Global Stock Market Rampant Buy Signals

Stock-Markets / Global Stock Markets Nov 09, 2008 - 11:35 AM GMT

Richard Russell (Dow Theory Letters): First deflation – then inflation

Richard Russell (Dow Theory Letters): First deflation – then inflation

“Deflation/Inflation. First deflation – then inflation. I don't have to convince you that we're now dealing with world deflation. Copper is down 35% this year, cotton down 32%, oil down 26%, platinum down 43%, orange juice down 44%, wheat down 35%, gasoline is now around $3 a gallon, stocks have collapsed, autos are cheaper, home prices have plummeted, suburbs are hanging out ‘for sale' signs. No price is firm – you can make an offer for anything, and you're likely to get it at your bid price.

“But here in the US the Fed and the Treasury are having nightmares – they're wondering – ‘Are we following in Japan's foot steps?' Bernanke and Paulson are well aware of the danger of deflation, and they are spending hundreds of billions of dollars in an attempt to ward off deflation. The Fed knows it can halt inflation, simply by raising interest rates. But deflation is another story, and it's very difficult to halt deflation once it becomes imbedded in an economy. In fact, the last thing Ben Bernanke, an expert on the long Japanese recession and the Great Depression, wants to do is to battle the forces of deflation. Stop it before it happens is his philosophy, and if that kicks the national debt up a few trillion dollars – well, so be it.

“The trillions being spent today won't show up in the economy immediately. Neither will the current low Fed Funds rate of 1.5%. It may take a year or two before today's massive injection of dollars into the banking and business system shows up in the economy. But when it does surface, it will reveal itself as raging inflation.

“Before inflation resumes, the US dollar is going to get the chills. The Fed has covered the world with a blanket of Federal Reserve Notes. These dollars are needed now, but in the period ahead these dollars will set off a wave of inflation. When there's too much of any item, that item loses value. When the supply of anything, stocks, champagne, cars, becomes excessive, the value of those items declines. Yes, it can even happen to a currency. Too many dollars are now being created. Somewhere ahead, the dollar is going to lose its value against other currencies. Our overseas creditors won't accept a trillion more dollars, and that's what gold is now beginning to take into account. The intrinsic value of gold does not fluctuate in terms of dollars. The number of dollars required at any given time to purchase an ounce of gold fluctuates.”

Source: Richard Russell, Dow Theory Letters , November 5, 2008.

Asha Bangalore (Northern Trust): Employment report – deep economic woes will take long to fade

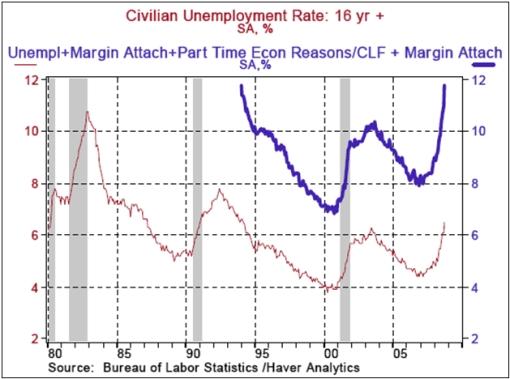

“ Civilian Unemployment Rate : 6.5% in October versus 6.1% September, cycle low is 4.4% in March 2007.

Payroll Employment : -240,000 in October versus -284,000 in September, net loss of 179,000 jobs after revisions of payroll estimates for August and September; private sector payrolls fell 263,000 in October versus a loss of 243,000 in September.

Hourly earnings : +4 cents to $18.21, 3.5% yoy change vversus 3.4% yoy change in September; cycle high is 4.28% yoy change in Dec. 2006.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , November 7, 2008.

Bloomberg: Jan Hatzius – a unemployment at 8% by end of 2009

“Jan Hatzius, chief US economist at Goldman Sachs, talks with Bloomberg about the outlook for the October employment report and the need for another government-sponsored stimulus package.”

Source: Bloomberg , November 7, 2008.

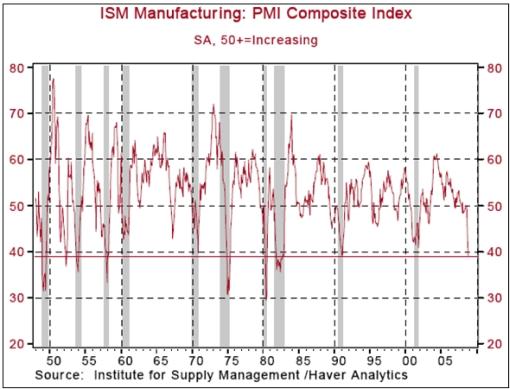

Asha Bangalore (Northern Trust): ISM Manufacturing Survey – significant decline

“The ISM manufacturing index dropped to 38.9 in October, the lowest since September 1982. Survey results for October indicate that factory conditions have turned weaker than data suggested in the past few months.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , November 3, 2008.

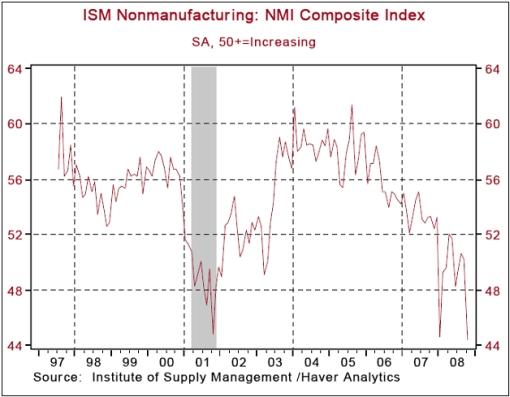

Asha Bangalore (Northern Trust): ISM Non-Manufacturing Survey showing weakness

“The ISM Non-Manufacturing Survey results show broad based weakness. The headline composite index dropped to 44.4 in October from 50.2 in September. This is the lowest in the short history of this index. The results of the ISM Non-Manufacturing Survey confirm the message of a fundamentally weak economy seen in other economic reports.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , November 5, 2008.

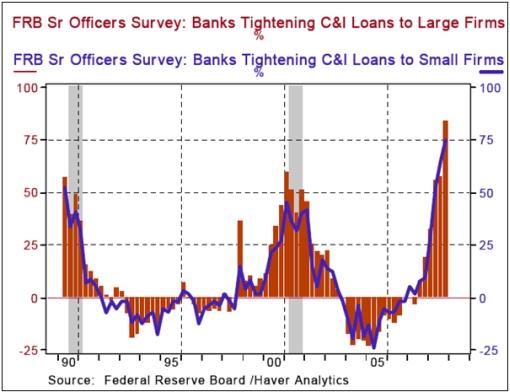

Asha Bangalore (Northern Trust): Senior loan officer survey – credit conditions remain strongly unfavorable

“The Senior Loan Officer Opinion Survey of October 2008 shows further tightening of loan underwriting standards for both big and small firms. Eighty three percent of respondents indicated imposing tighter lending standards for large firms compared with 57.6% in the July survey.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , November 3, 2008.

Charlie Rose: A conversation with Ted Forstmann

A conversation with Ted Forstmann of Forstmann Little & Company, a private equity firm, about the credit crisis, the US economy, Wall Street and philanthropy.

Source: Charlie Rose , October 29, 2008.

Jan Loeys (JP Morgan): How deep a crisis?

“The debate over whether we are in a severe world financial and economic crisis is settled, says Jan Loeys, head of Global Asset Allocation at JP Morgan. Now the focus has shifted to how deep and long the crisis will be.

“The financial crisis is in no doubt the worst since the second world war. The depth of the economic crisis is harder to gauge. It is clear that the global recession will be worse than the recession in the early nineties.

“Where are we in these crises? The worst of the financial crisis has past, but we have not seen the worst of the economic crisis.

“An avalanche of public measures to inject capital and liquidity brought some life to money and credit markets. More importantly, public authorities are becoming the largest financial intermediaries, taking in flight-to-quality money and lending it directly to industry.

“Where does this leave us in the cycle of cutting leverage? Banks have come a long way. Other companies will likely turn more cautious on spending.

“Households have started to cut debt, but are not halfway through yet. Pension funds are just starting to cut their risk appetite.

“That leaves hedge funds. They have reduced their reliance on leverage, but their real threat comes from redemptions that will increase significantly next year. Over time we expect the hedge funds involved in less liquid assets to gravitate to a private equity platform.”

Source: Jan Loeys, JP Morgan (via Financial Times ), November 3, 2008.

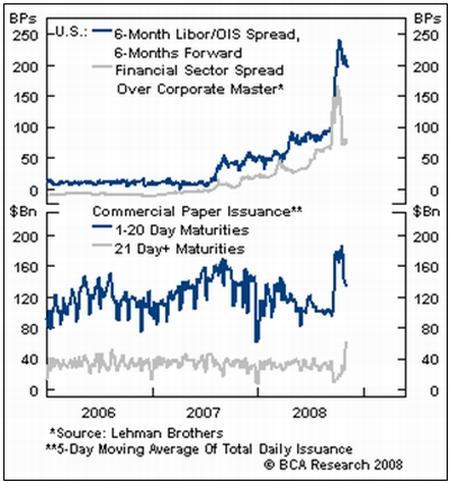

BCA Research: US credit markets – tentative signs of improvement

“Although tentative, there have been some early signs that monetary authorities are making headway in their fight to re-establish financial sector confidence.

“The banking system remains mired in a massive deleveraging process as it sheds risk and braces for recession. Nevertheless, there are early signs, in the US at least, that the various central bank liquidity facilities and capital injections are beginning to have the desired effect: forward libor/OIS spreads have rolled over; financial sector spreads have narrowed sharply from their October wides; and commercial paper (CP) issuance is beginning to shift back to longer maturities. Bottom line: Restoring confidence in the financial system will take much time, but the healing process appears to finally be underway.”

Source: BCA Research , November 6, 2008.

Bespoke: One-month treasuries still indicate fear

“The yield on the one-month Treasury Note is currently at 0.09%, which is still extremely low by historical standards. This indicates that investors continue to flock to the safest of safe haven assets, and we are by no means out of the woods yet in terms of the credit crisis.”

Source: Bespoke , November 5, 2008.

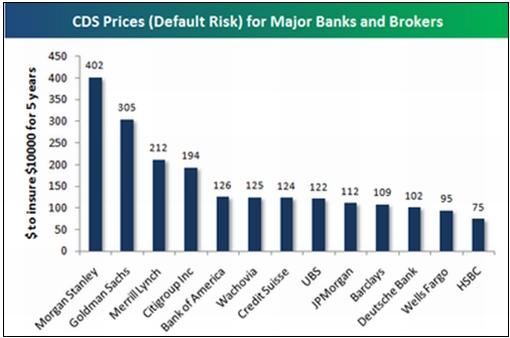

Bespoke: Default risk for key financials

“Below we highlight current credit default swap prices for 13 global financial firms. The prices indicate the cost per year to insure $10,000 of bonds for five years. These prices were much, much higher a few weeks ago, so it's good to see them come down, but they still remain elevated. Morgan Stanley and Goldman currently have the highest CDS prices, followed by Merrill and Citigroup. As of yesterday's close, Wells Fargo and HSBC were the only two financials of the group below to have CDS prices below 100.”

Source: Bespoke , November 6, 2008.

City Wire: Man Group sees assets hit by market volatility

“Alternative specialist manager Man Group topped the fallers on a grim day for markets after seeing its assets under management fall in the wake of recent market volatility.

“The company – the largest publicly traded hedge fund manager – said that its funds under management had shrunk by 9% in total in the last six months, standing at $67.6 billion at end of September.

“Crucially, this was also lower than the estimate of $70.3 billion in the pre-close trading update, with the group citing ‘extreme moves in markets and foreign exchanges in the last week of September' for the downward revision.

“It also warned that its Man Global Strategies (MGS) division had implemented a further reduction in investment exposure to cut back on risk because of ongoing volatility, which it said would result in further falls in assets of around $7.5 billion in the next two months.

“In reaction, brokers were downbeat, with Evolution calling the update a ‘shocking statement'. It said the main problem was that poor performance and market volatility had led Man to reduce the gearing in its structured products.

“Meanwhile redemptions came in at $6 billion, with traders noting the figure appeared to be lower than peers.”

Source: City Wire , November 6, 2008.

Eoin Treacy (Fullermoney): Government bond yields pulling back

“Government bond yields spiked in a number of countries from late-October, but the majority have since seen a significant easing of this risk premium. Some of the most extreme moves have taken place in Brazilian, Indonesian, Mexican, South African and Russian debt. All of these yields surged on the upside as concerns about the risks attached to emerging markets soared, but all have since pulled back sharply as bargains were perceived with yields at such elevated levels.

“The highs posted for these yields coincide with lows for a number of the respective currencies against the US dollar and Japanese yen. Stock markets have rallied reasonably well over the same time frame but the moves in the currency and bond markets are providing a clearer signal that investors are willing to tolerate some risk when the potential return is so appetising.”

Source: Eoin Treacy, Fullermoney , November 4, 2008.

Bloomberg: Jim Rogers says markets may go “a lot further down”

“Jim Rogers, chairman of Rogers Holdings, talks with Bloomberg in New York about the US government's rescue of troubled banks, the outlook for US stocks and investment strategy.”

Source: Bloomberg , November 3, 2008.

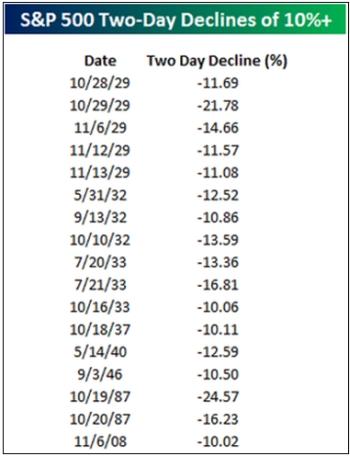

Bespoke: Worst two-day decline since the 1987 crash

“While the declines we saw in October seemed extreme, one landmark we failed to reach during that period was a two-day decline of 10% or more. Well, we can check that one off the list. With two 5% declines in a row, the S&P 500 is now down 10.02% since election day.”

Source: Bespoke , November 6, 2008.

Reuters: John Bogle – US market has “improved radically”

“The fundamentals of the US stock market have ‘improved radically' and declines in valuations to five-year lows are overblown, legendary investor and Vanguard Group founder John Bogle said on Tuesday.

“Bogle's comments, coming as US stocks rose in their biggest Election Day rally, underlines an emerging streak of optimism on Wall Street over corporate earnings and the prospect of more measures to prevent the financial crisis from turning into a global recession.

“‘It seems to me that people have lost sight of the fact that the fundamentals have improved radically,' said Bogle, who launched the colossal $97 billion Vanguard 500 Index in the mid-1970s as a low-cost investment strategy.

“The hard-charging, 79-year-old founder of the nation's second-largest largest mutual fund company said he expected the earnings of companies in the Standard & Poor's 500 Index to grow at a rate of about 7% annually over the next decade. That should pave the way for returns on US stocks of around 10%, according to his calculations that combine a projected earnings growth rate with a 3% dividend yield generated by stocks in the S&P 500 Index.

“‘The value of the US stock market was $18 trillion a year ago. And now it's about $9.5 trillion or let's call it $10 trillion with today's rally. Anyone who believes that American business is worth $8 trillion less than it was a year ago I think is a fool,' he told Reuters in a telephone interview.”

Source: Reuters , November 4, 2008.

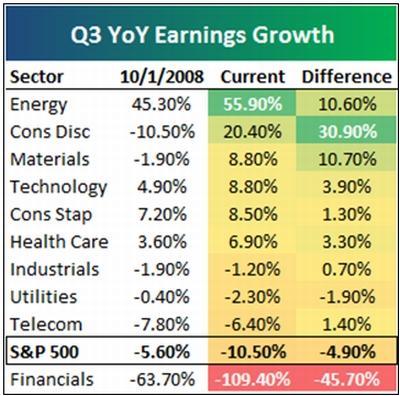

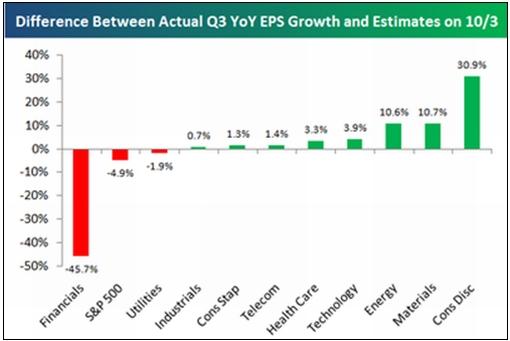

Bespoke: Q3 earnings growth not all that bad

“Below we highlight the current year-over-year growth (or decline) in earnings for the S&P 500 and its ten sectors in the third quarter. As shown, the Energy sector has seen the best growth at 55.9%, which is 10.6 points better than the expected 45.3% growth at the start of the reporting period. Surprisingly, Consumer Discretionary has had the second best growth at 20.4%, while it was expected to see earnings decline by 10% at the start of October. Industrials, Utilities, Telecom and Financials have all seen earnings decline in Q3 ‘08 vs. Q3 ‘07. Overall, the S&P 500 has seen earnings decline by 10.5% in Q3 ‘08, which is about twice as bad as was expected prior to earnings season. This decline is all due to the Financial sector, however, and every other sector is faring better than the index as a whole.”

Source: Bespoke , November 3, 2008.

Richard Russell (Dow Theory Letters): Is this a false rally?

“False rally? Following the 1929 crash, there was a spectacular upside correction that topped out in April of 1930. Many people lost their shirts when the great rally of 1929-30 topped out. These people accepted the huge rally as their opportunity to get their money back, money they had lost during the 1929 crash. More money was lost on the 1929-30 fake advance than was lost during the 1929 crash.

“Could we now be dealing with another fake-out advance? The thought has occurred to me, so we will have to monitor any advance from here with intense eagle eyes.

“One item that bothers me a bit is this – have we seen enough black pessimism to believe that this bear market has bottomed? My guess is that we will see more pessimism next year as unemployment climbs and as it becomes almost impossible to find a good job.

“Also, it's been exactly one year since the Dow Theory bear signal. The bull market started in 1980 – so we saw a 28-year bull market. Bear markets in duration usually run one-quarter to one-third as long as the previous bull market. Therefore, one year seems an awfully short time for a 28-year bull market to be corrected. I would normally expect the following bear market to run seven to nine years. However, the severity of the decline may take the place of duration.”

Source: Richard Russell, Dow Theory Letters , November 3, 2008.

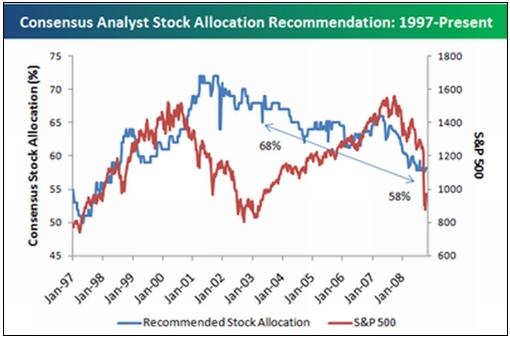

Bespoke: Recommended equity allocation continues to tick lower

“Below we highlight the consensus recommendation for portfolio stock allocation from Wall Street analysts going back to 1997. Since peaking at 72% back in September 2001, recommended stock allocation has trickled lower and now rests at 58%. As the chart shows, during the bear market of 2000 to 2002, analysts actually increased their recommended stock allocation initially as the market fell. Only after the bottom really fell out did analysts begin to drop stock allocation.

“This bear market has been different, however, as analysts have continued to lower their recommended stock allocation in the face of declining markets. As noted, the last time the market was at current levels back in 2003, stock allocation was at 68% versus 58% now. This is definitely a chart that contrarians like to see.”

Source: Bespoke , November 6, 2008.

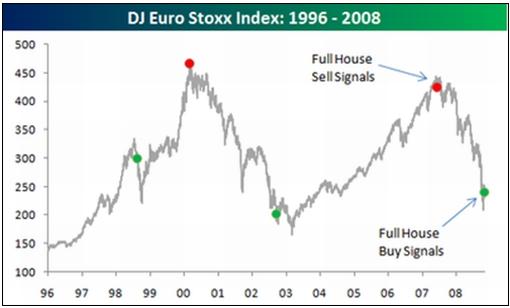

Bespoke: “Full House” buy signal for European equities

“European equities got a boost this morning following bullish comments made by Morgan Stanley's European strategist Teun Draaisma. Draaisma commented that European stocks are now flashing a ‘full house' buy signal after these markets have priced in an earnings recession, and retail investors, purchasing managers, and sell-side analysts have all capitulated.

“While we don't normally highlight specific calls by strategists, we think Draaisma's prior calls are worth pointing out. Judging by the buy and sell signals that we were able to document since 1996, his calls have been pretty timely.”

Source: Bespoke , November 4, 2008.

John Authers (Financial Times): Democrats and the dollar

Click here for the full article.

Source: John Authers, Financial Times , November 3, 2008.

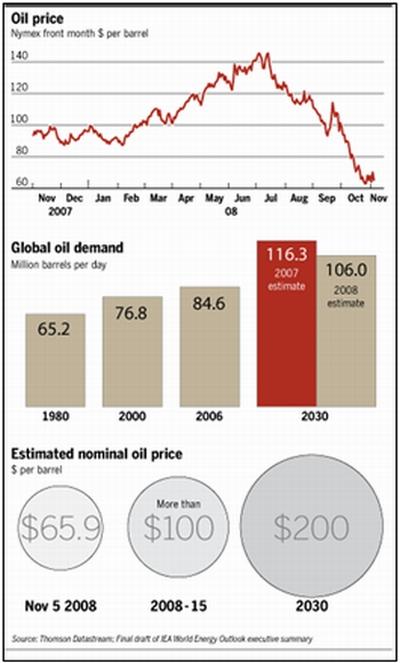

Financial Times: IEA predicts oil price to rebound to $100

Click here for the full article.

Source: Carola Hoyos and Javier Blas, Financial Times , November 5, 2008.

Seeking Alpha: UBS lowers gold expectations again

“UBS has again lowered its 2009 forecast for gold, this time from US$825 per ounce to US$700, while also cutting silver sharply from US$15.08 and US$12.58 in 2009 and 2010 to US$8.40 and US$8.95.

“‘The revised UBS commodity price outlook reflects an extended recessionary scenario with base metal prices in both 2009/2010 that are mostly below the marginal industry costs and current spot prices,' the investment bank said in a report. ‘If such a recessionary scenario were to unfold, we believe that almost all North American mining companies could experience challenges to liquidity and/or business continuity.'

“Platinum saw a US$200 per ounce reduction for those years to US$900 and US$1,100, respectively.

“UBS has also adjusted its base metals forecasts. Most significant for gold equities, copper moved from US$2.50 and US$3.00 per pound to US$1.30 and US$1.55.

“‘UBS believes gold will remain under pressure in 2009 from a combination of slowing demand for jewelery and disinvestment as inflation slows,' the report said. ‘Silver forecasts have been lowered sharply to take account of the dramatic underperformance of silver compared to gold in recent months. Platinum forecasts have been reduced to reflect exposure to weak auto sales in 2009/2010 due to a deeper global slowdown.'”

Source: Seeking Alpha , November 2, 2008.

The Wall Street Journal: A golden future

“Kitco Bullion Dealers senior analyst Jon Nadler discusses how the US dollar and the exodus of fund money from commodities are impacting the outlook for gold prices.”

Source: The Wall Street Journal , November 6, 2008.

Bloomberg: Commodities send sell signal before long recession

“A record plunge in commodities may signal the US is headed for the longest recession since 1981, just after Ronald Reagan became president and the economy began a 16-month slump.

“Industrial raw materials measured by the Journal of Commerce fell at an annual rate of as much as 56% last week, the most since 1949 and worse than the declines before every recession since then. Crude oil, copper and wheat tumbled more than 50% from records this year as the US economy declined in the third quarter by the most since 2001.

‘”The industrial sector, which was helping to keep the recession relatively mild, has completely given way and now we need to be prepared for a much more severe recession,' said Lakshman Achuthan, managing director at the Economic Cycle Research Institute in New York, which compiles the Journal of Commerce data. ‘It's at least going to look something like what we saw in the early 1980s, but it could be worse.'

“Goldman Sachs Group, once among the biggest commodity proponents, said on October 23 that the risk of a ‘sharp global economic slowdown' may send prices even lower. Codelco, the world's largest copper miner, said this year's price collapse signals the end of a ‘supercycle' for the metal.”

Source: Millie Munshi, Bloomberg , November 3, 2008.

Bloomberg: Ship orders plunged 90% last month

“Global ship orders tumbled 90% last month as the credit crunch damped world trade and made it harder for shipping lines to borrow money, according to Lloyd's Registers Group.

“Shipowners ordered a total of 37 container ships, tankers and other vessels in October, compared with 378 a year earlier, Lloyd's Register Chief Executive Officer Richard Sadler said in an interview yesterday at a conference in Dalian, China.

“Hyundai Heavy Industries, the world's largest shipyard, has also reported declining orders for the three months through September as shipping lines are slowing expansion plans because of a lack of financing and plunging demand for shipments of oil, raw materials and finished goods. The global full-year order tally will likely fall more than the 15% previously predicted by Lloyd's Register, Sadler said.

“‘We underestimated it,' he added. ‘On the positive side, compared to 2006, 2007 was an exceptional year.'

“The Baltic Dry Index, a measure of commodity-shipping costs, surged to a record 11,793 on May 20, having more than tripled in three years. Rates have since tumbled 93 percent, to near six- year lows, as traders are struggling to get credit for shipments. Chinese steelmakers are also curbing production amid slowing demand for new buildings and cars.”

Source: Wendy Leung, Bloomberg , November 7, 2008.

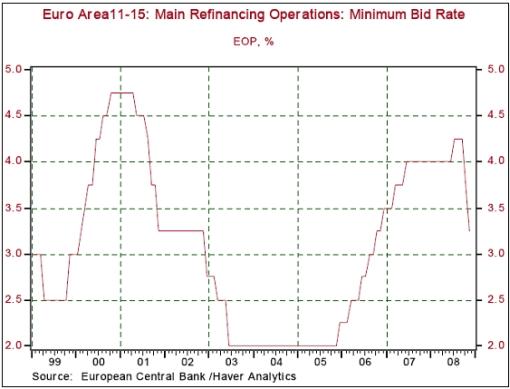

Reuters: Trichet on ECB rate cut

“The head of the European Central Bank talks to Reuters about Thursday's 50 basis point rate cut to the ECB's key interest rate.

“In the interview at the bank's headquarters in Frankfurt, ECB President Jean-Claude Trichet said future rate cuts, beyond Thursday's lowering of the benchmark rate to 3.25%, would depend on the trend of oil and commodities prices.”

Source: Reuters, November 6, 2008.

Victoria Marklew (Northern Trust): ECB cuts again

“As expected, the European Central Bank (ECB) lowered its refi rate again today, taking it down 50bps to 3.25%. In his subsequent press conference, Governor Trichet stated that the Council discussed cutting by 75bps but was unanimous in its decision to lower by 50bps. Unlike in the UK, the minutes of this discussion will never be released, but it appears that the Governing Council missed a chance to move more aggressively.

“Earlier this week the European Commission released its latest economic forecasts, anticipating real GDP growth of just 0.1% for the 15-member Euro-zone next year, and 0.2% for the 27-member EU. Q3 GDP data are due November 14, but the Commission stated that the Euro-zone is already in a technical recession. Assuming that the Q3 data are as weak as expected, and given the extent to which forward-looking data are deteriorating, the ECB is likely to ease again at the December 4 policy meeting.”

Source: Victoria Marklew, Northern Trust – Daily Global Commentary , November 6, 2008.

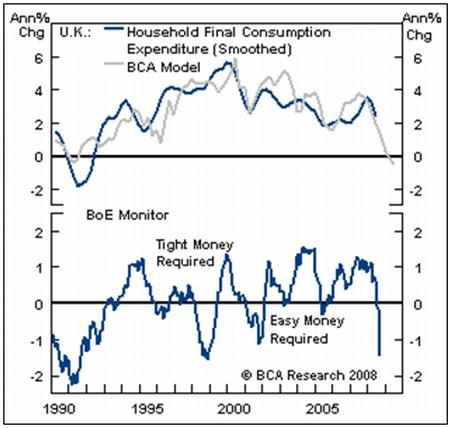

BCA Research: Bank Of England – too late

“The Bank of England's dramatic decision to lower rates by 1.5% (to 3%) brings rates to their lowest levels since 1955, but is too late to avoid a severe economic retrenchment.

“The rate cut was prompted by real risks of deflation and evidence that consumers are finally capitulating. Falling house and equity prices have knocked over 150% of GDP off household balance sheets over the past twelve months, at a time when the personal savings ratio stands only slightly above 1%. Unfortunately, further steep falls in consumption are still inevitable in the coming months. The Christmas spending season will likely be the weakest in real terms, since the 1940s.

“Although the government is leaning on financial institutions to increase lending in exchange for capital injections, credit demand will stay weak. The wealth destruction is consistent with a slow rise in the personal savings ratio to at least early 1990 recessionary levels of close to 10%, at a time when the rise in unemployment has only just begun. Bottom line: Stay short sterling and long gilts within global hedged fixed income portfolio.”

Source: BCA Research , November 7, 2008.

Victoria Marklew (Northern Trust): Swiss National Bank opts for intra-meeting rate cut

“The Swiss National Bank (SNB) announced an intra-meeting rate cut today, lowering its target band for three-month Swiss franc LIBOR to 1.50% to 2.50%, down from 2.00% to 3.00% previously, and aiming for the mid-point – effectively, a 50bps rate cut to 2.00%.

“With Switzerland's major export markets slowing sharply the economy is set to fall into recession around the turn of the year, and could be in for more than two consecutive quarters of negative real GDP growth. If current trends continue, the SNB is likely to ease again at its next scheduled policy meeting on December 11.”

Source: Victoria Marklew, Northern Trust – Daily Global Commentary , November 6, 2008.

BBC News: Spanish jobless hits 12-year high

“The number of unemployed people in Spain has reached a 12-year high of 11.3%, according to the Labour Ministry, the highest level in Europe.

“The number claiming unemployment benefit rose by 192,658 to 2,818,026 – the highest level since April 1996. Since October 2007, the number of those claiming jobless benefits has risen 37.5%.

“A severe slowdown in the construction industry has been one of the main causes of the economic slowdown. Recent figures showed that the economy contracted by 0.2% in the third quarter compared to the previous three-month period.

“On Monday the government set out a plan to help unemployed people who had difficulty keeping up with mortgage payments.”

Source: BBC News , November 4, 2008.

James Pressler (Northern Trust): India – Reserve Bank is still behind the curve

“Over the past two weeks, the unpredictable actions of the Reserve Bank of India (RBI) have become, well, predictable. Saturday's surprise cut to the repo rate comes almost two weeks after another intra-meeting easing, and oddly, a little more than a week after RBI policymakers had their regular meeting and actually held the benchmark rate steady. As this global credit crunch creates crises on a seemingly daily basis, we are increasingly distressed that the RBI has not quite picked up the rhythm that the rest of the world seems to be following.

“The details of this weekend's surprise easing are fairly straight-forward. The repo rate was trimmed by 50 basis points, to 7.50%, after being cut by 100 basis points two weeks ago, and the RBI also reduced the reserve requirement ratio by one percentage point, to 24%, effective this coming Saturday. This loosening should free up significant liquidity into a market that has been running dry of late, and is quite likely not the last measure to be seen this month. The Reserve Bank did note that inflation was still a concern and would be monitored, but keeping the markets stable took priority. Inflation is disturbingly high, but recent figures suggest prices have peaked for now.”

Source: James Pressler, Northern Trust – Daily Global Commentary , November 3, 2008.

Bloomberg: Chinese manufacturing shrinks by record, survey shows

“China's manufacturing contracted by the most on record last month as the global financial crisis cut demand for exports, a second survey showed.

“The CLSA China Purchasing Managers' Index fell to a seasonally adjusted 45.2 in October from 47.7 in September, CLSA Asia-Pacific Markets said today in an e-mailed statement.

“A government-backed survey released on November 1 also showed a record contraction, adding to concern that the world's fastest-growing economy may slump. Australia reported today that manufacturing shrank by the most since data began in 1992 as the crisis rips across Asia Pacific.

“‘The very sharp fall in the October PMI confirms that China is more integrated into the global economy than ever,' said Eric Fishwick, head of economic research at CLSA in Singapore. ‘Chinese manufacturers are seeing their order books cut, both at home and abroad, as the world economy falls into recession.'

“Tom Albanese, chief executive officer of mining company Rio Tinto Group, said yesterday that China's slowdown is deepening and demand for metals won't rebound until 2009. The nation's economy expanded in the third quarter at the slowest pace since 2003, growing 9%.”

Source: Nipa Piboontanasawat, Bloomberg , November 3, 2008.

City Wire: Mobius buying stocks as emerging markets approach bottom

“The IMF may be on the verge of offering Pakistan a loan to stave off bankruptcy, but Templeton's veteran investor Mark Mobius believes China will prove to be the ‘white knight' for the country's economy.

“Within the last week, there has been growing concern about the economic situation in Pakistan. This has fuelled worries about the security situation since political instability has been increasing in recent times. Mobius, however, says Chinese investment is likely to aid Pakistan and stabilise the surrounding countries.

“‘I think China is going to invest in Pakistan and help them through their balance of payments problems so we can be a little bit more positive about the situation there. Pakistan is going through a slow transition back to parliamentary democracy and in the process some very tough economic decisions are required.'

“On Tuesday, China slashed its interest rates by 27 basis points to 6.66% – a third such cut in six weeks. And while the reason behind lower rates is widely believed to be fear of slowing global demand, Mobius points out that China has not suffered as much as expected.

“‘There's no question there will be a hit to the export market', Mobius conceded. ‘We have seen that in a number of countries around the world but the actual exports of China have not come down yet. Some of the demand for Chinese products is ever-lasting because China is the only place that can make these products for these prices,' he says.

“Mobius believes that the Chinese economy will continue to grow at around 6% to 8%. ‘They've diversified their exports to emerging markets around the world and been pumping up domestic demand. So we see a surprisingly low decline in their exports but it remains to be seen how long the slowdown lasts,' he says.”

Source: Drazen Jorgic, Citywire , October 31, 2008.

James Pressler (Northern Trust): Australia – strong rate cut, bold statement about economy

“In the latest of a string of rate cuts throughout the world, the Reserve Bank of Australia (RBA) lowered its Overnight Cash Rate (OCR) by a surprisingly strong 75 basis points to 5.25%. The consensus forecast was for a less urgent 50 basis points.

“Looking forward, we believe the OCR has more room to fall, and the RBA could easily participate in any coordinated global rate cuts this year. By end-June 2009, most people are placing the OCR at 4.00% to 4.50%, and we place our bid at the lower end of that range. We also believe that Australia will avoid a formal, two-contracting-quarters recession, as monetary, fiscal and now exchange rate stimulus will all sustain a low level of expansion.

“Downside risks do exist – particularly any second-round impact of liquidity tightening and possible bank failures – but we insist that the country is in better position than most of the G-7 to handle such problems without severe economic pain.”

Source: James Pressler, Northern Trust – Daily Global Commentary , November 4, 2008.

Fin24: South African Credit Act a worldwide hit

“South Africa's National Credit Act (NCA) has become a hit with policy-makers around the globe as the international credit crisis tilts the world economy towards the worst recession since the 1930s.

“A number of African and European countries are studying the act with the aim of hardening their own credit legislation and reining in reckless lending.

“The ongoing credit turmoil, the architect of which is the world's financial powerhouse, the US, has laid bare to the global community how greedy and heedless lenders can ruin the world economy and its financial markets.

“Peter Setou, a senior manager at the National Credit Regulator (NCR), said this week in the light of the global credit crunch many African and European nations had been soliciting advice from South Africa to help them with strengthening their credit policies.

“‘There has been a lot of interest from mainly African and European countries wanting to study the act,' said Setou. He said the NCR had received delegations from Botswana, China, Mongolia and the European Coalition for Responsible Credit (ECRC) wanting to learn about the act.”

Source: Andile Ntingi, Fin24 , November 2, 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.