Stock Market Crashes Lead to Serious Recessions

Stock-Markets / Global Stock Markets May 01, 2007 - 06:15 PM GMTI normally don't read many other gold authors, tending to do my own research and publish my newsletter. There are one or two guys I respect who I do read to double check myself – to make sure that I'm not going off on a tangent. This is one reason I have been often quite different from the gold mainstream in my views. I don't get overly caught up in the commodity hype – something that I am going to address later in this piece.

I want to present a picture that has formed in my mind about the probability of a stock driven crash into a severe world economic recession. This scenario seems to be totally out of mind of many gold writers.

Typically, you will find the usual arguments that the precious metals complex has solid bullish fundamentals – as we hear now – and that the prospects of gold negative events such as unwinding stock crashes and gold and commodity liquidations being dismissed as mere short term events, while the ever present commodity bull will rise into the clouds.

Indeed, recently I have written several public articles that warned of a coming world stock liquidation, probably to be initiated in China, as we have already seen two instances this year of such events leading to Asia wide sell offs. One very serious example was the February 27 Asian stock crashes that lasted for two scary weeks before the Yen stopped strengthening, and unwinding the Yen carry trade…

I have asked my subscribers the question: ‘how many hints do we need to suspect that another serious stock driven sell off will occur, probably starting in Asia, and dragging all the bubble stock markets down, and harming the commodity complex due to speculative unwinding, as well as a fall in actual demand due to slowing economic demand following serious stock losses world wide?'

But, although my subscribers have benefited from my warnings of a weakening commodity market, and have emailed me that they greatly appreciated those warnings,

I have gotten one or two emails from public readers who have stated that since the Asian markets did not crash -the day after I last discussed this topic several weeks ago-, that I was wrong…

And all I would say is, ask yourself the question that I just posted above to my readers for the last weeks.

I will get into my reasoning in more detail in a moment, as to why I am very concerned about coming world stock drops leading to a severe world recession, as well as a serious drop in the commodity complex due to speculative unwinding and Yen carry unwinding.

But, I want to repeat that it appears that much of the gold community is overly optimistic as to the next year's or two prospects for the commodity complex, as they are apparently focusing on the recent economic history of the last several years , where China, and Asia have grown massively, and expect this to continue to cause price hikes in the commodity complex – to include gold and precious metals – without any significant interruption. (breaking back to more historic price levels that are far lower than they are today.

In other words, the commodity bull community is extrapolating the recent past well into the future – as if there would/could be no significant interruption of the commodity bull.

Now, granted, China likely will continue to grow massively in the next 50 years, and overtake the US as the world economic leader. But, to assume that that will happen without a serious interruption in the commodity bull is to ignore some serious risks that this complex faces from several fronts. I very much expect at least one serious commodity bear to ensue from present levels before that next great up leg in commodities continues apace, and in fact, I suspect we are near the first major turn in that down leg in commodities this year.

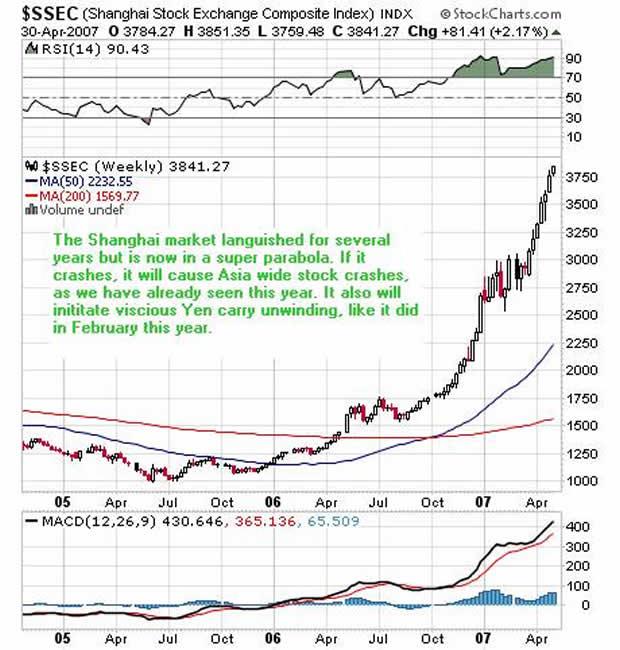

First of all, I don't think anyone would deny that the Shanghai stock market is in a hyper bubble. In the last two years, it has risen about 300%, and we have seen weeks this year where a million or more brokerage accounts were opened by native Chinese who are madly speculating in that market –a huge mania.

Parallels to the Great Depression

I find parallels to the onset of the great depression in the 1930, where the US was the fastest growing economy and manufacturing leader at the time, concurrent with a big stock bubble/mania here, that broke in 1929, and led to a massive world wide economic depression.

In that scenario, it was the onset of massive stock crashes after bubbles that led to serious losses of money by the general population, and led to huge pullbacks in spending. In fact, that pullback was so severe that the US GDP then contracted 30% in a few years.

I am broad brushing this analysis, but the theme for this portion is that the leading world economic growth engine of the time – the US – had stock crashes that led to a world economic depression.

I find the same concept now appearing, but with China in the role of the emerging economic giant, instead of the US. China provides a great deal of world GDP growth now, as the US did in the 1920's.

It would not be a surprise, then, to see why we have now seen two instances this year alone, of Asian stock crashes that started with a crashing Chinese stock market. Again, I ask, how many hints does one need to believe that this scenario is a serious world financial risk for 07?

Now, I cannot imagine the Chinese stock bubble, shown here, to be going along at a 1 or 2% gain each and every day, for the remainder of this year, can you?

Since Asia is now a prime driver of world economic growth, a major stock crash in the region will hammer world GDP growth if it sticks.

This is the reason why markets are looking to the Shanghai and Asian markets for harbingers of the next serious stock crashes.

Yen carry wants to unwind

In the last serious episode of Asian stock crashes late February this year, within less than two weeks the Yen strengthened a massive 6% and put severe pressure on all financial markets due to Yen carry unwinding. The commodity and gold complex were also hit hard due to liquidity problems and speculative unwinding. The stock markets alone were not the only victims of that scary two week episode.

The US Dow had one 500 point drop, but soon stabilized, and it was the lack of follow through of the Dow during the ensuing two weeks that seemed to stem further waves of Asian sell offs. Another interesting point is that DOW fell behind on the Dow quotes by an hour or two, and their computer systems could not keep up with the huge trading volume. When Dow switched over to a backup computer, the Dow quotes caught up in a second or two, and traders were blessed with observing the Dow dropping 200 points in a moments time when the system caught up… scaring the hell out of the already panicky markets.

I firmly believe that the sentiment of world financial markets, and particularly faith in the commodity bull for now have been severely shaken by those events. We have not yet seen gold breaking over $700 this year, and I suspect that one major reason for that lack of faith is concern that we will see yet another Asian driven sell off that cascades around the world, just like happened in February.

World stock sell of then economic recession

Now, let us look at what a severe world stock sell off could do to world economic growth this time around (this year if a crash happens).

First of all, a major reason the world stock markets are hanging in there, and making new highs, is because Asia, and the EU too, have been growing, and Asia growing madly.

The trouble is, China has been warning recently that their stock bubble has:

‘Gone up too long' – Vice Chair Gao, who runs their social security system

Their financial and manufacturing bubbles are ‘out of control and unsustainable' – Premier Wen.

And, we only need look at the chart above of the super parabolic Shanghai stock market to see how a stock mania has now developed over there, and to combine the two warnings I just quoted to read the ‘tea leaves' that portend a financial stock crash coming in Asia, and probably of a far greater severity than we have seen thus far.

It is not altogether clear that the US and other world stock markets would not follow on this time downward for weeks, and if that happened, faith in the non follow

through of the US markets will likely fail this time, and we will see a real nasty conclusion to the next severe Asian stock crashes.

Which brings me to observe that there will be likely serious pullbacks in spending by the Western consumers, as well as concurrent production drops in the overbuilt China manufacturing boom – and thus, a clear break in the present commodity bull for some time due to reduced demand.

That event, would lead to natural speculative unwinding in the commodity sector. I believe that at least 1/3 of the present commodity parabola is speculative froth that will fly out of commodities faster than it went in.

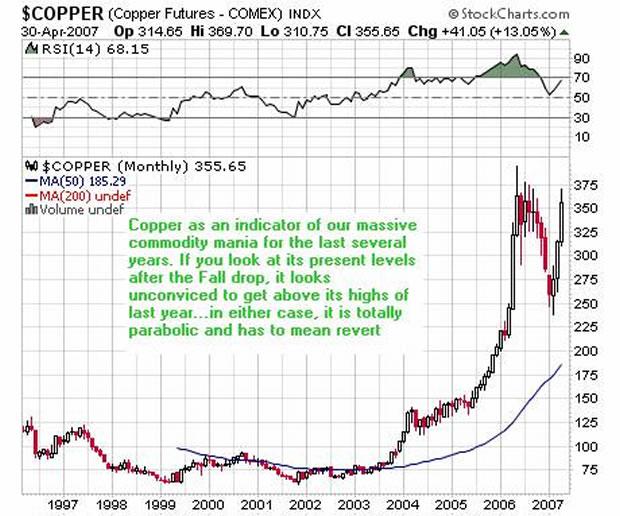

Here is a nice copper chart to get an idea of our present commodity mania:

Commodities are not automatic long term holds

In my last newsletters, I commented to subscribers that commodities are not an automatic long term hold right now, all ‘darling' status aside from the investment hype.

If Asia has a serious economic recession, which likely would follow stock collapses there, commodities will have one serious period of speculative unwinding and drops in prices due to falling demand.

Now, finally, I want to again emphasize that the Yen carry trade has infected all financial markets, to include commodities, and there is historic leverage out, with hedge funds in financial markets on top of that. If there is a serious wave of stock crashes again this year, the overhang of Yen carry likely will drastically unwind financial markets world wide.

Also, there is a great deal of pressure for the Yen to strengthen anyway, and we already saw one serious episode of that this year when it strengthened 6% following the late February stock crashes in Asia. That was a direct effect, and also a cause, of Yen carry unwinding. Yen carry unwinding is a vicious cycle that is almost impossible to stop once it starts.

In any case, the world stock bubbles are parabolic and are going to crash hard, perhaps sometime this year. The commodity complex will then see a long period of weakness and mean reverting prices if there is a serious world economic recession that follows the stock crashes.

Prudent Squirrel subscribers are already aware of this content, and have received email alerts and newsletters Sunday before last, and last week, that anticipated gold's present levels. I was told that those alerts were greatly appreciated.

Stop by and have a look.

Chris Laird has been an Oracle systems engineer, database administrator, and math teacher. He has a BS in mathematics from UCLA and is a certified Oracle database administrator. He has been an avid follower of financial news since childhood. His father is Jere Laird, former business editor of KNX news AM 1070, Los Angeles (ret). He has grown up immersed in financial news. His Grandmother was Alice Widener, publisher of USA magazine in the 60's to 80's, a newsletter that covered many of the topics you find today at the preeminent gold sites. Chris is the publisher of the Prudent Squirrel newsletter, an economic and gold commentary.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.