Stock Market Turning Around for Good?

Stock-Markets / Stock Market 2022 Apr 21, 2022 - 02:30 PM GMTBy: Monica_Kingsley

S&P 500 rose incessantly during the regular session but bonds don‘t yet confirm the decline would be over. So much hawkish noise (75bp hike next?), and tech keeps rising? Still a peculiar case of strength but a daily rotation out of energy stocks into tech can‘t be denied. I wouldn‘t yet jump to conclusions about lastingly improving market breadth though. The S&P 500 upswing may just take a few days more to run its course as the tightening heat hasn‘t yet played out. Powell talking tomorrow is a nice opportunity. Real assets will find it easy to recover from yesterday‘s daily setback – they had plenty of opportunities to decline before Feb 24th, yet tellingly didn‘t...

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

By the shape of yesterday‘s candle, the S&P 500 can extend its gains before turning south again. The volume doesn‘t yet indicate the presence of sellers nearby. Reversing when Powell speaks next?

Credit Markets

Sea of red, anywhere you look – HYG intraday upswing attempt looks too weak. Rising yields still work against the stock market bulls – these are running on borrowed time.

Gold, Silver and Miners

Precious metals downswing was partially bought, and odds are the downside wouldn‘t be too deep. The upside risks remain much greater, and with expectations building up for 75bp hike in May (i.e. it not being just a fantasy), the bulls will welcome even a mere 50bp hike getting out of the way. Anyway, good performance when you look at the USD strength.

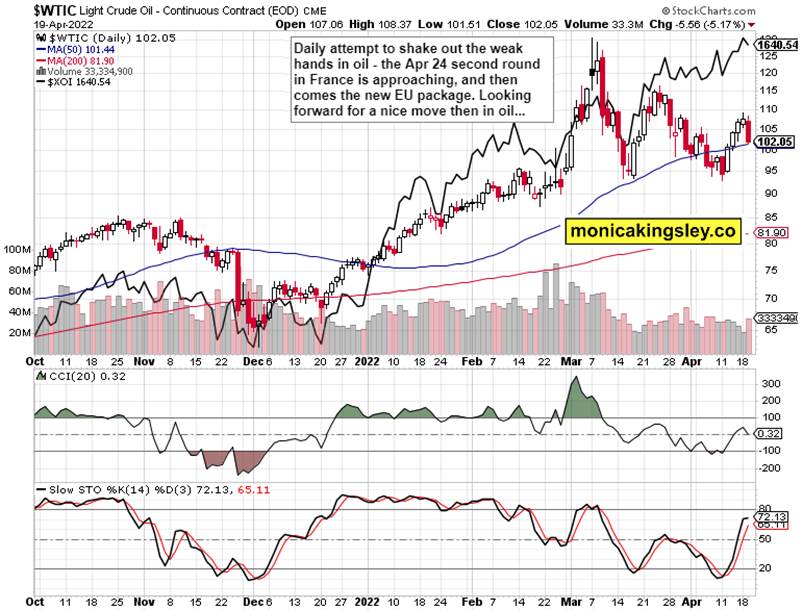

Crude Oil

Crude oil downswing will have a very limited shelf life – and the same goes for oil stocks. Don‘t be surprised by a spike early Monday.

Copper

Copper is holding up nicely, and would take the bullish cue as well. Before that, patience, quite some patience is called for.

Bitcoin and Ethereum

Cryptos failing to extend gains could be one of the first warning signs that the paper assets rally is coming to an end, slowly but surely. Bitcoin outperforming Ethereum is in itself defensive.

Summary

- The introduction to today‘s analysis together with the rich captions, serve as a good summary, so enjoy the many thoughts presented. Suffice to say that the stock market upswing isn‘t yet confirmed by bonds – there is no risk appetite there. It‘s a counter trend move at odds with the the dollar, and temporarily helped by real assets daily weakness. Strength would return into precious metals and commodities, and the Fed won‘t be able to break inflation regardless of putting up a good fight visually. The countdown to the approaching recession is on, and I have it set at rather 6 than 9 or even 12 months.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.