Stock Markets Hit by Barrage of Bleak Economic and Corporate Data

Stock-Markets / Global Stock Markets Jan 18, 2009 - 12:41 PM GMT Investor sentiment around the globe was negatively impacted during 2009's second full week of trading as a barrage of bleak economic and corporate news offered more confirmation of a deepening recession, bringing risk aversion to center stage.

Investor sentiment around the globe was negatively impacted during 2009's second full week of trading as a barrage of bleak economic and corporate news offered more confirmation of a deepening recession, bringing risk aversion to center stage.

The US dollar and government bonds (excluding emerging markets and countries on the periphery of the Eurozone) gained, but global equities and commodities were on the defensive as nervous investors tried to gauge the likely damage of the economic malaise.

Global bourses concluded a whipsaw week with hefty losses, but stemmed some of the downside as a relief rally came to the rescue towards the end of the week. The MSCI World Index and the MSCI Emerging Markets Index declined by 6.2% and 5.8% respectively.

The US indices all dropped over the week as shown by the major index movements: Dow Jones Industrial Index -3.7% (YTD -5.6%), S&P 500 Index -4.5% (YTD -5.9%), Nasdaq Composite Index -2.7% (YTD -3.0%) and Russell 2000 Index -3.1% (YTD -6.6%). As a matter of interest, the year-to-date returns at the same point last year (i.e. after 11 trading days) were -6.0% for the Dow and -6.5% for the S&P 500.

Adding a spark of hope on Thursday, the US Senate voted to release the second and final $350 billion tranche of the TARP funds, whereas the House Democrats unveiled a much-awaited $825 billion stimulus package aimed at halting the economic rot. Meanwhile, in a speech at the London School of Economics, Fed Chairman Ben Bernanke said Barack Obama's economic package could provide a “significant boost” to the US economy.

Source: Daryl Cagle

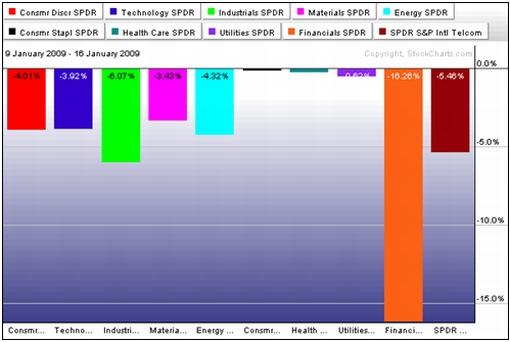

But back to the stock market. The bar chart below shows the US sector performance for the past week, and specifically how defensive sectors such as consumer staples, healthcare and utilities outperformed other sectors on a relative basis.

The financial sector plummeted by 16.3% as several US banking shares fell to multi-year lows amid growing concerns that they will battle to cope with increasing credit losses as the global recession intensifies.

Source: StockCharts.com

The nascent earnings season saw a glut of fourth-quarter losses. These included larger-than-expected losses from Bank of America (BAC) and Citigroup (C), resulting in their respective share prices plunging by 44.7% and 48.2% over the week.

Citi announced plans to break up the bank into two businesses, following the decision to sell a controlling interest in the valuable Smith Barney brokerage to Morgan Stanley (MS). On the other hand, Bank of America will receive an additional $20 billion of TARP funds to bed down its troublesome acquisition of Merrill Lynch, as well as a guarantee on $118 billion of potential losses on distressed assets. Elsewhere, the Irish government nationalized Anglo Irish Bank, and HSBC was rumored to be seeking fresh capital of $30 billion.

As far as the US housing situation is concerned, I am keeping a close eye on the mortgage situation. According to Freddie Mac's Primary Mortgage Market Survey , the national average rates for a US 30-year fixed mortgage last week declined to 4.96% from 5.33% two weeks ago and 6.46% in October last year. However, the rate is still 378 basis points higher than the three-month dollar LIBOR rate. This spread averaged 97 basis points during the 12 months preceding the crisis, indicating that lower rates are not being passed on to consumers.

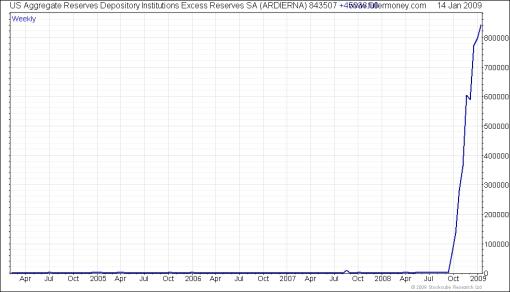

Despite the interbank lending rates having declined from their peaks, banks have significantly curtailed the amount of money they are actually lending. The US Depository Institutions Aggregate Excess Reserves continue their ascent at levels far in excess of the amount that banks need to keep on deposit to meet their reserve requirements (see chart below). This measure indicates that the balance sheets of banks remain under pressure, especially in view of the fact that the value of some assets is not known. A peak in the Excess Reserves graph should coincide with a turning point in the recovery of banks. (Also see my post “ Credit Market Watch “.)

Source: Fullermoney

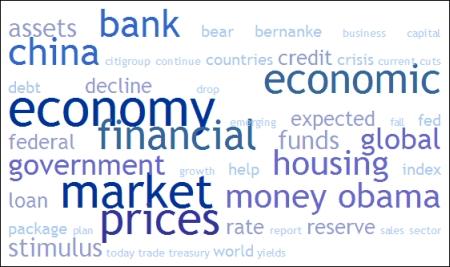

Next, a quick textual analysis of my week's reading. No surprises here with keywords such as “economy”, “market”, “bank”, “China”, financial” and “prices” featuring prominently.

On the issue of corporate bonds, I received a number of questions after referring to the iBoxx Investment Grade Corporate Bond Fund (LQD) and High Yield Corporate Bond Fund (HYG) in last week's “ Words from the Wise ” review. In the short term, a further correction of both investment-grade and high-yield corporate bonds looks likely, but the sector is worth watching for opportunities arising at lower levels. Also, the high-yield instruments - under intense pressure because of an avalanche of defaults predicted by the ultra-wide spreads - could see spreads contracting markedly if the defaults are not as bad as priced in.

Turning to the outlook for the stock market, Bennet Sedacca ( Atlantic Advisors Asset Management ) issued a short-term buy signal on Thursday: “We are once again increasing exposure to equities from 0% to a near fully invested posture. I fully recognize the bad news that is out in the marketplace, but given Treasuries at 0-2.25% and Mortgage Backed Securities at 3-4%, high quality large cap growth stocks (self-financing companies purchased via IVW - the S&P large cap growth ETF) look attractive to me.

“We also like healthcare via PPH (pharma holders ETF), USO (oil ETF), XLV (broader healthcare ETF), but have a negative bias towards bonds and have taken substantial profits in recent days in the Mortgage Backed Securities space, where government intervention has led to artificially high bids. We also added a smallish position in XLF (financials). We believe quality is king and that ‘a' low , but not THE low has been reached in stocks.”

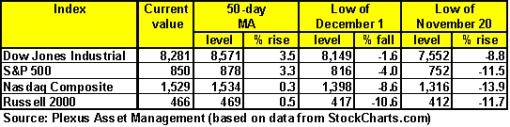

Key resistance and support levels for the major US indices are shown in the table below. The immediate upside target is the 50-day moving average, followed by the November 4 highs about 16% to 18% from current levels (not shown on table). On the downside, the December 1 and all-important November 20 lows must hold in order to prevent considerable technical damage.

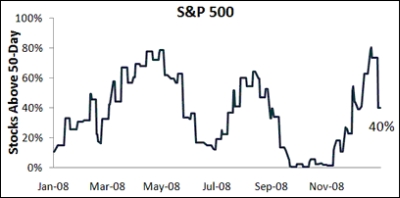

An analysis of the number of stocks trading above their 50-day moving averages makes for interesting reading. “With the S&P 500 back into oversold territory and even approaching its November lows, it's actually surprising to see this breadth measure at 40%,” said Bespoke . “At the prior lows, the number got down to zero! The fact that the overall declines have been limited to a smaller area of the market is a positive for those hoping that the lows will hold.”

“As January goes, so goes the year”, is one of the most frequently quoted seasonal trends of the stock market. With the S&P 500 down by 5.9% after two weeks of the month, January is not off to a promising start. According to Jeffrey Hirsch ( Stock Trader's Almanac ), every down January since 1950 has been followed by a new or continuing bear market or a flat year. Further research is provided by Jay Kaeppel of Optionetics.

The last word goes to Charles Kirk ( The Kirk Report ): “With the market closed Monday to observe Martin Luther King Jr., we are set to have another four-day work week and, in my experience, they tend to be some of the toughest. Not only will we have Obama's inauguration, but lots of earnings reports to sort through.

“While the market managed to end the week above S&P 850, we still have a lot of work to do to confirm that we can manage at least a decent counter-trend rally during earnings season. We are still oversold, but we need to see the buyers return in force and with confidence. Both have been missing so far in 2009.”

For more discussion about the direction of stock markets, also see my post “ Video-o-rama: Gloomy news batters investor sentiment “.

Economy

“Global business confidence remains very negative, but has improved a bit since hitting bottom at the very end of 2008. It is still too early to conclude that sentiment is improving in any measurable way,” said the latest Survey of Business Confidence of the World conducted by Moody's Economy.com . “Businesses are nearly equally pessimistic across the globe and across all industries. Hiring intentions have turned particularly negative in recent weeks. Pricing power has collapsed, suggesting that deflation is a significant threat.”

As far as the US is concerned, the Fed's January Beige Book indicated continued and broad-based weakening throughout the nation. The latest round of economic data also confirmed that the recession was intensifying.

• Industrial production declined by 2% in December, with output falling in all three major categories - utilities, mining and manufacturing - for the first time since October. For the fourth quarter as a whole, industrial production fell at an annual rate of 11.5%, more than twice as fast as at any time during the 2001 recession. All indications are that manufacturers will further reduce production in order to bring inventories in line with free-falling final sales.

• Retail sales in December were significantly worse than expected, plunging by 2.7% - the sixth consecutive month of falling sales.

• The US trade deficit narrowed substantially to $40.4 billion (consensus $51.5 billion) in November, marking the fourth straight month of declining gross exports and gross imports.

News on the US inflation front was relatively good with both the PPI and CPI continuing to retreat in December, falling by 1.9% and 0.7% respectively. Core prices barely managed to stay in positive territory, with core CPI rising by 0.1% for 2008 - the lowest increase since 1954.

Jamie Dimon, chief executive of JPMorgan Chase, predicted in an interview with the Financial Times that the US financial and economic crisis would worsen this year as hard-hit consumers default on credit cards and other loans. “The worst of the economic situation is not yet behind us. It looks as if it will continue to deteriorate for most of 2009,” said Mr Dimon.

Source: Daryl Cagle

Elsewhere in the world, evidence mounted that the recession was widespread and deepening.

• In a sign that the decline in economic activity in Japan was worsening, core machinery orders by Japanese businesses slumped by 16.2% in November - the sharpest monthly contraction since records began in 1987.

• Germany's coalition parties agreed on a second economic stimulus package totaling €50 billion (including €36 billion in infrastructure investment and tax cuts), to be put into place in an effort to pull the economy out of its worst recession since the end of the Second World War, according to CEP News . The package also includes a €100 billion “Germany fund” that would guarantee the debt raised by cash-starved businesses.

• The European Central Bank on Thursday cut its main policy interest rate by 50 basis points to 2% - the lowest level ever. The total reduction since mid-October amounts to 225 basis points and highlights the Eurozone slipping deeper into recession and inflation dropping sharply.

• Eurozone manufacturing continued to fell for the seventh straight month in November, amounting to a decline of 7.7% in year-ago terms.

Source: Moody's Economy.com

The International Monetary Fund's managing director, Dominique Strauss-Kahn, “chided European leaders for failing to grasp the depth of the coming slump in their region, creating the risk of social upheaval,” said Bloomberg .

RGE Monitor reported that China had revised its 2007 GDP growth up to 13% from the 11.9% it previously reported. “With Chinese exports, industrial production and other economic indicators slowing sharply, there is speculation that Chinese officials might smooth growth statistics. Uncertainty about Chinese economic statistics has led many analysts to use proxies for economic output which are more difficult to doctor. These proxies include electricity demand, construction, etc. However, there is a consensus that Chinese economic statistics have improved,” said Nouriel Roubini's research team.

Week's economic reports

Click here for the week's economy in pictures, courtesy of Jake of EconomPic Data .

Date |

Time (ET) |

Statistic |

For |

Actual |

Briefing Forecast |

Market Expects |

Prior |

| Jan 13 | 8:30 AM | Trade Balance | Nov | -$40.4B | -$51.0B | -$51.0B | -$56.7B |

| Jan 13 | 2:00 PM | Treasury Budget | Dec | -$83.6B | NA | -$83.0B | -$48.3B |

| Jan 14 | 8:30 AM | Export Prices ex-ag. | Dec | -1.9% | NA | NA | -2.9% |

| Jan 14 | 8:30 AM | Import Prices ex-oil | Dec | -1.1% | NA | NA | -1.8% |

| Jan 14 | 8:30 AM | Retail Sales | Dec | -2.7% | -1.0% | -1.2% | -2.1% |

| Jan 14 | 8:30 AM | Retail Sales ex-auto | Dec | -3.1% | -1.2% | -1.4% | -2.5% |

| Jan 14 | 10:00 AM | Business Inventories | Nov | -0.7% | -0.5% | -0.5% | -0.6% |

| Jan 14 | 10:30 AM | Crude Inventories | 01/09 | 1144K | NA | NA | 6682K |

| Jan 14 | 10:35 AM | Crude Inventories | 01/09 | - | NA | NA | NA |

| Jan 14 | 2:00 PM | Fed Beige Book | - | - | - | - | - |

| Jan 15 | 8:30 AM | Core PPI | Dec | 0.2% | 0.1% | 0.1% | 0.1% |

| Jan 15 | 8:30 AM | PPI | Dec | -1.9% | -1.7% | -2.0% | -2.2% |

| Jan 15 | 8:30 AM | Initial Claims | 01/10 | 524K | NA | 503K | 470K |

| Jan 15 | 8:30 AM | Empire Manufacturing Index | Jan | -22.20 | - | -25.00 | -27.88 |

| Jan 15 | 10:00 AM | Philadelphia Fed | Jan | -24.3 | -35.0 | -35.0 | -36.1 |

| Jan 16 | 8:30 AM | Core CPI | Dec | 0.0% | 0.0% | 0.1% | 0.0% |

| Jan 16 | 8:30 AM | CPI | Dec | -0.7% | -1.0% | -0.9% | -1.7% |

| Jan 16 | 9:15 AM | Capacity Utilization | Dec | 73.6% | 74.6% | 74.5% | 75.2% |

| Jan 16 | 9:15 AM | Industrial Production | Dec | -2.0% | -1.0% | -1.0% | -1.3% |

| Jan 16 | 9:55 AM | University of Michigan Sentiment -Preliminary | Jan | 61.9 | 61.0 | 59.0 | 60.1 |

Source: Yahoo Finance , January 16, 2009.

In addition to the Bank of Japan's interest rate announcement (Thursday, January 22), the US economic highlights for the week, courtesy of Northern Trust , include the following:

1. Housing starts (January 22): Permit extensions for new homes fell 15.8% in November, inclusive of a 11.9% drop in permits issued for single-family homes. The weakness in permits is indicative of fewer housing starts in December (595,000 versus 625,000 in November). Consensus : 615,000.

2. Other reports : NAHB Survey (January 21).

Click the links below for the following reports:

• Wachovia's Weekly US Economic & Financial Commentary (January 16, 2009)

• Wachovia's Global Chartbook (January 2009)

Markets

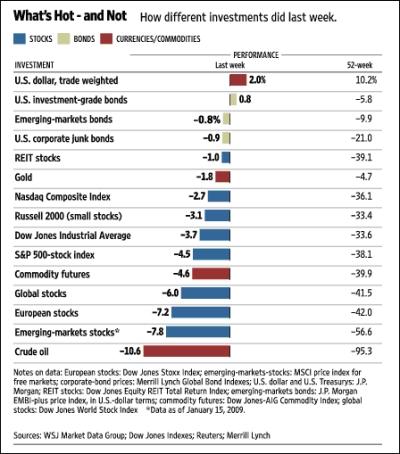

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , January 16, 2009.

Chinese philosopher Lau-Tzu said: “Those who have knowledge, don't predict. Those who predict, don't have knowledge.” Wise words indeed, but hopefully thorough research and a dose of common sense will cast some light on the lie of the investment land.

On Tuesday a new President will be inaugurated in the US, but the old concerns about financial markets will unfortunately still be around. In the meantime, have a great long weekend in the US!

That's the way it looks from Cape Town.

Source: Daryl Cagle

Clusterstock: Roubini - you're all fools for buying into a sucker's rally

“Yesterday Nouriel Roubini weighed in on the recent rally and said anyone that thought the worst was behind us is ‘delusional' and as a matter of fact the worst is yet to come, citing the gruesome macro data that's been released as of late, and the fact that that trend won't reverse until at least the fourth quarter of 2009.

“ RGE : For a few weeks since late November equity markets ignored the onslaught of much worse than expected macro news (and all the news were really worse than awful) and had a nice 25% bear market sucker's rally. But the drumbeat of terrible - and worse-than-expected - macro news and earnings news and financial news has finally taken a toll on the delusional market belief that the worst was over for financial markets and for equity markets and that the US and global economy would recover in the second half of 2009. So equity prices have already reversed more than half of their most recent bear market rally as the lousy macro news have finally shocked in the last week the wishful thinkers.

“Indeed, the retail sales figures published today confirmed a shopped-out, saving-less and debt-burdened US consumer is now faltering as job losses, income losses, fall in home wealth, fall in equity wealth, high and rising debt and debt servicing ratios and a severe credit crunch take a severe toll on the ability of consumers to spend. And reduction in spending and deleveraging of the US consumer will take years to rebuild the savings rate of a household sector now hit by a severe shock to its net worth (as equity and home values fall while debts have been rising) and shocked in its ability to generate income as job losses mount and the unemployment rate surges.

“Our research at RGE Monitor suggests that the US and global recession will continue at least all the way until Q4 of 2009 (a nasty 24 months U-shaped recession) and that the recovery in 2010-11 will be very weak with growth in the 1% range that is well below a potential of 2.75%. And we cannot rule out that a more severe L-shaped stag-deflation (as in Japan in the 1990s) will take hold.”

Click here for CNBC video.

Source: Jay Yarow, Clusterstock , January 15, 2009.

CNBC: Pimco's El Erian on the markets

“Discussing the global economic situation, with Mohamed El-Erian, Pimco co-CEO and Michael Spence, Philip H. Knight economics professor/Nobel Laureate.

Source: CNBC , January 15, 2009.

Barron's: Roundtable - hang on tight

“Our go-to group of investment experts sees tough times for the economy - but good fortune for stockpickers.”

Click here for full article.

Source: Barron's (via Fullermoney ), January 13, 2009.

Grace Cheng (Daily Markets): Exclusive interview with Jim Rogers

Do you think the period of forced liquidation has ended or does it still have a ways to go?

Rogers: I'm sure it has not ended. It certainly has not ended for many asset classes and it probably has not ended for most. It may be over for a few things but it still has a long way to go.

As you've said many times, the US government is printing a lot of money right now, when do you think inflation will come around and bite us?

Rogers: Well there is inflation now in many things. There's temporary deflation in raw material prices and in some property. But throughout history, whenever you've had gigantic printing of money and spending of borrowed money, it has always led to higher prices. Unless something is dramatic, it's going to happen again. When I don't know. It's already happening in some things. I don't know if you've bought any sugar recently or some other things, prices are up and that will continue and it will get worse.

You've been bullish on commodities for a long time, recently you said you're buying the Rogers Metal Index. Do you think that the Obama stimulus plan will create more demand for commodities?

Rogers: Well of course, anything that causes a revival of economic activity causes a revival of demand for everything including commodities. I mean if you're gonna build bridges you've got to build them out of something you cannot build virtual bridges you have to build real bridges, etc.

You've said that over the long term, the US dollar is doomed. What are your thoughts on the British Pound?

Rogers: More doomed. It will disappear sooner. If it weren't for the North Sea, the British Pound would have already disappeared. It's more doomed. The UK has been exporting oil for 26 years; within the decade, the UK will be a net importer of oil again, and they have nothing else to sell to the world once the oil dries up.

Do you think China will scale back on buying US bonds? And if that happens, how will it affect the US economy and the US dollar?

Rogers: Well if I were China, I would scale back. If I were everybody, I would scale back. The US bonds yield virtually nothing, the dollar is a flawed currency, inflation is coming, higher interest rates are coming. I would think everybody would be scaling back including China. We're going to have higher interest rates down the road because somebody's gonna scale back. If not China, Japan or Korea, or who knows, somebody.

Source: Grace Cheng, Daily Markets , January 15, 2009 (hat tip: Investorazzi ).

Bloomberg: Bernanke urges “strong measures” to stabilize banks

“Federal Reserve Chairman Ben Bernanke speaks about the possible need for more capital injections and guarantees to further stabilize and strengthen the financial system. Bernanke, speaking at the London School of Economics, warns that a fiscal stimulus won't be enough to spur an economic recovery and that the government may need to buy or guarantee banks' tainted assets to revive growth. Bernanke also discusses the Fed's balance sheet, inflation expectations and US unemployment.”

Click here for Financial Times article.

Source: Bloomberg , January 13, 2009.

Asha Bangalore (Northern Trust): Bernanke explains Fed's options

“In the context of financial market stability, Bernanke calls on history to stress that a ‘modern economy cannot grow if its financial system is not operating effectively'. Bernanke noted that in order to support and mend the fragile financial system ‘more capital injections and guarantees may become necessary to ensure stability and normalization of credit markets'.

“He suggested that purchases of troubled assets, a provision of asset guarantees, and/or purchase of assets from financial institutions in exchange for cash and equity in bad banks are other avenues through which fiscal policy could support the financial system. Also, reducing preventable foreclosures would be useful in reducing mortgage losses and promoting financial stability.

“In sum, the conclusion we draw here is that additional fiscal policy stimulus is necessary to ensure the working of the financial system and revival of economic activity.”

Source: Asha Bangalore, Northern Trust - Daily Global Commentary , January 13, 2009.

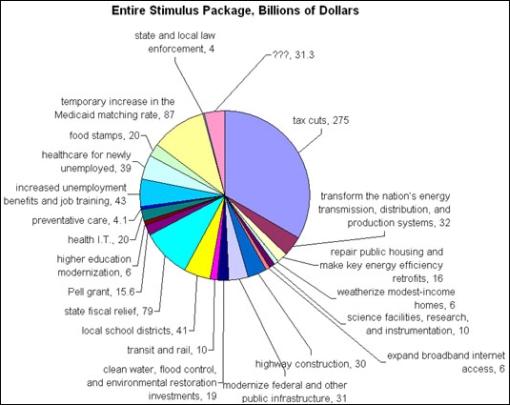

Financial Times: Democrats unveil $825 billion stimulus package

“Democratic lawmakers on Thursday unveiled a much-awaited $825 billion stimulus package to halt America's vertiginous economic slide which Nancy Pelosi, the speaker of the House, said was only the ‘first step' in a process that could take weeks to pass into law.

“The bill, which Barack Obama, the incoming president, wants enacted before mid-February when Congress goes into a short recess, comes in at $50 billion higher than the initial ceiling set by his transition team. But economists said they expected it to climb towards the important psychological threshold of $1,000 billion by the time it becomes law.

“The package was divided between $275 billion in tax cuts, mostly going towards a $1,000 tax credit for middle-class families and $500 for individuals, and $550 billion in public spending, which includes money for ‘shovel-ready' infrastructure projects, aid to state governments and investments in information technology upgrades for healthcare and a drive to make federal buildings energy-efficient.

“Thursday's bill coincided with Mr Obama's announcement that he would hold a ‘fiscal responsibility' summit next month that would address entitlement reform - an issue that has long been avoided by leaders from both sides of the aisle. ‘We've kicked this can down the road and now we are at the end of the road,' he told an editorial board meeting of the Washington Post. ‘We need to send a signal that we are serious.'

“He said he did not know how long it would take for the proposed fiscal stimulus to take effect. ‘We are in uncharted waters here. I don't have a crystal ball,' he said.”

Source: Edward Luce, Financial Times , January 15, 2009.

Economix (The New York Times): Stimulus pie chart

Source: Catherine Rampell, The New York Times - Economix , January 15, 2009.

The New York Times: Senate releases second portion of bailout fund

“President-elect Barack Obama's economic agenda advanced rapidly in Congress on Thursday as the Senate voted to release the second half of the financial industry bailout fund and House Democrats unveiled an $825 billion fiscal recovery plan aimed at putting millions of unemployed Americans back to work.

“The Senate action, by a vote of 52 to 42, spares Mr. Obama a messy legislative fight just as he takes office and gives him a $350 billion war chest to further stabilize the financial sector. The vote came amid renewed distress in the banking industry, including further deterioration of Citigroup and a pitch for more government aid by the Bank of America.

“Mr. Obama had personally lobbied reluctant senators to release the money. His top economic adviser, Lawrence H. Summers, made three visits to the Capitol and sent two letters to reassure lawmakers that the program would be better managed.

“In a statement, the president-elect applauded the outcome.

“‘I know this wasn't an easy vote because of the frustration so many of us share about how the first half of this plan was implemented,' Mr. Obama said. ‘Now my pledge is to change the way this plan is implemented and keep faith with the American taxpayer.'”

Source: David M. Herszenhorn, Financial Times , January, 2009.

Bloomberg: Seattle FHLB short of capital on mortgage ebt

“The Federal Home Loan Bank of Seattle said it will suspend dividends and ‘excess' stock repurchases, becoming the second of the government-chartered lending cooperatives to say its capital may be running low.

“The likely capital shortfall as of December 31 was caused by ‘unrealized market value losses' on residential mortgage bonds without government backing, the bank said in a US Securities and Exchange Commission filing today. Washington Mutual and Merrill Lynch had been the biggest stakeholders and borrowers in the Seattle Federal Home Loan Bank, or FHLB.

“Seattle joins the San Francisco FHLB in taking steps to guard its reserves after the US housing market collapse sent mortgage-backed bonds tumbling. The declines may leave as many as eight of the 12 FHLBs below capital requirements, Moody's Investors Service has said, eroding a below-market rate source of about $1 trillion in financing for Citigroup, JPMorgan Chase and other companies that participate in the cooperatives.”

Source: Jody Shenn, Bloomberg , January 13, 2009.

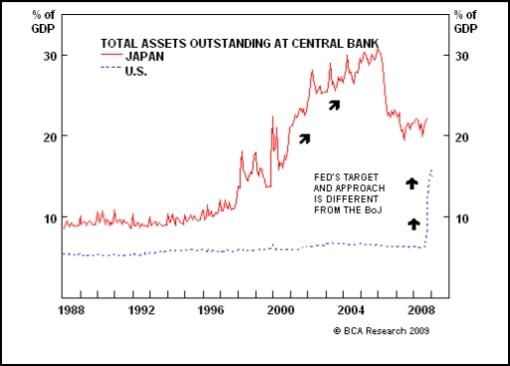

BCA Research: It's called credit easing, not quantitative easing

“Fed Chairman Bernanke argued in a key speech recently that the Fed's current policy will not lead to an inflation problem.

“Bernanke explained how the Fed's current policy, which he dubbed ‘Credit Easing', differs from ‘Quantitative Easing' (QE), as pursued by the Bank of Japan (BoJ) earlier this decade. Under QE, the BoJ set targets for excess bank reserves in the hope that the banks would increase lending. In contrast, the Fed is targeting an improvement in the functioning of the credit markets, an increase in the flow of credit, and lower private sector borrowing costs. There is no target for the size of the Fed's balance sheet or the monetary base; both will fluctuate with the liquidity needs of borrowers who are using the Fed's facilities.

“To the extent that banks keep excess liquidity on deposit at the Fed, Bernanke argued that there is little inflation risk in the near term. In terms of the exit strategy from the current policy, the Chairman explained that excess reserves and the monetary base will naturally decline when credit market conditions improve and recourse to the Fed's liquidity facilities wanes.

“The Fed also plans to eventually sell the private sector assets it is purchasing, which will also soak up excess liquidity.

“Bottom line: The Fed's ‘Credit Easing' policy will not necessarily be inflationary, as long as the excess reserves are re-absorbed in a timely manner once the economy resumes growing.”

Source: BCA Research , January 14, 2009.

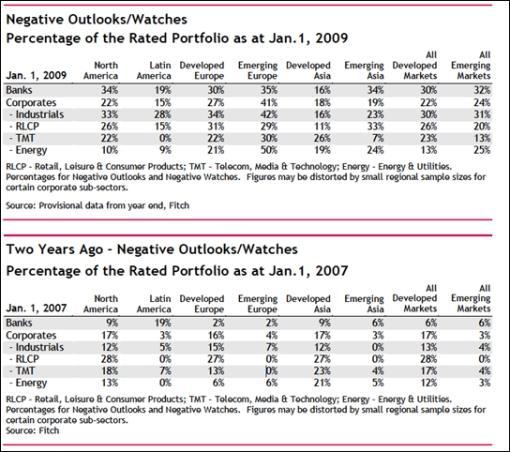

Paul Kedrosky (Infectious Greed): Dramatic changes in credit quality

“A fairly remarkable sea-change in Fitch Ratings' view of rated companies/countries/sectors over the last two years. The stresses in Europe, in particular, caught my eye.”

Source: Paul Kedrosky, Infectious Greed , January 16, 2009.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.