escalating with economic uncertainty and market volatility, gold looks more attractive. But there’s a big difference between its short- and longer-term prospects.Those analysts who believe that fear has made a comeback argue that gold is benefiting as equities slide and investors are increasingly concerned about the economic prospects of the U.S., China, Europe and Japan. Yet, even at $1,290, gold still remains more than 30% behind its all-time high of $1,898 in September 2011 amid the U.S. debt-limit crisis.

Although U.S. dollar has not strengthened as much as anticipated, the Fed’s rising rates have contributed to the fall in gold prices. In this view, a reversal may be unlikely because the investor assumption is that the Fed will continue to normalize, though perhaps slower than anticipated.

In the postwar era, such tightening meant a strengthening U.S. economy and a stronger dollar. But at the time, American economy was not haunted by budget and trade deficits or a debt burden. Today, it suffers from both twin deficits and a massive $22 trillion sovereign debt burden.

Read full article... Read full article...