Where Are the Bond Vigilantes? Rise of the Dollar Vigilante

Interest-Rates / US Bonds Nov 18, 2010 - 10:58 AM GMTBy: Jeff_Berwick

Last seen in full force in the inflationary early 1980s, bond vigilantes were shadowy figures who were said to have rebelled and swore to keep central banks and governments honest by raising long term interest rates whenever the authorities kept their own interest rates too low, or let budget deficits grow out of control.

Last seen in full force in the inflationary early 1980s, bond vigilantes were shadowy figures who were said to have rebelled and swore to keep central banks and governments honest by raising long term interest rates whenever the authorities kept their own interest rates too low, or let budget deficits grow out of control.

Yet now, with interest rates at near zero percent and budget deficits in the US stretching the boundaries of belief, not a peep.

Some say that bond vigilantes are re-awakening and showing their power to deeply bankrupt states such as Ireland and Greece. But that’s not bond vigilanteism, that’s just people selling bonds from an obvious insolvency situation. A bond vigilante would have, or should have, been selling Greek and Irish bonds years ago.

Others say that the bond vigilantes of today are other central banks as they are the largest holder of sovereign debt. But other central banks cannot be vigilantes without being hypocrites. After all, how could the People’s Bank of China state they are selling US Treasury Bonds because they are unhappy with the Federal Reserve’s Quantitative Easing money printing plan when they themselves have been inflating at rates even higher than the Fed’s and just injected a net CNY74 billion (US$11.14 billion) into the Chinese money market this week through its open-market operations, in a bid to “ease a liquidity crunch”.

One of the most identifiable bond vigilantes of the past is George Soros who , on September 16, 1992, Black Wednesday, sold short more than US$10 billion worth of pounds against the Bank of England's reluctance to either raise its interest rates to levels comparable to those of other European Exchange Rate Mechanism countries or to float its currency.

The BoE finally withdrew the currency from the European Exchange Rate Mechanism, devaluing the pound sterling, earning Soros an estimated US$1.1 billion. He was dubbed "the man who broke the Bank of England”.

And so, where is George now? He is clearly now part of the system and is doing embarrassing road shows trying to sell people on the importance of combating “global warming” and on global carbon taxes, years after the global warming ruse has been thoroughly debunked.

As for other big-time capitalists, like Warren Buffett, he recently penned an op-ed to the New York Times on November 16 where he gushingly thanks the US government and the Federal Reserve for bailing out himself and the majority of the defunct, non-free market, US financial system. Not once does he mention that it is the US taxpayer who did the bailing. Nor does he even seem to realize that is the case.

Both George and Warren have become one with the system. As their businesses became more and more entwined with the system, with Warren becoming a major investor in the vampire squid, Goldman Sachs, it has become clear that the older generation of capitalists have no interest in keeping governments in check – and have every interest in continuing to expand the size and scope of government.

Despite the fact that Warren Buffett’s father was a massive proponent of gold being an integral part of a money system in order to restrain governments, Warren has long been against any form of free market money.

Warren’s father, Howard Buffett, a libertarian-conservative banker who served four terms in Congress, fought against Roosevelt’s New Deal and Truman’s Fair Deal. The same type of “Deals” that Barack Obama embodies today and that Warren Buffett and George Soros promote.

This quote from Howard Buffett in 1948 on gold stands in stark contrast to the views held by his son, “When you recall that one of the first moves by Lenin, Mussolini and Hitler was to outlaw individual ownership of gold, you begin to sense that there may be some connection between money, redeemable in gold, and the rare prize known as human liberty. There is no more important challenge facing us than this issue - the restoration of your freedom to secure gold in exchange for the fruits of your labors.”

Meanwhile, his son Warren, who referred to himself as a “nephew of Uncle Sam” in his recent NY Times Op-Ed has this to say on gold, “It doesn't do anything but cost you charges and stare at you.”

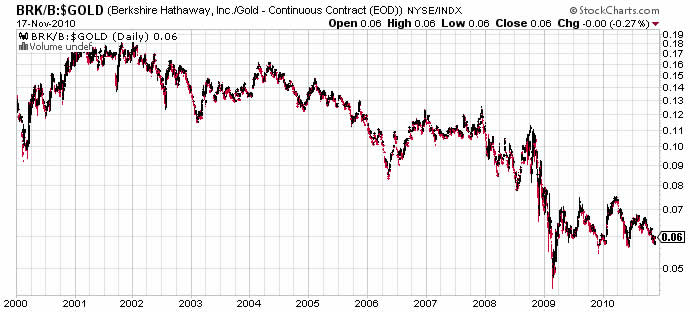

Looking at the relative performance of Berkshire stock to gold (chart below) over the last decade, one might be inclined to pay those charges, Warren.

BOND VIGILANTES ARE OBSOLETE

The truth is that in today’s age of fiat currencies and central banking, bond vigilantes have become obsolete. Governments and their central banks the world over are completely unrestricted in their money printing and they have shown that there is one group of people that they will always be there to save, bond investors.

In May, 2010, during the first flare-up of Greek sovereign debt insolvency, Greece's finance minister said that anyone betting against Greece would lose their shirts. And he was right. As soon as Europe’s first bailout fund was announced, Greece's ten year bond yield had collapsed a remarkable 47% to 6.6% from 12.4%.

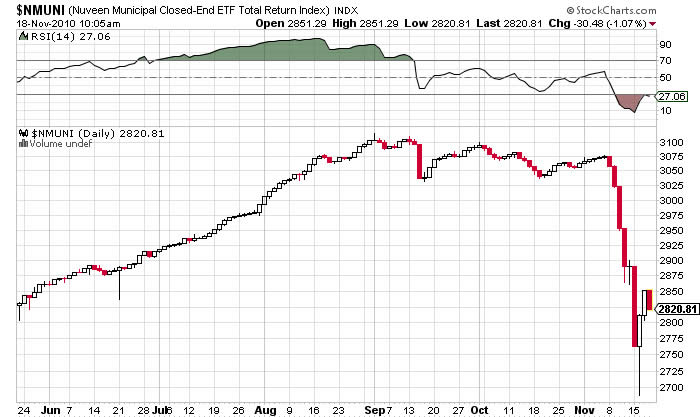

And now it appears the next wave of bond insolvencies will be coming from US municipalities. Municipal bonds had their biggest one-day sell-off since the height of the financial crisis on November 16th (see chart of the Nuveen Municipal Closed End ETF below). The yields on triple A 10-year bonds rose 18 bps to 2.93 per cent, the largest one-day rise since October of 2008, according the MMD index, which is owned by Thomson Reuters.

But what bond vigilante would step in to begin shorting municipal bonds when we live in a world of bailouts?

RISE OF THE DOLLAR VIGILANTE

Can anyone stop out of control governments from eternal deficits, money printing and bailing out the banks and other cogs of the financial system of today? The answer is yes, someone can: Everyone. And they are.

Around the world, individuals are slowly waking up to the tyrannical financial system that coercively forces them to use their paper money and fixes the price of said money (interest rates). Individuals are making the cognizant choice to sell their dollars, yuan, yen, rupees and pesos and buy things of real value with the proceeds.

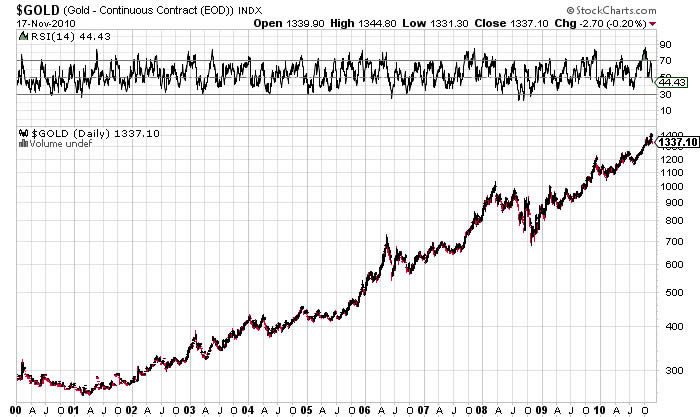

Obvious beneficiaries of this global shift have been the precious metals, gold and silver. Every time Ben Bernanke fires up the helicopters and begins to clusterbomb the world with federal reserve notes the dollar vigilantes sell more dollars and buy more gold and they have been doing so without pause for ten years running.

Clearly people like Bernanke, Soros and Buffett are unaware of the massive shift in perception that is going on. Every day, thanks to the internet, people are realizing that the current monetary and financial system are far from being free-market and, instead, are tightly owned and controlled by a small group of global financial elites who have been using their power and control to steal and destroy wealth for decades.

A global cast of thieves, murderers and sociopaths can meet for billion-dollar caviar and fine wine gnoshing at the G7 and G20 meetings and talk about the need for a new financial order with a basket of fiat currencies at its core but 6 billion+ individuals around the world have already decided which money has more value and on a nearly daily basis now, with the odd correction, for the past decade they have been making their voices heard.

It won’t be too much longer until Bernanke, Soros, Buffett, Geithner, Obama and the like will realize they aren’t in charge anymore.

Subscribe to The Dollar Vigilante to keep abreast of all aspects of the ongoing US dollar financial system collapse and how to protect and grow your assets during this time of great turmoil.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.© 2010 Copyright Jeff Berwick - All Rights Reserved

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.