Social Security: There Is No Trust; There Is No Fund

Politics / US Debt Apr 03, 2009 - 05:41 AM GMTBy: Mike_Shedlock

Social Security is back in the limelight where once again its problems will no doubt be ignored.

Social Security is back in the limelight where once again its problems will no doubt be ignored.

Please consider Recession Puts a Major Strain On Social Security Trust Fund .

The U.S. recession is wreaking havoc on yet another front: the Social Security trust fund.

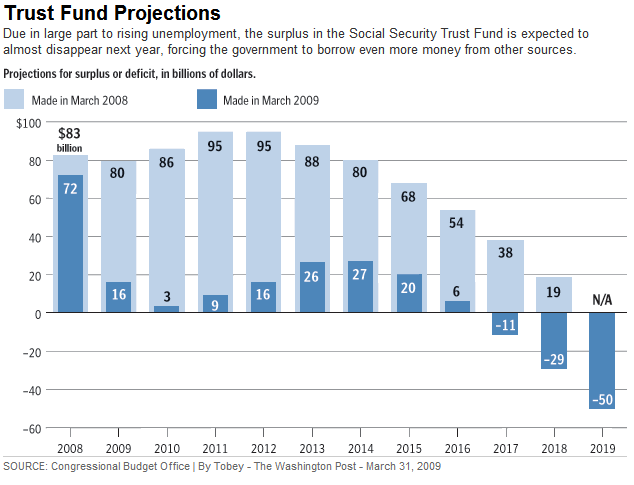

With unemployment rising, the payroll tax revenue that finances Social Security benefits for nearly 51 million retirees and other recipients is falling, according to a report from the Congressional Budget Office. As a result, the trust fund's annual surplus is forecast to all but vanish next year -- nearly a decade ahead of schedule -- and deprive the government of billions of dollars it had been counting on to help balance the nation's books.

The Treasury Department has for decades borrowed money from the Social Security trust fund to finance government operations. If it is no longer able to do so, it could be forced to borrow an additional $700 billion over the next decade from China, Japan and other investors. And at some point, perhaps as early as 2017, according to the CBO, the Treasury would have to start repaying the billions it has borrowed from the trust fund over the past 25 years, driving the nation further into debt or forcing Congress to raise taxes.

My Comment : Therein lies the rub. There is no fund per se. It's all been spent, and then some.

"It suggests we better get working on Social Security and stop burying our heads in the sand," said Sen. Judd Gregg (N.H.), the senior Republican on the Senate Budget Committee. "The Social Security trust fund, though technically in balance, is going to put huge pressures on taxpayers very soon."

My Comment : There is negative money in the fund so it's complete nonsense to claim it is "technically in balance".

Many liberal analysts reject the notion that Social Security needs fixing, arguing that the system is projected to fully support payments to beneficiaries through 2041 -- so long as the Treasury repays its debts.

My Comment : "...So long as the Treasury repays its debt" And exactly how likely is that? Has anyone looked at Obama's budget?

The trust fund has long taken in more in revenue from payroll taxes and other sources than it pays out in benefits. Last August, the CBO predicted that surplus would exceed $80 billion this year and next, then rise to around $90 billion before slowly evaporating by 2020. But the rapidly deteriorating economy -- particularly the loss of more than 4 million jobs -- has driven those numbers much lower much faster, with the surplus expected to hit $16 billion this year and only $3 billion next year, then vanish entirely by 2017.

In his budget, Obama predicted that the trust fund surplus would hit $30 billion this year, according to Mark Lassiter, a spokesman for the Social Security Administration.

But that number, too, is far less than the $80 billion the trustees had forecast for 2009. In addition to declining revenues, Lassiter said the system is likely to incur higher expenses due to big jumps in new retirement and disability claims. Both are expected to rise by at least 12 percent this year compared with 2008.

My Comment : Can we stop with the nonsense? Revenues exceed payouts but that does not mean there is a fund. Every penny and then some has been borrowed and spent. And even the so called surplus is falling like a rock, a decade faster than expected.

Obama's $9.3 Trillion Budget Deficit

Inquiring minds are pondering Obama budget could bring $9.3 trillion in deficits .

President Barack Obama's budget would produce $9.3 trillion in deficits over the next decade, more than four times the deficits of Republican George W. Bush's presidency, congressional auditors said Friday.

The new Congressional Budget Office figures offered a far more dire outlook for Obama's budget than the new administration predicted just last month — a deficit $2.3 trillion worse. It's a prospect even the president's own budget director called unsustainable.

The dismal deficit figures, if they prove to be accurate, inevitably raise the prospect that Obama and his Democratic allies controlling Congress would have to consider raising taxes after the recession ends or else pare back his agenda.

By CBO's calculation, Obama's budget would generate deficits averaging almost $1 trillion a year of red ink over 2010-2019.

Worst of all, CBO says the deficit under Obama's policies would never go below 4 percent of the size of the economy, figures that economists agree are unsustainable. By the end of the decade, the deficit would exceed 5 percent of gross domestic product, a dangerously high level.

Most disturbing to Obama allies like Senate Budget Committee Chairman Kent Conrad, D-N.D., are the longer term projections, which climb above $1 trillion again by the end of the next decade and approach 6 percent of GDP by 2019.

The worsening economy is responsible for the even deeper fiscal mess inherited by Obama. As an illustration, CBO says the deficit for the current budget year, which began Oct. 1, will top $1.8 trillion, $93 billion more than foreseen by the White House. That would equal 13 percent of GDP, a level not seen since World War II.

Trust Fund Projections

Let's return to the ridiculous claim made by analysts: Many liberal analysts reject the notion that Social Security needs fixing, arguing that the system is projected to fully support payments to beneficiaries through 2041 -- so long as the Treasury repays its debts.

For starters it is clear to see the 2041 figure is nonsense. And given that every cent of the fund has been spent, exactly how is the treasury supposed to repay that fund in light of $9.3 trillion (with a T) budget deficits when the "surplus" is a mere $16 Billion (with a B)?

Finally, why does everyone continue the charade of calling Social Security a "trust fund" when it's clearly not a fund and there cannot possibly be any trust in it?

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.