Stock Market Still Has A Pulse

Stock-Markets / US Stock Markets Jan 22, 2009 - 05:26 AM GMT

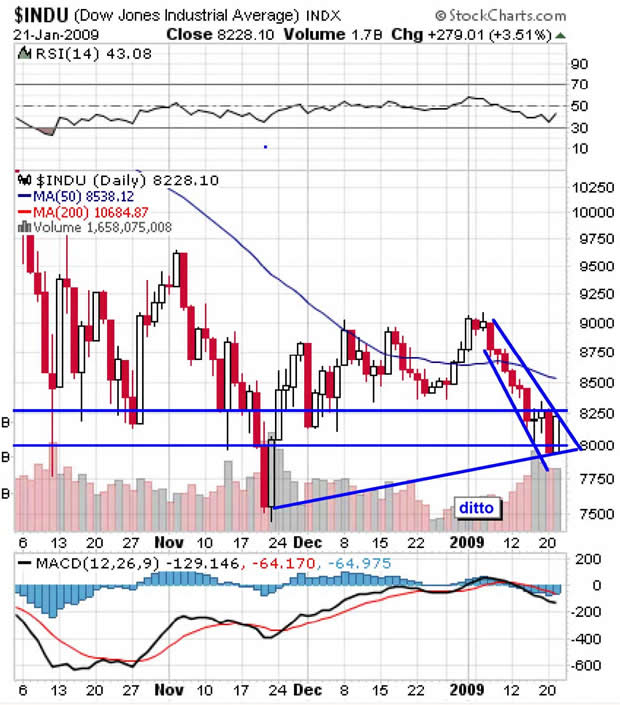

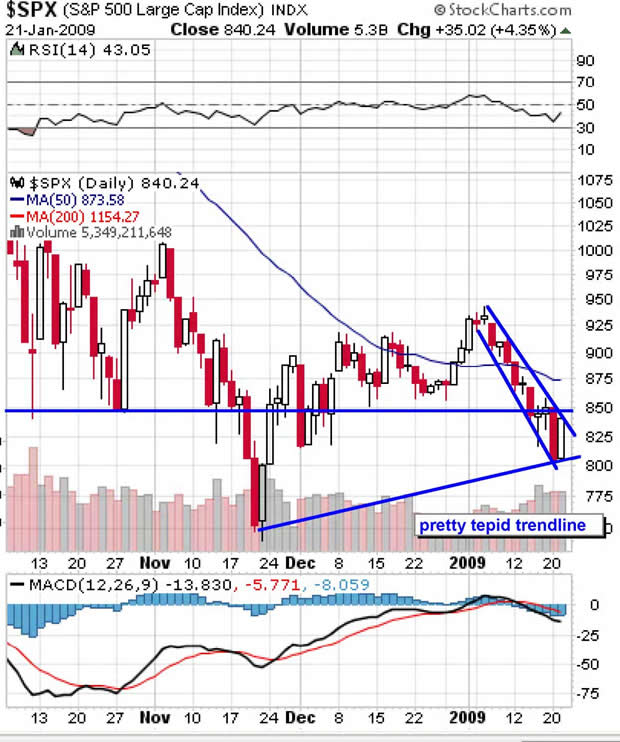

The market took back a large chunk of what it lost yesterday. However, considering the losses that have stretched over almost two weeks, the market is still under water. On the positive side, both the S&P 500 and the Dow Jones Industrial Average have established a lower low-for the time being. Both are also currently sitting right above support levels. For the S&P 500, support is in the 800 area and resistance is in the 850 area. For the DJIA, support is located in the 8000 area while it faces resistance at around 8280.

The market took back a large chunk of what it lost yesterday. However, considering the losses that have stretched over almost two weeks, the market is still under water. On the positive side, both the S&P 500 and the Dow Jones Industrial Average have established a lower low-for the time being. Both are also currently sitting right above support levels. For the S&P 500, support is in the 800 area and resistance is in the 850 area. For the DJIA, support is located in the 8000 area while it faces resistance at around 8280.

Is the sell-off over? I would not count on it. The aforementioned resistance levels will have to be surmounted. Moreover, the 50 day moving average is perched above the price action on each of the indexes. For a substantial rally to occur, the 50 day moving average needs to be taken out with conviction on solid volume.

Further confirmation should also come from the McClellan Oscillator. Generally, a short-term buy signal occurs when the oscillator goes above the zero line. Right now, it sits at -13.59-close but no cigar. If you are a short-term trader, using the oscillator in conjunction with the charts can be very helpful. If your time frame is longer, the McClellan Oscillator will not be as helpful to you, but it may indicate that the worst is over.

By Kingsley Anderson

http://tradethebreakout.blogspot.com

Kingsley Anderson (pseudonym) is a long-time individual trader. When not analyzing stocks, he is an attorney at a large law firm. Prior to entering private practice, he served as a judge advocate in the U.S. Army for five years and continues to serve in the U.S. Army Reserves. Kingsley primarily relies on technical analysis to decipher the markets.

Kingsley's website is Trade The Breakout (http://tradethebreakout.blogspot.com)

© 2009 Copyright Kingsley Anderson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Kingsley Anderson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.