Beginning Now: The Panic Phase of the Economic Collapse

Stock-Markets / Economic Depression Mar 02, 2009 - 08:48 AM GMT If you missed our latest video, “The 11 Laws of Bear Market Success,” or you want to watch it again, click here now for the recording.

If you missed our latest video, “The 11 Laws of Bear Market Success,” or you want to watch it again, click here now for the recording.

The timing couldn't be better. Indeed …

Just as the Obama Administration launches a triple tirade of new initiatives — a record stimulus package, a bigger round of rescues, and the largest deficit financing of all time …

Just as the Treasury Department doubles down on its bailouts for sinking giants — Fannie Mae, Freddie Mac, AIG, General Motors, Chrysler, and Citigroup …

And precisely when the government has raised hopes for a recovery in 2010 …

The panic phase of this collapse is about to begin.

The panic phase is an acceleration in the economic decline … a chain reaction of debt explosions … a free-fall in the financial markets … and a series of rude awakenings that will accelerate the decline even further:

Rude Awakening #1

In a Collapse, Washington's Economic

Forecasting Models Are Worthless.

Economists rely on computer models designed to forecast gradual, continuous, linear changes, such as economic growth.

But these models are incapable of handling sudden, discontinuous, structural changes, such as housing market collapses, mortgage meltdowns, megabank failures, credit market shutdowns, or stock market crashes.

Already, as explained by the New York Times on Saturday ,

“The fortunes of the American economy have grown so alarming and the pace of the decline so swift that economists are now straining to describe where events are headed, dusting off a word that has not been indulged since the 1940s: depression.”

They're a bit late. Three months ago, in “ Depression, Deflation and Your Survival ,” we warned you that we were sinking into America's Second Great Depression. And today, that's precisely what's happening.

But with no other model to turn to, most economists continue to forecast the future in terms of moderate, incremental changes.

In the panic phase now unfolding, a growing number will begin to realize how wrong they've been. They'll see that this crisis represents a clean break with the past, rendering their forecasting models worthless.

Some already see the light. It's only a matter of time before they admit it in public.

Rude Awakening #2

The Economy Is Sinking Three to

Five Times Faster Than Expected.

Every single step taken by the Bush and Obama administrations has been based on the flawed assumptions embedded in their economic models. They assume that:

- the world economy is not collapsing …

- the banking system is not broken …

- corporations, investors, consumers and entire nations will not take drastic action to protect their own interests, and, therefore …

- we will not see widespread factory shutdowns, wholesale layoffs, mass dumping of assets, or major new trade barriers.

They assume that none of this is happening or will continue to happen. They assume that the six-decade growth cycle that began after World War II remains largely intact. They think, talk and act as though we were still living in an era that's now over.

Each of these assumptions is, on the face of it, patently false. And yet, it's based on these assumptions that our government continues to spend, lend or guarantee TRILLIONS of dollars.

Starting right now, however, we can begin to see the first signs of a rude awakening in that realm as well:

- The New York Times reports “a sense of disconnect between the projections of the White House and the grim realities of everyday American life.”

- Economist Allen Sinai calls the White House's economic forecasts “a hope, a wing and prayer.”

- Even Obama advisor Paul Volcker admits this crisis is swifter and broader than that of the Great Depression — something that, at this juncture, most Obama advisers refuse to admit.

Despite all these doubts, however, the average GDP forecast of most private economists differs only marginally from the rosy forecasts of the White House. Specifically …

In 2009, the White House predicts the economy will contract by a meager 1.2 percent, while private economists predict a decline of only 2.0 percent.

The grim reality:

- The 6.2 percent plunge in the fourth quarter — plus a similar decline estimated for the current quarter — shows the economy is now sinking three to five times faster than they're forecasting for the year.

- There is absolutely no sign that the decline is ending and every sign that it's accelerating .

- Thus, to contain this year's decline to the meager 1 or 2 percent that the government and private economists are projecting would require a comeback in the second half that's nothing short of a miracle.

In 2010, the White House says the economy will grow 3.2 percent, while private economists say it will grow 2.1 percent.

The grim reality:

|

- In America's First Great Depression, the financial collapses beginning in 1929 led to GDP declines of 8.6 percent in 1930, 6.4 percent in 1931 and 13 percent in 1932.

- But in this cycle — America's Second Great Depression — the financial collapses that we saw in 2008, such as Bear Stearns, Lehman Brothers, Fannie and Freddie, Washington Mutual, Wachovia, AIG, Citigroup and many others, were markedly worse than those of 1929.

That doesn't necessarily mean that the GDP declines in 2009, 2010 and 2011 will be worse than those of the early 1930s. But it does mean that the 2 or 3 percent growth now forecast by private and government economists for 2010 is clearly a pipedream.

In the panic phase now unfolding, some prominent economists are now beginning to recognize their forecasts may be full of holes. It's only a matter of time before they admit it in public.

Rude Awakening #3

The Dangerous, Unintended Consequences of the

Government's Rescue Efforts Can Only Deepen,

Broaden and Prolong the Economic Decline.

These include:

- The dangerous and inevitable surge in government borrowing. Even with its fairy-tale forecast of a meager 1.2 percent decline in the economy this year, the White House projects a 2009 federal budget deficit of $1.75 trillion. If you assume the average private forecast of a 2 percent GDP decline, the deficit automatically grows beyond $2 trillion. And the only neutral assumption for GDP — no deceleration or acceleration in the 6.2 percent rate of decline now underway — leads you to a deficit that makes the above projections look puny by comparison.

- The dangerous and inevitable surge in borrowing costs. Even in the government's unrealistic rosy scenario, the explosion in government borrowing must drive real rates of interest sharply higher. There is simply no other conceivable scenario.

- The dangerous and inevitable damage caused by higher interest rates. When interest rates go up, they go up for nearly everyone, sweeping across the economic landscape into every home, business, or government. Result: Even a rate rise of just a few percentage points can quickly neutralize and overwhelm any benefits derived from the government's stimulus spending, banking bailouts or expansive budget plans.

- A dangerous and inescapable two-tiered market for credit. What happens when the government pumps money into defaulting households or failing banks even while nearly all other interest rates are rising? The answer is simple: The lucky few who get government aid are able to borrow at lower interest rates. But the vast majority, not eligible for government money, must pay much higher rates than they'd pay otherwise.

- A dangerous diversion of precious capital from strong hands to weak hands. With government money pouring into the weakest households and companies, precious resources are diverted from strong hands — those who could best help bring about a recovery — to weak hands, including those who were most responsible for the bust. Already, companies like Berkshire Hathaway, despite triple-A ratings, are paying record high spreads to borrow … while banks and others which get government guarantees can borrow far more cheaply, despite abysmal credit ratings and balance sheets.

In the panic phase of the crisis now unfolding, a minority of Washington and Wall Street experts is beginning to fear these dangerous consequences. It's only a matter of time before they openly confess their real concerns.

Sadly, though, confession is one thing; action is another. And sadly, each of these unintended consequences deepens the depression, spreads the pain, prolongs the crisis, and weakens the eventual recovery.

Rude Awakening #4

Investors Who Fail to Take Protective

Action Could Lose as Much as 90 Percent

In Virtually Every Asset Imaginable.

In an economic collapse of this magnitude, the only predictable bottom in the value of most assets is zero . In that context, any value investors can squeeze out of their assets that's significantly above zero must be counted as a blessing.

Here are my forecasts for each major investment sector …

Stocks:

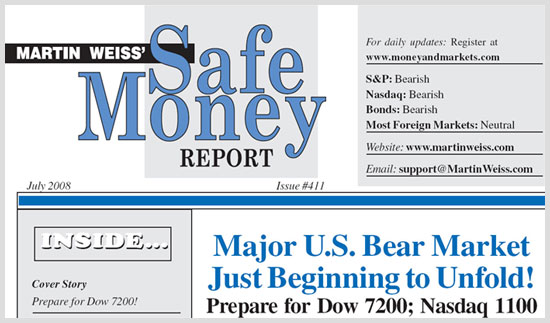

Eight months ago, in our July 2008 Safe Money Report headlined “ Major U.S. Bear Market Just Beginning to Unfold ,” we set our medium-term target for the Dow Jones Industrials at 7200. Now, that target has been reached.

Then, three months ago, in our December 2008 Safe Money headlined “ Starting Now: America's Second Great Depression ,” we set a new target at 5500 on the Dow.

And three weeks ago, based on the fundamental measures provided by Claus Vogt , editor of the German edition of our Safe Money Report , we have further revised that forecast to

- 5000 on the Dow

- 500 on the S&P 500, and

- 900 on the Nasdaq.

Today, Dow 5000 may seem far away. But with the Industrials closing at 7063 on Friday, it's actually relatively close: All that's needed to reach 5000 is another 29 percent decline — a modest move in contrast to the massive wipeouts already witnessed in the shares of our nation's largest banks.

And in America's Second Great Depression, the averages could easily fall to even lower levels.

Real Estate:

Chief economist Mark Zandi of Moody's Economy.com forecasts a possible “mild depression” scenario, in which the average price of a home — already down 27 percent from its peak — could fall another 20 percent. What he does not tell us how far home prices could fall in a worst-case, 1930s-type depression scenario. But I will: As much as 80 or even 90 percent from peak to trough.

Meanwhile, commercial real estate prices could fall with equal speed. As Mike Larson reported this week , the issuance of commercial mortgage-backed securities plunged 95 percent last year … S&P expects their delinquency rates to triple this year … and the resulting credit shutdown is already driving prices into a tailspin.

Bonds:

While Zandi forecasts a possible mild depression , his own colleagues at Moody's Bond Rating division are forecasting bond default rates that denote an inevitable severe depression .

Indeed, Moody's announced last week that

- It expects the number of defaults on high-yield bonds to triple this year to about 300, the worst since the early 1980s when the high-yield bond market first emerged …

- The default rates on those bonds could reach 15 percent, higher than that registered during the Great Depression …

- And default rates could rise even further — to 20 percent — if the economy deteriorates more than currently expected.

Even assuming Moody's less pessimistic forecast, a 15-percent default rate will gut the price of nearly all corporate bonds, regardless of rating.

Add the inevitable surge in interest rates driven by massive government borrowing, and you can see how most corporate bonds could lose anywhere from half to 90 percent of their current market value.

Banks:

Last week, the Federal Deposit Insurance Corporation (FDIC) announced that

- The number of troubled banks jumped from 76 at year-end 2007 to 252 at year-end 2008.

- The assets held by problem banks jumped to $159 billion, up more than seven-fold from $22 billion a year earlier.

But it appears that most of the large banks that have already failed or been bailed out by the government — IndyMac, Washington Mutual, Citigroup and Bank of America — were never on their list to begin with.

And based on our own lists of weak banks, the number in jeopardy is many times larger than the FDIC indicates.

This raises immediate questions about the FDIC's ability to flag problem banks. And it raises fundamental questions regarding the government's future ability to guarantee the deposits of millions of Americans.

My forecast: Expect to lose at least half and possibly up to 90% of your money in uninsured deposits of failing banks. And although it is not an immediate concern, in America's Second Great Depression, even insured depositors could lose money.

Your Urgent Action

First and foremost, get your money to safety. Follow the instructions in our free survival booklet , which we've just updated. In it, you'll find step-by-step instructions on how to buy Treasury bills, what to do with your 401(k), how to get rid of risky stocks, how to find a strong bank, how risky is your insurance company, plus more.

Second, in the guide, be sure to check our handy lists covering the weakest and strongest banks and thrifts, the weakest and strongest insurers, plus select U.S. brokers.

Third, use this bear market to build wealth. Dedicate an hour to watching our video, “ The 11 Laws of Bear Market Success ,” now available for your immediate viewing. Just turn up your computer speakers and click here .

Fourth, let me show you exactly what I'm planning to do this month with my own money — to transform this massive crisis into an equally massive profit opportunity. Click here for my latest report.

Good luck and God bless!

Martin

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.