Stock Market Valuation Reset and Future EPS

Stock-Markets / Stock Market 2022 Nov 29, 2022 - 10:20 PM GMTBy: Nadeem_Walayat

Stock markets trend between a state of over valuation and under valuation in earnings terms, hence my warnings to expect a valuation reset during most of the second half of 2021 which means regardless of what happens to the economy THIS bear market WAS inevitable! And it HAS come to PASS to great extent where many of the most over valued stocks have HALVED in price and not just the usual suspects but the likes of AMD and TSMC! AMAZON! And so on.

August 2021- AI Stocks Portfolio Buying and Selling Levels, Bubble Valuations 2000 vs 2021

Amazon to the MOON 2021! Then what?

YES, Apple, Amazon, Facebook, Google and Nvidia all have highly compelling reasons for why they should all continue keep going to the MOON! But so did all of the tech giants in 2000!

So in some months time we may be living in a completely different world where the likes of Microsoft, Amazon and Apple after a plunge in price have most investors who were happy to pile in at all time highs with their dollar cost averaging mantra are then too scared to either buy or sell as they watch in fear stock market armageddon take place all whilst the MSM, blogosFear and Youtubers reinforce their state of paralysis acting as echo chambers just regurgitating that which others have posted.

As for what I will be doing ? BUYING the PANIC! Even if I turn out to be early because during the mayhem most of the pieces of the puzzle will be unknown.

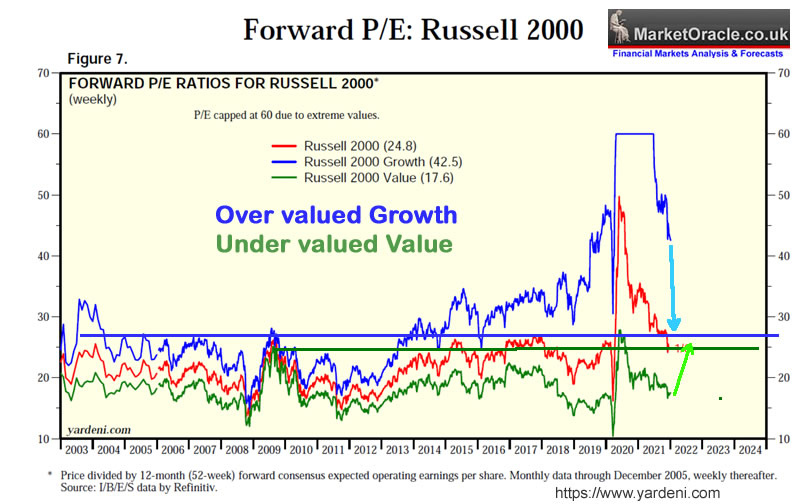

The valuation reset is the rotation out of over valued growth stocks the pinnacle of which populate Cathy Wood's ARK funds and into under valued low PE usually dividend paying stocks as the following illustrates for the Russell Small cap stocks where high value stocks were bid up to to fever pitch ridiculous valuations whilst the value stocks were largely neglected by the market this is what the valuation reset looked like 8 months ago.when I warned that AI tech stocks had much further to fall -

As you can see we are a long way from the value reset from running it's course so this could play out for most of 2022. Where our AI tech stocks are concerned this translates into the higher the PE stocks facing greater downwards pressure for the likes of Nvidia, AMD, Microsoft and Amazon.

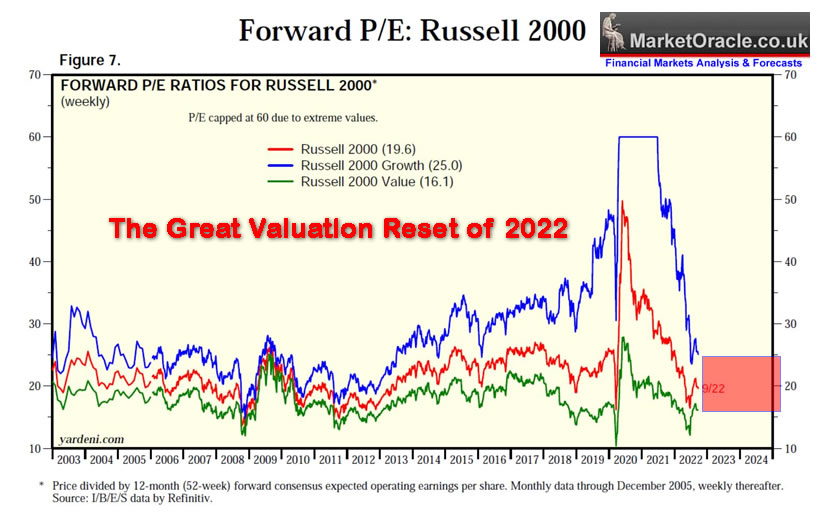

And here is the current state of the valuation reset -

The great valuation reset of 2022 is in it's last legs! Whilst not complete i.e. the gap has yet to shrink further where the indices are concerned, however on a stock by stock basis many of the target stocks HAVE reset whilst a few such as Apple and Microsoft remain pending that will likely either under perform or suffer their valuation reset moment in due course over the coming months, hence why I am reluctant to increase my exposure to such stocks, especially Apple and Amazon.

Going forward the name of the game will be to allow earnings to play catchup to prices, thus whilst the remainder of this year will enjoy a powerful bull run, given the earnings outlook for 2023 then we cannot expect target stocks to return to new all time highs anytime soon, definitely not during 2023. So it is very unlikely that stocks or indices will trade anywhere near their all time highs during 2023, instead more probable is a trading range as earnings play catch up to prices. Note I do not subscribe to the collapse in earnings thesis for it fails to account for the impact of HIGH inflation which AI tech stocks are leveraged to i.e raise their earnings at a rate in excess of inflation.

This article is an excerpt from my extensive analysis that concludes in detailed stock market trend forecast into the end of 2023 Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1 was was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Also access to my extensive analysis that concludes in detailed stock market trend forecast into the end of 2023 Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

Recent analysis includes -

- Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION!

- How High Could the Impossible Stocks Bull Market Fly Into Christmas 2022

- Stock Market Cool as a Cucumber Despite Earnings and Fed Noise

- Intel Empire Strikes Back! The IMPOSSIBLE Stocks Bull Market Begins!

- Stock Market White Swan - Why Fed Could PAUSE Rate Hikes at Nov 2nd Meeting, Q4 Earnings

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- UK House Prices Trend Forecast - Complete

- Stock Market Trend Forecast to December 2023 - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 85%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your mega-trend investing analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.