Dow Down 50% Against Gold Since Last Record Dow in October 2007

Commodities / Gold and Silver 2013 Mar 06, 2013 - 10:24 AM GMTBy: GoldCore

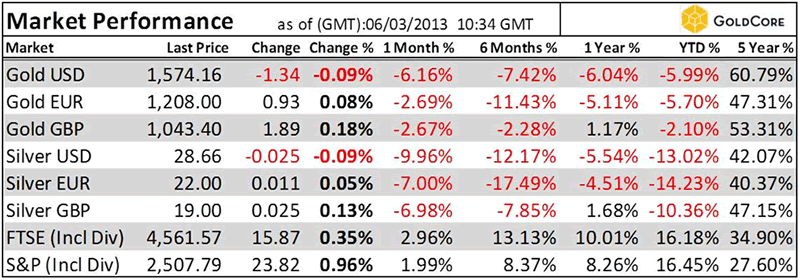

Today’s AM fix was USD 1,574.00, EUR 1,207.98 and GBP 1,043.42 per ounce.

Today’s AM fix was USD 1,574.00, EUR 1,207.98 and GBP 1,043.42 per ounce.

Yesterday’s AM fix was USD 1,584.25, EUR 1,214.82 and GBP 1,044.33 per ounce.

Silver is trading at $28.68/oz, €22.10/oz and £19.09/oz. Platinum is trading at $1,596.70/oz, palladium at $736.00/oz and rhodium at $1,200/oz.

Gold rose $1.20 or 0.08% yesterday in New York and closed at $1,575.00/oz. Silver surged to a high of $29.07 and fell down to $28.51, but it still finished with a gain of 0.42%.

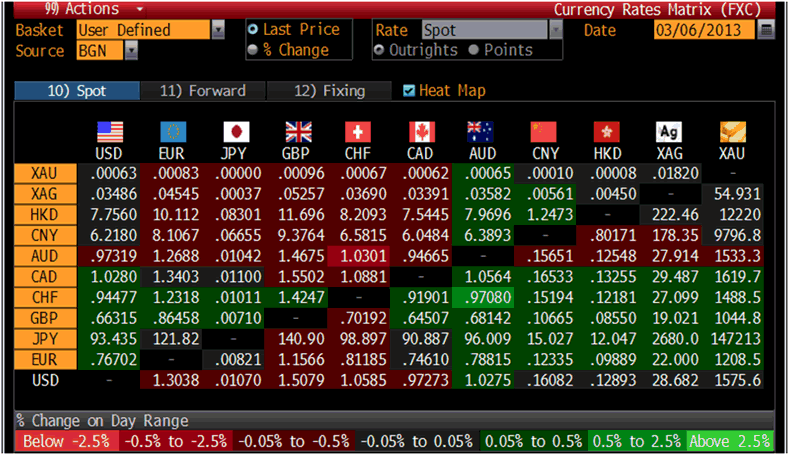

Cross Currency Table – (Bloomberg)

Gold edged higher in Asian and European trading today, supported by modest physical demand in Asia and from central banks. This continuing demand is creating expectations that prices will consolidate at current levels before moving higher again.

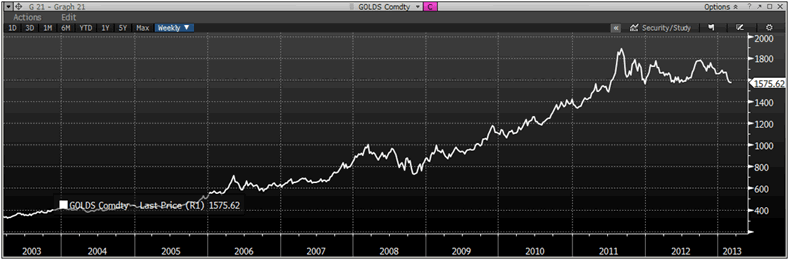

Dow Gold Ratio, 2003-2013 – (Bloomberg)

Prices have been range bound between $1,564/oz and $1,587/oz over the past few weeks which suggests consolidation.

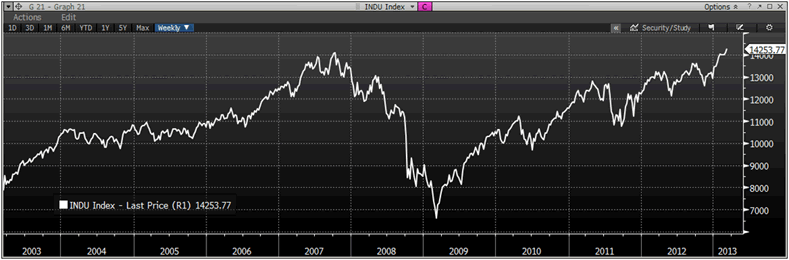

INDU Index Weekly, 2003-2013 – (Bloomberg)

Currency debasement is being seen internationally and will again benefit gold in the medium and long term. The second round of money printing by the Federal Reserve pushed spot gold prices to a record nominal high of $1,920.94/oz in September 2011.

Given continuing debasement new record nominal gold highs and indeed inflation adjusted gold highs over $2,400/oz will almost certainly be seen in the coming months.

This currency debasement and ‘stimulus’ on a scale never before seen in financial and monetary history contributed to the Dow Jones Industrial Average reaching a new record high yesterday.

Gold Price Weekly, 2003-2013 – (Bloomberg)

The Dow Jones Industrial Average hit a new high yesterday, surpassing the previous high of 14,164 on 9 October 2007 leading to proclamations that ‘happy times are here again.’

However, importantly in gold terms, the Dow has not made any gains whatsoever, rather it has fallen by 50% (see chart).

In gold terms the DJIA has fallen from above 18 to 9.05 today and this clearly shows how the DJIA is not a good barometer for the health of an economy – especially one completely dependent on ultra loose monetary policies.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.