Deflation, Nowhere to Hide for Investors

Economics / Economic Depression Dec 02, 2008 - 01:32 PM GMT “I've been in the market 50 years...(back in 1974) there were 40 people in the (London) office...I had to take it to half a dozen...there was a very severe downturn in equity markets but credit markets were still working. That's what is different this time. There's nowhere to hide .”

“I've been in the market 50 years...(back in 1974) there were 40 people in the (London) office...I had to take it to half a dozen...there was a very severe downturn in equity markets but credit markets were still working. That's what is different this time. There's nowhere to hide .”

Terry Campbell, senior chairman Goldman Sachs JB Were. (by Ingrid Mansell, Australian Financial Review 21 Nov. 2008).

In a world whereeconomies are inter-connected as never before (thanks to globalization and the internet) the speed and viciousness of the recent global stock market collapse and credit freeze has caught most financial advisors and investors by surprise.Those few who can remember back to 1974 and 1987 are adamant that the present situation is worse with some calling it the worst market meltdown since the Great Depression of '29.

Being invested over a broad range of asset classes hasn't this time protected against horrific losses. Many stock markets around the globe have plummeted by 50 percent or more. The share prices of some blue chip companies have been decimated ...Leheman Bros bankrupt; Citigroup down 94% from $54.67 in June 2007 to $3.20; General Motors down 93% from $38.31 in November 2007 to $2.63.

The “Global Property Guide” records “The End of the Property Boom” with house prices down up to almost 35 per cent in some areas and “World Property Market Slide Worsens”.

http://www.globalpropertyguide.com/investment-analysis/The-end-of-the-global-house-price-boom

http://www.globalpropertyguide.com/investment-analysis/World-property-market-slide-worsens

Meanwhile, commercial property prices have fallen 30 to 40 per cent already in some parts of London with many other areas around the world set to follow.

The commodities boom has hit the wall in the face of a looming global recession with prices of oil, copper, silver, wheat, corn, cotton and platinum all dropping more than 50 per cent .

Many investors who have seen their savings or retirement nest eggs savaged by these losses, or had savings frozen as funds blocked redemptions, must be right now wishing they'd had the foresight to pull their money out and park it at (at least temporarily) in boring but safe cash...which actually was a place to hide over the past several months.

The Dreaded “D” Word.

Suddenly, with prices of many asset groups dropping rapidly, the dreaded “Deflation” word is popping up everywhere. Google “deflation” and you'll find 3,570,000 results.

The prospect of Deflation strikes fear into the hearts of Central Bankers because once it becomes entrenched and prices start falling across a broad range of assets, products and services, nervous consumers pull back on spending in anticipation of lower prices in the future. This in turn sends the economy into a deadly downward spiral that sees businesses close down and unemployment skyrocket which in turn drives prices of most things relentlessly lower in a series of vicious feedback loops.

Robert Prechter (who has long been warning that deflation was inevitable rather than hyperinflation...which will likely come later) is more confident than ever that “ DEFLATION IS WINNING”.

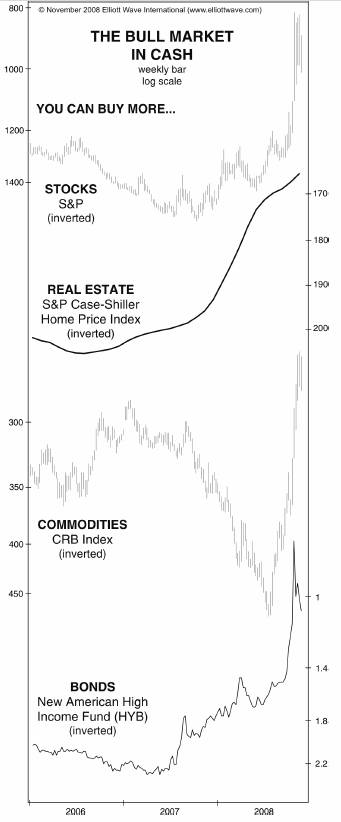

In his November edition of Elliott Wave Theorist he goes on to say ... “cash is soaring in value, as creditors demand dollars and debtors sell everything they can to come up with them. Cash now buys 1.7 times as much stock and real estate, twice as much silver, and 2.5 times as much oil as it did a short time ago. Is that a bull market, or what? This trend is far from over. The longer you hold onto your money, the more it will be worth, until deflation ends”

Graph courtesy of Robert Prechter's Elliott Wave International.

www.elliottwave.com

In his “Deflation Speech” of January 1998 former Federal Reserve Chairman Alan Greenspan remarked that “The severe economic contraction of the early 1930s, and the associated persistent declines in product prices, could probably not have occurred apart from the steep asset price deflation that started in 1929... the onset of deflation involves a flight from goods to money.”

In December 2002 Greenspan warned that “Deflation is more of a threat to economic growth than is inflation... It is a pretty scary prospect.”, but reassured everyone that “Options for aggressive monetary policy response are available” to the Fed which could flood the economy with money even if nominal interest rates fell to zero.

Only a month before that Governor Ben Bernanke had given his famous “helicopter drop of money” speech entitled “Deflation: Making Sure “It” Doesn't Happen Here” . He too had come to “The conclusion that deflation is always reversible under a fiat money system... (because) the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost... (so it) can always generate higher spending and hence positive inflation”.

![]() Now was that a light bulb moment or what?

Now was that a light bulb moment or what?

What everyone seems to have overlooked is the next sentence Bernanke uttered directly after those words;

“Of course, the U.S. government is not going to print money and distribute it willy-nilly”.

Of course not! (This is pure double-speak... “Trust me. Would I lie to you? ... No, not much!)

Most U.S. economist are now resigned that America will suffer a deep recession over the next two to three quarters, while the International Monetary Fund has warned that the world's other major developed economies will also be hit by recession in 2009 with no quick recovery in sight.

So what's a poor, confused schmuck supposed to do now with his life's savings? Does he listen to his financial advisor who tells him “Sit tight! Don't panic! Now's not the time to sell. You'll only crystallize your losses. You'll miss the inevitable bounce-back that comes within 6-12 months. Buy in now...stocks are cheap...you won't get another buying opportunity like this again. Stop reading the newspapers...they only peddle that doom & gloom stuff to sell papers.”

Or does he cut his losses and rush to the safety of cash and gold just in case the deflationary forces overwhelm the Central Banker's best efforts to reinflate the economy and the situation spirals back down in an all out collapse of prices and confidence?

That's what Storm Financial, an Australian financial planning firm with $4.5 billion under management, recommended to its 13,000 clients last month calling it a “stabilisation action” . In selling their heavily geared portfolios and switching to cash many investors would sustain heavy losses but they were advised “Our recommended strategy keeps you in the game and still standing through this crisis – whilst not perfect, nor without risk, we believe it contains less risk than leaving you open to this potential situation”. Storm explains that this same strategy proved successful following the financial turmoil caused by the terrorist bombings in the U.S. on September 11, 2001.

What if the massive government bail-outs finally stop working and no longer boost investor's confidence, but instead have the reverse effect and become alarming indicators of just how serious the situation is becoming?

And what about the Cassandras and their dire predictions that we might eventually plunge deeper into depression? ... Is that even remotely possible?

The Other Dreaded “D” Word.

Nobel laureate economist Paul Krugman recently stated there were very strong parallels between the Great Depression of '29 and the present financial crisis.... “What we learned 70 years ago, and then kind of forgot, was that capitalism needs regulation and management...This is not your father's recession, this is your grandfather's recession”.

Even president-elect Barack Obama is aware of the problems that lie ahead when he warns that the financial situation is “likely to get worse before it get better.” Perhaps a lot worse.

Google in “Economic Depression” ... you'll get 10,700,000 results.

All the best, Joe.

www.lifetoday.com.au

Copyright © 2008 Dr William R Swagell

Disclaimer: This newsletter is written for educational purposes only. It should not be construed as advice to buy, hold or sell any financial instrument whatsoever. The author is merely expressing his own personal opinion and will not assume any responsibility whatsoever for the actions of the reader. Always consult a licensed investment professional before making any investment decision.

Dr William R Swagell Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.