Global Stock Markets Get Halloween Relief

Stock-Markets / Global Stock Markets Nov 01, 2008 - 11:15 AM GMT

I will be covering a global stock market performance round-up after the month end, but thought it would make for interesting reading to briefly review the action of the past three days.

I will be covering a global stock market performance round-up after the month end, but thought it would make for interesting reading to briefly review the action of the past three days.

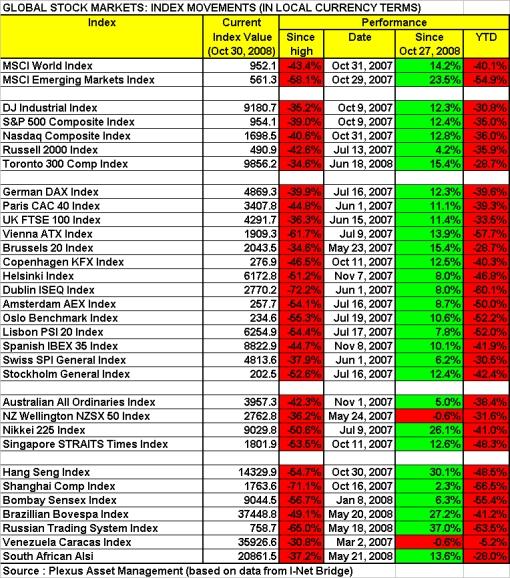

The numbers speak for themselves, showing the MSCI World Index and the MSCI Emerging Markets index surging by 14.2% and 23.5% respectively since Monday's closing levels. Strong stuff indeed, but these rallies still leave the two indices down by 43.4% and 58.1% respectively since the highs of October last year.

The strongest performers over the past few days were Russia (+37.0%), Hong Kong (+30.1%), Brazil (+27.2%) and Japan (+26.1%). This begs the question: Are these bourses back in bull markets according the traditional definition of a 20% improvement?

On the other end of the scale, the following markets were left behind: New Zealand (-0.6%), Venezuela (-0.6%), China (+2.3%), the Russell 2000 Index (+4.2%) and Australia (+5.0%).

Here is Richard Russell's ( Dow Theory Letters ) take on matters: “Things are looking better. After a series of 90% down-days , we had a 90% up-day on Tuesday, October 28. Since then, the market action has been fairly good. With bonds appearing to have topped out, I'm beginning to think that there's a fairly good chance the market has bottomed. Adding to the bullish case, Lowry 's published a significant contraction in selling pressure today.”

I give the current rally the benefit of the doubt provided the recent lows (8,176 on the Dow Jones Industrial Index and 849 on the S&P 500 Index) do not get taken out. However, it remains difficult to say whether a secular low has been reached in an environment of economic and profit recession. At least, the extent to which central banks, governments and the IMF are becoming involved to fend off a total economic meltdown is a sign that we could be in a bottoming-out phase of the bear market.

Click on the image below for a larger table.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.