THE INFLATION MONSTER is Forecasting RECESSION

Stock-Markets / Stock Market 2022 Apr 19, 2022 - 02:36 PM GMTBy: Nadeem_Walayat

Dear Reader

What if you could know the future, had a chart of the stock market that showed a high probability trend forecast into the middle of May 2022. We'll that's what my Patrons got in a market brief at the end of March 2022, a trend forecast right into the middle of May 2022.

Latest Update - The Stocks Stealth BEAR Market, AI Stocks Buying Levels Going Into Earnings

This article is Part 2 of my extensive analysis that filsters through some 50 small cap tech stocks to indentiy those with the most favourable prospects trading at knock down prices due to the bear market panic.

World War 3 Phase 1 - Putin WINS Ukraine War!

What Putin Plans for Ukraine

JRS.L Capitalising on Russia's War CRASHED Stocks

THE 2020's INFLATION MONSTER!

Stock Market Trend Forecast Current State

Stock Market FOMO Gives Way to FEAR of Buying the Dip

AI Stocks Portfolio Current State With Updated Buying Levels

FACEBOOK Stock 45% CRASH - Game Over for META?

FACEBOOK RINSE AND REPEAT

INVESTING LESSON - HAVE A PLAN AND THEN EXECUTE IT!

HIGH RISK STOCKS - INVEST AND FORGET

High Risk Stocks Portfolio Revised Buying Levels

GROWTH STOCKS TO CAPITALISE ON THE PANIC OF 2022

1. XXXX - RANK 1 - $121.8, PE 7.8, EGF 38%

2. XXXX - RANK 1 - $58.5, PE 9.9, EGF 30%

3. XXXX- RANK 2 - $16.7, PE 8.7, EGF 33%

4. XXXX - RANK 2 - $89.5, PE 17.2, EGF 23%

5. XXXX - RANK 2 - $49.7 - PE 196, EGF 188%

That was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Part 1 - World War 3 Phase 1 - Putin WINS Ukraine War!

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

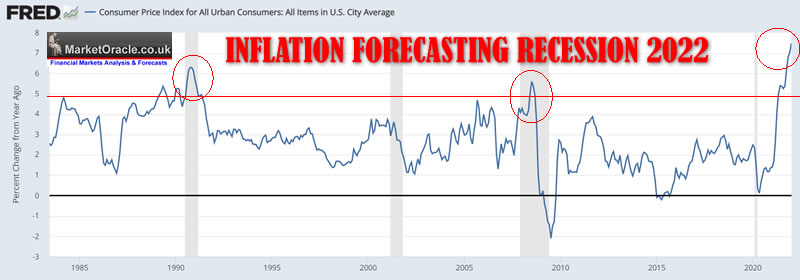

THE 2020's INFLATION MONSTER!

Many investors used to buying the dip are confused as to why rallies from the dip lows keep fizzling out with stocks once more resuming a trend to fresh lows, despite many if not most stocks now trading over 50% off their highs.

INFLATION and it's consequence of sending sleep at the wheel central banks scrambling to prevent an Inflationary CRASH!

Just in case you have not got my Inflation message, I expect HIGH Inflation to be with us for virtually the WHOLE of THIS DECADE!

YES, I understand it is hard to take such statements seriously, especially when subjected to Deflation clowns such as Cathy Wood. But I have been charting the course of the Inflation Mega-trend for well over a decade hence none of what is happening today comes as any surprise not that high inflation that will run far beyond that which most folks are able to comprehend.

And it is going to be tough for many stocks, perhaps most stocks, especially the Cathy Wood style stocks to survive let alone rise in an permanent inflationary environment.

The stocks have to have earnings growth else the inflation monster will eat them alive! Thus I see myself as having NO CHOICE but to INVEST in select stocks that grow their earnings because if one thing is for certain more than anything else it is that the value of our currencies, Dollar, Sterling, Euro, Rouble are heading to ZERO!

So what do we do?

Hold assets that are LEVERAGED to INFLATION!

- Housing

- Commodities

- And AI STOCKS!

As for the so called panic. " Understand this, whatever the stock market does over the coming weeks and months it will turn out to be a mere blip on the long-term charts as is the October 1987 Crash today." Nadeem Walayat, Oct 2008. - Which is a mantra that I iterate during most corrections and panic events so as to put things into perspective, for if investors are panicking over a barely 10% drop in the indices, then we'll maybe they should strop investing and take the time to LEARN about the market, that most stocks deviate form their highs by as much as 50% MOST years!

Most stocks have fallen by at least 10% to 25% from their highs with most stocks probably having a lot further to fall given the extent to which they had become over valued as I was warning to great extent during the second half of 2021 i.e. Aug 9, 2021 at 9:20 PM AI Stocks Portfolio Buying and Selling Levels, Bubble Valuations 2000 vs 2021

However, it does not matter where the bottom of any bear market will be, all that matters is gaining exposure to AI mega-trend stocks that grow their earnings when trading near fair value because they will always tend to surprise to the upside that will leave most puzzled and confused as to how can stocks be trading higher when for instance the pandemic death toll is doubling every week as was the case during April 2020 when many Patrons kept asking me if they should sell now to bank gains of 50% or so, which had me rolling my eyes in their socket, warning that it would be a BIG MISTAKE to SELL and that the thought of SELLING had not even crossed my mind at that time. Instead it would be well over a year later when I would start to distribute into the FOMO bubble valuations of late last year with the aim of capitalising on THIS SELL OFF, seeking to buy deviations from the highs in GOOD STOCKS which is precisely what I am doing right now just as most are becoming fearful of buying anything.

UNDERSTAND THIS - MOST INVESTORS WILL LOSE MONEY! INFLATION ENSURES THAT! As that which worked during the great Covid bull run is DEAD and BURIED! It was an anomaly! But if one flips over to CNBC or a myriad of Cathy Wood cult youtube channels one sees that nothing much has changed, they still mostly peddle the same old turd stocks that are destined to see their investments go to ZERO!

The key point about investing in stocks is that one is getting out of fiat currency which is 100% guaranteed to go to ZERO and into something that at the every least has a fighting chance at maintaining it's real terms value. What the stock price does AFTER one buys over subsequent days, weeks and months is irrelevant, as one is investing and not seeking to trade in and out like a fool.

Stock Market Trend Forecast Current State

We are in for a volatile trend with a downwards bias for much of 2022, as I wrote to expect on the 5th of Dec 2021 accompanied by revised trend forecast graph.

Following which my expectations were for the Dow to target a trend to $31k as illustrated by the graph from my last article

The 2nd leg of the downtrend following the corrective rally is now under way with the Dow and other indices BREAKING below support that resulted in a panic sell off on Thursday's open that had my phone notifications pinging like crazy as buy limit orders were being triggered all in the opening minutes at well below where they were set which I am sure had buy the dip brigade who do not understand what is going on SCREAMING at their stock charts as their earlier buy the DIP FAILED, Perhaps RESULTING IN PANIC SELLING OUT OF LOSNG POSITIONS right at the very LOW of the most recent LOW!

This is how those who bought the dip a couple of weeks ago would have experienced yesterday's opening sell off, likely then taking the bounce to call it a day and EXIT their longs. Or else permanently sat on the sidelines convinced that stocks will go much lower, just as only a few weeks ago many failed to sell convinced that there was going to be a blow off top. This is what happens when investors expose themselves to FOOLTUBE, MSM and the BlogosFear! If you follow that tripe then you are either selling or being stopped out because all those fools advocate putting in stops at levels that usually turn out to be exactly where markets bottom! The blind leading the blind!

Instead this was me during yesterdays panic sell off, just like Billy Ray Valentine buying target stocks at deep discounts as the panic selling FOMO fools sent stock prices sharply lower on Thursdays open, significantly expanding my exposure to stocks!

As for what happens next, we'll so far everything appears on queue to follow the trend trajectory for a volatile weak first half of 2022 that looks like resolving in a stronger second half of the year. The Dow remains on target towards achieving $31k in a volatile trend lower, a lot of wild swings up and down as I warned to expect months ago so I buy whenever opportunities present themselves as individual stocks tend to do their own thing.

Everyone wants to know if this was the bottom, just as a couple of weeks ago I was being asked if Dow 33k was the bottom, NO it was NOT the bottom. Though in reality I don't give a fig where the actual bottom will be as all I am doing is buying the deviations from the highs rather than trying to buy the bottom so whenever stocks plunge to new lows I WILL BE BUYING usually via limit orders as was the case yesterday or via direct at the market orders that I tend to share live in the patron comments. The more good stocks fall the more I buy! Of course I track exposure to each stock but remember I did SELL 80% of my AI stocks portfolio going into the HIGHS! So I have plenty of ammo to fire at this stocks BEAR MARKET as I continue to scale into positions as and when opportunities present themselves towards the Buying levels I gave many weeks ago that act as good markers that represent deep deviations from the highs of upto 50% for some stocks.

In the long-run the only thing that will matter is if one is invested or not, as where prices bottom will be irrelevant!

You are either invested or you are not, that's it, nothing more.

Though I very much doubt stocks bottomed yesterday, I suspect this bear market has a lot further to run. We need to see BLOOD ON THE STREETS!

INVEST AND FORGET DOES NOT MEAN BUY GARBAGE IT MEANS TO BUY GOOD COMPANIES FOR GOOD REASONS WHEN FAIRLY PRICED AND THEN FORGET ABOUT THE STOCK PRICE BECAUSE THAT WILL YOYO ALL OVER THE PLACE BETWEEN FOMO MANIAS AND EXTREME PESSIMISM, likely every other day!

My investing time horizon is to remain invested for as long as the company remains GOOD and does not become overly overvalued in which case I would seek to reduce exposure the more overvalued the stock becomes as was the case during the second half of last year where by the time I was done I had sold out of 80% of my AI stocks portfolio due to extreme over valuations and this despite adding to to Intel and Facebook.

Stock Market FOMO Gives Way to FEAR of Buying the Dip

Stock Market Investor FOMO of barely a month ago on expectation of a blow off top that most clinged onto during the first few weeks of this sell off is now increasingly giving way to FEAR of an inexplicable never ending slide into the depths of a 2000 style bear market. We'll the Cathy Wood style stocks have been on that path for approaching a year now so perhaps not much downside in those, then again they still are what they were a year ago, NO EARNINGS GARBAGE!

However FEAR is infectious especially for the weak hands, those who where once eager to buy now FEAR perpetual falling prices that results in a state of paralysis. THIS IS WHAT IT ACTUALLY FEELS LIKE TO INVEST IN A FALLING MARKET! Something that is not apparent when looking at the price charts at tops and bottoms where one could easily have bought and sold with the be benefit of hindsight, yeah we'll maybe if one switched OFF the information flow that generates the GREED and FEAR that encourages buying at the top and inaction at the bottom!

Instead all that is happening is what II was iterating through much of 2021, that the market WILL PUNISH all those who forget the primary long-term driver of stock prices which is EARNINGS GROWTH!

The market gave a pandemic pass for the whole of 2020 and much of 2021 but since Mid year has increasingly sought to punish those stocks that are based on BS, you know the likes of that which populate Cathy Wood's funds.

THEY HAVE NO EARNINGS SO ALL OF THE FOCUS IS ON PURE BS METRICS CONJURED OUT OF THIN AIR!

The relentless mantra of DISRUPTIVE INNOVATION! Throwing fancy words around to justify investing in garbage!

And here I thought my of AI Tech stocks that were typically trading on multiples of 30-40 had become over valued and were ripe for downwards revaluation of about 1/3rd.

Listen folks the CORNER STONE OF INVESTING IS EARNINGS! IF A COMPANY HAS NO EARNINGS THEN NO MATTER THE SALES PITCH IT CAN GO BUST! THUS HAS VERY LITTLE MARGIN FOR ERROR WHEN INVESTING IN SUCH STOCKS that are literally floating on thin air. So it does not matter that a stock such as Roku has fallen by 80% of it's high, NO THAT DOES NOT NOW MAKE IT A POTENTIAL BUY as some patrons keep asking of r such stocks! It's just as big a pile of poop as it was when it was trading at it's all time high!

Whilst one has oodles of margin of error in investing in the likes of Intel, Facebook even Nvidia, because THEY ARE NOT GOING TO GO BUST! i.e. one can get timing very badly wrong and STILL COME OUT A WINNER, cos when a company is growing earnings then over time the valuations will moderate to the point it will lift stock prices higher. Take Facebook currently trading at $206, it's earnings multiple is 16, and it's EGF is 6%, so no matter how far the pendulum swings against it, earnings growth ensures ultimate upwards price pressure.

Instead Cathy Wood is a loony toons insane fund manager who literally point blank DOES NOT KNOW HOW TO INVEST! SERIOUSLY! SHE DOES NOT KNOW HOW TO INVEST! And hence has gambled away her investors monies in to black holes that will NEVER generate EARNNGS! So there is no coming back!

Yes by all means take a gamble, take a punt, but not with the WHOLE OF ONES CAPITAL!

This is why I repeatedly state that FUNDS are HIGHER risk than individual stocks and why funds form such a small part of my portfolio because the fund managers can be INSANE! Just watch this video and tell me Cathie Wood is not destined for a straight jacket!

They are not shorting innovation Cathie they are SHORTING YOU!

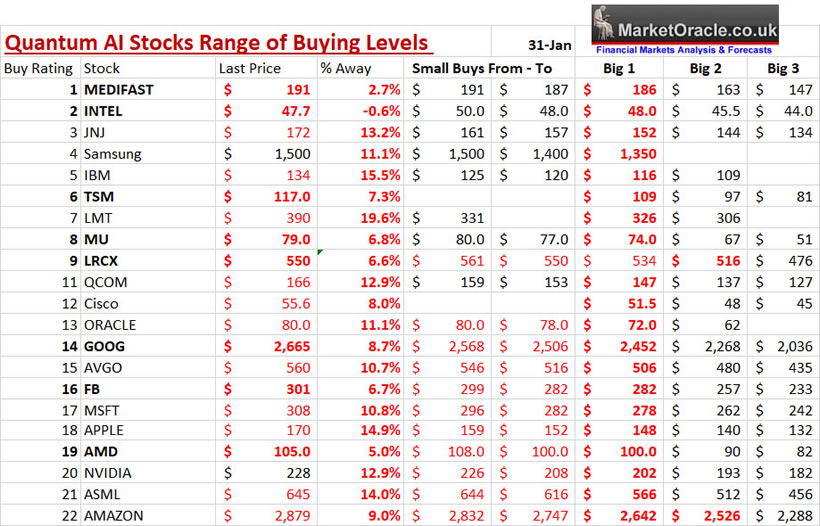

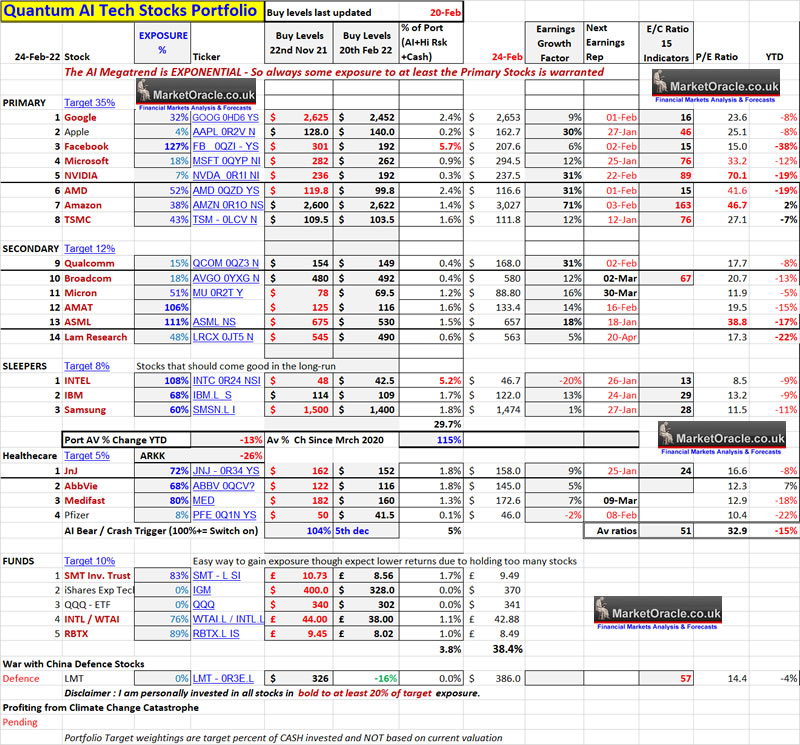

AI Stocks Portfolio Current State With Updated Buying Levels

My key buying levels for target stocks to accumulate into remain largely unchanged as of 31st Jan 2022.

Whilst many of the big buys remain pending. Nevertheless the small buys on each price plunge continues to expand the size of my AI stocks portfolio which is now approaching twice that of early January. Where after each price plunge I tend to repopulate with fresh small buy limit orders in advance of the expected NEXT price plunge as I scale into positions by buying the panics.

And here's my updated AI stocks portfolio table with revised buying levels and the original levels, where levels in red have been achieved and those in black remain pending, for instance Google's $2625 buying level has been achieved, where I am currently viewing to accumulate more at $2512 (just above last low) with my new buying level for a larger buys a little lower at $2442 which is little changed from the table above.

Table Large Image - https://www.marketoracle.co.uk/images/2022/Feb/NW-AI-Stocks-portfolio-22-BIG.jpg

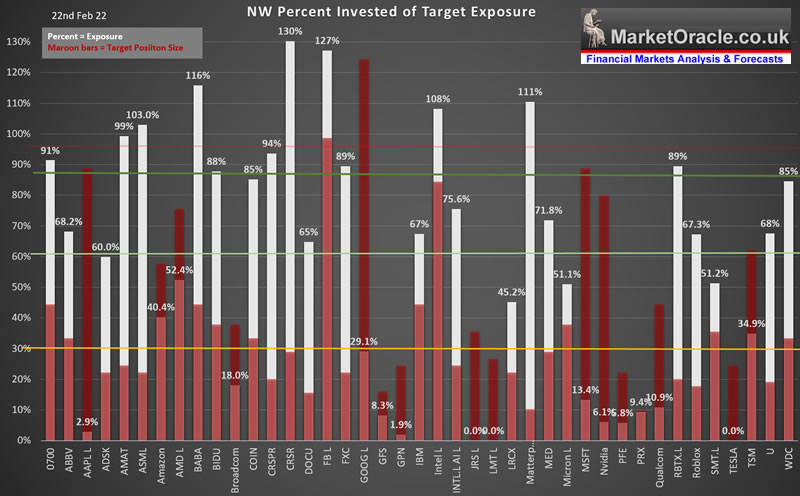

Also see my previous article for the charts showing the buying levels for the Primary AI stocks. Most big buying levels continue to remain pending lower prices.The following graph shows my exposure vs target position size for key stocks as off 22nd Feb.

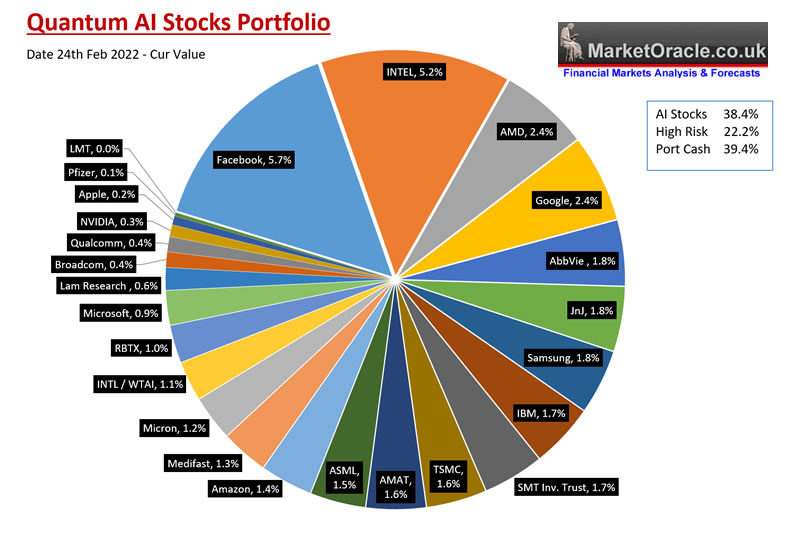

My AI stocks portfolio currently stands at 38.4% invested, with 22.2% in high risk stocks and 39.4% in cash, where my objective is to reach at least 80% invested vs 60% today. The big change in the portfolio was the migration of ABBV from the high risk portfolio to the Heathcare section which means I will be seeking to increase my exposure to ABBV whenever an opportunity presents itself.

So it's a continuing case of lots of nearby small buy orders constantly being refreshed as executed on each price plunge slowly building my portfolio whilst I wait for the larger buy limit orders to be executed that occur from time to time, such as SMT.L this week.

FACEBOOK Stock 45% CRASH - Game Over for META?

The Facebook (META) stock price has CRASHED by over 45%! Far beyond anything anyone could have imagined the stock price could trade down to. So no wonder many investors are now too frightened to hit the BUY button given the epic collapse in the stock price fearing that it could be game over for this social media giant as it places it's bets on reinventing itself as a metaverse giant. So is it a case of game over and all those who bought ont he way down now destined to lose all in a dying stock despite the stock now trading on just 15X earnings?

NO WAIT The above is what happened in 2019! Less than THREE YEARS ago! Which had the same investors who missed the boat in 2019 prepared to FOMO into Facebook during 2021 typically north of $330 and in many cases right upto it's trading high of $386 all on the backs of only blue sky's ahead mania commentary purporting to be analysis that flooded the net, morons on youtube with huge followings buying into their slick or rather SICK presentations, though far worse was in store for the Cathy Wood cultists..

A case of DEJAVU! 2022

The 2019 Facebook bear ran for 5 months and saw a 45% price drop, the current bear has run is 5.5 months and seen a 46% price drop. EXTREME FOMO has now given way to EXTREME FEAR RIGHT AT THE VERY BOTTOM (probably)! When the dust settles I can easily see facebook trading back above $250, so I don;t expect it to stay down for long.

Savour what contemplating investing in stocks such as Facebook feels like right now! Make a diary entry, "Facebook was trading at $203 today, 46% below it's high but I was too scared to buy any" AND THIS is why most investors FAIL to buy GOOD stocks when they are CHEAP but instead FOMO into them when they are EXPENSIVE!

FACEBOOK RINSE AND REPEAT

All I am doing today is what I did during 2019 in Facebook and many other stocks such as Nvidia that experienced and even worse decline in it's stock price. Which is to BUY THE DEVIATON FROM THE HIGHS IN GOOD STOCKS! NOT ROCKET SCIENCE, the more they fell the more I bought just as I did this time round with Facebook that has seen my exposure mush rum to 127% of target! So why is is that I can do it without ANY FEAR whilst others are paralysed into inaction BY FEAR?

We'll what I keep getting asked on a near daily basis right now is have stocks bottomed, is this the bottom, where will the stock bottom, BOTTOM, BOOOTTTOOOM! BOTTOM!

I COULD NOT CARELESS WHERE THE BOTTOM WILL BE! ALL I CARE ABOUT IS THE DEVIATION FROM THE HIGH WHICH REDUCES THE STOCKS VALUATION FROM OVER VALUED TO UNDER VALUED.

UNDERSTAND THIS - The facebook stock price today is cheaper then when it was trading at it's lowest price in 2019! PAY ATTENTION TO WHAT THIS CHART IS SHOUTING! (blue line is FB PE ratio).

So once more, instead of trying to buy the bottom (which you will never do!) aim to accumulate the deviation from the high. Where the greater the deviation the greater the buying opportunity being presented in GOOD STOCKS! A MANTRA THAT I HAVE BEEN ITERATING ONLINE FOR A GOOD 13 YEARS NOW!

Here's what I concluded about Facebook back in 2019 when Facebook was trading at $166

1st April 2019 - Top 10 AI Stocks for Investing to Profit from the Machine Intelligence Mega-trend

"Facebook is definitely a AI machine mega-trend investing stock to hold as long as you are prepared to ride its roller coaster which on the plus side can from time to time generate buying opportunities as we witnessed during the past few months."

And as we are witnessing once more today!

As for me, I wont be staring in that rear view mirror wishing I had bought more Facebook stock when I had the chance to do so...

INVESTING LESSON - HAVE A PLAN AND THEN EXECUTE IT!

Have a plan and stick to it i.e A list of good stocks coupled with a list of buying levels and then ACT when triggered and then IGNORE THE NOISE THAT IS MASS MEDIA,, ELSE FORGET ABOUT INVESTING! Because you will FAIL to buy when you should be buying and FAIL to sell when you should be SELLING. Remember the only price that counts is that which one buys at and that which one sells at. What happens before and after is IRRELEVANT, but apparently mostly investors FAIL to RECOGNISE THIIS FACT and thus are perpetually stuck looking in the rear view mirror at past tops and bottoms.

A quick glance from time to time maybe, but being fixated on that rear view mirror is both BAD for Investing and Driving!

For me investing is fairly straightforward - I buy the deviations from the highs in good stocks at PRE-SET buying levels based on technical's and valuations. I REALLY DON'T CARE ABOUT BUIYIIONG AT TH EBOTTOME OR SELLING AT THE TOP! Because having that mindset will ensure you will NOT sell AFTER the TOP or buy AFTER the bottom! Because they will only become clear with the benefit of HINDSIGHT! And then you will be forever chasing at second chance to buy at the bottom that good stock very rarely give!

Think about it, what is easier to implement, buying the deviation from the highs or trying to buy at the bottom?

One has certainty i.e. I'll buy Google at $2625, $2512, $2412, and $2312, , even if Google could fall to as low as $2000 which if it did then I would buy even more.

OR

Google is falling., $2625 now, it could fall further, I'll wait for lower prices, $2512 now, media is full of Fed tightening and inflation doom could go as low as $2000,

Damn jumped to $2800, I should have bought at the $2442 low, I'll wait for it to get back down there again and buy big.

Damn $3,000, I have no choice but to buy before it takes off towards $4000.

what happens next? $2625?

One has certainty of action the other has uncertainty of action.

And yes, I really do think Google 'could' fall to $2000 for an approx 33% deviation from it's high! Even so my big buys start at $2512.

HIGH RISK STOCKS - INVEST AND FORGET

If one does NOT invest and forget then one will BAIL out of a stock at 10% instead X10! Of course things are never black and white, but the more one spends time focusing on ones portfolio then the more one is likely to make huge blunders.

Do refer to my earlier article How to Invest in HIGH RISK Tech Stocks for 2021 and Beyond so that one understands what Invest and forget means, as asking me every other day why a stock is randomly up or down is NOT INVEST AND FORGET! Once invested the price action should not be on your mind.

This article was an except for my recent analysis focused on continuing to capitalise on the downward spiral in stock prices in response to first Inflation Panic and now plus Ukraine War Panic. With the primary focus on identifying 5 small cap tech growth stocks to add to my High Risk stocks portfolio out of a short list of 50 stocks.

World War 3 Phase 1 - Putin WINS Ukraine War!

What Putin Plans for Ukraine

JRS.L Capitalising on Russia's War CRASHED Stocks

THE 2020's INFLATION MONSTER!

Stock Market Trend Forecast Current State

Stock Market FOMO Gives Way to FEAR of Buying the Dip

AI Stocks Portfolio Current State With Updated Buying Levels

FACEBOOK Stock 45% CRASH - Game Over for META?

FACEBOOK RINSE AND REPEAT

INVESTING LESSON - HAVE A PLAN AND THEN EXECUTE IT!

HIGH RISK STOCKS - INVEST AND FORGET

High Risk Stocks Portfolio Revised Buying Levels

GROWTH STOCKS TO CAPITALISE ON THE PANIC OF 2022

1. XXXX - RANK 1 - $121.8, PE 7.8, EGF 38%

2. XXXX - RANK 1 - $58.5, PE 9.9, EGF 30%

3. XXXX- RANK 2 - $16.7, PE 8.7, EGF 33%

4. XXXX - RANK 2 - $89.5, PE 17.2, EGF 23%

5. XXXX - RANK 2 - $49.7 - PE 196, EGF 188%

That was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Whilst my most recent in-depth analysis is - UK House Prices Three Trend Forecast 2022 to 2025, where I pealed away every layer of the UK housing market I could think of to arrive at a high probability of trend forecast, no following of the consensus herd here!

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024.

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 70%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

- Current Best Value AI Tech Stocks, New Tax Year Best Stocks and Shares ISA"s - Imminent

- Why Draw downs Don't Matter

- The VR Mega-trend

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Your Analyst

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.