Are Rising Oil Prices Sending Stocks into a Downtrend?

Stock-Markets / Stock Market 2022 Mar 15, 2022 - 06:11 PM GMTBy: EWI

See a time when the economy revived as oil prices doubled

A long-held assumption is that "oil shocks" or dramatically rising oil prices are bearish for stocks.

Look at these headlines:

- Dow slides nearly 800 points as oil hits $120 a barrel (Washington Post, March 7)

- Why soaring oil prices could soon make the stock market sputter (Marketwatch, October 2021)

As you might imagine, if observers assume that dramatically rising oil prices make the stock market decline, they also believe the reverse, namely, a drop in oil prices makes the stock market climb.

Here's a sample headline:

Stocks jump most since June 2020 as oil prices fall sharply (Los Angeles Times, March 9)

However, on March 3, neither of the two scenarios just mentioned applied. This recent headline says stocks and oil moved in the same direction:

Stocks Finish Lower; Oil Prices Decline (Wall Street Journal, March 3)

And this headline talks about stocks and oil rising together:

Stocks rise as Powell signals steadiness, and oil prices continue to march higher (The New York Times, March 2)

So, the headlines are all over the place as far as a linkage between oil and stocks is concerned. The bottom line is that if observers take a close look, they'll see that there's no consistent relationship between oil and stock prices.

History verifies this.

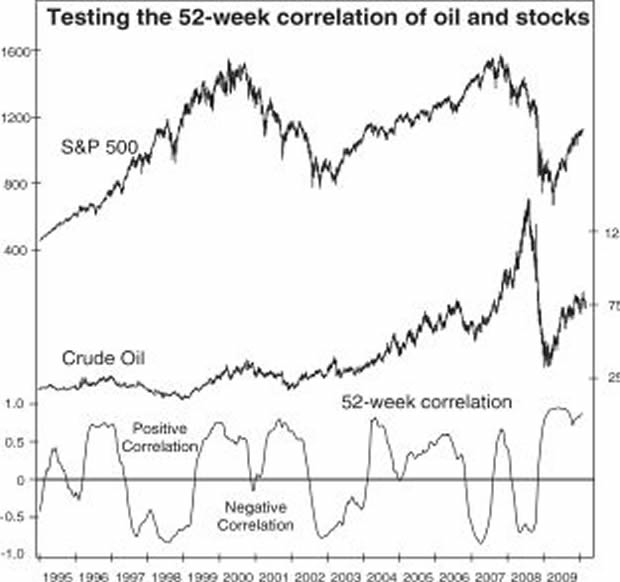

This chart and commentary are from a 2010 Elliott Wave Theorist, a monthly publication which provides analysis of financial markets and cultural trends:

[F]or the past 15 years there has been no consistent relationship between the trends of oil prices and stock prices. Sometimes it is positive, and sometimes it is negative. … The quarters during this period when the economy contracted the most occurred during and after the oil price collapse of 2008. Thereafter oil prices doubled as the economy was reviving in 2009.

So, it's a myth that rising oil prices hurt the stock market or falling oil prices help the stock market.

You see, the stock market is not governed by events outside of the market – no matter how dramatic.

Stock market prices are determined by investor psychology, which unfolds in repetitive patterns. Since these patterns are repetitive, they have predictive value!

The Elliott wave model is a direct reflection of these patterns, and that's why it works so well in anticipating trend turns.

For more eye-opening charts, check out EWI President Robert Prechter's classic presentation on oil in a rebroadcast event on Thursday, March 17 at 2:00 PM Eastern (NY time). The lessons Prechter shows can be applied to any liquid market -- cryptos, commodities, stocks, bonds and more. Whatever the vehicle, these insights help viewers sweep aside the noise and uncover what's really going on in big moves.

Get started by following this link: Join Club EWI to reserve your seat.

Club EWI is the world's largest Elliott wave educational community and is free to join. Members enjoy complimentary access to a treasure trove of Elliott wave resources on investing and trading without any obligation.

This article was syndicated by Elliott Wave International and was originally published under the headline . EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.