After This Holiday Stock Market Rally, You Better Know When To Walk Away

Stock-Markets / Stock Market 2022 Nov 27, 2022 - 08:44 PM GMTBy: Chris_Vermeulen

This week’s investor insight will make you think twice about the current stock and bond rally as we head into the end of the year.

We get a lot of questions about if the stock market has bottomed or if it is headed lower and how they can take advantage of the next Major market move. Over the next 6 to 12 months, I expect the market to have violent price swings that will either make or break your financial future. So let me show a handful of charts and show what I expect to unfold.

Let’s dive in.

We’re told that “quitters never win.” But is it always wise to stick with something when it no longer serves us or, worse, continues to harm us?

Many years ago, when Texas hold’em poker was big and online gambling was allowed in Canada, I used to run a poker league and build custom poker tables for people across the United States and Canada. I love poker, and I still play it to this very day, but the game does require skill, a proper mindset, and self-discipline. Without all three of these things, poker is pure gambling. It’s the same when it comes to active trading or investing if you lack the skills, mindset, and self-discipline.

Retired professional poker player Annie Duke, who is also a best-selling author, and decision strategist who advises seed-stage Startups, says that learning when to quit is a critical skill, especially for investors.

Annie states, “Quitting is a good thing when applied at the right time.”

If you’ve been following me for any time, then you know I follow a detailed trading strategy with position and risk management rules. As a result, you won’t find me taking random trades or trading based on emotions. Instead, you’ll find me patiently waiting on the sidelines for a high-probability trade signal to reinvest my capital.

I trade differently. I don’t diversify. I don’t buy-and-hope, and I don’t have any positions at certain times.

What I do is reinvest in assets that are rising in value. And when a particular asset stops moving higher, I give up on the position and exit it immediately. Because I use technical analysis to follow price action, we can quickly and easily determine if an asset is rising or falling. Therefore, I can step aside and let the asset fall and look for a new opportunity that is rising, or hold the falling position and ride it lower for who knows how long…

Unfortunately, most traders and investors do not understand how to read the markets, or they don’t have control of their money. They are at the mercy of what the market does or the skills of whoever controls their capital.

Let me share some of my market insight

and help guide you

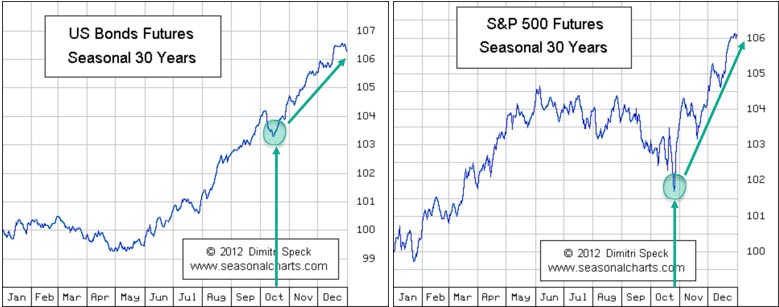

On October 21st, I stated that retirement accounts should bottom and rally into the end of the year. Bonds were hitting 11-year lows. In short, anyone holding 20+ year treasury bonds just had more than ten years of investment growth wiped out.

Bonds, the highly touted safe, low-risk asset, fell over 47% from the 2020 high. It caused similar losses to the average investor portfolio comparable to the 2008 financial crisis.

It was the worst selloff ever for treasury bonds that I can see on my charting platform. The real kicker is that the selloff in both stocks and bonds could have been avoided with just a little education and management. Subscribers and I happened to ride the COVID bond rally higher by 19%, exited the position, and moved to cash the day bond prices topped. It was partly luck to exit at the peak, but we would have exited the following trading session if we didn’t lock in profits because we managed our positions and risk. As the price reversed direction, we jumped shipped to one of my favorite positions, which almost no one thinks about or uses – CASH.

2022 has been a painful year for investors, and people are telling me they are scared to look at their investment statements. It now looks like bonds and stocks have started a seasonal rally that could help lift your portfolio as we head into the end of the year, but once it ends, look out!

Bonds and Stock Seasonality Price Movement

Daily Chart of 60/40 Portfolio

You should have seen your account rally 6% or more since Oct 21st, and I think it will continue higher once the market digests the recent move up. While this may excite you, be aware that after this rally, we could see another 20-47% decline in stocks and bonds in 2023. This year-end bounce is nothing more than an opportunity to get out of the antiquated Buy-and-Hope strategy that does not work during a volatile and weakening economic environment.

The next few charts, which are big heavyweight stocks that drive the market higher and pull it lower, should help you see what I see.

AAPL Weekly Chart and Potential Breakdown

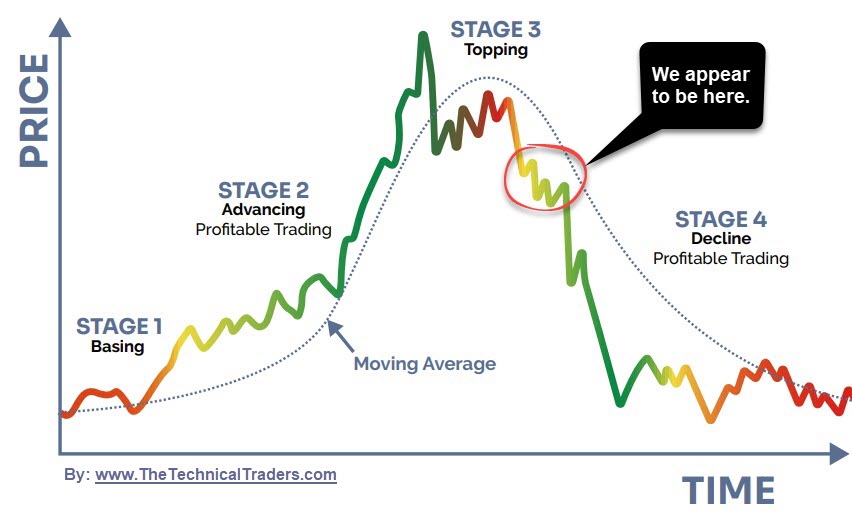

Apple is a heavyweight stock. When it moves, it moves the stock market. Currently, AAPL shares are in what I call a STAGE 3 Distribution phase, and if support is broken, then look out below!

TSLA Weekly Chart and Potential Breakdown

Tesla shares are another heavyweight, and its weekly chart paints a bleak future for holders.

META (Facebook) Weekly Chart Breakdown Leads The Way Down

Facebook, or what is now called META, is a heavyweight stock that has already broken down from its STAGE 3 Distribution phase. As you can see, when these mega stocks break down and unwind, individual investors who have their money managed by so-called professionals who don’t know how to manage risk suffer the most.

The drop in META shares has held the tech, social, and even the S&P 500, and Nasdaq from rallying freely to the upside in the past month. When/if AAPL, TSLA, and other heavyweights break down, expect panic on Wall Street.

My general rule of thumb is if someone tells you to diversify into a bunch of different assets, stocks, commodities, bonds, crypto, etc… then they don’t know what they are doing. They are a buy-and-hold believer and willing to let their own money or that of their clients experience the severe price swings the market dishes out.

Billionaire investor warren Buffet says, “Diversification makes very little sense for those who know what they are doing.”

Multimillionaire investor Jim Rogers said, “Diversification is something that stockbrokers came up with to protect themselves, so they wouldn’t get sued for making bad investment choices for clients, and that you can go broke diversifying.”

The Four Stages Of Asset Prices

If you think the 2022 pullback has been distressing, you better buckle up because the bear market has not even technically started yet, from my standard. Instead, in early 2023 we should enter a STAGE 4 Decline. This is when people’s financial future and retirement lifestyles are created or broken, depending on how it’s managed.

Don’t get me wrong, I’m not saying the market will fall in 2023. I’m letting you know it’s very possible, and you best have a plan in place. On the other hand, if the markets have some miraculous recovery and start a new bull market, well, you better have a plan for that also. Either way, you need a plan, and if you are a technical trader who follows price and manages positions, it doesn’t matter what the market does; we are set either way.

If you want to learn more about who you are at a deeper level and what you specifically need to make your personality work best with your trading and investing be sure you read this and do the mini quiz on your trading personality type.

S&P 500 Bear Market Expectations 2023

The S&P 500 chart shows the extreme low that we could possibly reach if the economy and stock market fully unwind. Bonds would sell off as well until the Fed decides to step in and starts lowering the rates to try and save investors, but there will be a delay, and bonds will likely fall sharply before we see that take effect.

CONCLUDING THOUGHTS:

In short, without going off too much on a rant, you can read the three lies we are told by financial professionals that really IRK me. Because of these lies, individual investors must work harder, work longer and often experience painful financial outcomes.

What you may not know is that what you went through in 2008, the 2020 crash, and this year’s correction could have been completely avoided. If you followed a NO BS investing method that tracks price using technical analysis, is simple to follow, and is uber-conservative, then your account would be sitting at a new all-time high watermark as of this week.

The financial industry tells us to do all the wrong things, and almost everyone falls for the BS; it’s so frustrating to watch!

LIE #1: Diversify, Diversify, Diversify

LIE #2: Bonds Are A Safe Investment And Should Represent A Large Portion Of An Investors Portfolio

LIE #3: Speak With An investment Broker Or Advisor Before Placing Any Trade To Be Sure It Is Suitable For Your Personal Circumstances.

It’s total baloney because almost everyone gets the same generic advice, buy-and-hold stocks and bonds, don’t give up on it, ride out the rollercoaster, and you will be fine, trust me…

Who came up with that strategy? Sure, my 10-year-old son could buy some stocks and bonds once, let it ride for 20-30 years, and be ok. He has time and not that much money, but the big question is at what age does the stock and bond, buy-and-hope strategy become a harmful and risky investment strategy? 50-ish years of age is my thinking.

Knowing bear markets can take 3-12 years to recover from, someone who is 50+, planning to retire soon, or is already retired, doesn’t have 10+ years to keep working and saving to avoid withdrawing funds from their retirement account. Also, the fact that they have the most wealth ever in their lifetime, they should be concerned about holding through future bear markets.

Don’t be fooled. Just because everyone else has been brainwashed to buy-and-hold, aka buy-and-hope, and suffers stock market selloffs does not mean you should…

It’s like the average investor has Stockholm syndrome. They have all been beaten up by the markets over and over again. They think that’s how it should be. And in some cases are paying someone to take their money, plop it into the market, and do nothing with it for 10 – 40 years. They pay a % of their life savings each year to someone who has no risk and does not need to do too much of anything, while the investor suffers massive multi-year drawdowns, experiences high levels of stress, and sometimes big losses.

The typical investing experience most people endure is NOT how it should be. There is a better way, and I can show you.

My passion is trading and investing, having been at it for over 25 years. My goal is to help as many investors as possible to preserve their capital during difficult times and also be able to grow their wealth by trading only the most liquid ETFs. My investing strategy signals allow individuals to only hold assets that are rising in value.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.