Stock Markets Bullish Like There's No Tomorrow

Stock-Markets / US Stock Markets May 07, 2007 - 09:36 AM GMTBy: Joseph_Russo

THE FINANCIAL SPHERE FLOORS IT

THE FINANCIAL SPHERE FLOORS IT

All that remains to seal absolute victory is to re-mastermind the majestic performance put on by the Clinton/Rubin administration in masterfully engineering a strong dollar policy concurrent with rising equity values, while commodities, gold, and interest rates plunged into the abyss.

FEELING LUCKY - GO AHEAD GET LONG (just don’t be fooled again)

Those who have been sitting on the sidelines, scratching their heads as equity markets go ballistic - fear not. One can BUY their favorite 7-year breakout of choice for the long haul without feeling like a complete fool, to save face and fortune; just remember to get the heck out of Dodge in the event of a majority plateau failure.

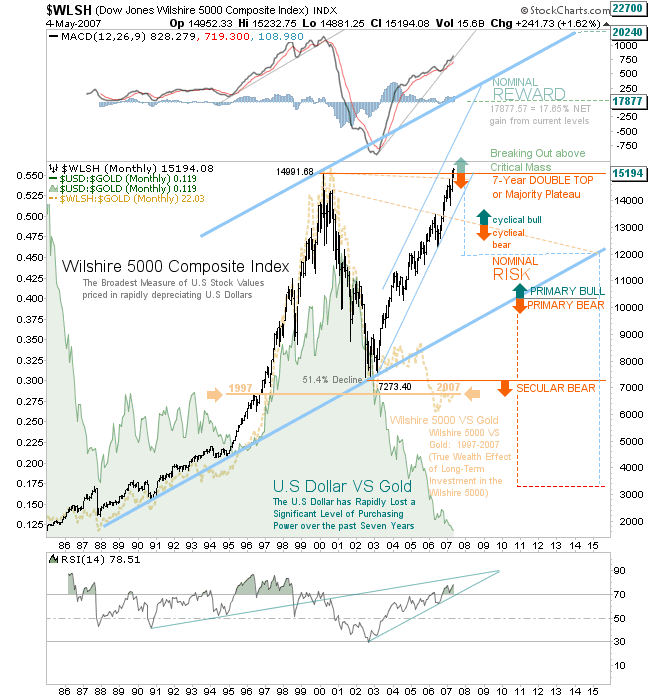

BROADEST MEASURE OF U.S STOCKS CLOSES IN UNCHARTED TERRITORY

What might one expect from the Wilshire 5000 breaking above critical mass? Sizing up, and more importantly, realizing an eventual full range nominal-expansion target of 22700 (50% from current levels) would validate one's anticipated genius. To maintain prudence while embarking upon such an optimistic campaign, all one need do, is set an initial monthly closing stop below 14740 (3%), and then trail it up accordingly. In the event of a false start, no problem, just redeploy the strategy and repeat as necessary.

ONE MORE ESSENTIAL ELEMENT FOR LONG HAUL INVESTORS

We shall assume such brilliant minds have long since acquired, and regularly rebalance at least 10% to 15% of their total net worth (including paper profits on inflated real estate values ) in physical gold and silver bullion. The purpose in adopting such protocol (under ALL market conditions) insures against the ongoing deterioration of purchasing power inherently resident in government issued fiat currency. After all, we would not want to see such genius executed in vain. Therefore, if one is void of this vital investment component, might we suggest earmarking a portion of one's long-haul equity purchases toward strategically planned bullion acquisitions.

THE TAKE AWAY

To survive the persistent and egregious financial horrors bestowed upon us for more than 90-years, we must aggressively pursue practical initiatives in order corner the out-of-control financial sphere in such a way, as to remain whole against every possible outcome to which the masters of illusion may serve us.

HOPE FOR THE FUTURE

Upon inevitable closure to the present paradigms widespread tolerance of illusory and deceptive economics, it is our hope that the generation earmarked to restructure the system, will prevail with minimal sacrifice amid a probable revolution. Furthermore, it will be essential that future generations of stewards contain vast numbers of visionaries, possessing unshakable principles, grounded in truth, holding steadfast to the highest levels of discipline and integrity for themselves, their families, their countries, their planet, and for the greater good of humankind.

THE UPSIDE FOR RIGHT NOW (nominal or otherwise)

The present upside is that robust market's frothing with animal spirit; lend themselves to an abundance of highly profitable, short-term trading opportunities. More experienced participants trade these markets aggressively in attempt to maximize nominal returns. To do so successfully is no small task. First, one must practice sound money management, and maintain a resident understanding and respect for risk. Secondly, one must acquire a competitive edge to assist in the effective deployment of risk capital. We categorize these unique and vital market participants as seasoned traders, or prudent speculators. Elliott Wave Technology devotes its highest level of focus and attention to these bold, creative, and determined combatants.

Traders & Speculators

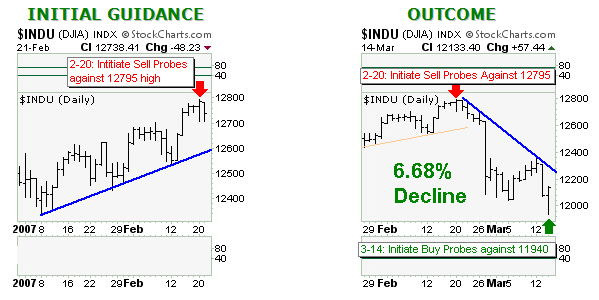

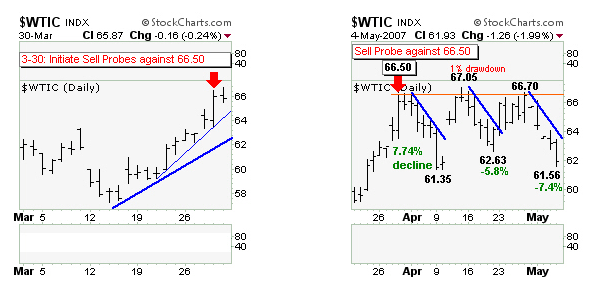

For experienced traders speculating in the short-term direction of broad based indices, Elliott Wave Technology renders unrivaled forecasting guidance from which to execute one's trading plans profitably. Thumbnail charts below illustrate a typical guidance and outcome study reflecting recent short-term forecasts from Elliott Wave Technology's Near Term Outlook .

The above examples are not results of specific trading instructions, or closed trade outcomes. They are representative of Elliottwave Technology's navigational guidance from which speculators gain a unique competitive advantage in formulating and managing their trading offensives.

Our approach to short-term market guidance, and long-term forecasting, is by no means arcane. We never “predict prices” nor become tied to a fixed bias or singular perception; instead, we adapt to the price action as it unfolds. Doing so impartially, enables us to formulate astute and measured guidance based on the dynamic evolution of price.

Trade Better / Invest Smarter...

By Joseph Russo

Chief Editor and Technical Analyst

Elliott Wave Technology

Copyright © 2007 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.