Stock Market Bulls and Bears Lick Their Wounds

Stock-Markets / US Stock Markets Jan 25, 2009 - 02:20 PM GMT

Once again, a lot of back and forth action occurred on the indexes, but not real movement. After the most recent sell-off, the market has begun to move in an ever-smaller price range. For those on either side of the spectrum, there are plenty of arguments as to why a new bull market is being born, or the bear market will continue.

Once again, a lot of back and forth action occurred on the indexes, but not real movement. After the most recent sell-off, the market has begun to move in an ever-smaller price range. For those on either side of the spectrum, there are plenty of arguments as to why a new bull market is being born, or the bear market will continue.

The bulls can be pleased that short-term support levels have been established on the DJIA , S&P 500, and NASDAQ. The bleeding has stopped. Bulls can also revel in the fact that over the past two days bears have pushed the indexes down but failed to follow through. In particular, the recent low on the DJIA , 7936, was undercut but still held. Moreover, volume has picked up over the last few days while the indexes have held their ground- possible accumulation?

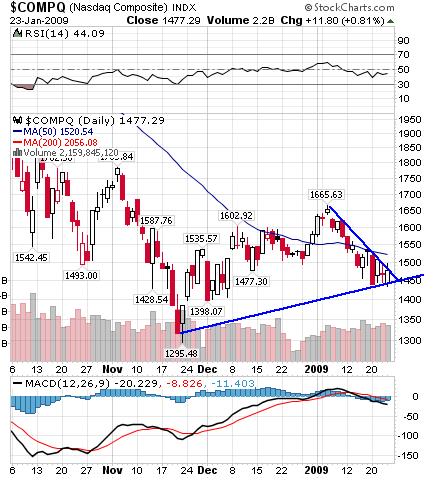

On the other hand, the bears hold the trump card. The bottom line is that the primary trend is down, and will continue to be so until proven otherwise. The resistance levels above are plentiful and include an area of congestion that has been building over the last several months, the 50 day moving average, and the recent highs (943 S&P 500, 9088 on the DJIA , and 1665 on the NASDAQ ). Bears can confidently argue that this most recent trading range is just another consolidation before we continue downward and retest the November lows.

The investment sentiment indicators demonstrate the indecision of investors. The Volatility Index has been caught in a range for the last few days. It bounced around the area of 45 and 55 (with the exception of Tuesday). However, compared to what investors are accustomed to, these levels are still high. As for the Investors Intelligence poll of Bullish/Bearish newsletters, after the bulls outnumbered the bears last week, both are about dead even (38.7% bullish while 37.6% are bearish).

If anyone tells you he/she knows the future direction of the market, run. While the price action and investor sentiment is similar to what occurs near bottoms, anticipating the move is not wise. How many times were we told that the bottom was put in the banking sector? I recall hearing it back in the summer of 2007. Buying and holding back then would have destroyed a portfolio. Or, one only needs to recall the tech. bubble at the turn of the century to realize that trying to catch the falling the knife is like playing the lottery- only with more money on the line (unless of course, you spend thousands, or maybe millions, on scratch-offs).

One also should continue to question all the pundits (myself included). Putting blinders on and listening to one side is no way to analyze the market. While pure impartiality is almost impossible to achieve, it is something that should be strived for. If an investor can objectively analyze the current markets, he/she should emerge from this bear market relatively unscathed.

By Kingsley Anderson

http://tradethebreakout.blogspot.com

Kingsley Anderson (pseudonym) is a long-time individual trader. When not analyzing stocks, he is an attorney at a large law firm. Prior to entering private practice, he served as a judge advocate in the U.S. Army for five years and continues to serve in the U.S. Army Reserves. Kingsley primarily relies on technical analysis to decipher the markets.

Kingsley's website is Trade The Breakout (http://tradethebreakout.blogspot.com)

© 2009 Copyright Kingsley Anderson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Kingsley Anderson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.