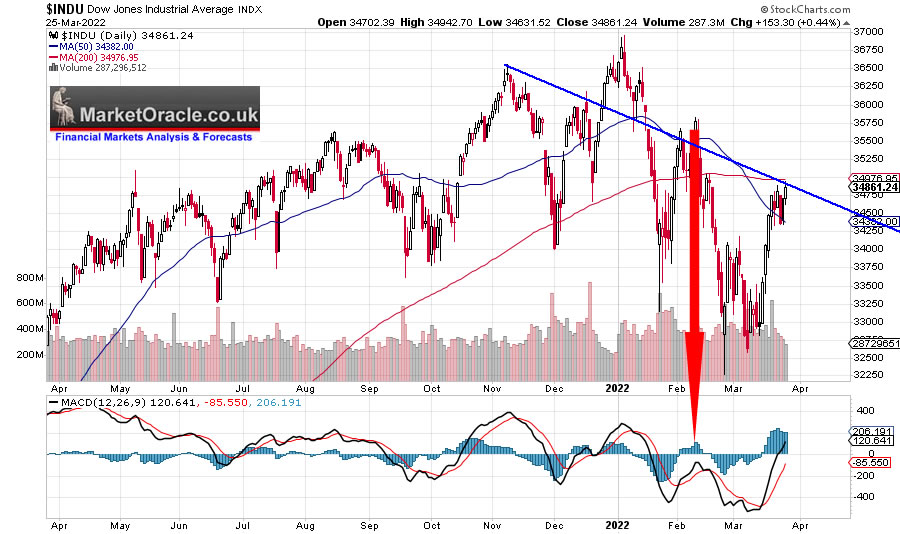

Stocks Bear Market About to Resume?

Stock-Markets / Stock Market 2022 Apr 14, 2022 - 07:38 AM GMTBy: Nadeem_Walayat

Tthe stock market rally that had the the bulls salivating is probably coming to and end, and thus the direction of travel over the coming days should be lower as the Dow continues to target $31k. In terms of the bear market we will probably eventually see the Dow gravitate to below $30k, how low and in what time frame requires in-depth analysis which I will focus on next after housing. In the meantime, This is the type of trend I warned to expect, VERY VOLATILE as investors gyrate between FEAR and GREED. A sell off now could set the scene for a strong April i.e. off a higher end March / early April low rather than a break to new bear market lows.

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

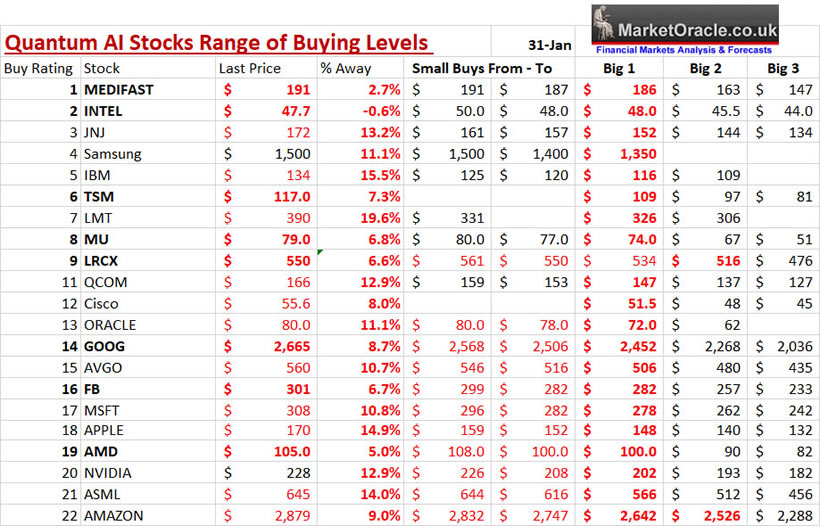

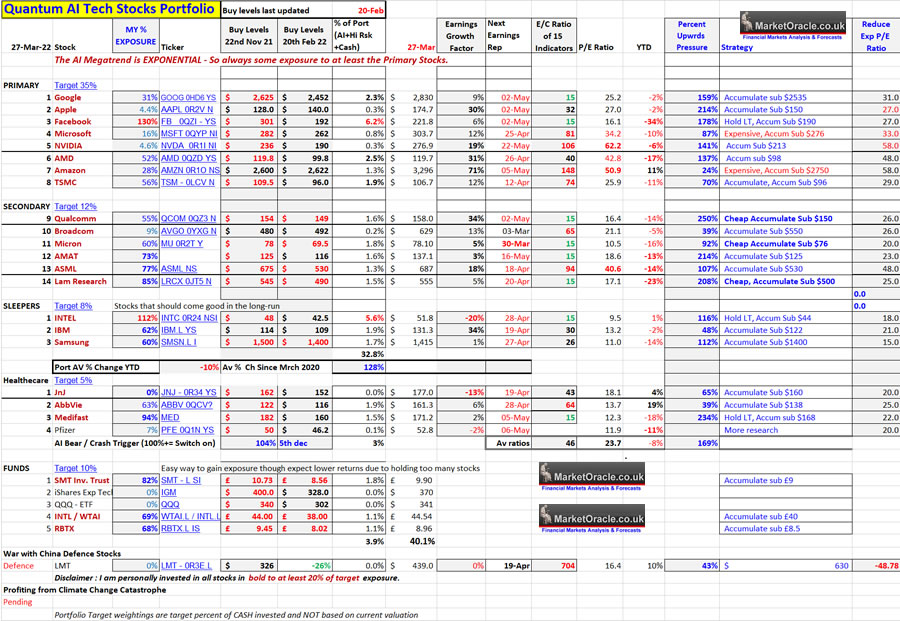

Whilst the name of the game is not what the indices are doing but rather to accumulate AI tech stocks whenever opportunities arise, in respect of which my exposure to AI tech stocks has doubled from about 20% of Mid Jan to today's 40%. Where the buying levels I posted in late January remain the primary guide posts that I am still adhering to some 2 months on and where my plan is to get to about 60% invested in AI stocks by the end of June, with about 23% in High risk stocks..

Some patrons have asked for selling levels which don't really work for me, so instead I have added something much better. a new column which is the Reduce exposure P/E Ratio beyond the level where I am both reluctant to accumulate and eager to distribute (usually into rising prices), which is apparent when one looks at my % exposure column for all those stocks listed with a red P/E Ratio. This should be fairly simple to grasp, i.e. a PE Ratio that exceeds the Reduce exposure PE Ratio is ones signal to REDUCE EXPOSURE.

Big Image - https://www.marketoracle.co.uk/images/2022/Mar/Quantum-AI-tech-stocks-27-3-22.jpg

Current stocks that exceed their reduce exposure PE are Apple, Microsoft, and Nvidia and hence I hold very little exposure to these stocks and even when stocks plunge these 3 stocks tend to be on the back burner. Also I would be wary of piling into Amazon because on the EC ratio it is the most expensive stock on this list, hence I have actually been reducing exposure to Amazon.

AI Stocks What's Cheap and What's Not?

DIRT CHEAP

Qualcom

Micron

CHEAP

Google

AMAT

Lam Research

INTEL

So and So

Medifast

IBM

ABBV

AMD

TSMC

Pfizer

EXPENSIVE

Apple

Microsoft

AVGO

NVDA

ABBV

VERY EXPENSIVE

ASML

Amazon

Do bare in mind that the EC ratio like all of the other stock financial ratios tend to change on release of earnings reports,

What am I doing?

Waiting to catch more falling knives, especially for Apple at $140, Microsoft at below $262, Nvidia at below $190, and Google at below $2452. And my antenna is tuning towards Pfizer at $46.2.

PUTIN CHANGES TACK TO SPLIT UKRAINE INTO TWO

The bane of all dictatorships are their YES MEN, YES you can easily grab the whole of Ukraine, YES, the Ukrainians will surrender after watching youtube videos of Russian military exercises, YES, YES, YES. Reality is that Russia's military sucks in offensive terms anyway. Xi Ping take note when your YES men agree that grabbing Taiwan would make a great birthday present for their Dear Leader.

So what's Putin's revised plan ?

Finish the job that he started in 2014, that was always the most probable outcome, , though now with a decimated army. At least this should reduce the risks of Putin using Nukes, but you never know, given how badly the Russian army has performed on the offense that may still turn out to be Putin's final solution, either that or it's bye bye to Czar Putin.

That analysis was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

MARKET BRIEF - Stocks Bear Market About to Resume?

Whilst my most recent analysis is - UK House Prices Three Trend Forecast 2022 to 2025, where I pealed away multiple layers of the UK housing market of to arrive at a high probability of trend forecast.

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

So if you want immediate access to a high probability trend forecast of UK house prices, with US and global housing markets analysis to follow soon then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 70%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

- Current Best Value AI Tech Stocks, New Tax Year Best Stocks and Shares ISA"s - Done.

- Why Draw downs Don't Matter

- The VR Mega-trend

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst BUYING the panic selling falling knives.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.