Stocks: Is the Really Scary Part Just Ahead?

Stock-Markets / Stock Market 2022 May 27, 2022 - 06:34 PM GMTBy: EWI

Here's one of the actions which investors take when they get "rattled"

Big daily selloffs have occurred since the stock market's downtrend began in January.

For instance, on May 18, the Dow Industrials closed lower by 1,161 points -- a 3.6% drop. The S&P 500 shed 4% on the same day.

Yet, most investors aren't exactly shaking in their boots. Panic is absent.

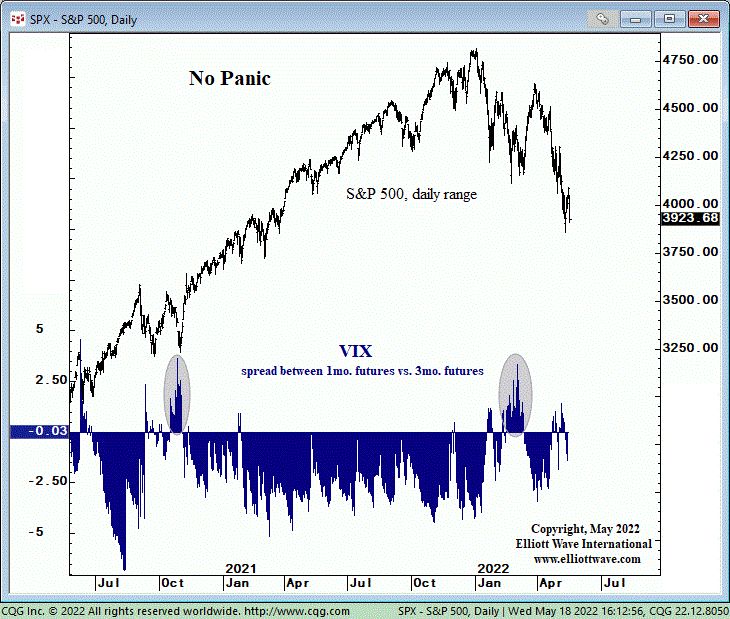

After the market close on May 18, the U.S. Short Term Update, a thrice weekly Elliott Wave International publication which analyzes near-term trends for major U.S. financial markets, showed this chart and said:

Traditional measures of investor complacency and panic, such as the CBOE Volatility Index (VIX), remain somewhat subdued relative to prior extremes over the past six months. One of the ways we measure the level of investor panic is to compare the one-month VIX futures contract to the three-month VIX futures contract, which is shown by the histogram at the bottom of the chart. When investors are rattled, they bid the short-term contract (one month) above the longer-term contract (three month), feeling as if they need "protection" from a falling market now versus later (see grey ellipses).

During the most vicious phase of a major bear market, the spread between the one- and three-month futures contract should dramatically soar.

In the meantime, there was this headline just two days after that big May 18 selloff (CNBC, May 20):

These are the cheapest stocks in the S&P 500 that could be buying opportunities

Yep, many market participants are still viewing the drop in prices as a time to go bargain hunting rather than running for the hills.

Memories of the longest bull market in history die hard. Remember, it started back in March 2009.

However, panic will set in when the downtrend reaches a "third of a third" Elliott wave. If you're new to Elliott wave analysis, the third of a third is the strongest part of a trend -- both up and down.

Want more U.S. markets insights like this?

Check out Elliott Wave International's new report, "Bitten by FANG? Clocked by Cryptos? -- "Air Pockets" Everywhere."

Down more than 25%, the NASDAQ is "officially" in bear-market territory.

"Big whoop" as they used to say -- some of the hi-tech darlings have already been cut in half and then some. Bet the folks down 50% or more in their so-called investments are glad to hear they're "official."

And now Bitcoin, the King of Cryptos, has hit an "air pocket" of its own and fallen below $30,000. Wonder if that's officially a bear market, too?

This excerpt from EWI's May Financial Forecast explains how it all fits together.

Sign up for Club EWI -- FREE -- and read it now.

This article was syndicated by Elliott Wave International and was originally published under the headline . EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.