Global Stock Markets Spluttered Due to Dreadful Economic Data

Stock-Markets / Global Stock Markets Jan 11, 2009 - 10:41 AM GMT

Global stock markets reversed course during the last three days of the first full trading week of 2009 as investors were confronted with dreadful economic data, escalating layoffs and a bleak earnings outlook. As investor sentiment soured, the MSCI World Index and the MSCI Emerging Markets Index declined by 2.5% and 1.7% respectively during “turnaround week”.

Global stock markets reversed course during the last three days of the first full trading week of 2009 as investors were confronted with dreadful economic data, escalating layoffs and a bleak earnings outlook. As investor sentiment soured, the MSCI World Index and the MSCI Emerging Markets Index declined by 2.5% and 1.7% respectively during “turnaround week”.

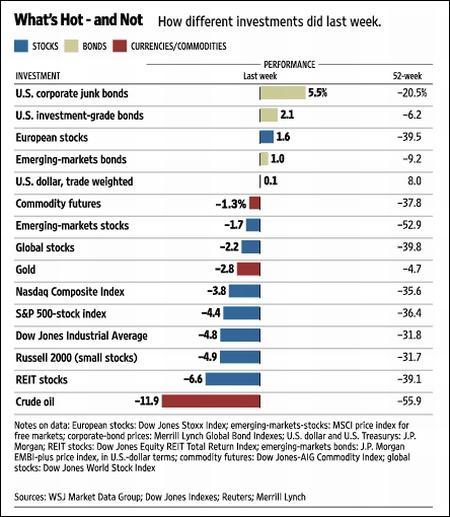

The US stock markets - leaders among mature markets since the November 20 low - were on the receiving end of the selling orders and recorded relatively large weekly losses of 4.8% for the Dow Jones Industrial Index and 4.4% for the S&P 500 Index. On the other end of the performance scale, Brazil (+11.8%) and Ireland (+11.0%) brought investors cheer. (The Dublin ISEQ Index was the worst bear market performer, losing 76.8% from June 2007 to November 2008.)

Source: Daryl Cagle

Elsewhere, the US Dollar Index (+1.0%) closed up for the week, but off its highs on the back of dismal US labor market data. As governments seek to raise record amounts of debt to stimulate declining economies, the increasing supply of sovereign paper pushed up yields of longer-dated bonds in the US, UK and eurozone. “The long-held assumption that US assets - particularly government bonds - are a safe haven will soon be overturned as investors lose their patience with the world's biggest economy,” said respected economist Willem Buiter in The Telegraph .

Despite geopolitical problems and the disruption of European gas supplies, West Texas Intermediate Crude closed 11.9% down on the week as the severity of the global recession raised fresh concerns about demand. Platinum (+6.2%) made up lost ground relative to its precious metal cousins, gold (-2.8%) and silver (-1.5%). (Also see my post “ Picture du Jour: Gold or platinum? “.)

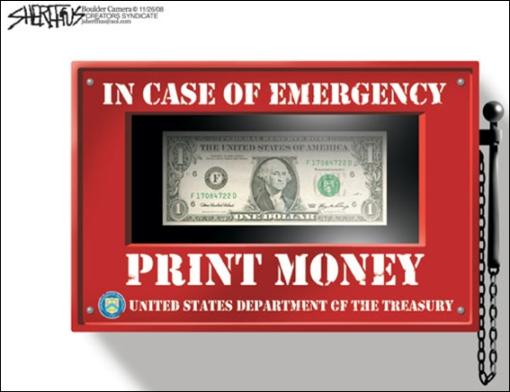

The release on Tuesday of the minutes of the Federal Open Market Committee's meeting of December 15 and 16 showed committee members very concerned about the economic outlook. It was decided to move beyond using the Fed funds rate as the key policy tool, expand the central bank's balance sheet to buy assets to help reduce longer-term interest rates, and make it explicit to keep the Fed funds rate low for an extended period of time, also in an attempt to bring down longer-term rates.

The Fed on Monday started its $500 billion program of buying securities guaranteed by Fannie Mae, Freddie Mac and Ginnie Mae, resulting in a decline in home loan rates.

Meanwhile, President-elect Barack Obama's incoming administration is planning an economic stimulus package worth more than $800 million, including $300 million of tax cuts. Obama said: “The economy is very sick. Economists from across the political spectrum agree that if we don't act swiftly and boldly, we could see a much deeper economic downturn …”

Source: Daryl Cagle

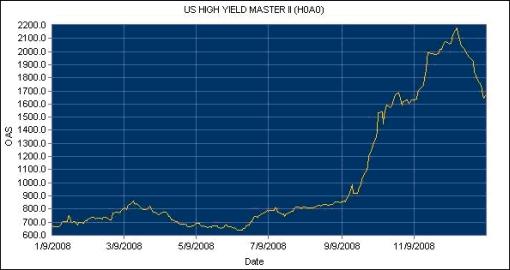

The past week saw some progress on the credit front, with the TED spread (down to 1.20% from 4.65% on October 10, 2008), LIBOR-OIS spread (down from 3.64% on October 10 to 1.07%) and GSE mortgage spreads having narrowed markedly since the record highs. More recently, high-yield spreads have also seen a strong improvement, with the Merrill Lynch US High Yield Index declining by 23.7% since its high of December 15 (see chart below).

Although credit spreads still have to narrow considerably before the world's financial system functions normally again, the recent action has been a step in the right direction.

With many analysts warning that the bubble in Treasuries looks ready to pop, corporate credit seems to beckon. According to a Financial Times survey of 30 leading asset managers and strategists “high-grade corporate bonds are set to outperform other asset classes in 2009″.

The iBoxx Investment Grade Corporate Bond Fund (LQD) and High Yield Corporate Bond Fund (HYG) both rallied over the past week and increased by 2.0% and 3.8% respectively. These Funds have performed excellently since their October/November lows, with LQD up by 26.7% and HYG by 26.2% from November.

Next, a quick textual analysis of the dozens of articles I have read during the past week. Interestingly, many reports were concerned with “bonds” and “yields”.

Turning to the outlook for the stock market, Bennet Sedacca ( Atlantic Advisors Asset Management ) warned as follows in a guest post entitled “ Setting the bull trap “: “The Fed has declared a war on savers, a war on prudence and provided the ultimate Moral Hazard Card - and with our money no less. They are also setting up the ULTIMATE BULL TRAP - a trap so large that when it is sprung, perhaps as early as the end of the first quarter/beginning of second quarter, there will only be sellers left.”

Turning to the outlook for the stock market, Bennet Sedacca ( Atlantic Advisors Asset Management ) warned as follows in a guest post entitled “ Setting the bull trap “: “The Fed has declared a war on savers, a war on prudence and provided the ultimate Moral Hazard Card - and with our money no less. They are also setting up the ULTIMATE BULL TRAP - a trap so large that when it is sprung, perhaps as early as the end of the first quarter/beginning of second quarter, there will only be sellers left.”

“It is difficult to see how equities can sustain an advance until the monetary transmission mechanism begins to function more normally,” added BCA Research . “In addition, the poor earnings outlook will be a persistent headwind for stocks throughout 2009 and analysts are likely to be disappointed in their overly optimistic profit forecasts: earnings could fall by as much as 25 to 30% as revenue growth slows and margins contract.”

Arguing the bullish case from Hong Kong, Puru Saxena 's MoneyMatters newsletter listed the following reasons to support his viewpoint that “the skies are clearing for a four- to five-year bull market”: surging liquidity, low interest rates, declining corporate bond yields, declining TED spread, low valuations, volatility has peaked, the US dollar rally has ended, global stock markets are making higher lows, and a huge amount of cash on the sidelines.

The short-term technical picture is tricky, with the Dow having pulled back below the 50-day moving average and the S&P 500 (shown in the graph below) testing both the 50-day line and the short-term trendline defining the bottom of a rising wedge (usually a negative chart pattern). The December 22 and 29 lows of 857 are also important initial levels for the uptrend to remain intact.

Commenting on the chart, Richard Russell ( Dow Theory Letters ) said: “My guess (and I do have to guess) is that the market will be doing work inside the bottom pattern. This is only natural since it takes a good deal of ‘work' for stocks to break out of a bottom in the face of the ongoing abysmal news. It looks like we are going to have some bobbing and weaving inside the base that has formed. A breakout either way may be a matter of months away.”

An old stock market saying tells us the first five trading days of January sets the course for January, and if the month of January is higher, there is a good chance the year will end higher, i.e. the so-called "January Barometer". So far so good, as the S&P 500 registered a gain of 0.7% over the first five days (although the Dow was down by 0.4%).

Jeffrey Hirsch ( Stock Trader's Almanac ) said: “The return of seasonal bullish market action is encouraging. Since the week of Thanksgiving the market has been constructive. Thanksgiving week was bullish, as was the last half of December, the Santa Claus Rally and now the First Five Days. The final arbiter of these year-end/new-year indicators is of course the January Barometer at month-end.”

Jeffrey Hirsch ( Stock Trader's Almanac ) said: “The return of seasonal bullish market action is encouraging. Since the week of Thanksgiving the market has been constructive. Thanksgiving week was bullish, as was the last half of December, the Santa Claus Rally and now the First Five Days. The final arbiter of these year-end/new-year indicators is of course the January Barometer at month-end.”

While a sustained stock market advance will rely on the thawing of credit markets, I am of the opinion that selective buying in global markets is in order. However, make sure to winnow the wheat from the chaff. The current default rate on American high-yield bonds is less than 4%, but Barclays Capital is predicting a rate of 14.3% by the second half of 2009. “If 2008 was the year of systemic risk [i.e. risk affecting all assets], 2009 seems likely to be a year dominated by specific risk [i.e. risk that is unique to each asset],” said The Economist .

For more discussion about the direction of stock markets, also see my post “ Video-o-rama: Figuring out the lie of the financial land “.

Economy

“Global business confidence began 2009 as dark as it has ever been. While sentiment has improved a bit during the last two weeks, it remains near record lows,” said the latest Survey of Business Confidence of the World conducted by Moody's Economy.com . “Businesses are nearly equally pessimistic across the globe and across all industries. Hiring intentions have turned particularly negative in recent weeks. Pricing power has collapsed, suggesting that deflation is a significant threat.”

The eurozone economy contracted by 0.2% in the third quarter of 2008, according to Eurostat. Following a similar decline in GDP in the previous quarter, the monetary union has officially entered a recession.

The latest industrial production data for the UK, Germany and France continued a downward spiral. It therefore did not come as a surprise that the Bank of England (BoE) on Thursday lowered its repo rate by 50 basis points to 1.5% - the lowest level since the inception of the BoE in 1694. The European Central Bank (ECB) is also expected to lower interest next Thursday as a result of gloomy economic reports and the eurozone inflation rate last month falling below the ECB's target.

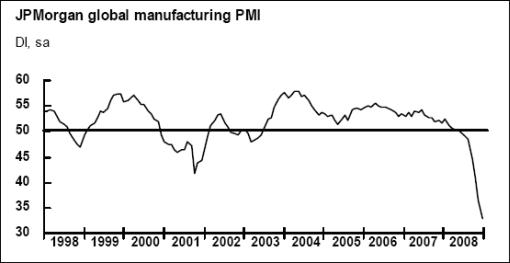

Nouriel Roubini ( RGE Monitor ) said: “Manufacturing surveys reflect simultaneous contraction in manufacturing throughout the G7 and in key emerging markets like China, Brazil and Russia, verifying the global recession that is well on course. PMI and industrial production is at decade lows in key emerging markets, and the US and EU PMI surveys reflect the weakest levels in several decades.” The JPMorgan Global Manufacturing PMI , posting its weakest reading ever in December, bears this out.

As far as the US is concerned, 2008 ended on a depressing note for the US labor market. Payroll employment declined by 524,000 jobs in December, slightly more than expected and the largest one-month decline since December, 1974. Payrolls shrank by 2.6 million jobs over the course of 2008, recording the largest annual decline since 1945. The unemployment rate rose to 7.2% - the highest level since the early 1990s.

“The Bureau of Labor Statistics employed seasonal adjusting chicanery to mitigate job losses. Not seasonally adjusted (NSA), 954,000 jobs were lost. Additionally, the BLS's hokey Net Business Birth/Death Model unfathomably created 72,000 jobs in December,” commented Bill King ( The King Report ).

Asha Bangalore ( Northern Trust ) summarized the US economic situation as follows: “The Fed is expected to stay on hold for all of 2009 in terms of implementing monetary policy changes via adjustments of the target Fed funds rate, but other non-interest avenues to support/ease financial market conditions remain open. The details of the employment report are grim and provide ample evidence for proponents of a large fiscal stimulus package to revive economic activity.”

Week's economic reports

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Jan 5 | 10:00 AM | Construction Spending | Nov | -0.6% | -1.3% | -1.4% | -0.4% |

| Jan 5 | 2:00 PM | Auto Sales | Dec | - | 3.1M | NA | 3.3M |

| Jan 5 | 2:00 PM | Truck Sales | Dec | - | 4.1M | NA | 4.3M |

| Jan 6 | 10:00 AM | Factory Orders | Nov | -4.6% | -2.0% | -2.3% | -6.0.% |

| Jan 6 | 10:00 AM | ISM Services | Dec | 40.6 | 37.0 | 36.5 | 37.3 |

| Jan 6 | 10:00 AM | ISM Services | 12/08 | - | NA | - | 37.3 |

| Jan 7 | 10:30 AM | Crude Inventories | 01/02 | 6682K | NA | NA | 549K |

| Jan 7 | 10:35 AM | Crude Inventories | 01/02 | - | NA | NA | NA |

| Jan 8 | 8:30 AM | Initial Claims | 01/03 | 467K | 540K | 545K | 491K |

| Jan 8 | 2:00 PM | Consumer Credit | Nov | -$7.9B | $2.0B | $0.0B | -$2.8B |

| Jan 9 | 8:30 AM | Average Workweek | Dec | 33.3 | 33.5 | 33.5 | 33.5 |

| Jan 9 | 8:30 AM | Hourly Earnings | Dec | 0.3% | 0.2% | 0.2% | 0.4% |

| Jan 9 | 8:30 AM | Non-farm Payrolls | Dec | -524K | -520K | -525K | -584K |

| Jan 9 | 8:30 AM | Unemployment Rate | Dec | 7.2% | 7.0% | 7.0% | 6.8% |

| Jan 9 | 10:00 AM | Wholesale Inventories | Nov | -0.6% | -0.7% | -0.7% | -1.2% |

Click here for the week's economy in pictures, courtesy of Jake of EconomPic Data .

Source: Yahoo Finance , January 9, 2009.

In addition to a speech by Fed Chairman Bernanke at the London School of Economics (Tuesday, January 13) and the European Central Bank's interest rate announcement (Thursday, January 15), the US economic highlights for the week, courtesy of Northern Trust , include the following:

1. International Trade (January 13): The trade deficit is predicted to have narrowed in November ($54.5 billion versus a trade gap of $57.2 billion in October), largely reflecting lower prices of imported oil. Consensus : $51.5 billion.

2. Retail Sales (January 14): Auto sales moved up slightly in December (10.7 million versus 10.3 million in November). But lackluster non-auto retail sales and lower gasoline prices should bring down the headline reading. Consensus : -1.2% versus 0.3% in January; non-auto retail sales: 0.2% versus 0.3% in January.

3. Producer Price Index (January 15): The Producer Price Index for Finished Goods is expected to have declined by 1.7% in December, reflecting lower energy prices. The core PPI is most likely to have risen by 0.1% after a 0.2% increase in November. Consensus : -2.0%, core PPI +0.1%.

4. Consumer Price Index (January 16): A drop in the overall CPI, due to lower energy prices, is nearly certain. The core CPI is expected to have increased by 0.1% after holding steady in November. Consensus : -0.9%, core CPI +0.1%.

5. Industrial production (January 16): The 2.4% drop in the manufacturing man-hours index in December is indicative of a large decline in industrial production (-1.3%). The operating rate is projected to have dropped to 74.5 in December. Consensus : -1.2%; Capacity Utilization: 74.5 versus 75.4 in November.

6. Other reports : Inventories, Import prices (January 14), Consumer Sentiment Index (January 16).

Click here for a summary of Wachovia's weekly economic and financial commentary.

Markets

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , January 9, 2009.

And now for a few news items and some words from the investment wise that should be of help in keeping our investment portfolios on a winning path. As the Irish say: “Go n-éirí an bóthar leat. May the road rise with you.”

That's the way it looks from Cape Town.

CNN Money: The wealthy self-destruct

“Millionaires and billionaires are turning to suicide in the wake of the financial crisis.”

Source: CNN Money , January 9, 2009.

CNBC: Marc Faber - markets to rally, but retest lows

Click here for article.

Source: CNBC , January 9, 2009.

Mish's Global Economic Trend Analysis: Themes for 2009

“Looking ahead in 2009 here are some things I see as likely.

“Obama will pass a stimulus package of $850+ billion but $300 billion will be ‘tax relief' amounting to $19 a week per household at most. $19 a week is not going to stimulate much of anything but it will add to the budget deficit. People will use that money to pay down bills, which is exactly what they should be doing with it.

“The first 3-5 months are going to be extremely weak on the jobs front with 400,000 or more jobs lost each month. Obama is going to need to create 2-3 million jobs just to counteract job losses in first half of the year. There is no way he is going to create jobs that fast given implosions in state budgets and retailers.

“In 2009 consumers will continue to retrench, housing will continue to decline, and as many as 100 small or regional banks will implode over falling commercial real estate prices. The Fed may arrange shotgun marriages with these banks instead of letting them go under.

“I am sticking with a thesis that says we are currently in a sucker rally in the stock market that will end soon after inauguration or moments after Obama signs a new stimulus package. My target is 600 on the S&P but 450 is not out of the question. However, it is better to think of this in ranges and that range would roughly be 450-700.

“It is quite possible the lows in treasury yields are in. Unlike 2008 where I was constantly beating the drums for lower yields, 2009 could be different. Here are the facts: 3 month and 6 month yields hit 0% and the 10 year came close to hitting 2%. Could there be lower yields still? Yes, quite easily. Is it worth playing for other than as a hedge or part of an overall investment strategy? No.

“Should treasuries be shorted? No, it is too early. Yields can easily make lower lows. Just because something is not a good long, does not make it a good short. Look at how long yields stayed low in Japan. I doubt we see a print of 4 on the 10-year treasury for a long time. If one wants to bet on yields rising for a reflation trade, there are better plays such as going long energy stocks that yield a nice dividend as well.”

Click here for the full article.

Source: Mike “Mish” Shedlock, Mish's Global Economic Trend Analysis , January 6, 2009.

CNBC: President-elect Obama on the economy

Source: CNBC , January 8, 2009.

BBC News: Obama says US economy “very sick”

“US President-elect Barack Obama has described America's economy as ‘very sick' and has said that the situation was worsening. Earlier, he met politicians in Washington to discuss ways to boost the economy and create new jobs.

“US media reports say he is planning a stimulus package worth more than $800 billion, including $300 billion of tax cuts.

“Mr Obama has said he wants a plan that will create 3 million jobs by 2011.

“The president-elect hopes to be able to enact the package shortly after his inauguration on 20 January.

“‘The economy is very sick,' he said. ‘We have to act and act now to break the momentum of this recession. We've got an extraordinary economic challenge ahead of us, we're expecting a sobering job report at the end of the week.'

“‘Economists from across the political spectrum agree that if we don't act swiftly and boldly, we could see a much deeper economic downturn that could lead to double-digit unemployment and the American dream slipping further and further out of reach,' Mr Obama said.”

Source: BBC News , January 06, 2009.

CNBC: Barney Frank on TARP

“Rep. Barney Frank comments on the revisions to the TARP.”

Source: CNBC , January 9, 2009.

Fox Business: Outraged! - Peter Schiff on the economy

Source: Fox Business , January 7, 2009.

Financial Times: New York Fed starts $500 billion home loans aid

“The Federal Reserve Bank of New York on Monday said it had started its $500 billion plan to drive down US mortgage rates by buying securities guaranteed by Fannie Mae, Freddie Mac and Ginnie Mae, the government-run mortgage financiers.

“Mortgage bond yields fell sharply as a result, extending a dramatic decline that followed the New York Fed's announcement of the programme on November 25. Thirty-year agency mortgage securities yielded 190 basis points over Treasuries on Monday, compared with 208bp on Friday.

“The Fed did not disclose the amount of its purchases on Monday, but said it would provide weekly updates on its buying programme from Thursday.

“Last week, the New York Fed pushed forward with its plan by setting a goal of buying $500 billion in mortgage-backed securities by mid-2009, part of a sustained effort to help the US weather the financial crisis.

“A reduction in financing costs for the mortgage agencies translates into lower rates for US home loans. Average interest rates on 30-year fixed-rate mortgages have fallen from 6% to about 5.3% since the program was announced in November, according to Bankrate.com.”

Source: Saskia Scholtes, Financial Times , January 5, 2009.

The Seattle Times: Steel industry hopes for big stimulus shot

“The steel industry, having entered the recession in the best of health, is emerging as a leading indicator of what lies ahead. As steel production goes, and it is now in collapse, so will go the national economy.

“That maxim once applied to the Big Three car companies. Now they are losing ground in good times and bad, and steel has replaced autos as the industry to watch for an early sign that a severe recession is beginning to lift.

“The industry itself is turning to government for orders that, until the collapse, came from manufacturers and builders.

“Its executives are waiting anxiously for details of President-elect Obama's stimulus plan and adding their voices to pleas for a huge public investment program - up to $1 trillion over two years - that will lift demand for steel to build highways, bridges, power grids, schools, hospitals, water-treatment plants and rapid transit.

“New spending should provide an immediate jolt to the steel business, which has already gone through the painful makeover now demanded of the Big Three.”

Source: Louis Uchitelle, The Seattle Times , January 2, 2009.

Financial Times: US deficit set for postwar record

“The US budget deficit will hit nearly $1,200 billion this fiscal year even without the cost of Barack Obama's planned fiscal stimulus, Congress's budget watchdog warned on Wednesday.

“The warning came as the president-elect said that the stimulus would be ‘on the high end of our estimates' - implying close to $775 billion over two years - but ‘will not be as high as some economists have recommended, because of the constraints and concerns we have about the existing deficit'.

“The estimate, published by the Congressional Budget Office, threw into stark relief the dilemma facing the president-elect, highlighting the urgent need for stimulus and the fraught state of public finances.

“The CBO said that the budget deficit for the fiscal year 2009 would ‘shatter the previous post-World War Two record' relative to the size of the US economy. Without a stimulus, it said that the deficit would reach 8.3% of gross domestic product. Its numbers imply that the proposed stimulus could push the US fiscal deficit close to or over 10% of GDP.”

Source: Krishna Guha, Edward Luce and Andrew Ward, Financial Times , January 7, 2009.

Financial Times: Auto sales hit fresh lows in December

“Motor vehicle sales plumbed fresh lows around the world last month, adding to pressure on carmakers, their suppliers and dealers.

“General Motors, Toyota, Ford and Honda all reported declines of more than 30% in the US, the biggest market, compared with December 2007. Total fourth-quarter sales were the lowest since 1981.

“Car sales in Japan, including buses, dropped 22% to the lowest December level on record, according to the Japan Automobile Dealers Association.

“In Europe, registrations in Spain plunged by almost half, in France by 24% and Italy 13.2%.

“The slump in the US and Europe reflected flagging consumer confidence and tight credit.”

Source: Bernard Simon, Financial Times , January 5, 2009.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.