Half Million Job Losses as Economic Depression Spreads

Economics / Economic Depression Dec 06, 2008 - 09:25 AM GMTBy: Mike_Shedlock

I wrote about the latest jobs numbers this morning in Jobs Contract 11th Straight Month; Unemployment Rate Hits 6.7% .

I wrote about the latest jobs numbers this morning in Jobs Contract 11th Straight Month; Unemployment Rate Hits 6.7% .

Let's look at some more details starting with this report: Half-million jobs vanish as economy deteriorates .

An alarming half-million American jobs vanished virtually in a flash last month, the worst mass layoffs in over a third of a century, as economic carnage spread ever faster and the nation hurtled toward what could be the hardest hard times since the Great Depression.

Staring at 533,000 lost jobs, economists were anything but hopeful. Since the start of the recession last December, the economy has shed 1.9 million jobs, and the number of unemployed people has increased by 2.7 million -- to 10.3 million now out of work.

Some analysts predict 3 million more jobs will be lost between now and the spring of 2010 -- and that the once-humming U.S. economy could stagger backward at a shocking 6 percent rate for the current three-month quarter.

The jobless rate would have bolted to 7 percent for the month if not for the exodus of 422,000 people from the work force for any number of reasons -- going back to school, retiring or simply abandoning job searches out of sheer frustration. When people stop looking, they're no longer counted in the unemployment rate.

The United States -- already in recession for a year, may not be out of it until the spring of 2010 -- making for the longest downturn since the Great Depression of the 1930s, economists are now saying. Recessions in the mid-1970s and early 1980s last 16 months.

Unemployment peaked at 10.8 percent in 1982, terrible but still a far cry from the Depression, when roughly one in four Americans were out of work.

Depressionomics

On Wednesday I wrote Prepare For Depression Level Unemployment .

Deflation has already set in and it's now realistic to start talking about another "D" word, this one being depression. Before we can use a word, we must define it. For the sake of argument, let's define depression as unemployment of 10% or greater. Some did lot like that measurement pointing out that unemployment peaked at 10.8 percent in 1982, and nearly 25% during the Great Depression. Others wanted to use a GDP decline of 10% as the definition of depression .

Still others will not define a depression at all.

Please consider Is U.S. facing a depression?

Now that the "R" word is officially out of the closet, can the "D" word be far behind?

The National Bureau of Economic Research, the august body that serves as a thermometer for the U.S. economy, confirmed Monday what many already suspected: We're in a recession and have been for a year.

But as the economic crisis has deepened this fall, analysts and business executives increasingly have raised the prospect that we're headed for a depression. The most recent example came Wednesday, when a top Chrysler executive told Congress that the failure of a major U.S. automaker could "trigger a depression."

If so, don't expect the National Bureau of Economic Research to give us a head's up when it happens.

"It's just not a part of the business-cycle-dating process that the NBER has been involved in," a spokeswoman for the bureau said.

According to the bureau's website, "The NBER does not separately identify depressions. The NBER business cycle chronology identifies the dates of peaks and troughs in economic activity. We refer to the period between a peak and a trough as a contraction or a recession, and the period between the trough and the peak as an expansion."

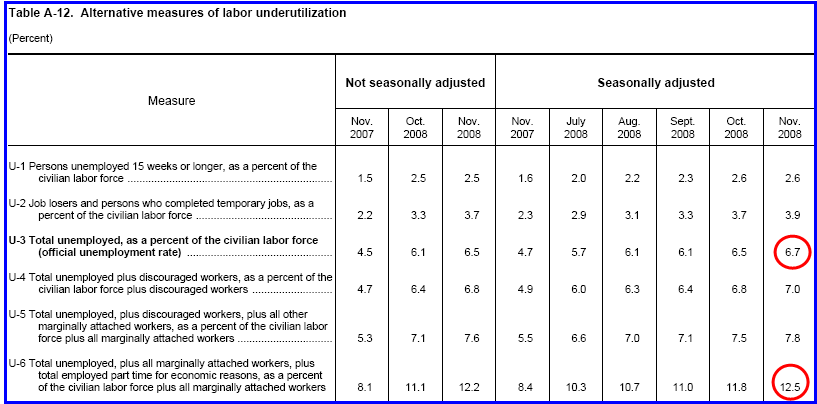

I mentioned 10% as depression level unemployment but the important point is the context. Yes, we hit 10% before, but we are also not counting unemployment like we did before. Here is Table A-12 again.

Table A-12

Table A-12 is where one can find a better approximation of what the unemployment rate really is. Let's take a look.

The official unemployment rate is 6.7%. However, if you start counting all the people that want a job but gave up, all the people with part-time jobs that want a full-time job, all the people who dropped off the unemployment rolls because their unemployment benefits ran out, etc., you get a closer picture of what the unemployment rate is. That number is in the last row labeled U-6.

It reflects how unemployment feels to the average Joe on the street. U-6 is 12.5%. Note that it was 8.4% a year ago. Both U-6 and U-3 (the so called "official" unemployment number) are poised to rise further.

We are already at 12.5% by what I consider fair counting. And by the time we get to 10% officially agreed upon unemployment, row U-6 is likely to be approaching 15-17%. The only time job losses exceeded that number was during the Great Depression.

Other Factors

- Unprecedented numbers of foreclosures and bankruptcies.

- Home prices have declined the most in history.

- The S&P 500 was down 49% at one point this year. That exceeded any yearly loss during the great depression.

I suggest that 10%+ U-3 or 15%+ U-6 in conjunction with the other factors noted above qualifies as a "depression". However, there is no official arbiter of terms like there is for recession. Thus the difference between recession and depression will continue to be debated by personal experience, most likely the old saw "Recession is when my neighbor loses his job, depression is when I lose mine".

By that measure, 533,000 more people are in a state of economic depression this month compared to last month. I suspect that 500,000+ number is not an outlier. Be prepared to see an array of more dismal numbers in 2009.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.