Stock Market Trend During Presidential First Year

Stock-Markets / US Stock Markets Jan 26, 2009 - 10:10 AM GMTBy: Oxbury_Research

A New Era: But Probably Not The One We Hope For - With the inauguration of President Obama, the world feels that genuine change is in the air. All the policy and economic horrors of the previous administration are soon to be washed away. And before we know it, things will be back to "business as usual" and the great American Dream will soar onward and upward to unseen new heights.

A New Era: But Probably Not The One We Hope For - With the inauguration of President Obama, the world feels that genuine change is in the air. All the policy and economic horrors of the previous administration are soon to be washed away. And before we know it, things will be back to "business as usual" and the great American Dream will soar onward and upward to unseen new heights.

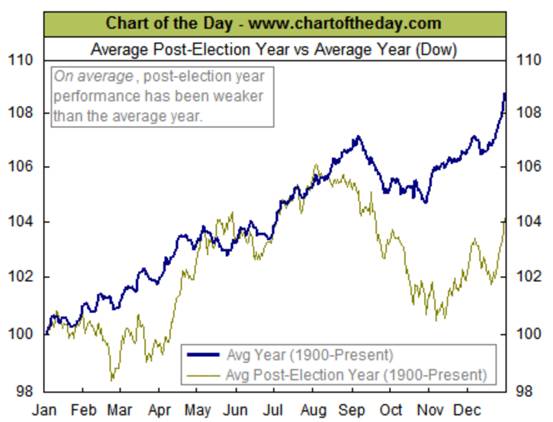

Well, that's what most of the media and Obama's supporters are certainly hoping. But we disagree. The future will at best be less dark than it looked several months ago, and perhaps even that is a tad optimistic. History is not on Change-meister's side:

We personally have nothing against Obama -- in fact, he seems like a truly pleasant fellow -- but in his own charismatic style he's still adhering to the concept of state intervention on a massive scale.

The success of such intervention depends on our leaders actually knowing what they're doing and taking the correct actions to perceive and resolve major economic problems. Based on what we've seen so far, this isn't going to happen, although there are a few encouraging signs.

Lots Of Plans But No Real Sea Changes

Although Treasury Secretary-designate Tim Geithner has promised to tighten the terms for companies receiving federal rescue packages, there are no specific ideas in place and his idea of "aggressive action to address the housing crisis and to get credit flowing again" would pretty much describe the failed measures already in place. Titanic and iceberg, anyone?

Supposedly he's going to deliver a plan to ensure the hundreds of billion still in the TARP will now be subject to "tough conditions to protect the taxpayer". He seeks to establish "the necessary transparency to allow the American people to see how and where their money is being spent and the results those investments are delivering." (A great idea but we very cynically believe this will conveniently fall by the wayside like virtually every other government promise during this crisis.)

He's also promised to unwind the government's support for financial markets and banks as soon as possible, and to develop a plan to establish a sound fiscal base for the nation. We wonder if this includes ensuring that everyone pays their self-employment taxes in a timely fashion? (Seeing as how he himself conveniently "forgot" to do so until pressed to do so by his imminent appointment which includes overseeing the IRS?)

While some of these ideas are commendable – especially the ones about oversight and transparency – we'd like to remind him that a lot of the necessary legislation was already in place. However, it was simply ignored by regulatory agencies and financial institutions alike in the belief that the government would always bail them out no matter what. (Which has in fact happened but not until things ballooned so badly that it's unlikely that even the U.S. Fed can raise the sinking Titanic.)

Banks Still In Crisis

At least he's got this part right: “Many people believe the program has allowed too much upside for financial institutions, while doing too little for small business owners, families who are struggling to keep their jobs and make ends meet, and innocent homeowners,” Mr. Geithner said. “We have to fundamentally reform this program to ensure that there is enough credit available to support recovery.”

Let's look at how the banks and financial institutions have been doing since being the beneficiaries of this exceptional Fed and government largesse:

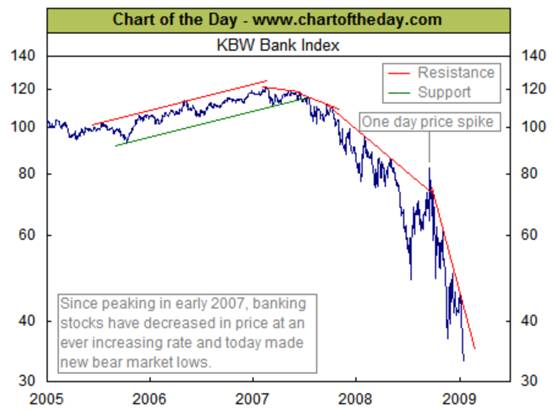

And over the longer term (the “today” referenced in this chart dates back three days):

From the longer chart, it should be obvious that the market “knew” the banks were in trouble long before the newspapers and TV channels began wailing about the crisis. And since that time, when the brown stuff hit the fan, all those billions going into the banks' balance sheets did pretty much nothing but merely delay their continued slide. The tide of toxic debt washed over the gunwales like a tsunami. The legend of King Canute and the inexorable push of an incoming tide comes to mind.

Yes, there was a banking rally on Wednesday with KBW Bank (BKX) sector index rallying 14.6%, with Bank of America (BAC, Fortune 500) and Citigroup (C, Fortune 500) both jumping 31%. But a similar rally in late November quickly stalled and the index stagnated for a month before plunging once again at the need for yet more bailout funds.

In fact, was actually quite amusing that one of the reasons cited for the rally is the announcements by Bank of America and JP Morgan executives that they'd purchased some of their own troubled equity issues. After receiving billions from the government, doesn't it strike you as the height of outrageousness to suddenly announce a grand total of $12.7 million in stock purchases? Receive a dollar, invest a penny?

Perhaps the government would like to lend us a few billion so we can buy a few million in stock!

Is Anything Going Up?

In the spirit of Obama-style optimism however, we'd like to close out this report by pointing out that Diversified Consumer Services (up 11.0%) and Power Production & Energy Traders (up 1.3%) have been up since election day. (Just don't ask about the other 63 sectors, however.)

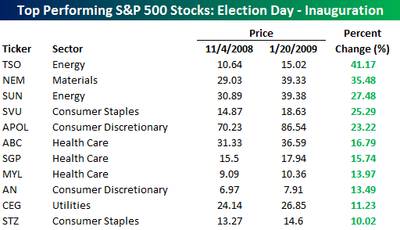

Certain individual stocks in the Energy, Materials, Consumer Staples, Health Care, Utilities and Consumer Discretionary sectors have fared well since that date, however. (Table courtesy of Bespoke Investment Group)

This would seem to confirm the growing idea that the only areas worth investing in are the areas which are basic, boring must-haves in day to day life. Consumer goods are not exactly the thing to get investors' pulses racing, but if they're losing less money than more exotic investment options, then these sectors are going to benefit from capital flows.

The problem with many of these consumer oriented companies, however, is that management knows they have what amounts to a sure thing and treats their investors accordingly. Don't count on impressive dividends or shareholder relations from such companies.

Good investing,

Disclosure: no positions

Nick Thomas

Analyst, Oxbury Research

Nick Thomas is a seasoned veteran of technical analysis and has mastered all intra-day trading in stocks, options, futures and forex. He prefers to scout investments as one asset class of many and shapes his investment strategies accordingly. He writes extensively about offshore banking and offshore tax havens and is active in the career development field of independent investment research.

Oxbury Research originally formed as an underground investment club, Oxbury Publishing is comprised of a wide variety of Wall Street professionals - from equity analysts to futures floor traders – all independent thinkers and all capital market veterans.

© 2009 Copyright Oxbury Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Oxbury Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.