Category: Gold and Silver 2013

The analysis published under this category are as follows.Friday, March 08, 2013

Silver: Making the Case for This Precious Metal / Commodities / Gold and Silver 2013

By: Jeff_Clark

Even though the newsletter I write for Casey Research is focused primarily on gold, our metals investments cover all the precious metals, and when warranted, some base-metals plays too. And with the markets in the state they are, I want to say something about silver.

Even though the newsletter I write for Casey Research is focused primarily on gold, our metals investments cover all the precious metals, and when warranted, some base-metals plays too. And with the markets in the state they are, I want to say something about silver.

Thursday, March 07, 2013

Silver and Gold: You Have to LIE! / Commodities / Gold and Silver 2013

By: DeviantInvestor

“When it becomes serious, you have to lie.” That statement was made by Jean-Claude Juncker, head of the Eurozone. Let’s call this a Juncker Moment.

“When it becomes serious, you have to lie.” That statement was made by Jean-Claude Juncker, head of the Eurozone. Let’s call this a Juncker Moment.

As per Tyler Durden, “He uttered (the above) after getting caught with a bold faced lie about the stability of the failed European project.”

Read full article... Read full article...

Thursday, March 07, 2013

More Banks Bearish on Gold as Price Flatlines in "Spinning Top" Pattern / Commodities / Gold and Silver 2013

By: Adrian_Ash

WHOLESALE PRICES to buy gold held around $1580 per ounce on Thursday morning, trading in a tightening range as Asian and European stock markets crept higher after the Dow stock average recorded another all-time high in New York last night.

WHOLESALE PRICES to buy gold held around $1580 per ounce on Thursday morning, trading in a tightening range as Asian and European stock markets crept higher after the Dow stock average recorded another all-time high in New York last night.

The Euro and Sterling both rallied this morning against the Dollar after the ECB and Bank of England both left their key interest rates unchanged.

Thursday, March 07, 2013

Dow vs. Gold vs. XAU, What Gold Bubble? / Commodities / Gold and Silver 2013

By: Vin_Maru

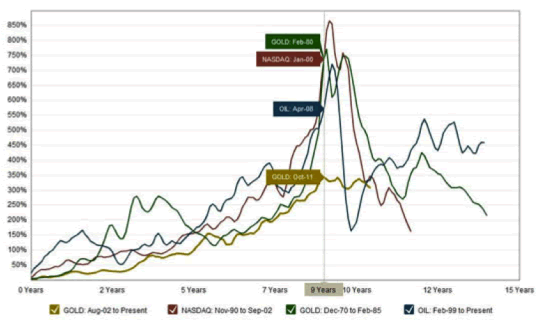

The current bull market for gold has risen steadily for about 9 years, but on a percentage basis we still haven’t seen the exponential rise in a 1 to 2 year period that would clearly mark it as a bubble mania phase. In fact, after making solid gains and rising for 9 years, the gold market has essentially gone sideways over the last eighteen months. The good thing is that in the previous bubbles, after it burst the asset class had given back several hundred percent in the 1-2 years following the peak. Luckily we haven’t seen that in this bull run for gold, not yet anyways, but we could see the cycle bottom later this year. The recent correction has given back about 20% from the peak of just over $1900 to just below $1550.

Can the correction continue and steepen to the downside? Sure, anything is possible, especially in a market that can easily be manipulated. But looking at the charts below, gold never went into a mania exponential rise and has been consolidating sideways for 18 months. This gold bull market run is definitely not like previous bubbles and the further this correction at these prices goes out in time, the more likely we will still see one more mania phase push higher with a several hundred percent rise before we can state that gold is truly in a bubble.

Graph courtesy of Macrotrends.org - This chart tracks the performance of gold since July of 2002 against the three largest bubbles of the last 40 years. Past bubbles have shown strong but steady growth for the first 7-8 years before moving into a hyper-growth phase for the last 18-24 months. Each series is adjusted for inflation and is smoothed with a 3-month moving average.

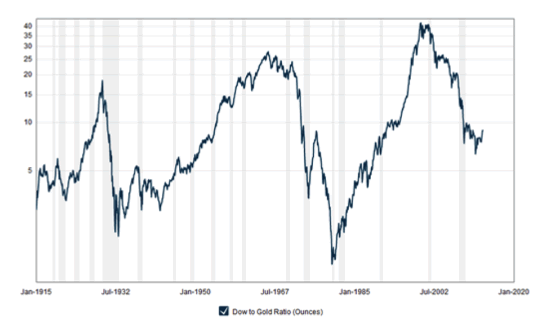

Dow vs. Gold Over the Last 100 Years and in the Current Bull Market

When we look at the Dow to Gold ratio for the last 100 years we see that the Dow has traded between less than 5 times the price of gold on several different occasions. Most of this time was between 1915 and 1940s, with the exception of the roaring 20s when the stock markets outperformed gold significantly. The only other time we saw gold become over valued compared to the Dow was during the 60s and 70s, this was the last time when gold was in a bull market and it lasted less than 20 years. From the early 1980s to about 2000, the Dow has clearly outperformed gold going from one extreme to another. In fact, at the peak of the Dow to gold ratio in 1999, you could buy the Dow 45 times over gold, but ever since then gold has been outperforming the Dow up until recently. What we haven’t seen during this bull market for gold is a Dow to Gold ratio below 5 which could easily mark gold as way over valued compared to the Dow. In order for gold to be considered in a bubble territory, history has shown us that we need the ratio to be clearly below 5 to 1 on a spike low.

Graph courtesy of Macrotrends.org

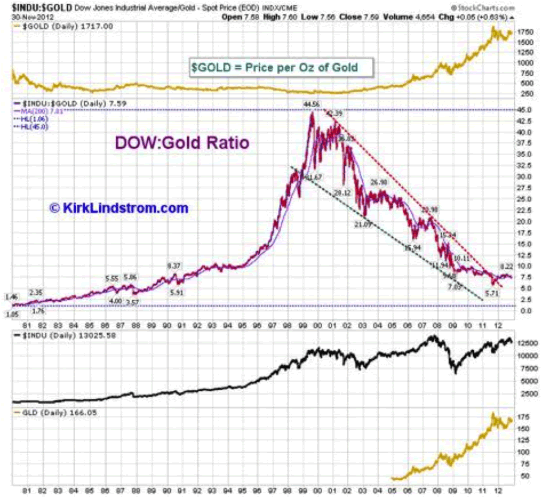

Now let’s take a look at the recent chart for Dow to Gold over the last 12 years shown below. Starting in 1999, the Dow was priced 45 times gold and since then has given up a significant portion of that ratio. In 2011, the ratio did go as low as 5.7 to 1 when the gold price peaked at about $1900 and ever since then the Dow has been advancing while gold has still been correcting. Today the Dow to Gold ratio is about 9 to 1 and the Dow just made all time highs at 14,286 while gold is sitting at about $1580.

While the ratio is working in favour of the Dow for the moment, it would clearly need to break above 10 to 1 on a strong advance before we can say that gold is in trouble and that the bull market may be over. The 10 to 1 Dow to Gold ratio can be considered the line in the sand; this is where a period of great consolidation will take place before any judgement can be made. Assuming gold stays at about $1600, the Dow can easily move to all time new highs and towards 16,000, it will probably do so by May. At that time, the Dow will most likely take a pause and possibly start a correction going into the summer.

The only question is what will gold do once we reach the 10 to 1. Does it enter a strong bear market and retreat further compared to the Dow as it goes on to make all time highs from Fed enduced printing? Or does the bull market in gold reassert itself and the Dow starts a correction as we move back towards a 5 to 1 ratio. Looking at the chart above, the Dow to Gold ratio is still in favour of gold but has started to move sideways. Maybe a new trading range of 5 to 1 and 10 to 1 between the Dow and Gold still holds for the remainder of the decade. If that is the case, we are much closer to the Dow being at a top and gold at a bottom if the 10 to 1 ratio holds. At some point in the next decade we could see this ratio dip below 5 to 1 which would mean a strong rise in gold compared to the Dow at it enters bubble territory, but we are clearly not there yet.

One thing the charts above clearly show are that gold has never entered a strong parabolic rise into bubble territory. If that was the case, we would have seen a strong percentage gain of several hundred percent in gold within a very short period of time, of which it would be all given back in the same amount of time. Also, looking at the 100 year Dow to Gold ratio chart, the ratio never went below 5 to one which would mark that gold was way over valued compared to the Dow on a historical basis.

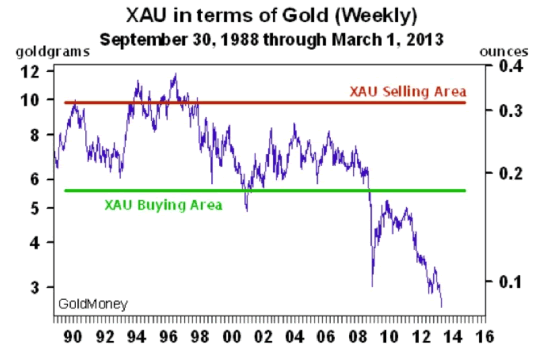

The Gold Miners Have Under Performed Everything

As for the gold miners, the XAU is a much broader index used to measure the performance of 30 mining companies. A chart courtesy of James Turk from Gold Money shows how the miners have done compared to gold since 1988. As we can clearly see, gold has outperformed the Dow and the miners during the current Bull Run we have been in. Following the melt down that started in 08, the miners have seriously underperformed and have gone on to historical lows compared to gold. During the 90s when there was technically no bull market in gold and you could buy the mining companies in the XAU index between 6 to 10 grams of gold. The range between 6 to 8 grams of gold for the XAU held between 2001 and 2008 when the bull market started. Since 2008, the miners have seriously underperformed versus gold and you can now buy the index for less than 3 grams of gold. The miners are extremely cheap compared to gold; in fact they probably have never been this cheap throughout history.

If you enjoyed reading this article and are interested in protecting your wealth with precious metals, you can receive our free blog by visiting TDV Golden Trader.

Cheers,

Vin Maru

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2013 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

Wednesday, March 06, 2013

Gold Eating the Dow for Breakfast / Commodities / Gold and Silver 2013

By: Adrian_Ash

How to get past money illusion now that it's day-break in America once again...

How to get past money illusion now that it's day-break in America once again...

FORGET about the Apple effect. Not including AAPL in its 30 constituents is just one of the Dow Jones Industrial Average's many quirks.

So too is its ever-changing Dow divisor, a number seemingly picked at random to smooth out the math in the DJIA. But neither of these oddities changes the fact that this oddest of equity averages is hitting new all-time highs right now.

Read full article... Read full article...

Wednesday, March 06, 2013

Raging Gold Bull and Disputed Propaganda / Commodities / Gold and Silver 2013

By: Jim_Willie_CB

The propaganda has turned openly laughable. On the popular major financial news networks, the recent decline in the so-called Gold price has prompted quite the parade of clowns on the ship of fools to trumpet nonsense. The widely published and posted Gold price is dominated by futures contracts, and thus as corrupted as meaningless. The entire global financial structure is crumbling before our eyes. The gang of central bankers has applied their monetary policy for four and a half years since the implosion of Lehman, Fannie Mae, and AIG. The first is dead, while the second has transformed into a sanctioned subprime lender again, and the latter is a sinkhole. The deceptive messages are shrill, acute, and motivated from desperation.

The propaganda has turned openly laughable. On the popular major financial news networks, the recent decline in the so-called Gold price has prompted quite the parade of clowns on the ship of fools to trumpet nonsense. The widely published and posted Gold price is dominated by futures contracts, and thus as corrupted as meaningless. The entire global financial structure is crumbling before our eyes. The gang of central bankers has applied their monetary policy for four and a half years since the implosion of Lehman, Fannie Mae, and AIG. The first is dead, while the second has transformed into a sanctioned subprime lender again, and the latter is a sinkhole. The deceptive messages are shrill, acute, and motivated from desperation.

Wednesday, March 06, 2013

The Mexican standoff: Gold, Banxico and the Bank of England / Commodities / Gold and Silver 2013

By: Jan_Skoyles

Late last month it was reported that Mexico are going to organise an audit of their gold stored at the Bank of England.

Late last month it was reported that Mexico are going to organise an audit of their gold stored at the Bank of England.

Financial journalist Guillermo Barba, writes that that the Mexican Superior Audit of the Federation (“ASF” in Spanish) has made an official ‘recommendation’ that the Bank of Mexico “should “make a physical inspection with the counterparty that has the gold under its custody, in order to be able to verify and validate its physical wholeness and the compliance with the terms and conditions of dealing with this Asset…” It was verified by the ASF that this has never been done by Banxico.”

Read full article... Read full article...

Wednesday, March 06, 2013

Gold Contrarian Bullish Indicator / Commodities / Gold and Silver 2013

By: InvestmentContrarian

Sasha Cekerevac writes: The recent pullback in gold has certainly unnerved long-term investors. It has also seen a dramatic shift in market sentiment. However, recent data shows that this shift in market sentiment has primarily come from shorter-term institutional funds.

Sasha Cekerevac writes: The recent pullback in gold has certainly unnerved long-term investors. It has also seen a dramatic shift in market sentiment. However, recent data shows that this shift in market sentiment has primarily come from shorter-term institutional funds.

When considering gold as an investment, one must consider the timeframe as well as the underlying participants in the market. Market sentiment for every asset class oscillates from overly optimistic to overly pessimistic. The goal for the long-term investor is to use this volatility to accumulate during overly pessimistic times and take profits during overly optimistic times.

Read full article... Read full article...

Wednesday, March 06, 2013

Surprising New Paradigm in the Gold and Silver Markets! / Commodities / Gold and Silver 2013

By: Rambus_Chartology

How many times have we heard that the precious metals stocks are so oversold and cheap that they can’t go any lower and have to rally. They just can’t go any lower because the low in 2008 was the absolute low that will never be hit again as it was just an extraordinary event. A precious metal stock crash that was a once in a lifetime thing. So based on that low many PM investors bought their precious metals stocks thinking they were buying on the cheap. I’m wondering if they still think the precious metals stocks were a good buy at that 2008 crash low in the ratio charts?

How many times have we heard that the precious metals stocks are so oversold and cheap that they can’t go any lower and have to rally. They just can’t go any lower because the low in 2008 was the absolute low that will never be hit again as it was just an extraordinary event. A precious metal stock crash that was a once in a lifetime thing. So based on that low many PM investors bought their precious metals stocks thinking they were buying on the cheap. I’m wondering if they still think the precious metals stocks were a good buy at that 2008 crash low in the ratio charts?

Wednesday, March 06, 2013

Gold Price "Tug of War" as Asians Buy Physical and ETF Investors Sell / Commodities / Gold and Silver 2013

By: Ben_Traynor

U.S. DOLLAR prices to buy gold hovered around $1575 per ounce Wednesday morning in London, in line with last week's close, as dealers in Asia reported an increase in demand for physical bullion, in contrast with exchange traded funds, which have continued to see selling, in what one analyst calls a "tug of war" between physical buying and ETF selling.

U.S. DOLLAR prices to buy gold hovered around $1575 per ounce Wednesday morning in London, in line with last week's close, as dealers in Asia reported an increase in demand for physical bullion, in contrast with exchange traded funds, which have continued to see selling, in what one analyst calls a "tug of war" between physical buying and ETF selling.

"Short-term, gold should drift lower to the short-term support line at $1569/65 or even to the previous low at $1555," say technical analysts at Societe Generale.

Read full article... Read full article...

Wednesday, March 06, 2013

Dow Down 50% Against Gold Since Last Record Dow in October 2007 / Commodities / Gold and Silver 2013

By: GoldCore

Today’s AM fix was USD 1,574.00, EUR 1,207.98 and GBP 1,043.42 per ounce.

Today’s AM fix was USD 1,574.00, EUR 1,207.98 and GBP 1,043.42 per ounce.

Yesterday’s AM fix was USD 1,584.25, EUR 1,214.82 and GBP 1,044.33 per ounce.

Silver is trading at $28.68/oz, €22.10/oz and £19.09/oz. Platinum is trading at $1,596.70/oz, palladium at $736.00/oz and rhodium at $1,200/oz.

Read full article... Read full article...

Tuesday, March 05, 2013

Yes, Gold Prices ARE Being Manipulated, Here's What To Do About It / Commodities / Gold and Silver 2013

By: Money_Morning

Keith Fitz-Gerald writes: If you've ever suspected gold prices are being manipulated, you're not alone--and you're right, they are.

Keith Fitz-Gerald writes: If you've ever suspected gold prices are being manipulated, you're not alone--and you're right, they are.

Against the backdrop of fiscal mismanagement, political incompetence, and failed austerity measures, the world's biggest traders have all bet heavily on gold. Lately, they've been pulling out all the stops to get what they want while laughing all the way to bigger bonuses.

Read full article... Read full article...

Tuesday, March 05, 2013

SPDR Gold Trust (GLD) Sees Longest Ever Run of Gold Outflows / Commodities / Gold and Silver 2013

By: Ben_Traynor

U.S. DOLLAR gold prices climbed to $1584 an ounce Tuesday morning, 1.2% above last week's low, as stocks and commodities also edged higher and the Dollar weakened slightly after another Federal Reserve policymaker spoke in favor of ongoing quantitative easing.

U.S. DOLLAR gold prices climbed to $1584 an ounce Tuesday morning, 1.2% above last week's low, as stocks and commodities also edged higher and the Dollar weakened slightly after another Federal Reserve policymaker spoke in favor of ongoing quantitative easing.

Silver hovered just below $29 an ounce this morning, 3.5% up on last week's low, while major government bond prices fell.

Read full article... Read full article...

Tuesday, March 05, 2013

Record Silver Eagle Sales - SocGen Say Silver “Cheaper Alternative To Gold” / Commodities / Gold and Silver 2013

By: GoldCore

Today’s AM fix was USD 1,584.25, EUR 1,214.82 and GBP 1,044.33 per ounce.

Yesterday’s AM fix was USD 1,578.00, EUR 1,214.13 and GBP 1,049.06 per ounce.

Silver is trading at $28.93/oz, €22.30/oz and £19.16/oz. Platinum is trading at $1,588.50/oz, palladium at $722.00/oz and rhodium at $1,200/oz.

Read full article... Read full article...

Tuesday, March 05, 2013

Gold and Interest Rates Direction of Travel / Commodities / Gold and Silver 2013

By: Adrian_Ash

Yes, the real rate of interest matters to gold. But not as much as its direction...

Yes, the real rate of interest matters to gold. But not as much as its direction...

Wall Street and the City are coming to decide that gold is a sell. Because interest rates, they reason, are set to rise sooner than they used to imagine.

This professional money is only half-wrong. Central banks aren't about to hike the returns on cash savings, which have been a wasting asset pretty much non-stop since 2007.

Read full article... Read full article...

Tuesday, March 05, 2013

Central Bankers Are Gaming Gold / Commodities / Gold and Silver 2013

By: The_Gold_Report

Some people may look at the stock market and see economic recovery. Eric Sprott of Sprott Asset Management and Sprott Money looks at myriad other economic indicators and sees an economy still in decline. Despite his suspicions that central banks are keeping gold prices artificially low, he tells The Gold Report that he favors gold, platinum, palladium and especially silver, over the near and long term.

Some people may look at the stock market and see economic recovery. Eric Sprott of Sprott Asset Management and Sprott Money looks at myriad other economic indicators and sees an economy still in decline. Despite his suspicions that central banks are keeping gold prices artificially low, he tells The Gold Report that he favors gold, platinum, palladium and especially silver, over the near and long term.

The Gold Report: The price of gold has dipped under $1,600/ounce ($1,600/oz); silver is below $30/oz. Is this a case of living by the sword and dying by the sword, where precious metals prices only go up in a bad economy and are doomed to languish when things go well?

Read full article... Read full article...

Monday, March 04, 2013

Silver Prices Defy the “Law of Supply and Demand” / Commodities / Gold and Silver 2013

By: DeviantInvestor

Mike McGill writes: Let’s begin with a definition. Investopedia.com defines the Law of Supply and Demand as follows:

Mike McGill writes: Let’s begin with a definition. Investopedia.com defines the Law of Supply and Demand as follows:

The effect that the availability of a particular product and the desire (or demand) for that product has on price. Generally, if there is a low supply and a high demand, the price will be high. In contrast, the greater the supply and the lower the demand, the lower the price will be.

Read full article... Read full article...

Monday, March 04, 2013

China’s $3.3 Trillion FX Reserves Could Buy All World’s Gold Twice / Commodities / Gold and Silver 2013

By: GoldCore

Today’s AM fix was USD 1,578.00, EUR 1,214.13 and GBP 1,049.06 per ounce.

Today’s AM fix was USD 1,578.00, EUR 1,214.13 and GBP 1,049.06 per ounce.

Friday’s AM fix was USD 1,570.00, EUR 1,203.99 and GBP 1,043.74 per ounce.

Silver is trading at $28.75/oz, €22.11/oz and £19.20/oz. Platinum is trading at $1,584.25/oz, palladium at $719.00/oz and rhodium at $1,200/oz.

Read full article... Read full article...

Monday, March 04, 2013

Gold Upside "Limited" Despite Comex Repositioning / Commodities / Gold and Silver 2013

By: Ben_Traynor

THE SPOT gold price dropped to $1575 per ounce Monday morning in London, broadly in line with where it ended last week, while stocks ticked lower and the Euro held steady near two-month lows against the Dollar ahead of this Thursday's European Central Bank policy meeting.

THE SPOT gold price dropped to $1575 per ounce Monday morning in London, broadly in line with where it ended last week, while stocks ticked lower and the Euro held steady near two-month lows against the Dollar ahead of this Thursday's European Central Bank policy meeting.

"For gold, the trending and momentum indicators are pointing lower," says a note from UBS, "indicating any upside in the near-term must be limited."

Read full article... Read full article...

Monday, March 04, 2013

Reasons to Sell Gold and Silver Now / Commodities / Gold and Silver 2013

By: Shelby_H_Moore

Sell or hedge a portion of your physical. Sell all mining stock asap.

Gold may dive below $1200 and silver below $21 ($1400 is very likely), due

to fact that USA $1.2 trillion fiscal cuts are going to occur. Obama wants

to use this to make the public hate the Republicans, so he can get a

majority in Congress at the mid-term elections, so then he can run the

country like a dictatorship his last 2 years.