Weimar Hyperinflation Gold And Silver Ratio Revisited

Commodities / Articles Mar 04, 2009 - 04:50 AM GMTBy: Roland_Watson

I wrote an article some years back pointing out an interesting fact about gold and silver during the great Weimar hyperinflation. That article lay dormant for some time until last October when I suddenly received dozens of emails about it from gold investors. As it turned out, the article had been mentioned on the website of one of gold's well known commentators and hence the rush of emails.

I wrote an article some years back pointing out an interesting fact about gold and silver during the great Weimar hyperinflation. That article lay dormant for some time until last October when I suddenly received dozens of emails about it from gold investors. As it turned out, the article had been mentioned on the website of one of gold's well known commentators and hence the rush of emails.

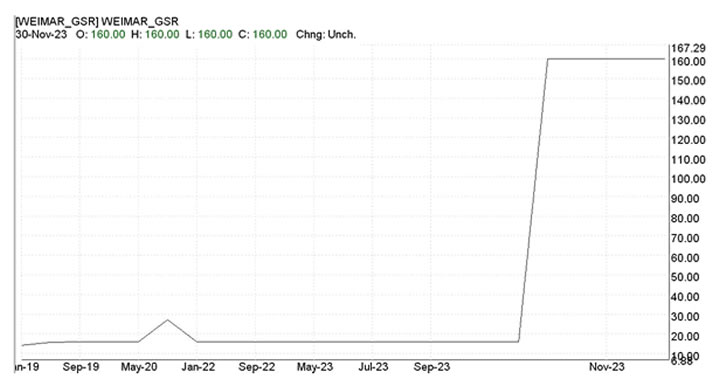

The point of that article is summarized in the chart below which displays the gold-silver ratio for German Marks between 1919 and 1923. As expected, the ratio moved near the historic level of 16 despite both prices rocketing as hyperinflation took a hold. The mystery was why the ratio leapt from 16 to 160 from October 1923.

The answer was soon discovered on a perusal of German events around that time. As I wrote in that prior article:

"On October 23rd, the communists began an uprising in Hamburg. With memories of the Bolshevik Revolution of 1917 still fresh in the memories of Germans, this must have set alarms bells furiously ringing. Was Weimar Germany about to go the way of Tsarist Russia? The message racing through the minds of many a panicked German must have been "Get out of here!" and spare no expense in doing so!

Tales of mass executions and the often violent expropriation of wealth by Lenin and his cohorts surely would have focused the minds of wealthy Germans on getting their wealth changed into a form that was easily transportable and that could only mean gold. With an equivalent amount of silver weighing about sixteen times as much, it seems quite apparent that demand for gold skyrocketed whilst other forms of tangible but more cumbersome wealth were traded in for gold to the extent that people were prepared to give up 90% of their assets to accommodate this dectupling of the gold price. It must have been a desperate frame of mind that bid gold up to such feverish prices."

So the story goes and I see no reason to change my conclusions. The question is how relevant is that scenario for today? People who are more gold oriented than silver will use this as an argument to hold gold rather silver in times of crisis. After all, portability of wealth is an important consideration if one is forced to move at short notice.

Well, the first question to ask is whether we are in a time of crisis that is comparable to Weimar Germany in 1923? The answer is clearly " No " and is easily demonstrated. Let me ask you a few questions.

Are Americans burning dollars to fuel their stoves as the paper costs more than the face value?

Is inflation running at a rate where prices double every week, day or even worse?

Has any American city succumbed to a takeover by radical groups anywhere?

The answer to all these questions is a resounding " No " - not even close. You may wish to argue that these things are going to happen soon but what are the facts? Gold has failed to take out its March 2008 highs despite things appearing to be even worse than March 2008. This is in the face of gold bullion disappearing off the counters worldwide.

You have two choices here, you either deduce the markets have already discounted the panic in the price of gold or the price of gold is not truly reflecting the panic. Those who take the latter view believe the gold price is therefore being suppressed. That of course begs the question why gold ever managed to get from $255 to $1032 in the first place. Either a gold suppression scheme does not exist or it is impotent and therefore not worthy of serious consideration.

In my opinion, the financial panic is near its conclusion. Do not expect the Dow and gold simultaneously at $3000 - that is not for this present time. The equity markets are rapidly approaching a bottom that may never be seen again. If you are sidelined in cash waiting for Dow 3000, you may end up sitting on cash for the rest of your life.

But what about the argument regarding portability of hard wealth? Today gold and silver have been digitized. You can open a storage account with a number of companies and have your metal stored in various vaults around the world (though when you can hold $100,000 worth of gold in one hand I was never convinced of the absolute need for a gold storage scheme). If you don't think one country will be safe in a crisis then you can move it to another country for storage. In other words, unlike our rich Germans, we can store it quickly beyond the immediate area of crisis. I bet those Germans would have loved the idea of opening a storage account via the Internet in Britain or the USA and buying up the desired amount of gold and silver ready to be reclaimed if they had to flee the country.

We have that option and if you feel insecure in your precious metal holdings then by all means open an account in Britain, Switzerland or some other perceived safe haven. The main point I see for such accounts is liquidity. When you buy or sell precious metals, it may be quicker to sell into a price spike by this method as other methods may incur more delay and miss the spike. Alternatively, it also has the advantage of buying in at a major bottom without having to fight the high premiums we see for retail bullion products just now.

I am personally thankful that technology has advanced to the stage that we have these great and varied advantages over our Weimar investors. So let us use them to our benefit whether we are gold investors or otherwise.

By Roland Watson

http://silveranalyst.blogspot.com

Further analysis of the SLI indicator and more can be obtained by going to our silver blog at http://silveranalyst.blogspot.com where readers can obtain the first issue of The Silver Analyst free and learn about subscription details. Comments and questions are also invited via email to silveranalysis@yahoo.co.uk .

Roland Watson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.