The last time this happened, Gold Price Soared for 10 years

Commodities / Gold and Silver Stocks 2023 Mar 29, 2023 - 10:14 PM GMTBy: Submissions

Justin Spittler : 615% gains the last time this was triggered… “This is incredibly bullish”… “Someone big” is loading up… I’m no gold bug, but…

- Gold is closing in on its all-time highs.

On Monday, gold broke above $2,000 per ounce—the highest it’s been in over a year:

Its all-time high of $2,074 is now within reach.

And if history repeats, gold could soar 600% from here.

Here’s what I mean…

- The gold price has been stuck in neutral for the last 12 years.

In 2011, gold traded at $1,920 per ounce.

Today, it’s at $1,951.

In other words, gold’s risen just 2% in 12 years.

We can blame that mostly on the strength of the US dollar.

Since May 2011, the dollar index has gained 40%. At its peak, it was up 58%.

That’s only the second time in the last 30 years the dollar gained 50% or more. The other was from 1995 to 2001. And it killed the gold market. Gold lost 30% of its value from January 1995 to January 2001.

However, once the dollar peaked, gold skyrocketed. It soared 615% over the next 10 years.

We’re on the cusp of another such opportunity…

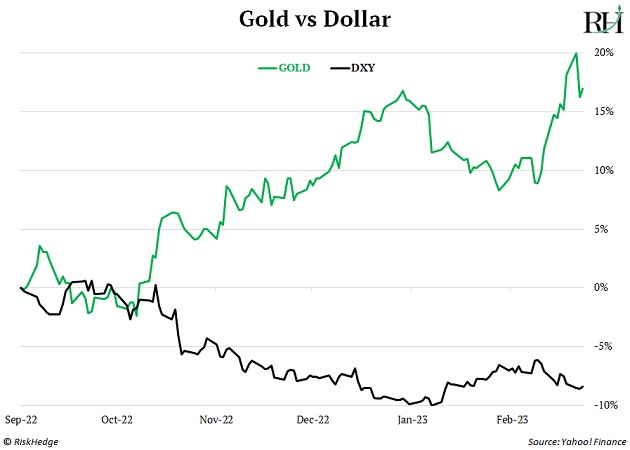

As I showed you, gold’s on a tear.

It bottomed in October and is up 20% since.

Guess what else happened in October?

The dollar peaked. Just like it did in 2001 when it sparked the last gold bull market:

This is incredibly bullish for gold.

And it’s not the only signal screaming “buy gold”…

- “The longer the base, the higher the space.”

This is a popular saying amongst traders.

Generally, the longer an asset consolidates (trades sideways), the bigger gains it will produce when it finally breaks out.

Gold’s been consolidating since 2011…

Source: StockCharts

What you see is a massive “cup-and-handle” pattern.

It’s probably the single most bullish pattern there is. When the price breaks above the “handle,” the pattern is complete, and the uptrend continues.

For now, gold remains in the handle portion of the pattern. But it looks on the cusp of breaking out.

If it does, it would signal a new gold bull market has begun.

- Recent price action tells me this breakout could be just days or weeks away…

SPDR Gold Trust (GLD) is an ETF that tracks the price of gold.

On Friday, it broke above last month’s highs. And it did so on heavy volume…

Source: StockCharts

The bars on the bottom represent volume. Notice how they surged in recent days? It tells me “someone big” is loading up on gold. By that, I mean hedge funds, institutional investors, or other big-money players who often control billions of dollars.

That means this rally likely has legs... and the gold price could be just days or weeks away from breaking to new all-time highs.

- The leveraged way to profit off rising gold prices is to buy gold stocks.

These companies make money finding gold and pulling it out of the ground. That’s important because it gives them “leverage” to the price of gold. When gold moves an inch, gold stocks can move a mile.

Again, gold spiked 615% between 2001 and 2011. But the average gold stock soared much higher.

For example, Agnico Eagle Mines (AEM) surged 1,593%... Kinross Gold (KGC) shot up 1,992%... and Newcrest Mining (NCM.AX) jumped 1,478%.

Gold stocks are like gold on steroids. Keep in mind, they’re extremely volatile in both directions. Realize you’re making a risky bet when you buy a gold stock.

That said, gold stocks look great…

Osisko Gold Royalties (OR) broke to new 52-week highs on Monday. The stock is up 60% in the last six months. And as you can see, the breakout happened on massive volume:

Source: StockCharts

Alamos Gold (AGI) is another surging gold miner.

It’s up 80% in the last six months—on huge volume as well…

Source: StockCharts

Same story with Caledonia Mining Corporation (CMCL).

The stock doubled in the last six months. And the volume is spiking.

Source: StockCharts

- But the safest way to profit—and protect your savings—is to own physical gold.

I think everyone should own at least a little physical gold, just in case.

Gold is the ultimate money. For thousands of years, it’s stood strong and protected folks’ savings as fiat currencies have come and gone.

I’m no gold bug. But, like it or not, the value of the US dollar depends on our politicians acting prudently.

Owning gold is a hedge against them printing infinite amounts of dollars to bail out banks, fund green energy, or participate in whatever the next big “cause” is.

Justin Spittler

Chief Trader, RiskHedge

To get more ideas like this sent straight to your inbox every Monday, Wednesday, and Friday, make sure to sign up for The RiskHedge Report, a free investment letter focused on profiting from disruption.

Expect smart insights and analysis on the latest breakthrough technologies, the big stories the mainstream media isn't reporting on, and much more... including actionable recommendations.

Click here to sign up.

By Justin Spittler

© 2023 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.