U.S. Dollar Panic Selling Following Rate Cut Abating

Currencies / Futures Trading Dec 18, 2008 - 09:55 AM GMTBy: ForexPros

The USD continued to decline today despite good indications that near-term technical levels would hold surprising traders with the speed of the move. All the major pairs fell through key support levels for the second day after traders chose to sell the Greenback with both hands after yesterday’s larger than expected interest rate cut by the FOMC.

The USD continued to decline today despite good indications that near-term technical levels would hold surprising traders with the speed of the move. All the major pairs fell through key support levels for the second day after traders chose to sell the Greenback with both hands after yesterday’s larger than expected interest rate cut by the FOMC.

A larger than expected production cut by the OPEC members failed to inspire Crude Oil to rally lending support to the argument that energy prices will decline further lending some support for an economic recovery but analysts remind that is a minor issue against the size of the economic crisis; most likely the interest rate cut putting the USD as the worlds cheapest currency will outweigh a rise or drop in commodities prices. For the most part the USD fell to two-month lows or more against the majors today and more losses are expected as traders adjust to zero-cost of money and how that will fuel growth and inflation.

GBP high print overnight at 1.5725 went unchallenged in New York today as the rate struggled to follow EURO higher; low prints at 1.5243 making for nearly a 500 point range on the day.

EURO rallied again blowing through expected resistance areas for a high print at 1.4438 almost matching the range seen in GBP with a low print at 1.3997; the rate has now put on more than 20 full handles between current prices and the lows of October. The volatility is huge and traders remind that stops have been one of the big drivers the past two days suggesting that shorts have been effectively eliminated from the markets.

USD/JPY failed to hold the previous lows at 88.10 area for a low print at 87.12 finding stops in size under the previous lows; traders note that official interest on the bid was seen as well as the unusual step of the BOJ checking rates. Some analysts suggest that a possible coordinated intervention to stop the Yen’s rise could be in the works but I would find that highly unlikely as the BOJ hasn’t intervened since 2004 and conditions are worse now for them.

USD/CHF smashed support for a low print at 1.0745 and closes within 20 pips of the low suggesting that money is going into Gold; gold prices were sharply higher in Gold as well today. Traders note that lows today in Swissy are nowhere near support levels that were expected to offer a bounce and with the speed of the move no one is willing to get on the buy side just yet; prices could be much lower to end the year.

USD/CAD low prints at 1.1930 were no surprise but the rate has lagged the speed of the decline seen elsewhere suggesting that the rate may behave more rationally near-term. In my view, panic was the rule today and traders will likely come to their senses by the end of the year. The USD is now getting back to more realistic price levels given the conditions of the economy; a return to lower prices for the USD is coming but it needs to be organized a bit better. I think the panic needs to subside and then more reasonable two-way action will result.

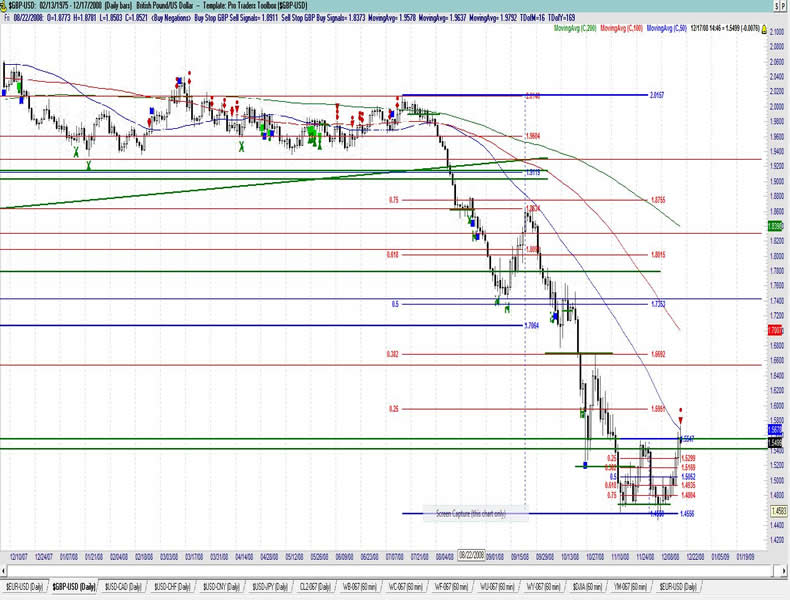

GBP/USD Daily

Resistance 3: 1.5800/10 , Resistance 2: 1.5780 , Resistance 1: 1.5710/20 , Latest New York: 1.5500

Support 1: 1.4850 ,Support 2: 1.4740 , Support 3: 1.4680

Comments

Rate struggles to track EURO higher; fails at resistance to make lows in New York after follow-on buying dries up and EURO/GBP cross reaches new lifetime high. Toolbox signals a trend sell; aggressive traders can short the rate for the pullback to possibly test the breakout from 1.5050 area. Spillover from EURO no doubt. Lows holding at 1.5200/10 area likely has stops below. Stops cleared above Tuesday highs cleared with sellers taking a stand at 1.5700 area. Cross-spreaders likely keeping pressure on as GBP/EURO cross holds near lifetime high. Traders note solid two-way action. Sellers hold control above 1.5500 area so far. Be ready for whipsaw around news this week as both sides have technical reasons to execute.

Data due Thursday: All times EASTERN (-5 GMT)

4:30am GBP Retail Sales m/m

4:30am GBP Prelim M4 Money Supply m/m

4:30am GBP Public Sector Net Borrowing

7:01pm GBP GfK Consumer Confidence

EURO/USD Daily

Resistance 3: 1.4520 , Resistance 2: 1.4480 , Resistance 1: 1.4430/40 , Latest New York: 1.4360

Support 1: 1.3850 , Support 2: 1.3780 ,Support 3: 1.3720/30

Comments

Rate scores another new high during New York trade and holds above technical retracement; bears take a stand at 1.4180 area and lose. Toolbox signals Strong Trend sell around current levels but is negated on today’s action. Technical traders will be looking for a test of the 100 day MA near-term to offer support this time after blowing through to the upside. Traders note lots of aggressive active buying getting disappointed. Stops building in size over the 1.3750 area cleared all the way to 1.4180 area. Traders note some stops within range overnight suggesting longs are late or nervous. Correction is likely. Likely bulls will lighten up but will need to see failure at 1.4400 area first I think. Stops likely now around 1.4450 area.

Data due Thursday: All times EASTERN (-5 GMT)

4:00am EUR German Ifo Business Climate

4:00am EUR Italian Unemployment Rate

5:00am EUR Trade Balance

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2008 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.